Regulatory News

2021 First Half Year Financial Results

Brussels, 22 September 2021

The enclosed information constitutes inside information and is to be considered regulated information as defined in the Belgian Royal Decree of 14 November 2007 regarding the duties of issuers of financial instruments which have been admitted for trading on a regulated market.

Cenergy Holdings S.A. (Euronext Brussels, Athens Stock Exchange: CENER), hereafter “Cenergy Holdings” or “the Group”, announces today its financial results for the first half year of 2021 together with the issuance of its Interim Report for the same period.

Healthy profitability, strong backlog, steady growth

Highlights

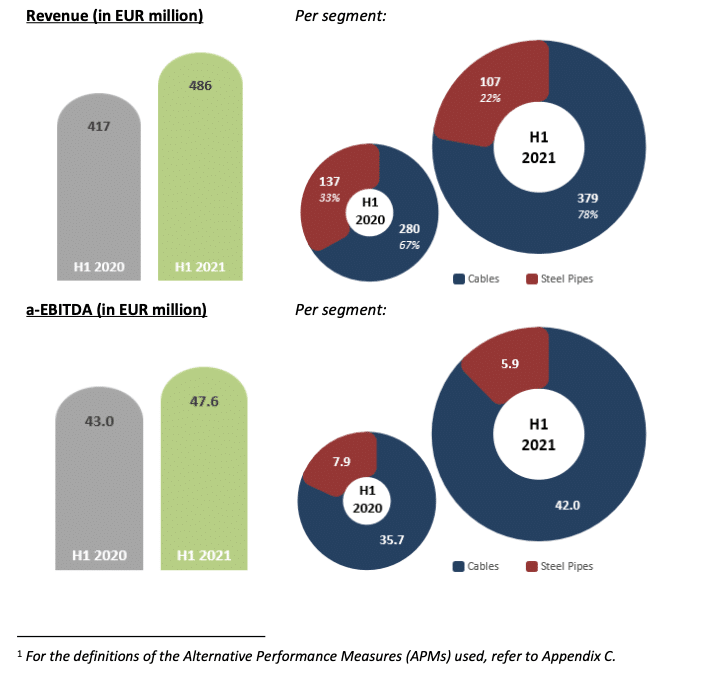

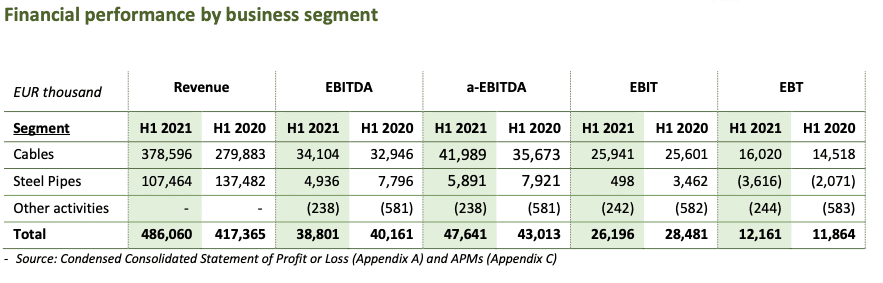

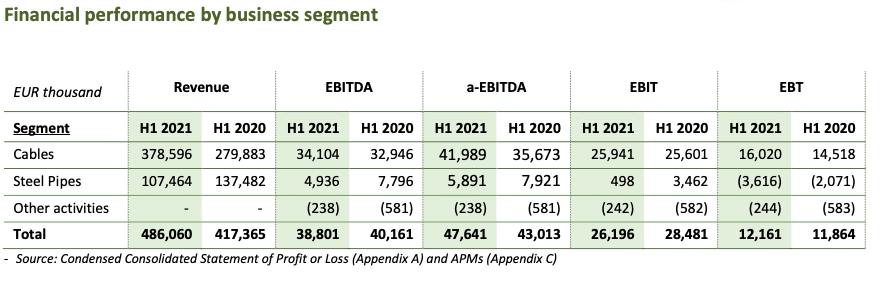

- Growth in revenue (+16.5% y-o-y) driven by increased level of activity in cables segment

- Higher operational profitability with adjusted EBITDA1 exceeding EUR 47 million for the first half of 2021(+11.3% y-o-y); the main driver for this increase remains the Cables projects business.

- Substantial order backlog at EUR 600 million as of June 30, 2021 signals robust growth for the future(31/12/20: EUR 500 million), while more orders are secured in Q3 2021

- Consolidated profit before tax of EUR 12.2 million vs. EUR 11.9 in H1 2020 (+2.5%)

- Consolidated net profit after tax reached EUR 11.6 million vs. EUR 8.1 in H1 2020 (43% growth y-o-y)

Οverview

During the first semester of 2021, Cenergy Holdings demonstrated its ability to keep the momentum created over the last two years alive and take it further ahead. The smooth execution of energy projects in both the cables and the steel pipes segments continued, with each segment marking significant highpoints during the first half of the year, such as the successful completion of the record-breaking high-voltage Crete Interconnection and the delivery of the first hydrogen-certified pipeline for a high pressure gas network in Italy.

At the same time, all Cenergy Holdings’ companies took advantage of the strong commercial momentum and supported a healthy backlog for future growth, as all commercial teams brought in significant orders for energy projects around the globe, driving the backlog to EUR 600 million as of June 30, 2021. The recent awards of the subsea cable connection of Greece’s largest wind farm, an offshore high-pressure gas pipeline in Israel, the first award in the Adriatic Sea for a submarine cable interconnection project and frame contracts signed with significant Transmission system operators (TSOs) in Europe are some examples of the successful tendering activity during the first half of the year.

Throughout the year and as the world continues to experience several waves of outbreaks of the SARS-Cov-2 virus, all companies in Cenergy Holdings keep taking actions to shield their most valuable asset, the health of their personnel. The action plan initiated in early 2020 to prevent the virus spread remains in place, while management actively supports vaccination programs in all countries where subsidiaries are operating.

In the cables segment, the high utilization of all production lines and the smooth execution of high-profile submarine projects led to further growth and solid performance. Demand in cables products rebounded during the first semester of 2021 and sales volume increased by 16%. This increase covered a wide range of cable types and led to satisfactory utilization of all land cables production lines. The continuous focus in value added projects and products, allowed higher profitability, leading the entire segment to a strong performance with adjusted EBITDA reaching EUR 42 million. This was further stimulated by initiatives to enter new geographical markets as well as the ongoing investment program to further enhance the production capacity of the offshore business unit. In the field of sustainable development, Hellenic Cables awarded a silver 2021 EcoVadis Sustainability Rating for its sustainability practices, confirming the commitment to implement responsible business practices across its operations.

In the steel pipes segment, on the contrary, insufficient demand still prevails, especially in large-diameter pipes. Market conditions remain highly volatile, whilst a large number of energy projects are either postponed or abandoned, especially in the USA. As a result, turnover fell by 22% compared to H1 2020 and operational profitability (adjusted EBITDA) suffered a decrease by EUR 2 million. As oil prices and demand recover though, pulling energy prices higher, the available tender opportunities for Corinth Pipeworks (hereafter “CPW”), the Group’s main company in the segment, increase slowly but steadily. To further compensate for general sluggish demand conditions and to protect its core profitability, CPW completed a cost optimization programme started in 2020, including cost reduction measures but also industrial excellence initiatives in its Thisvi plant. On the financial side, the strict working capital management continued, slowing down any net debt acceleration pressures due to rising raw material prices.

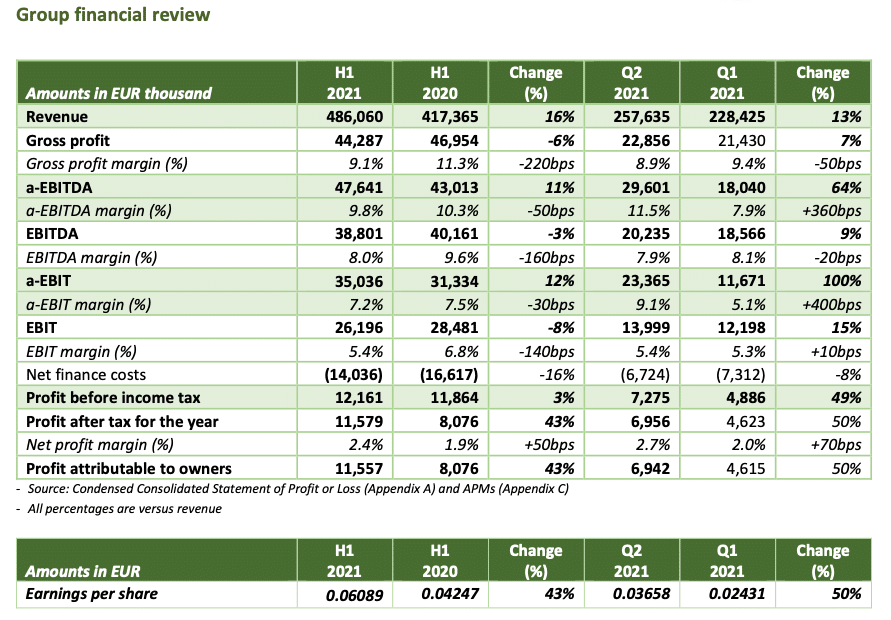

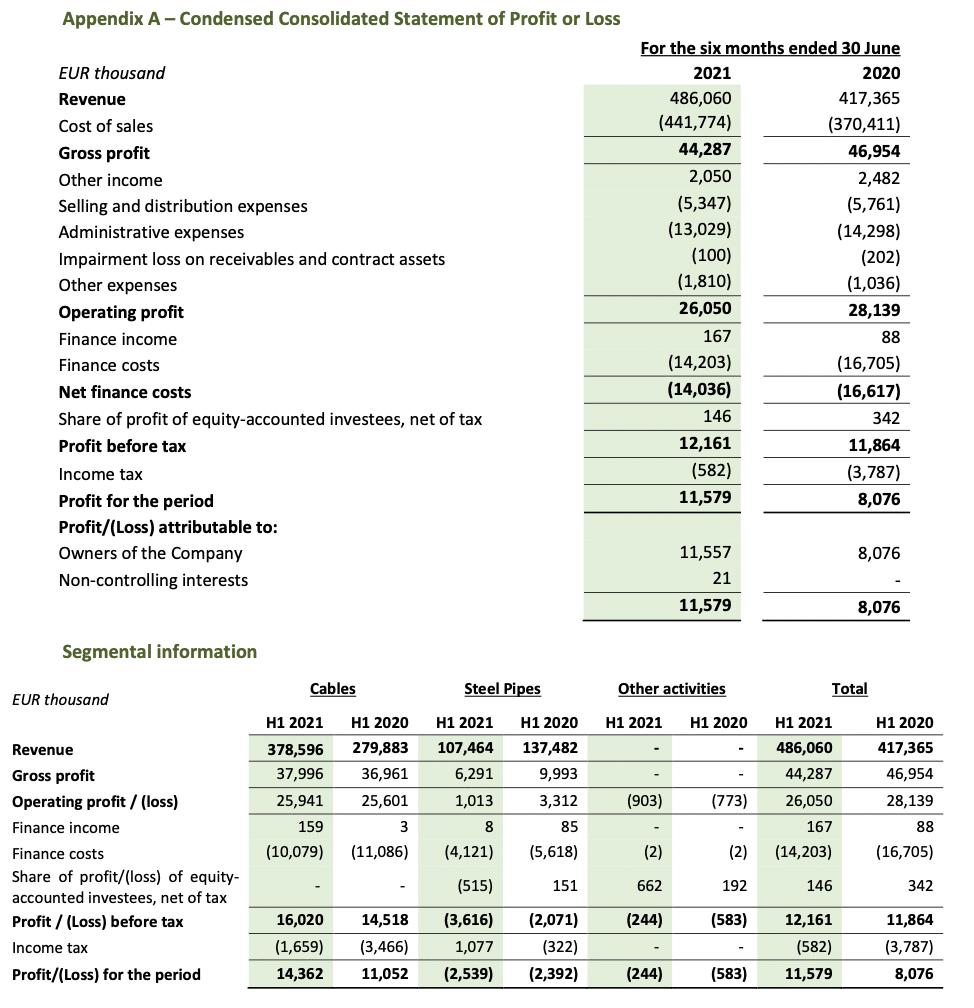

Revenue grew by 16% to EUR 486 million, supported by a strong execution of cables projects from the order backlog, as well as strong demand for cables products, along with increasing LME metal prices. On the other hand, demand in steel pipes segment faced challenges, as fossil fuel transportation projects have not yet rebounded from the recent crisis. The revenue in cables segment accelerated during Q2 2021 covering the gap in steel pipes and leading to a 13% increase over the previous quarter.

Adjusted EBITDA increased by 11% to approx. EUR 48 million as the successful execution of energy projects kept operational profitability at satisfactory levels, despite low utilization levels of the steel pipes plant. Conversely, EBITDA was influenced by metal price fluctuations and amounted to approx. EUR 39 million (3.4% y-o-y). The subsidiary companies continued to focus on value-added products and services growth and managed to maintain their margins despite price inflation in all major raw materials, throughout the year.

Net finance costs further decreased by EUR 2.6 million (-16% y-o-y) to EUR 14 million for the first half of 2021, due to both lower interest rates and lower average debt levels versus the comparable period.

Profit before income tax amounted to EUR 12.2 million, at nearly the same levels of H1 2020. Stronger sales in cables during Q2 2021 affected all profitability measures leading to an almost 50% increase in profit before tax compared to the first quarter of the year.

In contrast, profit after tax for the period increased significantly to EUR 11.6 million (EUR 8.1 million in H1 2020) reaching 2.4% of sales (against 1.9% in H1 2020), as Greek subsidiaries profited from a corporate tax rate reduction from 24% to 22% on their deferred tax liabilities.

The Group continued its investments mainly in the submarine cables production plant of Fulgor in Corinth, Greece. Total capital expenditure for the Group reached EUR20million in H1 2021, split between EUR 15.6 million for the cables and EUR 4.4 million for the steel pipes segment.

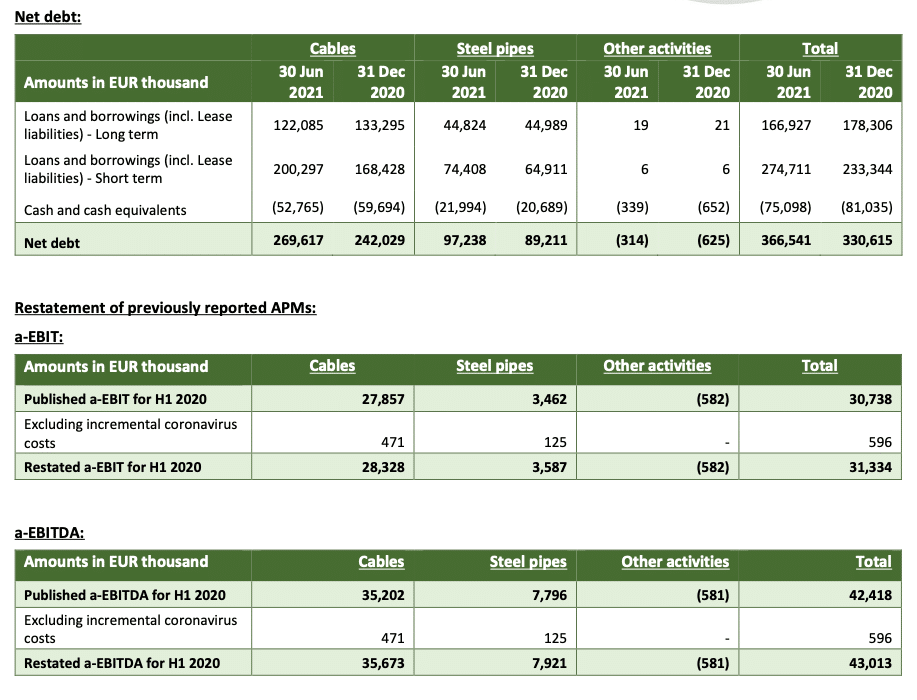

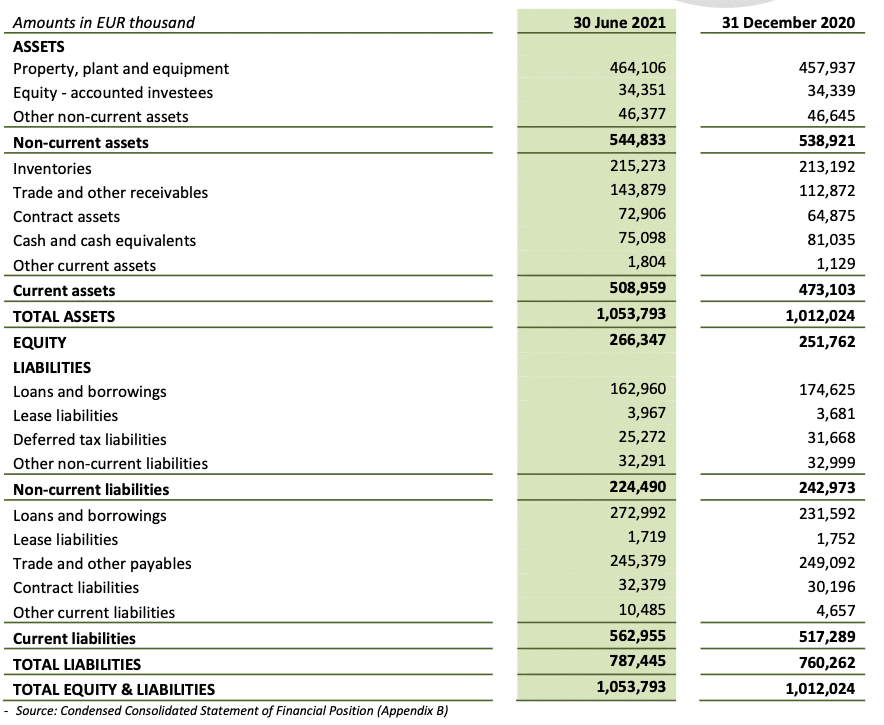

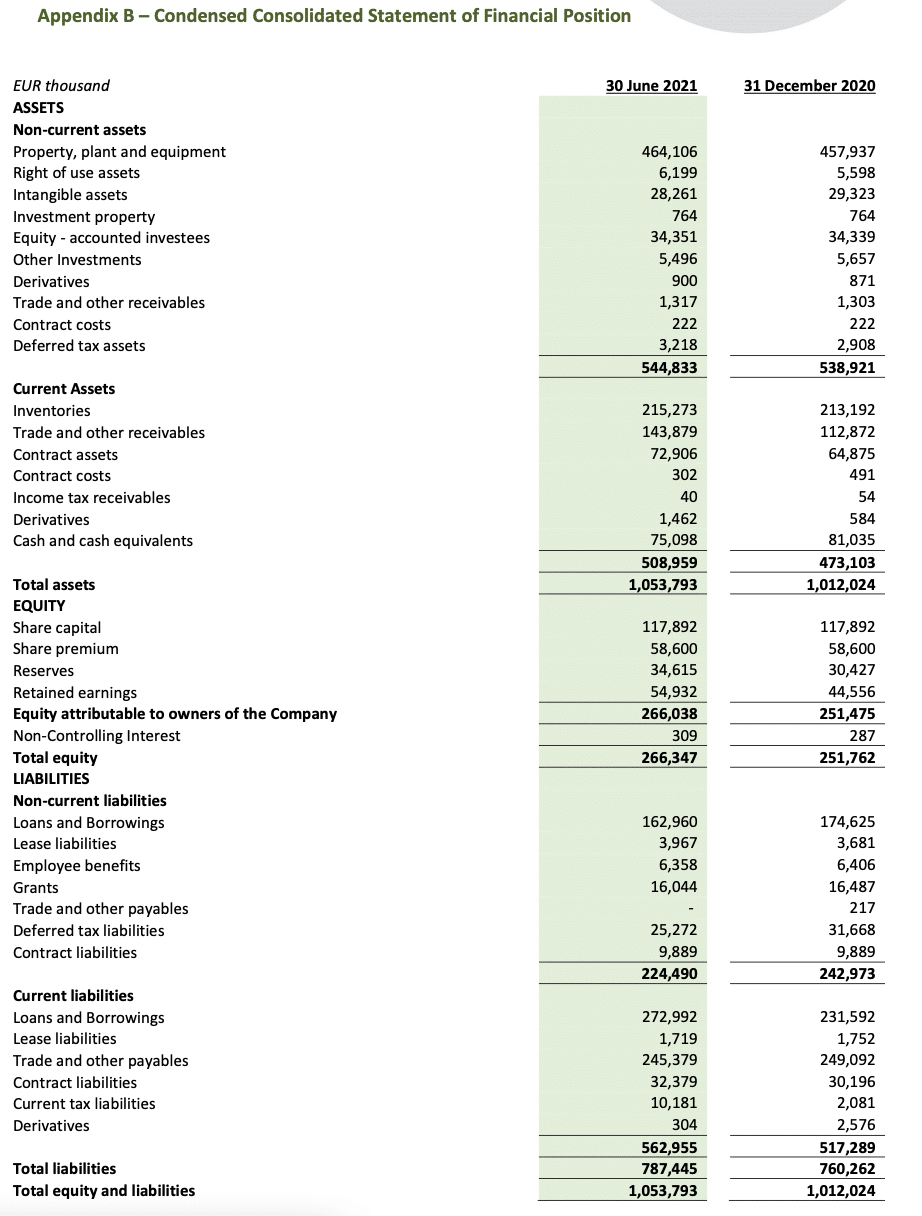

Total working capital increased significantly to EUR 135 million on June 30, 2021 (+34% vs. EUR 100 million on 31.12.2020). Such increase is due to higher raw material prices and the timing of milestone payments for projects in execution. The increase was, however, constrained through stricter working capital management, i.e. negotiation of better payment terms with supply chain partners as well as closer monitoring of raw material purchases where possible. Consequently, net debt increased to EUR 367 million on June 30, 2021, up by EUR 36 million from 2020 year-end level.

Cables

The cables segment’s results in the first six months depict a solid growth in the projects’ business, as orders awarded over recent years are executed smoothly, along with some volume growth in cables products. Consequently, all plants had a full production schedule throughout the semester leading to further growth in profitability.

Hellenic Cables continued its tendering efforts and succeeded to secure several awards for new projects in the offshore wind and interconnections markets, along with frame contracts from major TSOs. At the same time, a number of projects were successfully delivered, in full or partially, during this period:

- the1 78km-long submarin eand underground electrical interconnection between Crete and Peloponnese, one of the most demanding projects ever completed worldwide (the longest and deepest – 1000m – HVAC interconnection), was successfully installed and electrified in May;

- the electrical tests of the 150kV high voltage submarine cable that connects Skiathos to the Greek National Transmission System were successfully completed early in the year;

- the first deliveries of 66kV inter-array cables for the Seagreen offshore wind farm in the UK took place during the semester, while the production of the remaining quantities for the project continues;

- the production for phase B of Hollandse Kust Zuid project in the Netherlands was also completed, with delivery of the two 220kV subsea cables completed in the second quarter of the year; and

- the production for the submarine cables for Kafireas II Wind Farm interconnection with Greece’s mainland grid started during 2021, on schedule.

On the products business unit, sales volume increased by 16% in the first half of the year, signaling a demand upturn. This, along with a positive mix, further favored the entire segment’s profitability.

Thus, the cables segment exhibited a EUR 6.5 million increase in adjusted EBITDA, reaching EUR 42.0 million in H1 2021, up from EUR 35.7 million in H1 2020, with margins slightly lower, as revenue from products increased more than revenue from projects.

Corresponding profit before income tax reached EUR 16 million, compared to EUR 14.5 million in H1 2020, while net profit after tax followed the same trend and reached EUR 14.4 million (EUR 11.1 million in H1 2020).

As a final point, it is worth noting that the investment in Fulgor’s plant for the expansion of inter-array cables capacity is now almost completed. Capital expenditure for the segment reached EUR 15.6 million, out of which EUR 12.9 million concerned the aforementioned investments in Fulgor’s plant.

Steel pipes

During H1 2021, the steel pipes segment witnessed a first market reaction in the unprecedented decline in oil and gas prices during the previous year. As oil prices rebounded during the first six months of 2021 many postponed fossil-fuel distribution projects have slowly restarted. Several investment decisions, however, are still pending in the oil & gas sector, as the substantial increase of steel prices led to the recalculation of budget figures for many projects, creating turbulence in the wider fuel market.

In these adverse market conditions, revenue for the segment declined considerably to EUR 107 million in 2021H1, 22% lower from its H1 2020 level of EUR 137 million. Consequently, gross profit decreased to EUR 6.3 million in H1 2021 (from EUR 10.0 million in H1 2020) and adjusted EBITDA followed, down to EUR 5.9 million (EUR 7.9 million in H1 2020). As a result, the segment yielded a loss before tax of EUR 3.6 million, compared to loss of EUR 2.1 million in H1 2020.

Corinth Pipeworks has nonetheless showed significant resilience, mainly illustrated by:

- Efforts to strengthen its presence in new markets in Europe, the Americas, North Africa and Asia, and winning new projects for well-known customers (e.g. Snam in Italy, INGL in Southeast Mediterranean, Williams in USA and more offshore projects like KEG in Norway and Zendolie in Trinidad).

- Strict working capital and stock management, which secured liquidity.

- Initiatives to develop solutions towards the green energy transition. One of the most prominent exampleswas the certification of pipes to transport up to 100% hydrogen achieved in early June by CPW together with Snam, one of the world’s largest energy infrastructure companies. It concerns a 440km contract for the manufacture of the first high-pressure transmission gas pipeline network in Europe, certified to transport up to 100% hydrogen and manufactured in Corinth Pipeworks’ plant in Thisvi.

- Actions to safeguard the safety of its employees, fulfilling its contractual obligations and securing uninterrupted production for all its current projects.

As a final point, it should be noted that, over the course of the first semester, Corinth Pipeworks successfully continued its rigorous programme of major energy qualifications and innovative programs to enhance competitiveness and completed the cost optimization programme started in the last quarter of 2020, which is expected to improve its competitive position.

Subsequent events

Please refer to the Notes of the Condensed Consolidated Financial Statements for the 6-month period ended 30 June 2021.

DISCLAIMER: Any forward-looking statements that may be included in this press release are statements regarding or based on current expectations, plans or understandings of our management relating to, inter alia, Cenergy Holdings’ future results of operations, financial position, liquidity, prospects, growth, strategies or developments in the markets in which its subsidiaries operate. Such forward-looking statements shall be treated as a reflection of information, data and understandings as of the date of the publication of this press release, so you are encouraged not to place undue reliance on them, given that by their nature, forward-looking statements are subject to risks, uncertainties and assumptions that could materially alter the actual results or future events from those expressed or implied thereby. The outcome and financial effects of the understandings, intentions, and events described herein could be adversely affected by these risks, uncertainties and assumptions. Forward- looking statements contained in this press release related to trends or current activities shall not to be taken as a report of the future status of such trends or activities. We undertake no obligation to update or revise any forward-looking statements, either as a result of new information or developments, future events or otherwise. The information contained in this press release is subject to change without notice. No re-report or warranty, express or implied, regarding the fairness, accuracy, reasonableness or completeness of the information contained herein and no reliance shall be placed on it.

This press release has been prepared in English and translated into French and Greek. In case of discrepancies between different language versions, the English one shall prevail.

About Cenergy Holdings

Cenergy Holdings is a Belgian holding company listed on both Euronext Brussels and Athens Stock Exchange, investing in leading industrial companies, focusing on the growing global demand of energy transfer, renewables and data transmission. The Cenergy Holdings portfolio consists of Corinth Pipeworks and Hellenic Cables, companies positioned at the forefront of their respective high growth sectors. Corinth Pipeworks is a world leader in steel pipe manufacturing for the oil and gas sector and major producer of steel hollow sections for the construction sector. Hellenic Cables is one of the largest cable producers in Europe, manufacturing power and telecom cables as well as submarine cables for the aforementioned sectors. For more information about our company, please visit our website at www.cenergyholdings.com .

Contacts

For further information, please contact:

Sofia Zairi

Chief Investor Relations Officer Tel: +30 210 6787111, 6787773 Email: ir@cenergyholdings.com

All figures and tables contained in these appendices have been extracted from the Condensed Consolidated Interim Financial Statements for the period ended 30 June 2021, which have been prepared in accordance with IAS 34 Interim Financial Reporting, as adopted by the European Union and authorised for issue by the Board of Directors on 22 September 2021. The statutory auditor PwC Bedrijfsrevisoren BV has reviewed these Condensed Consolidated Interim Financial Statements and concluded that based on the review, nothing has come to the attention that causes them to believe that the Condensed Consolidated Interim Financial Statements are not prepared, in all material respects, in accordance with IAS 34, as adopted by the European Union. For the Condensed Consolidated Interim Financial Statements for the period ended 30 June 2021 and the review report of the statutory auditor, please refer to www.cenergyholdings.com.

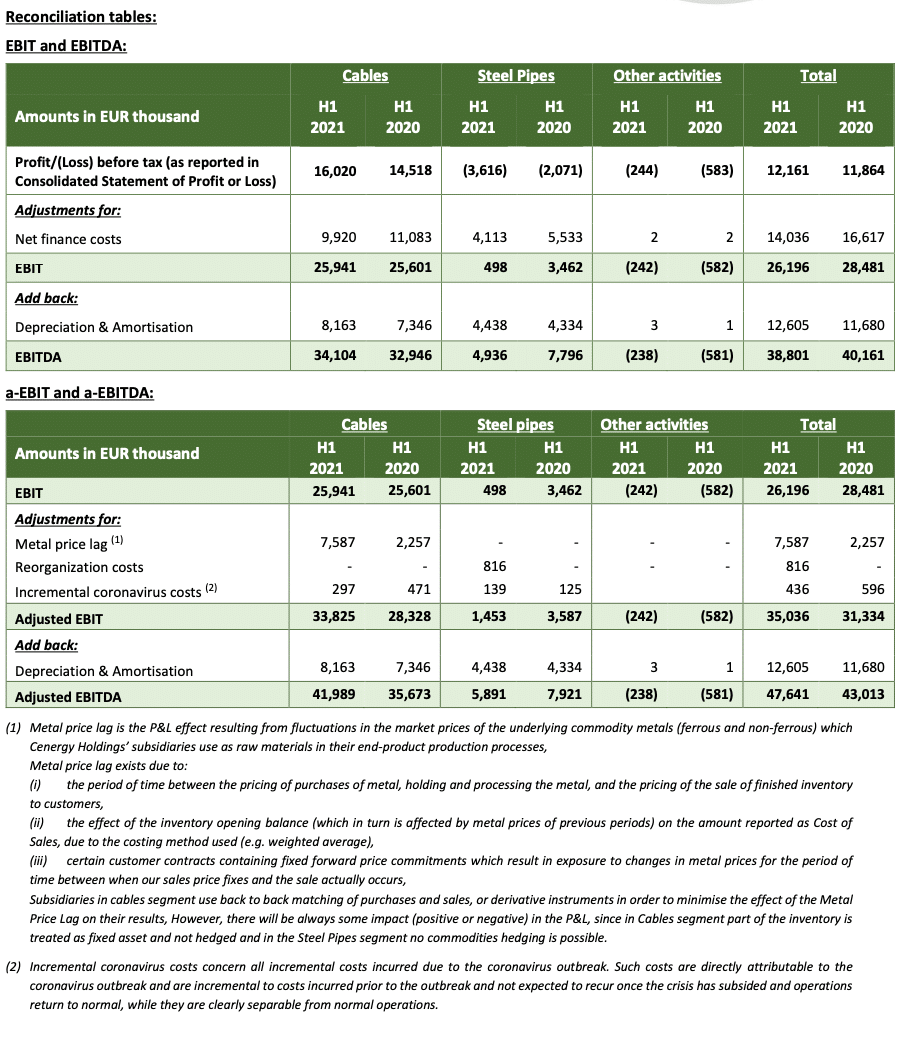

Appendix C – Alternative performance measures

In addition to the results reported in accordance with International Financial Reporting Standards (“IFRS”) as adopted by the European Union, this press release includes information regarding certain alternative performance measures which are not prepared in accordance with IFRS (“Alternative Performance Measures” or “APMs”). The APMs used in this press release are: Earnings Before Interest and Tax (EBIT), Adjusted EBIT, Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA), Adjusted EBITDA and Net debt. Reconciliations to the most directly comparable IFRS financial measures are presented below.

We believe these APMs are important supplemental measures of our operating and financial performance and are frequently used by financial analysts, investors and other interested parties in the evaluation of companies in the steel pipes and cables production, distribution and trade industries. By providing these measures, along with the reconciliations included in this appendix, we believe that investors will have better understanding of our business, our results of operations and our financial position. However, these APMs shall not be considered as an alternative to the IFRS measures.

These APMs are also key performance metrics on which Cenergy Holdings prepares, monitors and assesses its annual budgets and long-range (5 year) plans. However, it must be noted that adjusted items should not be considered as non- operating or non-recurring.

EBIT, Adjusted EBIT, EBITDA and Adjusted EBITDA have limitations as analytical tools, and investors should not consider it in isolation, or as a substitute for analysis of the operating results as reported under IFRS and may not be comparable to similarly titled measures of other companies.

APM definitions remained unmodified compared to those applied as at 31 December 2020. The definitions of APMs are as follows:

EBIT is defined as result of the period (earnings after tax) before:

- income taxes,

- net finance costs

EBITDA is defined as result of the period (earnings after tax) before:

- income taxes,

- net finance costs

- depreciation and amortisation

a-EBIT and a-EBITDA are defined as EBIT and EBITDA, respectively, adjusted to exclude:

- metal price lag,

- impairment / reversal of impairment of fixed, intangible assets and investment property

- impairment / reversal of impairment of investments

- gains/losses from sales of fixed assets, intangible assets, investment property and investments,

- exceptional litigation fees and fines and,

- other exceptional or unusual items

Net Debt is defined as the total of:

- Long term loans & borrowings and lease liabilities,

- Short term loans & borrowings and lease liabilities,

Less:

- Cash and cash equivalents