Regulatory News

Financial results for the year ended 31 December 2016

Brussels, 30 March 2017

Cenergy Holdings S.A. (Euronext Brussels, Athens Stock Exchange: CENER), hereafter “Cenergy Holdings” or “the Company”, today announces its financial results for the year ended 31 December 2016.

Key highlights

Cenergy Holdings S.A. (Cenergy Holdings or the Company) is a Belgium-based holding company founded in 2016 and listed on Euronext Brussels and the Athens Stock Exchange. Cenergy Holdings is a subsidiary of Viohalco S.A (81.93% of voting rights).

Viohalco S.A. (Viohalco) is the Belgium-based holding company of leading metal processing companies across Europe. Viohalco’s subsidiaries specialise in the manufacture of aluminium, copper, cables, steel and steel pipes products and technological advancement. They have production facilities in Greece, Bulgaria, Romania, Russia, FYROM, Turkey, Australia, and the United Kingdom.

On 14 December 2016, Cenergy Holdings announced the completion of the cross-border merger by absorption by Cenergy Holdings of the formerly Greek listed companies, Corinth Pipeworks Holdings S.A. and Hellenic Cables S.A. Holdings Société Anonyme. On 21 December 2016, the trading of its shares commenced on Euronext Brussels and the Athens Stock Exchange.

The cross-border merger between Cenergy Holdings, Hellenic Cables, and Corinth Pipeworks has been considered as a common control transaction, since all of the combining entities are ultimately controlled by the same party, namely Viohalco, both before and after the business combination. Due to the above and in order to provide financial information which is relevant, meaningful and reliable, the consolidated financial statements of Cenergy Holdings as of and for the period ended 31 December 2016 are presented as if the cross-border merger had occurred before the start of the earliest period presented (i.e. 1st January 2015).

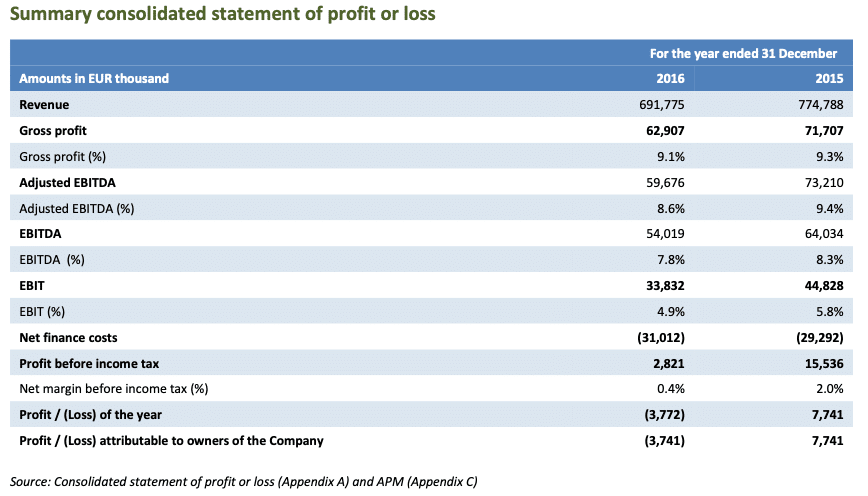

Financial highlights

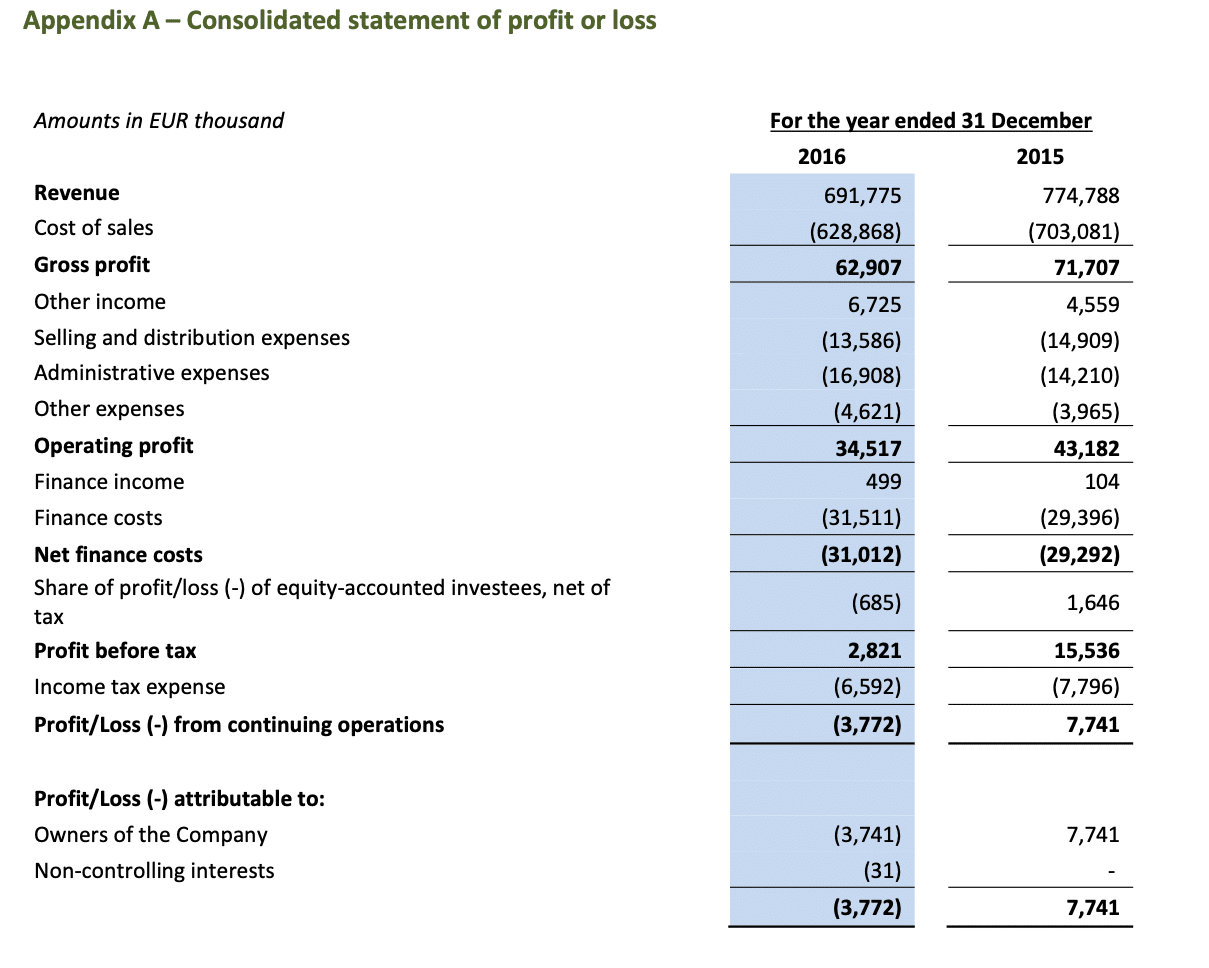

- Consolidated revenue down by 10.7% to EUR 692 million, compared to EUR 775 million in 2015, mainly due to lower LME prices, lower sales volume in medium voltage and low voltage power cables in the European markets, during the second semester of 2016 and delays in new energy projects as a result of low oil and gas prices;

- EBIT* of EUR 34 million, compared to EUR 45 million in 2015;

- Adjusted EBITDA* of EUR 60 million, compared to EUR 73 million in 2015;

- Restructuring costs amounted to EUR 2.1 million in 2016;

- Profit before income tax of EUR 2.8 million, compared to EUR 15.5 million in 2015;

- Loss of the year of EUR 3.7 million, compared to a profit of EUR 7.7 million in 2015;

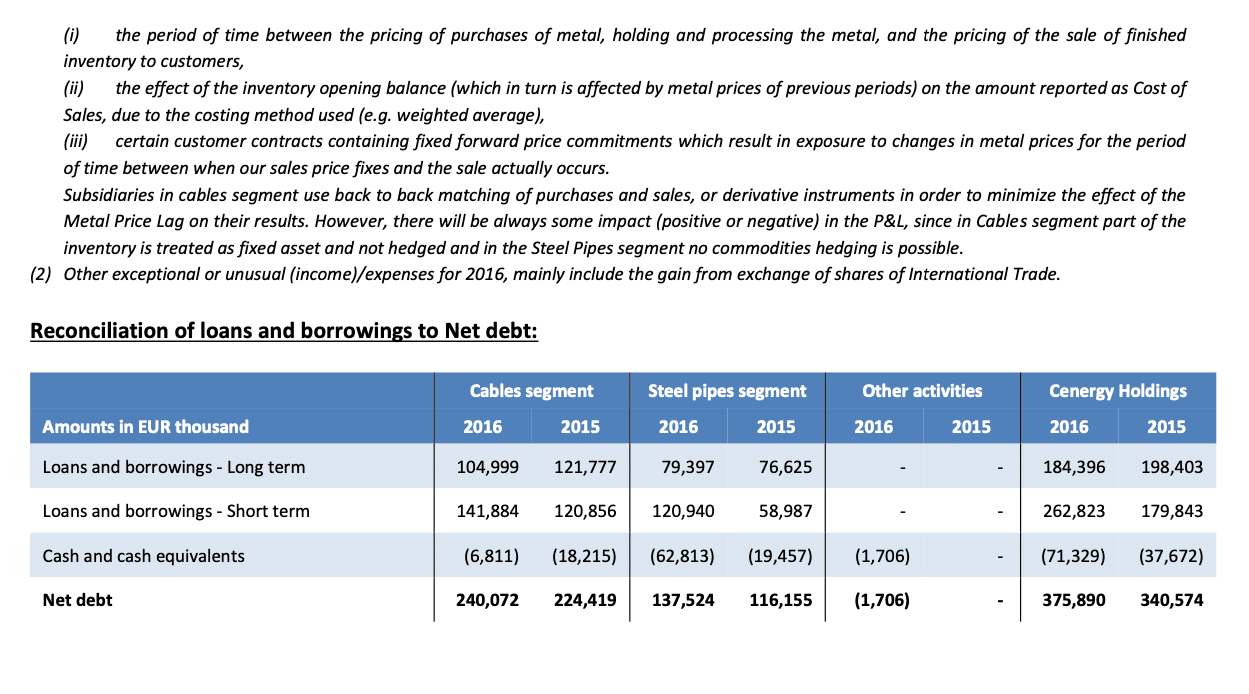

- Net debt* up 10.4 % to EUR 376 million as at 31 December 2016.

* For the definitions of the APMs used, refer to Appendix C.Operational highlights

During 2016, Cenergy Holdings’ operating environment was negatively affected by continuous modest global economic growth, lower prices of copper and aluminium, as well as further delays to steel pipes projects worldwide due to low oil and natural gas prices. However, the execution of significant contracts such as the Trans Adriatic Pipeline (“TAP”), Cyclades interconnection and St. George project partially counterbalanced the above.

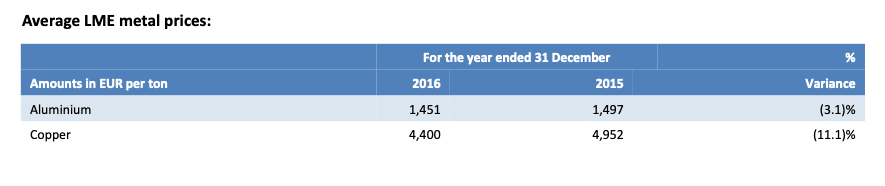

Consolidated revenue for 2016 amounted to EUR 692 million, a decrease of 10.7% compared to EUR 775 million recorded in 2015, as a result of the decline in metal prices, as reported below, and the reduced demand in European markets noticed mainly during the second half of 2016 in the cables segment.

Gross profit decreased by 12.3% to EUR 63 million in 2016, from EUR 72 million in 2015. However, the gross profit margin remained rather stable compared to 2015 at 9.1%.

Adjusted EBITDA decreased to EUR 60 million from EUR 73 million mainly due to the different mix of projects executed, the lower sales volume in medium voltage and low voltage power cables in the European markets, during the second semester of 2016 and delays in new energy projects as a result of low oil and gas prices.

Net finance costs increased by 5.9%, amounting to EUR 31 million, as a result of the increased net debt which financed working capital needs.

Profit before income tax decreased to EUR 3 million from EUR 16 million as a result of the above, the restructuring costs of 2.1 million related to the spin-offs, administrative reorganization, cross–border merger and the listing of the Company and the negative results of AO TMK-CPW (equity-accounted investee).

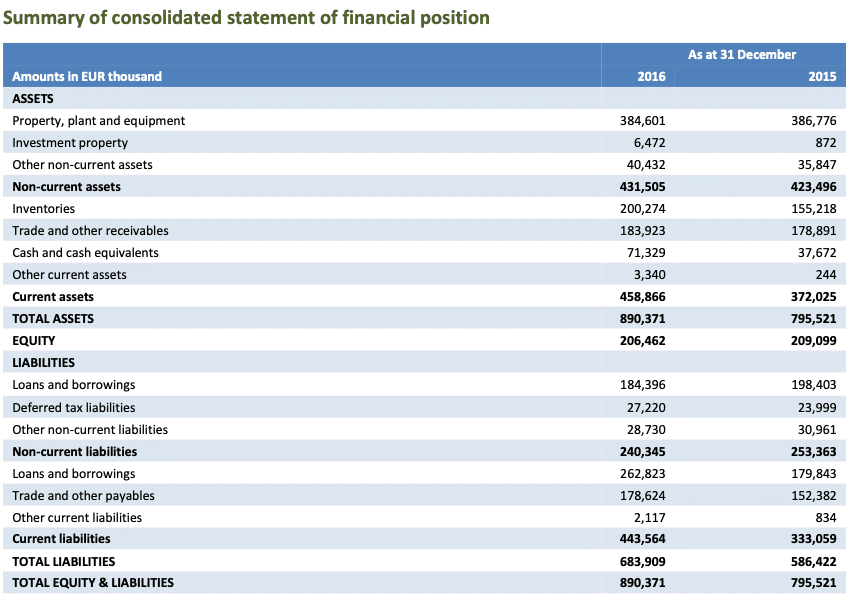

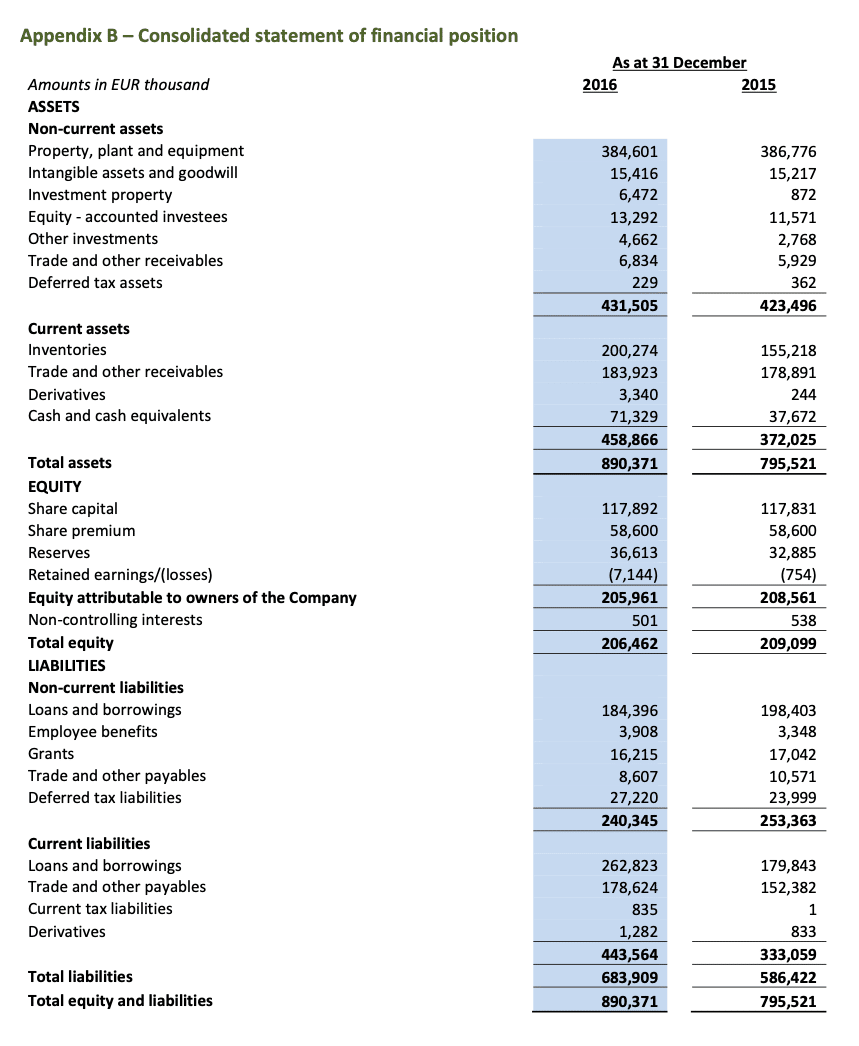

Source: Consolidated statement of financial position (Appendix B)

Non-current assets increased from EUR 423 million in 2015 to EUR 432 million in 2016. This increase is mainly due to the acquisition of an investment property from an affiliate of Viohalco, VET S.A., the increase in value of the equity accounted investee AO TMK – CPW mainly as a result of the fluctuation of euro / ruble exchange rate, and the acquisition of shares of the affiliated company, International Trade S.A.

Capital expenditure during the year amounted to EUR 12 million for the cables segment and EUR 7 million for the steel pipes segment, while depreciation of PP&E for 2016 amounted to EUR 20 million.

Current assets increased by 23.3% from EUR 372 million to EUR 459 million, mainly due to higher inventory levels (EUR 45 million) as a result of the increased raw material purchases for the forthcoming projects of steel pipes segment, as well as increased cash and cash equivalents (34 million).

Liabilities increased by 16.6% from EUR 586 million in 2015 to EUR 684 million in 2016, mostly driven by higher debt by EUR 69 million which is partially counterbalanced by the increase in cash and cash equivalents. This debt is related to financing of the new pipe mill which was concluded in 2015 and began operations in 2016. Cenergy Holdings companies’ debt in 2016 comprises of 41% long term and 59% short term facilities. Short term facilities are predominately revolving credit facilities which finance working capital needs and specific ongoing projects. The increase in trade payables of EUR 26 million is attributed to purchases of raw materials for the execution of the on-going projects, mainly in the steel pipes segment.

Performance by business segment

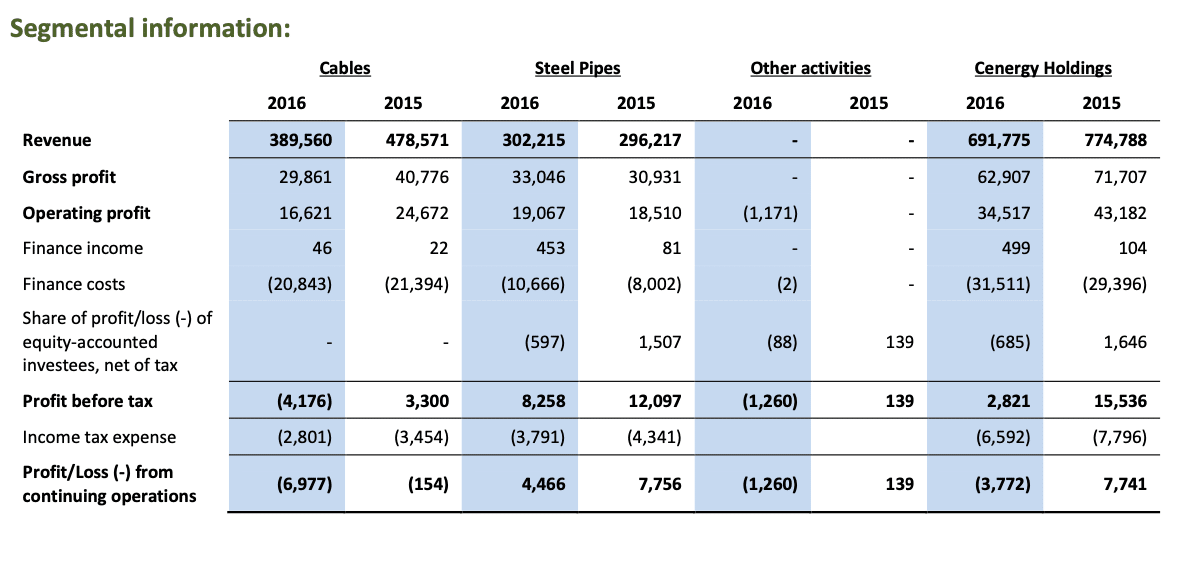

Cenergy Holdings’ financial performance is impacted by the performance of its subsidiaries, which in turn, are significantly affected by market conditions in their respective segments. Cenergy Holdings’ portfolio operates under the following organisational structure which includes three business segments:

- Steel pipes: Corinth Pipeworks engages in the production of steel pipes for the transportation of natural gas, oil and water networks, as well as steel hollow sections which are used in construction projects.

- Cables: Hellenic Cables, its subsidiaries, and Icme Ecab S.A. (Icme Ecab) constitute one of the largest cable producers in Europe, manufacturing power, telecommunication and submarine cables, as well as enamelled wires and compounds.

- Other activities: The segment includes the activities of the holding company that do not apply either to steel pipes or cables segments.

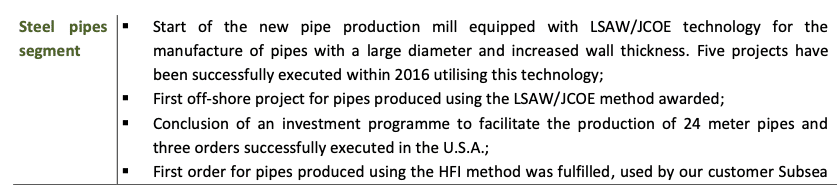

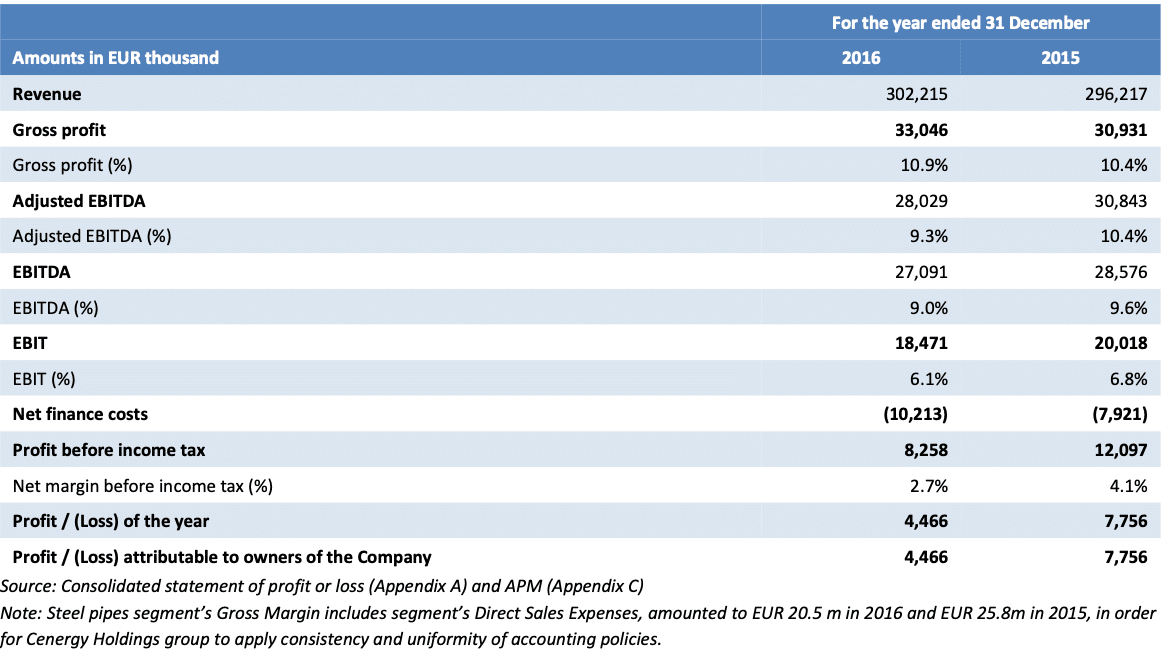

Steel pipes

Revenue amounted to EUR 302 million in 2016, a 2% increase year-on-year (2015: EUR 296 million). During 2016, Corinth Pipeworks executed about 50% of the TAP project, the biggest project in its history. The first reeling project for pipes up to 20m in length was also successfully completed during the year. In addition, Corinth Pipeworks completed the upgrade of the HFIW pipe mill and Coating and Lining plants during the year to facilitate the production of pipes up to 24 metres in length.

Gross profit amounted to EUR 33 million in 2016, a 7% increase compared to 2015 (EUR 31 million). In 2015, gross profit is reduced by a one-off loss derived from impairment of inventories of EUR 3.4 million.

Adjusted EBITDA amounted EUR 28 million in 2016, a 9% decrease year-on-year (2015: EUR 30.8 million). The decrease is mainly due to the loss recorded in 2016 of EUR 0.8 million from AO TMK-CPW, in which Corinth Pipeworks has a 49% stake, compared to profits of EUR 1.5 million recorded in 2015, as well as a small decrease in the profit margins of the projects executed in 2016 compared to those of 2015.

In 2016, profit before income tax amounted to EUR 8.3 million, compared to EUR 12.1 million in 2015. This decline is largely due to the above, as well as restructuring costs of EUR 540 thousand and increased interest costs relating to long term debt.

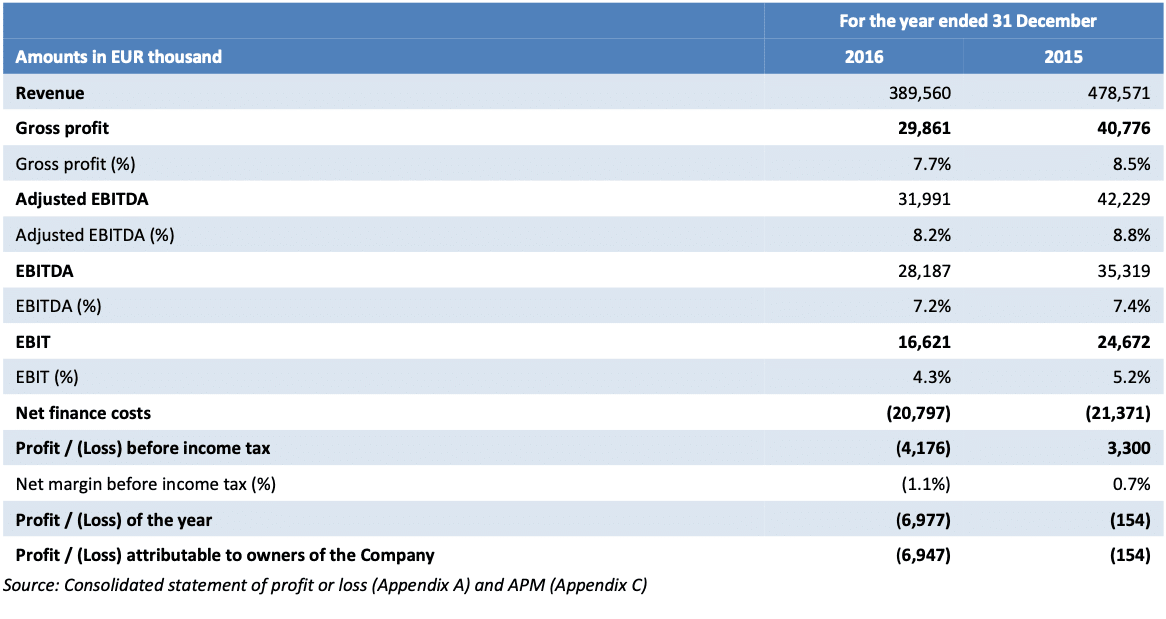

The summary consolidated statement of profit or loss of the steel pipes segment is as follows:

As for 2017, the international economic environment remains volatile, and low oil and natural gas prices (albeit increased from 2015 levels) do not support the implementation of significant projects in the energy sector. Despite the above, Corinth Pipeworks continues to focus on growth through the penetration of new geographical and product markets, particularly by targeting value adding products. Furthermore, raw materials prices remain high, which may negatively affect the Company’s profit margins. With years of experience and a continued focus on innovation, Corinth Pipeworks is well positioned to utilise its significant production capacity and focus on product diversification to enter new markets.

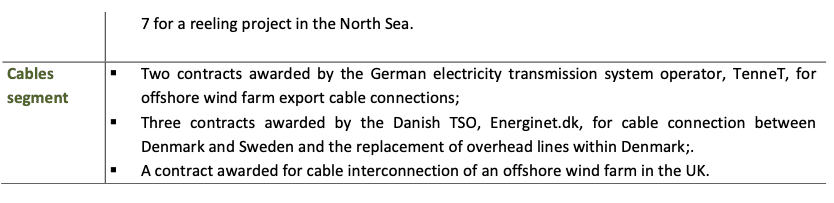

Cables

Revenue in 2016 amounted to EUR 390 million, down 18.6% year-on-year (2015: EUR 479 million). Sales volumes decreased by 6%.

During 2016, execution of different types of construction contracts resulted in changes to the product mix compared with the previous year. This, in turn, had an adverse effect on results for the year, in combination with weaker demand for medium and low voltage power cables in our main European markets during the second half of the year. As a result of the above, adjusted EBITDA amounted to EUR 32 million versus EUR 42 million in 2015. Metal price fluctuations during 2016 resulted in a loss of EUR 5.7 million. This fact also contributed to the decrease of gross profit from EUR 41 million to EUR 30 million.

Investments reached EUR 12.2 million for the year in the cables segment, attributable largely to productivity and capacity improvement projects at Fulgor S.A. (Fulgor), Hellenic Cables and Icme Ecab plants. Net debt increased to EUR 240.1 million in 2016 (2015: EUR 224.4 million), driven by increased working capital requirements and ongoing construction contracts.

Over the course of the year, Hellenic Cables and Fulgor successfully executed the remaining part of the Cyclades and St. George contracts. Hellenic Cables was awarded significant contracts for offshore wind farm export cable connections by TenneT, and a contract from Danish TSO Energinet.dk for cable connection between Denmark and Sweden and replacement of overhead lines within Denmark. Hellenic Cables also won a contract for cable interconnection of an offshore wind farm in the UK.

Finally loss before income tax amounted to EUR 4.2 million, compared to a profit of EUR 3.3 million in 2015.

The summary consolidated statement of profit or loss of the cables segment is as follows:

Despite a volatile business environment, Hellenic Cables, its subsidiaries, and Icme Ecab remain optimistic for 2017. Recent initiatives have focused on increasing sales of value-added products, developing a more competitive sales network, increasing productivity and reducing production costs. As a result, Hellenic Cables and its subsidiaries are well positioned to exploit international opportunities and compete globally with leading companies in the sector.

Subsequent events

There are no subsequent events affecting the consolidated financial information presented in this press release.

Outlook

In this volatile operating environment, Cenergy Holdings companies remain well-positioned to execute their longer- term strategies for growth through a continued focus on innovation, product diversification, efficiency, and strengthening customer relationships. The emphasis on these areas supports plans for international expansion and continuous pursuit of large-scale projects in high growth segments. In Greece, a successful conclusion to negotiations with the country’s creditors is expected to have a positive effect on economic indicators going forward, which should add further impetus to growth.

The outlook for 2017 is subject to several major uncertainties, such as the economic and political environment in the European Union and the United States, with potential major changes in trade policies as well as the impact of Brexit on the European economy in general and on the financing of major infrastructure projects in the United Kingdom.

Statement of the Auditor

The statutory auditor, KPMG Bedrijfsrevisoren – Réviseurs d’Entreprises, represented by Benoit Van Roost, has confirmed that the audit procedures on the consolidated financial statements, which have been substantially completed, have not revealed any material misstatement in the accounting information included in the Company’s annual announcement.

The Annual Financial Report for the period 1 January 2016 – 31 December 2016 shall be published on 28 April 2017 and shall be posted on the Company’s website, www.cenergyholdings.com, on the website of the Euronext Brussels europeanequities.nyx.com, as well as on the Athens Stock Exchange website www.helex.gr.

About Cenergy Holdings

Cenergy Holdings is a Belgian holding company listed on both Euronext Brussels and Athens Stock Exchange, investing in leading industrial companies, focusing on the growing global demand of energy transfer, renewables and data transmission. The Cenergy Holdings portfolio consists of Corinth Pipeworks and Hellenic Cables, companies positioned at the forefront of their respective high growth sectors. Corinth Pipeworks is a world leader in steel pipe manufacturing for the oil and gas sector and major producer of steel hollow sections for the construction sector. Cablel® Hellenic Cables is one of the largest cable producers in Europe, manufacturing power and telecom cables as well as submarine cables for the aforementioned sectors. For more information about our company, please visit our website at www.cenergyholdings.com.

Contacts

For further information, please contact:

Sofia Zairi

Head of Investor Relations

Tel: +30 210 6787111, 6787773 Email: ir@cenergyholdings.com

Appendix C – Alternative performance measures

In addition to the results reported in accordance with International Financial Reporting Standards (“IFRS”) as adopted by the European Union, this press release includes information regarding certain alternative performance measures which are not prepared in accordance with IFRS (“Alternative Performance Measures” or “APMs”). The APMs used in this press release are: Earnings Before Interest and Tax (EBIT), Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA), Adjusted EBITDA and Net debt. Reconciliations to the most directly comparable IFRS financial measures are presented below.

We believe these APMs are important supplemental measures of our operating and financial performance and are frequently used by financial analysts, investors and other interested parties in the evaluation of companies in the steel pipes and cables production, distribution and trade industries. By providing these measures, along with the reconciliations included in this appendix, we believe that investors will have better understanding of our business, our results of operations and our financial position. However, these APMs shall not be considered as an alternative to the IFRS measures.

EBIT, EBITDA, Adjusted EBITDA have limitations as analytical tools, and investors should not consider it in isolation, or as a substitute for analysis of the operating results as reported under IFRS and may not be comparable to similarly titled measures of other companies.

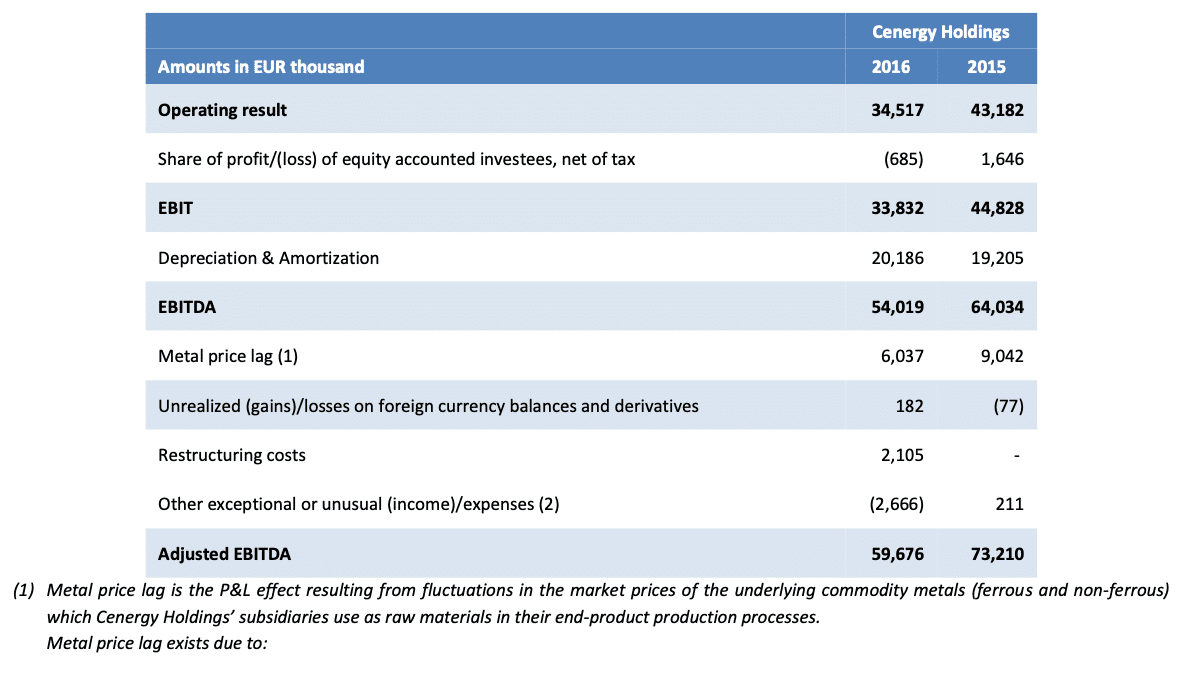

EBIT is defined as the Operating result as reported in the Consolidated statement of profit or loss plus Share of profit/(loss) of equity accounted investees, net of tax.

EBITDA is defined as EBIT plus depreciation and amortisation.

Adjusted EBITDA is defined as EBITDA excluding restructuring costs, metal price lag, unrealised (gains)/losses on foreign currency balances and derivatives and other exceptional or unusual (income)/expenses.

Reconciliation of Operating Profit to EBIT, EBITDA and Adjusted EBITDA: