Regulatory News

Financial results for the year ended 31 December 2020

Brussels, 17 March 2021

The enclosed information constitutes inside information and is to be considered regulated information as defined in the Belgian Royal Decree of 14 November 2007 regarding the duties of issuers of financial instruments which have been admitted for trading on a regulated market.

Cenergy Holdings S.A. (Euronext Brussels, Athens Stock Exchange: CENER), hereafter “Cenergy Holdings” or “the Group”, today announces its financial results for the year ended 31 December 2020.

Profitability growth and record-low net debt

Highlights

- Record high operational profitability, as adjusted EBITDA1 exceeded EUR 100 million (13% growth y-o-y)

- Steady order backlog at EUR 500 million as of 31 December 2020

- Net debt1 down by EUR 83 million to record-low levels of EUR 331 million

- Consolidated profit before tax of EUR 35.4 million vs. EUR 28.5 in 2019 (24% growth y-o-y)

- Consolidated net profit after tax reached EUR 24.8 million vs. EUR 20.2 in 2019 (23% growth y-o-y)

- Free cash flow2 for 2020 reached EUR 89 million, reflecting strict working capital management

- Management’s top priority to protect and ensure employees’ health & safety, secure supply chain andguarantee production continuity

- Capital expenditure of EUR 65 million to secure future value creation

Overview

2020, despite being an extremely difficult year for humanity with the Covid-19 pandemic claiming globally more than 2.5 million lives until now and changing fundamentally most of our everyday life, has proven to be a positive year for Cenergy Holdings. All segments succeeded in providing effective solutions in the energy and data transfer sector, while our vision to a “greener” future gained momentum through a number of initiatives.

During the year, all key financial objectives set for the year were realised, despite the unprecedented global health and economic crisis. Cenergy Holdings demonstrated its ability to create value for its stakeholders and outperformed its own previous results, both in operational profitability and free cash flow, leading to a record- low net debt.

As the world was experiencing the outbreak of the SARS-Cov-2 virus, all companies in Cenergy Holdings managed, immediately and effectively, to shield their most valuable asset, the health of their personnel. They also took prompt action to prevent the spread of the virus, provide a flexible working framework, where possible, and ensure the best possible working conditions in an uncertain economic environment. While adapting their activities to the new Health and Safety standards, both segments mitigated the financial impact of the pandemic by focusing on liquidity, guaranteeing raw material availability and closely monitoring local and global developments.

The growth in all profitability measures recorded by the Group during 2020 demonstrates both the resilience created in recent history and the outcomes of the above measures which allowed all plants to work at satisfactory levels throughout the year. As a result, operational profitability (adjusted EBITDA) increased by 13% compared to 2019, despite the 5% fall in sales, as both segments successfully delivered high technology and high margin projects in the energy transition markets. The tendering activity continued without disruptions and total backlog as of December 31st, 2020 reached EUR 500 million.

In the cables segment, the good momentum of 2019 persisted throughout 2020. The high utilization of submarine cables production lines and the smooth execution of high-profile projects cemented its solid performance. Demand in cable products was undoubtedly affected by the outbreak of the COVID-19 pandemic during the 2nd quarter, but it rebounded later in the year and finally led to a marginally lower turnover in the cables products business unit. The overall focus in value added projects and products, however, allowed higher profit margins and a lift in profitability, leading the entire segment to a remarkable performance with a-EBITDA exceeding EUR 80 million. The above was further stimulated by initiatives to enter new geographical markets and the ongoing investment program to further enhance the production capacity of the offshore business unit.

On the other hand, the steel pipes segment was affected by the historical decrease in oil & gas prices observed throughout 2020, further amplified by the effects of the pandemic. Market conditions being highly volatile, a large number of exploration projects, especially in the USA, were postponed, if not cancelled, narrowing the available tender opportunities for Corinth Pipeworks (hereafter “CPW”), the Group’s main company in the segment. Turnover fell by 18% compared to 2019 and operational profitability (adjusted EBITDA) suffered a decrease by EUR 5.1 million. To compensate for the general slowdown in demand and protect profitability, CPW focused in new geographical markets and implemented a cost optimization programme, undertaking cost reduction initiatives and maintaining the industrial excellence programme in their Thisvi plant. At the same time, working capital management in the steel pipes segment tightened and contributed significantly in the free cash flow generation of the Group. In brief, CPW demonstrated considerable stamina throughout these hard times, strengthening its presence in existing and emerging markets (Europe, North Africa, Asia, Central America), winning important new onshore and offshore projects and securing an uninterrupted production process all throughout the year.

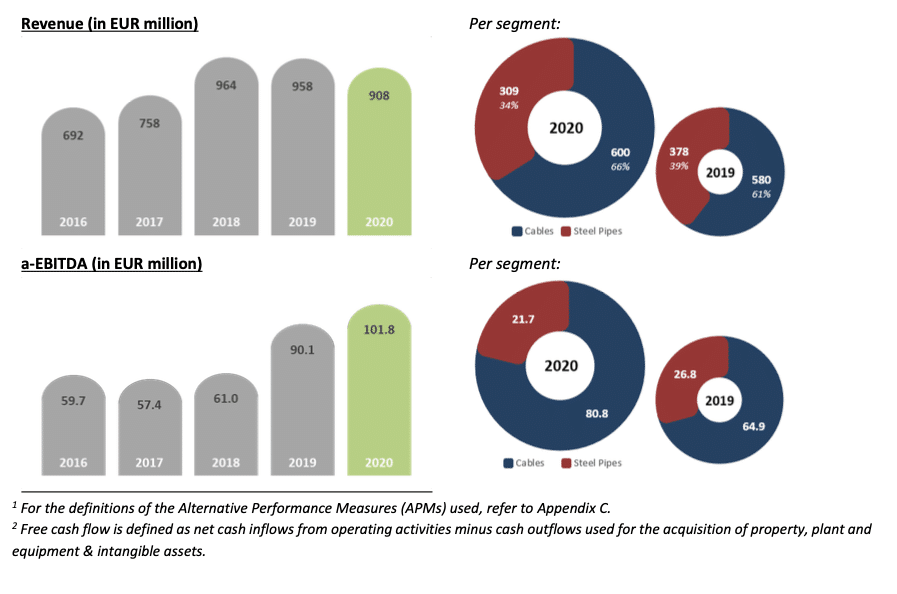

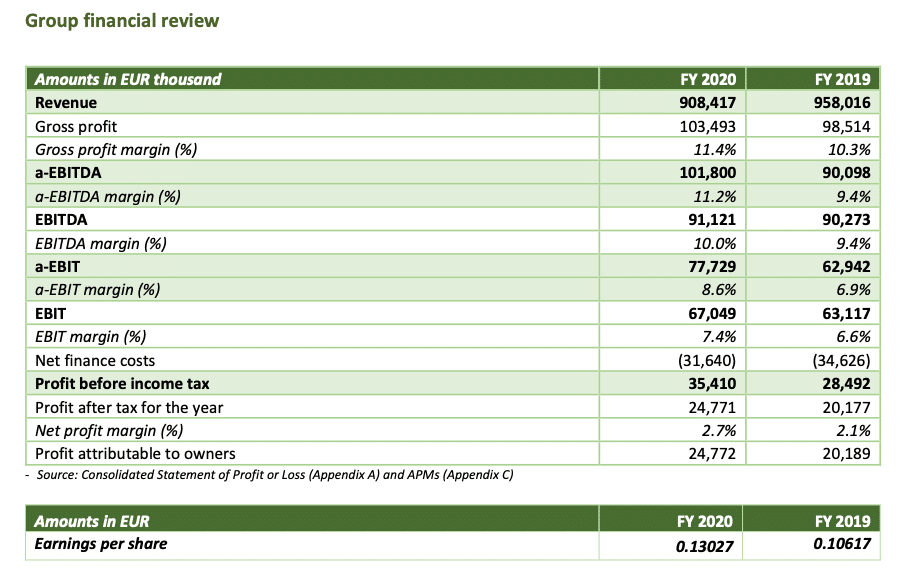

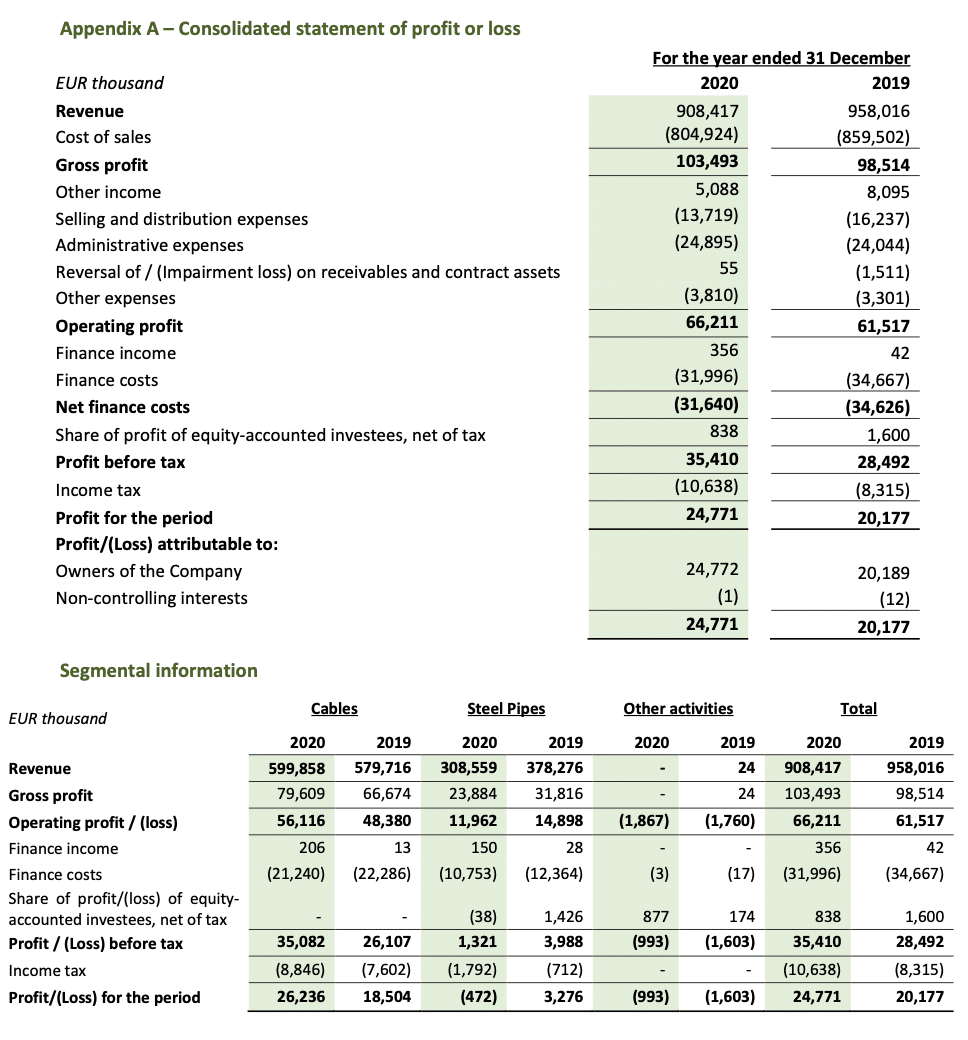

Consolidated revenue for 2020 stands at EUR 908 million, a 5.2% y-o-y decrease reflecting the pandemic effects on products demand and the impact of lower oil & gas prices on the steel pipes segment.

On the contrary, adjusted EBITDA increased by 13% y-o-y to EUR 102 million. The cables segment achieved a rise in operational profits for the second consecutive year, from EUR 35 million in 2018 to EUR 65 million in 2019 reaching EUR 81 million in 2020 which covered the decline in steel pipes segment (EUR 22 million vs. EUR 27 million in 2019). Overall, the a-EBITDA margin increased further to 11.2% compared to 9.4% during 2019 attesting to the emphasis given in value-added solutions; most of this increase stemmed from the effective delivery of challenging cables projects.

Net finance costs fell by EUR 3 million (9%) to EUR 31.6 million, as net interest and related costs were EUR 2.4 million lower (7% y-o-y) due to both lower interest rates and tighter working capital management, mainly in the steel pipes segment.

The stronger EBITDA and lower finance costs yield a profit before income tax of EUR 35.4 million, a 24% jump compared to the EUR 28.5 million in 2019.

Profit after tax for the period stood at EUR 24.8 million, compared to EUR 20.2 million in 2019, representing 2.7% of revenue (against 2.1% in 2019).

Due to the significant amount of orders received in cables business, total capital expenditure for the Group reached EUR 65 million, split between EUR 49.4 million for the cables segment and EUR 15.5 million for the steel pipes segment. Investments in the former concerned mainly the expansion of Fulgor’s inter-array cables production capacity in order to supply a wide range of offshore wind developers worldwide. In the steel pipes segment, the “double jointing” project that will better position CPW in the US pipe market was completed in 2020, while a number of smaller scale investments targeted productivity and cost improvements in the Thisvi plant.

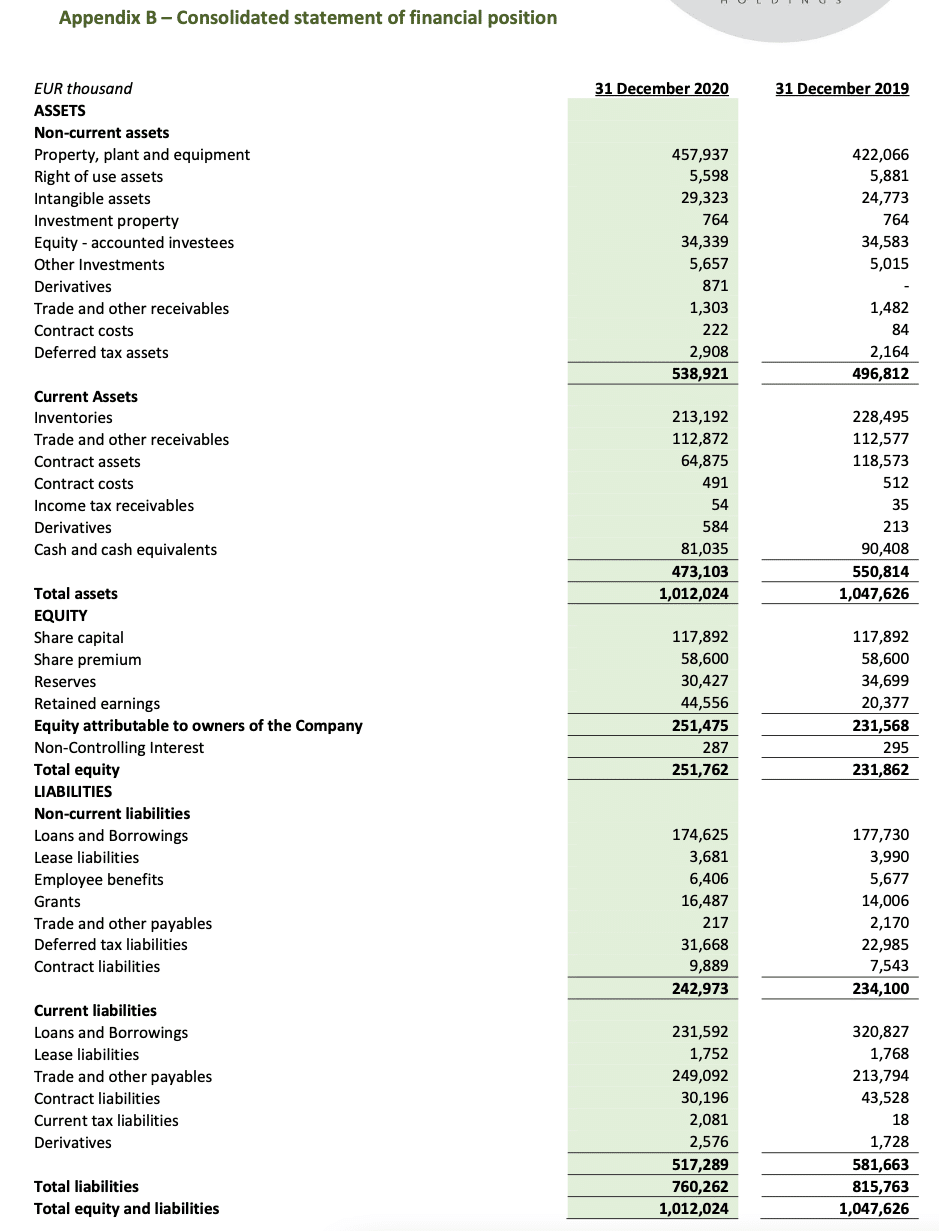

Working capital (incl. contract assets & liabilities) decreased significantly to EUR 100 million on December 31st, 2020, down by 49% y-o-y (EUR 195 million on 31.12.2019). This was the remarkable outcome of the strict working capital management in the steel pipes segment and the successful completion of milestones for the cables projects. Its future evolution will depend on the timing of both prepayments and milestone payments of energy projects undertaken by subsidiaries.

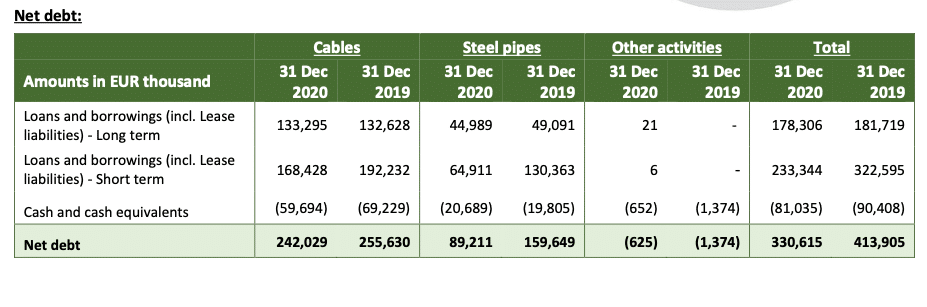

Consequently, net debt fell to record-low levels (EUR 331 million on December 31st, 2020), down EUR 83 million from the 31.12.2019 level (EUR 414 million), further proving the Group’s effort and commitment to deleveraging.

Cables

Cables segment’s 2020 results are characterized by the solid growth of projects’ business and the financial resilience demonstrated throughout the Covid-19 crisis. The products business and especially telecom cables, was, as expected, hit during the 2nd quarter by the pandemic crisis, despite a promising start during the first months of the year. However, the second half of the year witnessed a sound recovery for this business in our main markets in Central Europe and the Mediterranean, as lockdown measures ceased or softened. Despite the challenges faced, all segment companies achieved a high capacity utilisation level in all production units that drove operational profitability (adjusted EBITDA) higher by 24.5% compared to 2019.

Despite a full production schedule, Hellenic Cables continued its tendering efforts across a number of geographical areas and succeeded to secure several awards for new projects and frame contracts, both in the offshore and onshore sector:

- In the offshore sector, Hellenic Cables was awarded the biggest-ever inter-array cables contract for Dogger Bank offshore wind farm phases A & B in the UK, for the supply of 650km, 66kV inter-array cables. Other major offshore projects awards included the Seagreen offshore wind project in the UK, for the supply of 320km of 66kV inter-array cables and the supply of approx. 90km of 11kV and 33kV composite submarine cables and associated accessories to Scottish & Southern Electricity Networks.

- In the onshore sector, Hellenic Cables was awarded important frame agreements and turnkey contracts across Europe. It won a turnkey contract by SP Transmission plc., one of UK’s largest grid operators, for the supply and installation of 132kV cables for the Douglas North project. In Denmark, TSO Energinet selected Hellenic Cables as one of three cable manufacturers in its 8-year frame agreement for high voltage underground cable systems (145-170kV), while more frame contracts were awarded for low voltage cables in our main markets by local TSOs.At the same time, a number of projects were successfully delivered, in full or partially during the year:

• In the offshore sector, the submarine interconnection of Skiathos island to the mainland transmission system was successfully completed and the final delivery is expected earlier than originally scheduled. The Otary Seamade turnkey project in Belgium was successfully completed with the installation of two 220kV subsea cables connecting Seastar and Mermaid offshore wind farms to the MOG platform.

In addition, the production for phase A of Hollandse Kust Zuid project in the Netherlands was also completed, with the delivery of the two 220kV subsea cables.

A second important project was officially delivered in Greece, with the completion of Phase B of the Cyclades interconnection, which consists of the interconnections Paros-Naxos and Naxos-Mykonos, while the Crete-Peloponnese project ran in full pace throughout 2020, with the production of all cables completed and the installation phases of the project progressing significantly.

• In the Onshore sector, the underground segments of the 400kV Rio-Antirrio link and the 150kV Crete- Peloponnese interconnection were completed and electrified during 2020.

It is important to note here that, despite the implementation of several restrictions in the free flow of people and goods globally due to Covid-19, Hellenic Cables accomplished on-time delivery of such complicated projects. Such success is fully attributable to the company’s strict adherence not only to external mandates, but also to internal safety protocols and procedures and continuous coordination with clients and supply chain partners.

On the other hand, the products business units recorded a steady sales volume in line with 2019 and succeeded in improving the sales mix towards higher value-added products. Hence, the negative impact of the Covid-19 crisis on telecom sector was counterbalanced by solid demand for medium voltage cables coming from Central Europe and recovery from Q3 onwards in low voltage market.

It is also worth noting that all plants, irrespective of their specific product range, remained fully operational throughout the Covid-19 crisis, since an action plan to adapt to stricter health and safety standards, secure an undisrupted supply chain and mitigate financial impact with liquidity preservation, was immediately put in place from mid-March 2020 onwards.

Driven by the above, cables segment exhibited a EUR 15.9 million increase in adjusted EBITDA, reaching EUR 80.8 million in 2020, up from EUR 64.9 million in 2019.

Corresponding profit before income tax reached EUR 35.0 million, compared to EUR 26.1 million in 2019, while net profit after tax followed the same trend and reached EUR 26.2 million (EUR 18.5 million in 2019).

The segment’s net debt decreased by more than 5% y-o-y (from EUR256million on 31.12.2019 to EUR 242 million on 31.12.2020). The determination to re-profile debt, secure lower financing costs and achieve an effective capital structure continued with actions including, among others, the issuance of a EUR 20 million- bond loan to finance offshore projects.

Steel pipes

2020 was indeed a difficult year for the steel pipes segment. Energy markets were strongly shaken by the historic oil & gas price drop throughout 2020, rooted in a price war between major suppliers and leading to the postponement or even cancellation of many fossil fuel distribution projects. The outbreak of the Covid-19 pandemic further disturbed energy demand due to the extended lockdowns around the globe.

In these adverse market conditions, revenue for the segment declined considerably to EUR 309 million in 2020, 18% lower from its 2019 levels of EUR 378 million. Nonetheless, Corinth Pipeworks showed a lot of resilience, mainly illustrated by:

- The safeguarding of its personnel safety, securing uninterrupted production for all current projects;

- The efforts to strengthen presence in new markets like Europe, Americas, North Africa and Asia, and winning new projects:

o Energinet, Baltic Pipe, a 142 km gas pipeline of 32-36” pipes.

o King’s Quay project, 30km of 16” linepipe in deep water (1,250m) Gulf of Mexico o Anglo American, 35km of 24” slurry pipeline in Chile

o BG, Shell Colibri, 93km of 16” offshore pipeline in the Gulf of Mexico

o PPC, 150 km of 12” gas pipeline in Egypt

- The strict working capital management which secured liquidity and allowed the operating activities to finance the investments of EUR 15.5 million that took place during 2020.

During the second semester of the year, CPW managed to execute a significant part of its backlog, while implementing a cost optimization programme. This action plan led the segment increasing its profit margins in terms of a-EBITDA (8.1% for H2 2020 versus 7.2% for H2 2019 and 5.7% in H1 2020) and recording profit before tax of EUR 3.4 million in H2 2020, which covered losses recorded during the first semester of the year.

Overall for 2020, gross profit decreased to EUR 23.9 million in 2020 (from EUR 31.8 million in 2019) and adjusted EBITDA followed, down to EUR 21.7 million (EUR 26.8 million in 2019). As a result, the segment recorded a marginal profit before tax of EUR 1.3 million for 2020, compared to EUR 4.0 million in 2019.

In 2020, the segment managed to produce significant free cash flows, in spite of the decrease in operating profits. This fact resulted in a large decline in net debt from EUR 160 million as of 31 December 2019, to EUR 89 million. Long-term debt was also partially refinanced with more favourable terms, through the issuance of two bond loans amounting to EUR 16 million in total.

Last but not least, CPW successfully continued in the course of the year, its intense program of qualifications from major Oil & Gas companies along with innovative programs to enhance competitiveness like “Manufacturing Excellence”, the road to process digitalization and the revolution of Industry 4.0.

Subsequent events

There are no subsequent events affecting the Consolidated Financial Information presented in this Press Release.

Outlook

As the world lives through a third wave of the Covid-19 pandemic, the prediction of the full extent and duration of its business and economic impact remains challenging. Consequently, the full extent of the impact of the Covid-19 pandemic on the operational and financial performance of Cenergy Holdings is uncertain and will depend on several factors outside our control. These factors depend largely on the duration of the pandemic, the application of pandemic controls and restrictions, and the availability and effectiveness of treatments and vaccines worldwide. The range of potential outcomes for the global economy are difficult to predict and the outlook for 2021, is itself subject to the manner the pandemic will continue to impact different geographical areas.

Regarding the cables projects business, given the existing backlog and the nature of projects assigned and based on currently available data and information, the impact from Covid-19 on long term business and on short-term financial results is expected to be limited. Considering the strong forecast of new projects and the potential of expanding to new markets, the secured orders and the growth potential of the offshore cables sector, the overall outlook for cables segment remains positive for 2021. The ‘European Green Deal’, EU’s roadmap for economic sustainability and climate neutrality by 2050, the promising emerging offshore wind market in the USA and the projects announced in the Mediterranean area create a favourable environment for projects business, as demand for both offshore and onshore power cable systems is expected to increase. Fulgor’s plant (i.e., the submarine cables business unit) is expected to retain its high capacity utilisation throughout 2021, continuing to

drive the entire segment’s profitability. Furthermore, in the cable products business unit, some signs of demand stability in its main markets of Western Europe, Middle East and the Balkans, start to appear as demand from construction and industrial use showed signs of recovery during H2 2020, after being strongly hit during the first wave of the pandemic. Such markets, however, continue to experience competitive challenges and the segment subsidiaries will actively seek to geographically diversify their revenue streams. Finally, the focus for the cables segment always remains the successful execution of existing projects and the award of new ones, while optimising internal processes to take advantage of any arising new market opportunity.

In the steel pipes segment, the global economic environment in which Corinth Pipeworks operates remains volatile. Main points are expected to be the confrontment of the COVID-19 pandemic that will lead to the rebound of energy demand and the accelerated energy transition scenario. Despite these headwinds, Corinth Pipeworks remains focused on maintaining its leading position, through new investments, research & development initiatives concerning hydrogen and wind sector and the penetration of new geographical and product markets. It intensifies its efforts to enhance competitiveness and qualify for tenders offered from major Oil & Gas companies. This effort involves, among other projects, the “Manufacturing Excellence” program, an attempt to process digitization and schemes to introduce Industry 4.0 into CPW’s production lines. The transformation of CPW to a more diversified product profile is an essential part of its innovation agenda throughout 2021. Corinth Pipeworks maintains its positive outlook for 2021, with the execution of backlog and the upcoming finalization of many projects that had been put on hold due to the pandemic.

Overall, despite current world market volatility, Cenergy Holdings expects to maintain the positive momentum gained during the last two years. Its companies’ diverse business model and solid organizational structure continue to provide resilience in this challenging environment, providing confidence for long-term sustainable growth.

Statement of the Auditor

The statutory auditor, PwC Réviseurs d’Entreprises SRL / Bedrijfsrevisoren BV, represented by Marc Daelman, has confirmed that the audit, which is substantially completed, has not to date revealed any material misstatement in the draft consolidated accounts and that the accounting data reported in this press release is consistent in all material respects with the draft consolidated accounts from which it has been derived.

The Annual Report for the period 1 January 2020 – 31 December 2020 will be posted on the Company’s website, www.cenergyholdings.com, on the website of the Euronext Brussels www.euronext.com, as well as on the Athens Stock Exchange website www.helex.gr.

DISCLAIMER: Any forward-looking statements that may be included in this press release are statements regarding or based on current expectations, plans or understandings of our management relating to, inter alia, Cenergy Holdings’ future results of operations, financial position, liquidity, prospects, growth, strategies or developments in the markets in which its subsidiaries operate. Such forward-looking statements shall be treated as a reflection of information, data and understandings as of the date of the publication of this press release, so you are encouraged not to place undue reliance on them, given that by their nature, forward-looking statements are subject to risks, uncertainties and assumptions that could materially alter the actual results or future events from those expressed or implied thereby. The outcome and financial effects of the understandings, intentions, and events described herein could be adversely affected by these risks, uncertainties and assumptions. Forward- looking statements contained in this press release related to trends or current activities shall not to be taken as a report of the future status of such trends or activities. We undertake no obligation to update or revise any forward-looking statements, either as a result of new information or developments, future events or otherwise. The information contained in this press release is subject to change without notice. No re-report or warranty, express or implied, regarding the fairness, accuracy, reasonableness or completeness of the information contained herein and no reliance shall be placed on it.

This press release has been prepared in English and translated into French and Greek. In case of discrepancies between different language versions, the English one shall prevail.

About Cenergy Holdings

Cenergy Holdings is a Belgian holding company listed on both Euronext Brussels and Athens Stock Exchange, investing in leading industrial companies, focusing on the growing global demand of energy transfer, renewables and data transmission. The Cenergy Holdings portfolio consists of Corinth Pipeworks and Hellenic Cables, companies positioned at the forefront of their respective high growth sectors. Corinth Pipeworks is a world leader in steel pipe manufacturing for the oil and gas sector and major producer of steel hollow sections for the construction sector. Hellenic Cables is one of the largest cable producers in Europe, manufacturing power and telecom cables as well as submarine cables for the aforementioned sectors. For more information about our company, please visit our website at www.cenergyholdings.com.

Contacts

For further information, please contact:

Sofia Zairi

Chief Investor Relations Officer Tel: +30 210 6787111, 6787773 Email: ir@cenergyholdings.com

Appendix C – Alternative performance measures

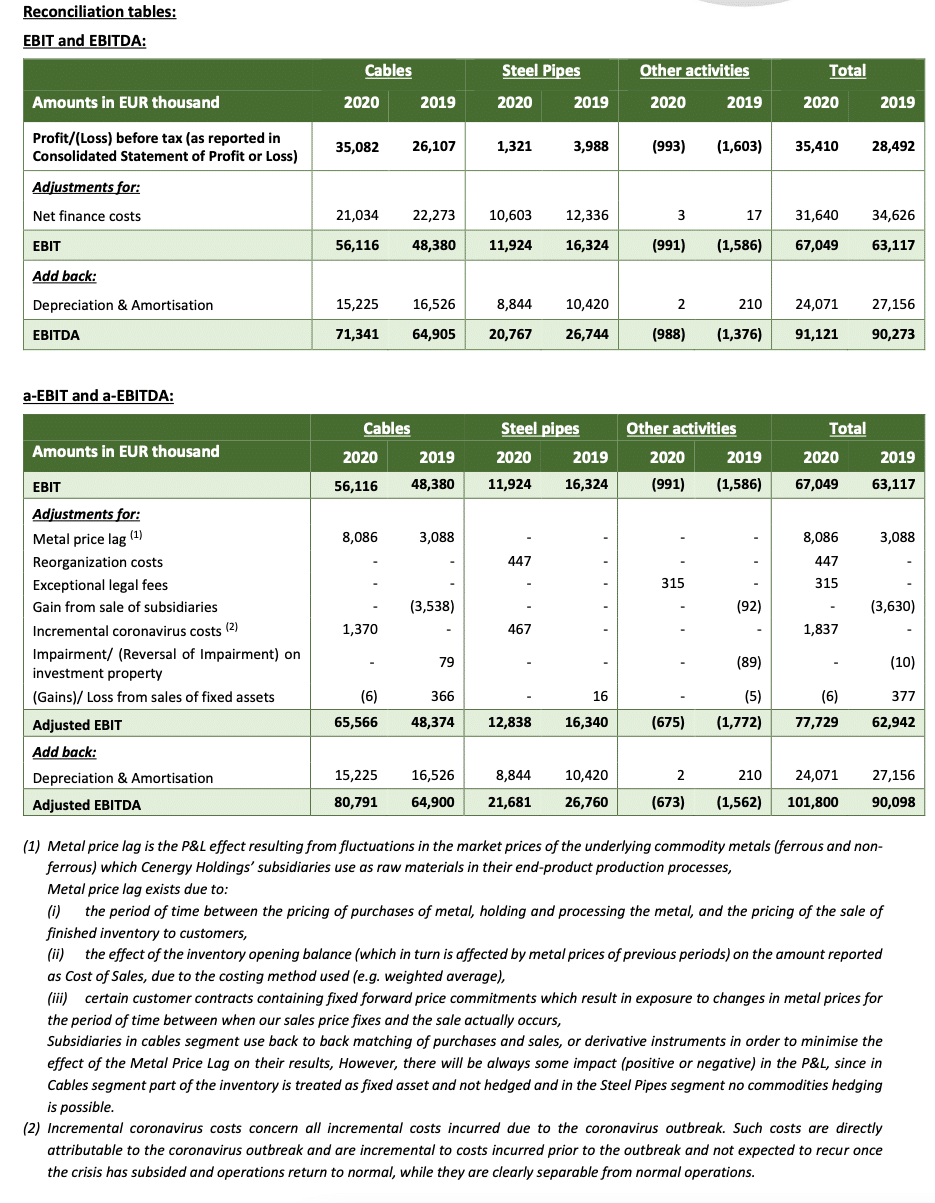

In addition to the results reported in accordance with International Financial Reporting Standards (“IFRS”) as adopted by the European Union, this press release includes information regarding certain alternative performance measures which are not prepared in accordance with IFRS (“Alternative Performance Measures” or “APMs”). The APMs used in this press release are: Earnings Before Interest and Tax (EBIT), Adjusted EBIT, Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA), Adjusted EBITDA and Net debt. Reconciliations to the most directly comparable IFRS financial measures are presented below.

We believe these APMs are important supplemental measures of our operating and financial performance and are frequently used by financial analysts, investors and other interested parties in the evaluation of companies in the steel pipes and cables production, distribution and trade industries. By providing these measures, along with the reconciliations included in this appendix, we believe that investors will have better understanding of our business, our results of operations and our financial position. However, these APMs shall not be considered as an alternative to the IFRS measures.

These APMs are also key performance metrics on which Cenergy Holdings prepares, monitors and assesses its annual budgets and long-range (5 year) plans. However, it must be noted that adjusted items should not be considered as non- operating or non-recurring.

EBIT, Adjusted EBIT, EBITDA and Adjusted EBITDA have limitations as analytical tools, and investors should not consider it in isolation, or as a substitute for analysis of the operating results as reported under IFRS and may not be comparable to similarly titled measures of other companies.

APM definitions remained unmodified compared to those applied as at 31 December 2019. The definitions of APMs are as follows:

EBIT is defined as result of the period (earnings after tax) before:

- income taxes,

- net finance costsEBITDA is defined as result of the period (earnings after tax) before:

- income taxes,

- net finance costs

- depreciation and amortisationa-EBIT and a-EBITDA are defined as EBIT and EBITDA, respectively, adjusted to exclude:

- metal price lag,

- impairment / reversal of impairment of fixed, intangible assets and investment property

- impairment / reversal of impairment of investments

- gains/losses from sales of fixed assets, intangible assets, investment property and investments,

- exceptional litigation fees and fines and,

- other exceptional or unusual itemsNet Debt is defined as the total of:

- Long term loans & borrowings and lease liabilities,

- Short term loans & borrowings and lease liabilities,Less:

- Cash and cash equivalents