Regulatory News

Financial results for the year ended 31 December 2021

Brussels, 16 March 2022

The enclosed information constitutes inside information and is to be considered regulated information as defined in the Belgian Royal Decree of 14 November 2007 regarding the duties of issuers of financial instruments which have been admitted for trading on a regulated market.

Cenergy Holdings S.A. (Euronext Brussels, Athens Stock Exchange: CENER), hereafter “Cenergy Holdings” or “the Group”, today announces its financial results for the year ended 31 December 2021.

Strong operating profitability, solid free-cash flow generation and a record-high backlog

Highlights

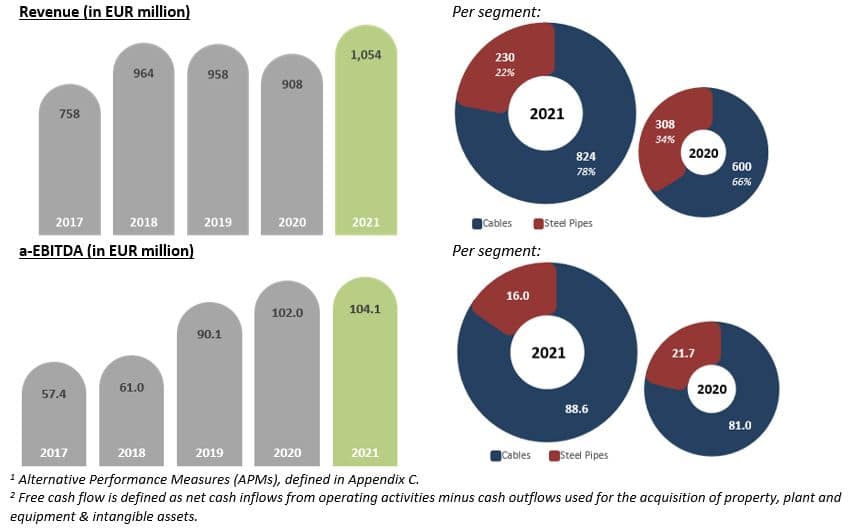

- Revenue exceeds EUR 1 billion (16% growth y-o-y) for the first time in Group’s history

- Operational profitability remains solid with a-EBITDA1 at EUR 104 million (2% growth y-o-y) driven by the execution of cables projects and constant focus on value added products

- The order backlog also breaks the EUR 1 billion barrier as of 31 December 2021, driven by significant order intakes in both segments during the last quarter of the year.

- Net debt1 is down by EUR 66 million to low levels of EUR 264 million

- Consolidated profit before tax was impacted by the one-off provision of EUR 12.8 million (USD 14 million plus interest) from the recent US antidumping duty on steel pipes (EUR 30.5 million vs. EUR 35.6 in 2020)

- Consolidated net profit after tax reached EUR 22.1 million EUR 24.9 in 2020

- Free cash flow2 for 2021 reached EUR 68 million, reflecting strict working capital management and cash generation potential

- Capital expenditure of EUR 44.5 million to secure our position in the new energy transition era.

Commenting on the Group’s performance, Alexis Alexiou, Cenergy Holdings’ Chief Executive Officer, said:

“The strong sales and operational performance of 2021 confirms our ability to keep moving ahead and foster further the energy transition paradigm by offering quality products to our partners across the globe. Cables drove the Group’s profitability, while Corinth Pipeworks succeeded to secure significant orders during the last quarter of the year. Our unique value-adding solutions and improved production efficiency helped us absorb the financial impact of the recent US Commerce decision on antidumping duties for steel pipes. Our companies keep on expanding their global commercial presence, as exhibited by a record order backlog by the end of 2021, and keep exploring possible cooperations based on their respective technical expertise, especially in the offshore wind sector that shows a very strong potential. Although we remain prudent in our management style, I am confident we will also achieve steady growth and satisfactory margins in 2022.”

Overview

In 2021, despite the continued impact of the Covid-19 pandemic in the global supply chain, Cenergy Holdings achieved a robust performance. Throughout the year, the Group maintained the health and wellbeing of its people at the top of its priority list with a concrete set of relative policies and measures, and secured a strong portfolio of orders in order to keep its production schedule undisrupted. As a result, Cenergy Holdings outperformed itself in operational profitability, absorbing any negative impact from external, unexpected events, while attaining a new record-low net debt level.

More specifically, operational profitability (adjusted EBITDA) for a second consecutive year exceeded the threshold of EUR 100 million, 2% higher than 2020, while tendering successes persisted bringing total backlog over EUR 1 billion as of December 31st, 2021.

In the cable segment, the good momentum endured throughout 2021 and the cable companies brought in positive profits, with solid growth across both the projects and the products businesses. All plants maintained a full production schedule during the year, facilitating the smooth execution of important projects and improving a-EBITDA by 9%. At the products Business Unit, sales volume increased as well due to an upturn in demand and the Unit’s successful commercial strategy as expressed by initiatives to enter new geographical markets and establish strategic relationships with clients and partners. Finally, the ongoing investment program in the submarine cables plant in Corinth to further enhance the inter-array cables capacity continued during the year and is now almost complete.

On the other hand, 2021 was again a challenging year for the steel pipes segment. The energy market rebounded strongly after an unprecedented decline in energy consumption and prices due to the pandemic, which, combined with the postponement or cancellation of several fossil-fuel distribution projects, saw energy prices climb to very high levels. A number of pipeline projects restarted in the second half of 2021 with natural gas remaining the main intermediate fuel in the global energy transition. The year, however, closed with a negative surprise, from the US Commerce (DoC) decision concerning the antidumping duty rate on large diameter welded pipes, affecting current year’s results by ca. EUR 12.8 million (USD 14 million plus interest).

Group financial review

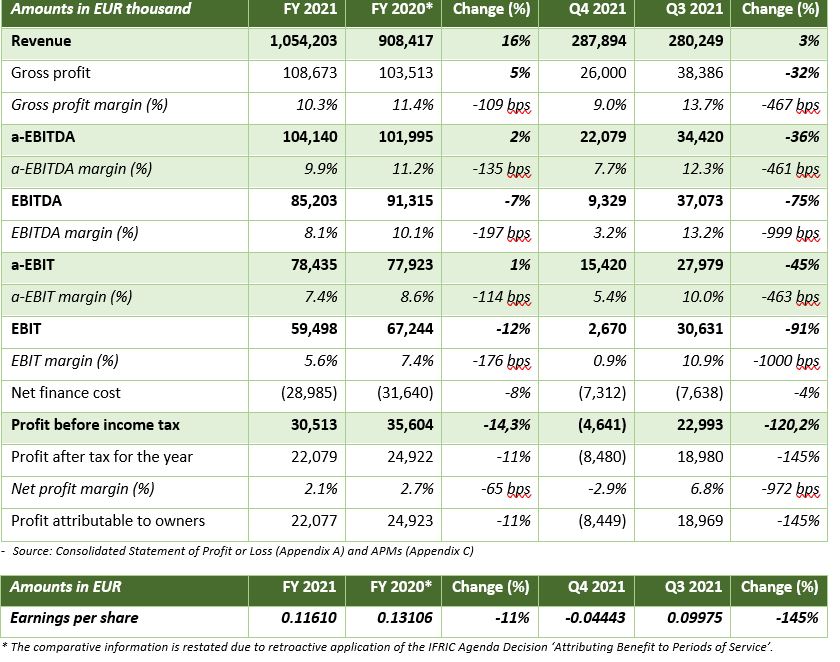

Consolidated revenue for 2021 stands at EUR 1,054 million, a 16% y-o-y increase reflecting the growth in volumes sold in cables segment and the impact of higher metal prices while turbulent times in the steel pipes business restrained Group’s revenue.

Adjusted EBITDA increased by 2% y-o-y to EUR 104 million. The cables segment achieved a substantial rise in operational profits for the third consecutive year, from EUR 65 million in 2019 to EUR 81 million in 2020 reaching EUR 89 million in 2021 (3-year compound annual growth: 17%), a success covering the decline in steel pipes (from EUR 22 million in 2020 to EUR 16 million this year). Overall, the a-EBITDA margin remained at high levels reaching approx. 10%, despite revenue inflation due to increased raw materials prices.

Net finance costs declined by EUR 2.7 million (9% y-o-y, to EUR 29 million), as lower interest rates and tighter working capital management in both segments kept net interest and related costs down.

The strong profitability was clearly impacted by the one-off, extraordinary EUR 12.8 million provision for the DoC decision. Thus, profit before income tax fell to EUR 30.5 million, (14% lower than 2020), dragging also profit after tax for the period slightly down to EUR 22.1 million, from EUR 24.9 million in 2020 (2.1% of revenue vs. 2.7% in 2020).

Though both segments possess modern and efficient plants, the Group continued its investment programmes in its subsidiaries to timely serve orders received and safeguard future growth. Total capital expenditure for 2021 reached EUR 44.5 million, split between EUR 35 million for the cables segment and EUR 9.5 million for the steel pipes. Furthermore, some of the new capital expenditure plans of companies have already been selected for inclusion under national investment incentives schemes as provided by the relative legislation.

Working capital (incl. contract assets & liabilities) decreased significantly to EUR 41 million on December 31st, 2021, down by 59% y-o-y (EUR 100 million on 31.12.2020). This was the outcome of the strict working capital management in both segments i.e. a negotiation of better payment terms with supply chain partners as well as closer monitoring of raw material purchases and on-time successful completion of project milestones. The future evolution of working capital will depend on the timing of both prepayments and milestone payments of energy projects as well as the evolution of raw material prices.

Consequently, net debt fell to new record-low levels (EUR 264 million on December 31st, 2021), down by EUR 66 million from the 31.12.2020 level (EUR 331 million), further proving the Group’s commitment to deleveraging.

Financial performance by business segment

Cables

In 2021 the projects business executed orders efficiently and further grew its book by winning major awards in Greece and abroad. Similarly, the products business exhibited a significant increase in sales volumes compared to 2020. All plants maintained a full production schedule throughout the year, supporting those commercial efforts.

Hellenic Cables continued its tendering activity and was awarded several new projects in the offshore wind and interconnections markets, along with frame contracts from major TSOs:

- In the offshore sector, it was awarded the submarine section of the Santorini-Naxos interconnection (total cable length: 82.5 km, maximum depth: 400 meters) in Greece, while the award of the inter-array cables contract for Dogger Bank offshore wind farm phase C in the UK, established Hellenic Cables as the exclusive array cable supplier for the world’s largest offshore wind farm. Other major offshore projects awarded included the first ever major subsea cables contract with Vattenfall for the design, manufacturing, testing, and supply of approximately 70 km inter-array cables and associated accessories for Vesterhav Nord / Syd offshore wind farm project.

- In the onshore sector, Hellenic Cables was awarded important turnkey contracts across Europe, especially in the UK, and signed frame agreements with major TSOs in Greece and abroad, notably the frame contract with RTE, the French TSO, for the supply of 90 kV and 225 kV underground cables, accessories and installation services.

As a result of the above, the order backlog of the segment by the end of the year exceeded EUR 650 million.

At the same time, a number of projects were successfully delivered, fully or partially, throughout 2021 including:

- The 178 km-long submarine and underground electrical interconnection between Crete and Peloponnese, one of the most demanding projects ever completed worldwide (the longest and deepest – 1000m – HVAC interconnection), was successfully installed and electrified in May;

- Electrical tests of the 150kV high voltage submarine cable that connects Skiathos island to the Greek National Transmission System were successfully completed early in the year;

- The production of all 66kV inter-array cables for the Seagreen offshore wind farm in the UK was completed and deliveries are expected to be concluded early in 2022;

- The production for phase B of the Hollandse Kust Zuid project in the Netherlands was also completed, with delivery of the two 220kV subsea cables completed in the second quarter of the year; and

- The production for the submarine cables for Kafireas II Wind Farm interconnection was concluded, on schedule during Q4 2021.

Sales volumes for the products business unit increased by 14% in 2021, as the demand returned. Together with the positive product mix, it added to the segment’s profitability.

Driven by the above, the cables segment exhibited a EUR 7.7 million increase in adjusted EBITDA, reaching EUR 88.6 million in 2021, up from EUR 80.9 million in 2020. Corresponding profit before income tax reached EUR 44.9 million, compared to EUR 35.2 million in 2020, while net profit after tax followed the same trend and reached EUR 37.2 million (EUR 26.4 million in 2020).

The segment’s net debt decreased by more than 18% y-o-y to less than EUR 200 million (from EUR 242 million on 31.12.2020). The determination to re-profile debt, secure lower financing costs and achieve an effective capital structure continued with actions including, among others, the issuance of two green bond loans of EUR 40 million in total. These are in compliance with ESG financial principles and will support working capital needs for the design, production, installation and operation of submarine and land cable systems in projects related to energy transmission from renewable energy sources and the electrical interconnection of islands.

Last but not least, the investment in the Corinth submarine cables plant to expand inter-array cables capacity is now almost complete. Capital expenditure for the segment reached EUR 35 million, out of which EUR 26 million concerned investments in Corinth plant.

Steel pipes

2021 was the second challenging year in a row for the steel pipes segment. After the unprecedented decline in energy consumption and prices due to the pandemic outbreak in early 2020, which led to the postponement or cancellation of several fossil-fuel distribution projects, the energy market slowly but steadily recovered and prices in 2021 climbed to very high levels, due to stock depletion and hastily rebounding global demand. Some of the pipeline projects put aside the year before, restarted in the second half of 2021, as it was apparent to all that natural gas would still be the main “bridging” fuel towards the energy transition period of the next decades.

Furthermore, over the course of the year Corinth Pipeworks remained focused on research and development initiatives (e.g. green hydrogen transportation, CCS technologies, potential opportunities in the offshore wind sector), tried successfully to enter new geographical markets and continued its rigorous program of major oil and gas company qualifications and innovative programs to enhance competitiveness including commencing digitalization of its processes. In brief, it demonstrated considerable stamina throughout these hard times, strengthening its presence in existing and emerging markets, winning important new onshore and offshore projects and securing an uninterrupted production process all throughout the year.

Despite a revenue decline by 25% relative to its 2020 levels (EUR 230 million in 2021), mainly driven by globally postponed energy projects, Corinth illustrated its resilience as shown mainly by the following actions:

- Efforts to strengthen its presence in new markets in Europe, the Americas, North Africa and Asia, and winning new projects (e.g. INGL offshore project in Israel, Gaz System in Poland, Hydrogen certified pipelines for Snam in Italy, offshore projects in the North and Norwegian sea etc.);

- Increased backlog reaching EUR 350 million by the end of the year, as a result of the successful tendering activity during the last months of 2021;

- Strict working capital management which secured liquidity and allowed its operating activities to finance investments that took place during 2021;

- Continuous R&D and innovation strategy that has put the company in the forefront of the energy transition and solutions on hydrogen transportation.

- Rigorous program of major oil and gas company qualifications and innovative programs to enhance competitiveness, including commencing digitalization of its processes.

- Conclusion of the cost optimization programme that started in 2020Q4.

Decreased revenue led to a decrease in a-EBITDA by 26% with gross profit lower to EUR 16.2 million in 2021 (from EUR 23.9 million in 2020) and adjusted EBITDA following to EUR 16.0 million (EUR 21.7 million in 2020). On the positive side, the segment managed to produce significant free cash flows in 2021. This resulted in a large decline in net debt from EUR 89 million as of 31 December 2020, to EUR 68 million. Long-term debt was also partially refinanced with more favourable terms, through the issuance of three bond loans amounting to EUR 22 million in total.

Finally, as a result of the retrospective implementation of the AD duty rate imposed by the US Department of Commerce (see below), the segment recorded a loss before tax of EUR 13.9 million for 2021, compared to profit before tax of EUR 1.3 million in 2020.

Subsequent events

On February 8th, 2022, the US Department of Commerce (DoC) published its final results in the administrative proceedings conducted by the DoC for the period from April 19, 2019 through April 30, 2020 (“POR”) in connection with an antidumping (“AD”) order on large diameter welded pipe (LDWP) from Greece. As a result, the DoC determined for the POR an antidumping duty rate of 41.04 percent based on total adverse facts available (AFA) for mandatory respondent Corinth Pipeworks S.A., Cenergy Holdings’ steel pipes segment.

Despite the lengthy process of the administrative review involving the supply of extremely detailed data sets on Corinth Pipeworks’ commercial practices for the POR under scrutiny, as well as all reasonable estimations made throughout 2021 on the size, if any, of a possible AD duty rate, the DoC concluded on such a high AD duty rate.

Corinth Pipeworks intends to file an appeal before the U.S. Court of International Trade against the decision of the DoC while continuing to actively work with the DoC in order to reverse the final determination. Cenergy Holdings considers that there will be no material impact on the business of its subsidiary Corinth Pipeworks S.A., as the latter strongly follows a geographically diversified commercial policy and the USA market does not presently constitute its core market. The one-off, additional provision charge on Cenergy Holdings’ annual consolidated economic results from a retrospective implementation of the AD duty rate and reaches ca. EUR 12.8 million (USD 14 million plus interest).

There are no other subsequent events affecting the Consolidated Financial Information presented in this Press Release.

Outlook

Following the strong performance recorded in 2021 and based on the current macroeconomic environment, the cables segment is expected to continue to benefit from the robust set of secured projects, while new significant orders (i.e. Sofia Offshore Wind Farm (OWF) project in the UK, Vesterhav OWF project in Denmark etc.) have already been awarded. The good market momentum, indicating a strong potential of the offshore wind sector, and the proven ability of the segment’s companies to expand into new markets announces solid growth for the near future. The announced possible partnership with Ørsted, world leader in offshore wind development, for the establishment of a submarine inter array cable factory in the State of Maryland, USA, is an example of opportunities created by the market’s positive potential. The submarine project business is expected to retain its high capacity utilisation throughout 2022 driving the entire segment’s profitability. Regarding the onshore projects business, several awards in the UK testifies Hellenic Cables’ continuous presence and investment in this market, while the strong positioning in other markets, such as East Mediterranean and Central Europe, signals a robust growth in this business, as well.

In the cable products business unit, the increased demand levels in the main markets of Western Europe, Middle East and the Balkans, are expected to be maintained, as both the construction and the industrials sectors have rebounded. On top of that, the recently signed frame contracts secure increased levels of capacity utilization for the forthcoming years, while the initiatives for further geographical diversification continue in order to spread out and fortify revenue streams.

The operational focus for the cables segment remains the successful execution of existing projects and the award of new ones, while strategically all possible co-operations aiming at utilizing the know-how in the offshore wind business and possible new business opportunities around the globe are explored.

For the steel pipes segment, we believe that the last two difficult years are left behind, and Corinth Pipeworks is now ready to benefit from the orders received during the last months. As global energy demand is growing faster than renewable energy capacity, demand for fossil fuels will rebound and hence, demand for steel pipes is expected to reach higher levels in the near future. Corinth remains focused on penetrating new geographical markets and developing new innovative products, e.g. infrastructure for the offshore wind sector, tubes for hydrogen transportation, carbon capture and storage (CCS) technologies etc. Such initiatives along with intensified efforts towards stronger competitiveness will improve the company’s market position and will lead to awards of new projects and return to profitability. Looking ahead, the energy sector is expected to stabilize at a higher price levels driven by continued geopolitical uncertainty. This, in combination with the solid backlog built during the last quarter of the year, offers a positive outlook for steel pipes segment.

Overall, Cenergy Holdings looks ahead to a positive year, with steady revenue supporting operational margins, while its companies’ solid structure and advanced technology offer confidence for long-term sustainable growth.

Statement of the Auditor

The statutory auditor, PwC Réviseurs d’Entreprises SRL / Bedrijfsrevisoren BV, represented by Marc Daelman, has confirmed that the audit, which is substantially completed, has not to date revealed any material misstatement in the draft consolidated accounts and that the accounting data reported in this press release is consistent in all material respects with the draft consolidated accounts from which it has been derived. The accounting data in respect of Q3 or Q4 2021 as included in this press release are unaudited.

The Annual Report for the period 1 January 2021 – 31 December 2021 will be posted on the Company’s website, www.cenergyholdings.com, on the website of the Euronext Brussels www.euronext.com, as well as on the Athens Stock Exchange website www.athexgroup.gr.

DISCLAIMER: Any forward-looking statements that may be included in this press release are statements regarding or based on current expectations, plans or understandings of our management relating to, inter alia, Cenergy Holdings’ future results of operations, financial position, liquidity, prospects, growth, strategies or developments in the markets in which its subsidiaries operate. Such forward-looking statements shall be treated as a reflection of information, data and understandings as of the date of the publication of this press release, so you are encouraged not to place undue reliance on them, given that by their nature, forward-looking statements are subject to risks, uncertainties and assumptions that could materially alter the actual results or future events from those expressed or implied thereby. The outcome and financial effects of the understandings, intentions, and events described herein could be adversely affected by these risks, uncertainties and assumptions. Forward-looking statements contained in this press release related to trends or current activities shall not to be taken as a report of the future status of such trends or activities. We undertake no obligation to update or revise any forward-looking statements, either as a result of new information or developments, future events or otherwise. The information contained in this press release is subject to change without notice. No re-report or warranty, express or implied, regarding the fairness, accuracy, reasonableness or completeness of the information contained herein and no reliance shall be placed on it. This press release has been prepared in English and translated into French and Greek. In case of discrepancies between different language versions, the English one shall prevail.

About Cenergy Holdings

Cenergy Holdings is a Belgian holding company listed on both Euronext Brussels and Athens Stock Exchange, investing in leading industrial companies, focusing on the growing global demand of energy transfer, renewables and data transmission. The Cenergy Holdings portfolio consists of Corinth Pipeworks and Hellenic Cables, companies positioned at the forefront of their respective high growth sectors. Corinth Pipeworks is a world leader in steel pipe manufacturing for the oil and gas sector and major producer of steel hollow sections for the construction sector. Hellenic Cables is one of the largest cable producers in Europe, manufacturing power and telecom cables as well as submarine cables for the aforementioned sectors. For more information, please visit our website at www.cenergyholdings.com.

Contacts

For further information, please contact:

Sofia Zairi

Chief Investor Relations Officer

Tel: +30 210 6787111, 6787773

Email: ir@cenergyholdings.com

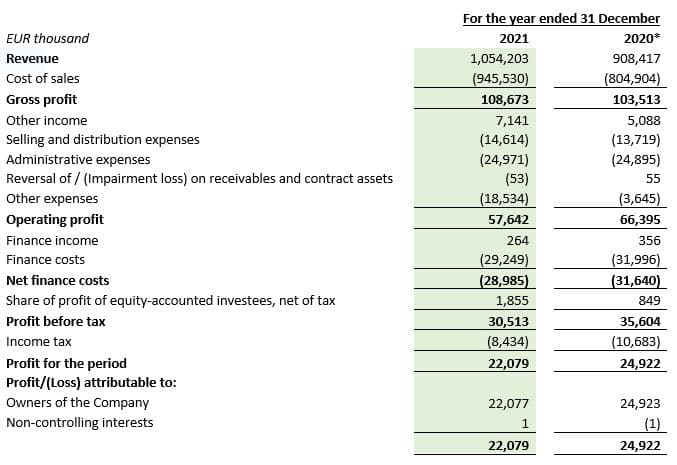

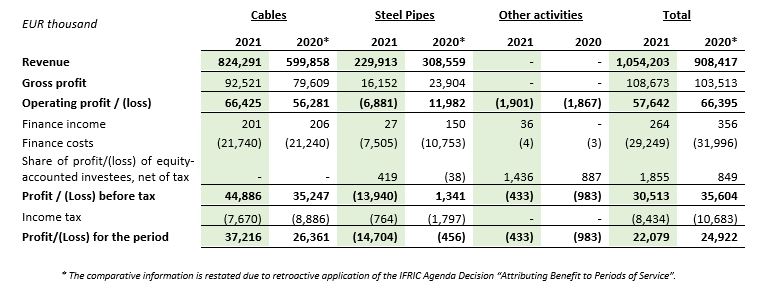

Appendix A – Consolidated statement of profit or loss

The impact of the adoption of the IFRIC Agenda Decision “Attributing Benefit to Periods of Service” on consolidated key figures for the period ended on 31 December 2020 is as follows:

- Profit before tax, EBITDA, EBIT, a-EBITDA & a-EBIT: EUR +195 thousand

- Profit after tax: EUR +151 thousand

- Equity: EUR +3,125 thousand

- Employee benefit liability: EUR -3,848 thousand

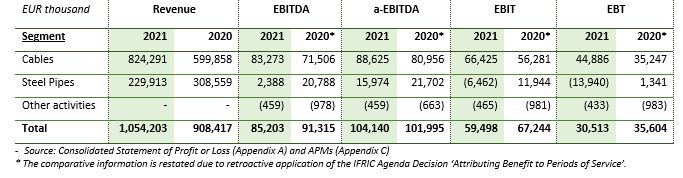

Segmental information

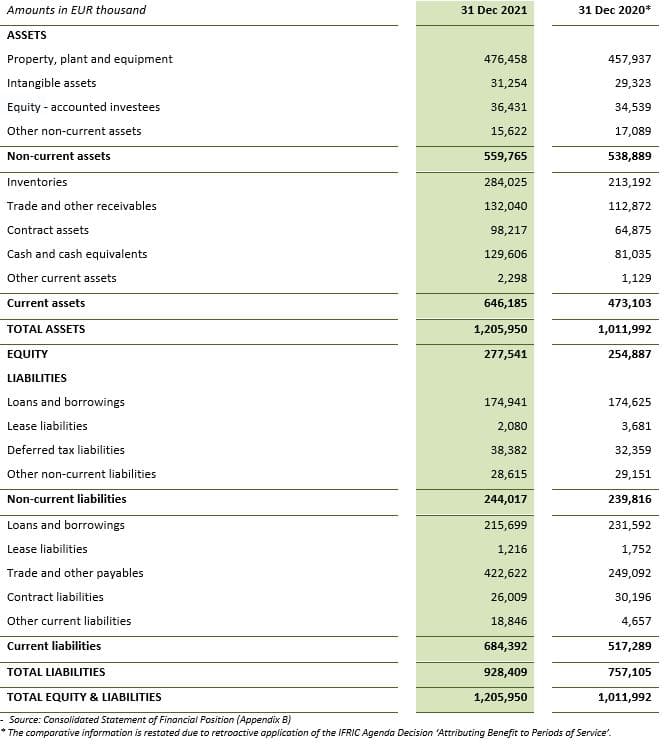

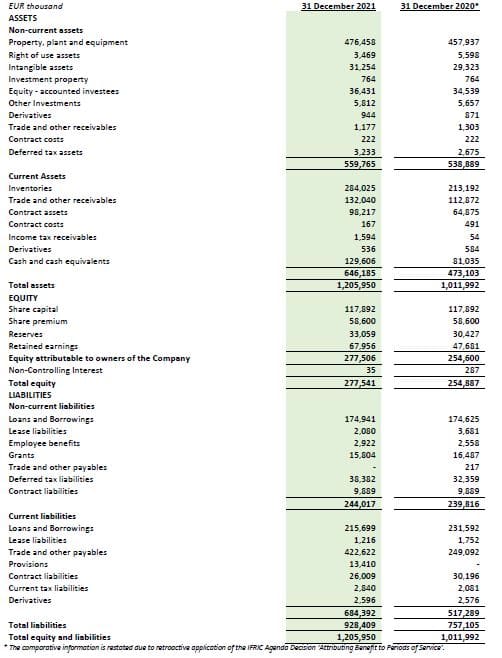

Appendix B – Consolidated statement of financial position

Appendix C – Alternative performance measures

In addition to the results reported in accordance with International Financial Reporting Standards (“IFRS”) as adopted by the European Union, this press release includes information regarding certain alternative performance measures which are not prepared in accordance with IFRS (“Alternative Performance Measures” or “APMs”). The APMs used in this press release are: Earnings Before Interest and Tax (EBIT), Adjusted EBIT, Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA), Adjusted EBITDA and Net debt. Reconciliations to the most directly comparable IFRS financial measures are presented below.

We believe these APMs are important supplemental measures of our operating and financial performance and are frequently used by financial analysts, investors and other interested parties in the evaluation of companies in the steel pipes and cables production, distribution and trade industries. By providing these measures, along with the reconciliations included in this appendix, we believe that investors will have better understanding of our business, our results of operations and our financial position. However, these APMs shall not be considered as an alternative to the IFRS measures.

These APMs are also key performance metrics on which Cenergy Holdings prepares, monitors and assesses its annual budgets and long-range (5 year) plans. However, it must be noted that adjusted items should not be considered as non-operating or non-recurring.

EBIT, Adjusted EBIT, EBITDA and Adjusted EBITDA have limitations as analytical tools, and investors should not consider it in isolation, or as a substitute for analysis of the operating results as reported under IFRS and may not be comparable to similarly titled measures of other companies.

APM definitions remained unmodified compared to those applied as at 31 December 2020. The definitions of APMs are as follows:

EBIT is defined as result of the period (earnings after tax) before:

- income taxes,

- net finance costs

EBITDA is defined as result of the period (earnings after tax) before:

- income taxes,

- net finance costs

- depreciation and amortisation

a-EBIT and a-EBITDA are defined as EBIT and EBITDA, respectively, adjusted to exclude:

- metal price lag,

- impairment / reversal of impairment of fixed, intangible assets and investment property

- impairment / reversal of impairment of investments

- gains/losses from sales of fixed assets, intangible assets, investment property and investments,

- exceptional litigation fees and fines and,

- other exceptional or unusual items

Net Debt is defined as the total of:

- Long term loans & borrowings and lease liabilities,

- Short term loans & borrowings and lease liabilities,

Less:

- Cash and cash equivalents

Reconciliation tables:

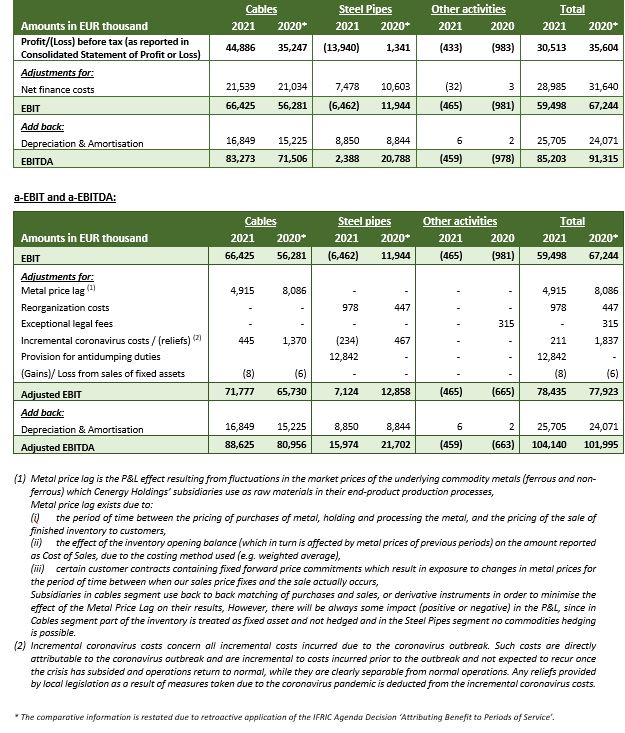

EBIT and EBITDA:

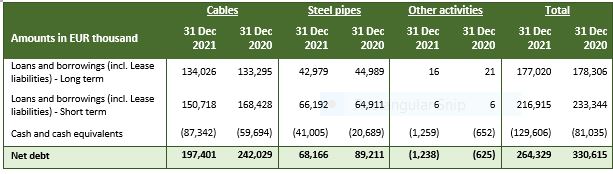

Net debt: