Regulatory News

Trading Update Q1 2021

REGULATED INFORMATION

INSIDE INFORMATION

Brussels, 12 May 2021

The enclosed information constitutes inside information and is to be considered regulated information as defined in the Belgian Royal Decree of 14 November 2007 regarding the duties of issuers of financial instruments which have been admitted for trading on a regulated market.

Today, Cenergy Holdings S.A. (Euronext Brussels, Athens Stock Exchange: CENER), hereafter “Cenergy Holdings” or “the Group”, announced its financial information for the first quarter of 2021.

2021 starts strong with a robust order backlog

Substantial order backlog at EUR 650 million as of March 31, 2021 signals robust growth for the future (31 December 2020: EUR 500 million).

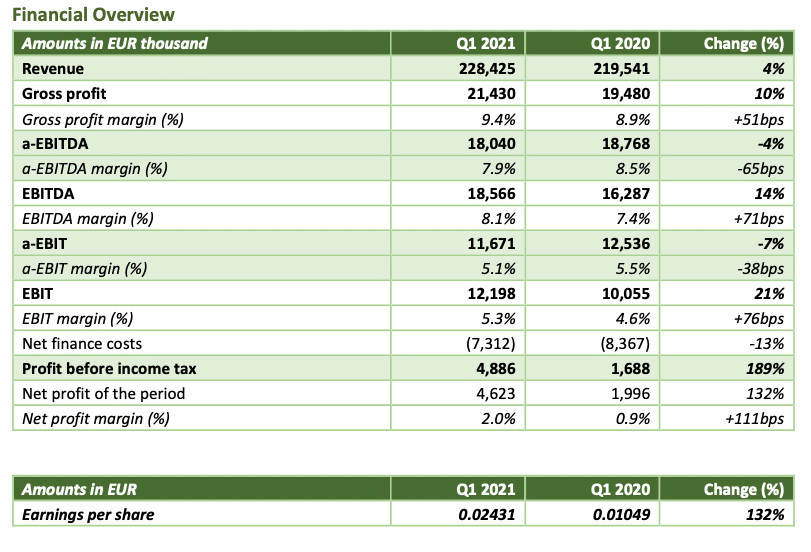

- Higher revenue at EUR 228.4 million, 4% higher than prior year’s corresponding quarter (Q1 2020: EUR 219.5 million).

- Operational profitability remains strong: a-EBITDA at EUR 18.0 million driven by the execution of cables projects and constant focus on value added products; EBITDA rises to EUR 18.6 million, 14% higher y-o-y (Q1 2020: EUR 16.3 million) confirming Cenergy Holdings’ resilience to the highly volatile market context.

- Consolidated profit before tax of EUR 4.9 million vs. EUR 1.7 million in Q1 2020. Commenting on the Group’s performance, Alexios Alexiou, Cenergy Holdings’ Chief Executive Officer,said: The strong start for 2021 demonstrates our ability to keep and take advantage of the momentum created over the last two years and set a good base for another successful year for Cenergy Holdings. Despite adverse conditions due to the ongoing pandemic, our commercial teams, in both the cables and the steel pipes segment, have managed to build a diversified backlog portfolio containing significant energy projects around the globe. The recent awards of the subsea cable connection of Greece’s largest wind farm, an offshore high-pressure gas pipeline in Israel and frame contracts signed with significant TSOs are some examples of the successful tendering activity during the first quarter of the year.For 2021, our priorities for further enforcement of the ongoing Industrial Excellence programme and for augmented health and safety preventive measures remain as strong as ever. These will lead us to the new digital era, secure health and safety of our people, guarantee an undisrupted operation of our plants and enable us to remain well positioned in an exciting global energy market.

Solid Revenue, satisfactory operational profitability

Revenue grew by 4% to EUR 228 million, supported by a strong execution of cables projects from the order backlog, as well as a generally strong demand for cables products, along with favourable LME metal prices. On the other hand, demand in steel pipes segment faced challenges as fossil fuel transportation projects have not yet rebounded from the H1 2020 crisis.

Adjusted EBITDA stayed almost unchanged, around EUR 18 million (-4% y-o-y) while increased metal prices pushed EBITDA up by EUR 2.3 million over the corresponding quarter of last year. The successful execution of energy projects kept profitability at satisfactory levels, despite lower utilization of the steel pipes plant, compared to Q1 2020 and the wide-ranging challenges faced around all production stages.

Adjusted EBITDA stayed almost unchanged, around EUR 18 million (-4% y-o-y) while increased metal prices pushed EBITDA up by EUR 2.3 million over the corresponding quarter of last year. The successful execution of energy projects kept profitability at satisfactory levels, despite lower utilization of the steel pipes plant, compared to Q1 2020 and the wide-ranging challenges faced around all production stages.

The subsidiary companies continued to focus on value-added products and services growth and managed to maintain their margins despite raw material price inflation noted throughout the first quarter of the year.

Net finance costs decreased by EUR 1 million (13%) compared to Q1 2020 to EUR 7.3 million for the first quarter of 2021, due to both lower interest rates and lower debt levels versus the comparable period.

The stronger EBITDA and lower finance costs yield a profit before income tax of EUR 4.9 million, a significant increase over the EUR 1.9 million in Q1 2020. Profit after tax for the period stood at EUR 4.6 million, compared to EUR 2.0 million in last year’s first quarter, representing 2.0% of revenue (against 0.9% in Q1 2020).

Winning tenders boosts order backlog

The successful tendering activity continued without disruptions and total backlog as of March 31st, 2021 reached EUR 650 million, the highest level ever achieved by the two segments.

Outlook

The cables segment benefits from a robust set of secured orders for projects, the bright potential of the offshore wind sector and the ability of expanding into new markets. The project business is expected to retain its high capacity utilisation throughout 2021 driving the entire segment’s profitability, as demand for cable products stabilizes, especially in the main markets of Western Europe, Middle East and the Balkans.

The steel pipes segment, on the other hand, is more influenced by global economic ecosystem and relies on the rebound of energy demand and the accelerated energy transition scenario to regain high profitability margins. Overall, Cenergy Holdings looks ahead to a positive year, with steady revenue supporting operational margins and its companies’ solid structure and advanced technology providing the confidence for long-term sustainable growth.

DISCLAIMER: Any forward-looking statements that may be included in this press release are statements regarding or based on current expectations, plans or understandings of our management relating to, inter alia, Cenergy Holdings’ future results of operations, financial position, liquidity, prospects, growth, strategies or developments in the markets in which its subsidiaries operate. Such forward-looking statements shall be treated as a reflection of information, data and understandings as of the date of the publication of this press release, so you are encouraged not to place undue reliance on them, given that by their nature, forward-looking statements are subject to risks, uncertainties and assumptions that could materially alter the actual results or future events from those expressed or implied thereby. The outcome and financial effects of the understandings, intentions, and events described herein could be adversely affected by these risks, uncertainties and assumptions. Forward- looking statements contained in this press release related to trends or current activities shall not to be taken as a report of the future status of such trends or activities. We undertake no obligation to update or revise any forward-looking statements, either as a result of new information or developments, future events or otherwise. The information contained in this press release is subject to change without notice. No re-report or warranty, express or implied, regarding the fairness, accuracy, reasonableness or completeness of the information contained herein and no reliance shall be placed on it.

This press release has been prepared in English and translated into French and Greek. In case of discrepancies between different language versions, the English one shall prevail.

About Cenergy Holdings

Cenergy Holdings is a Belgian holding company listed on both Euronext Brussels and Athens Stock Exchange, investing in leading industrial companies, focusing on the growing global demand of energy transfer, renewables and data transmission. The Cenergy Holdings portfolio consists of Corinth Pipeworks and Hellenic Cables, companies positioned at the forefront of their respective high growth sectors. Corinth Pipeworks is a world leader in steel pipe manufacturing for the oil and gas sector and major producer of steel hollow sections for the construction sector. Hellenic Cables is one of the largest cable producers in Europe, manufacturing power and telecom cables as well as submarine cables for the aforementioned sectors. For more information about our company, please visit our website at www.cenergyholdings.com.

Contacts

For further information, please contact:

Sofia Zairi

Chief Investor Relations Officer Tel: +30 210 6787111, 6787773 Email: ir@cenergyholdings.com