Latest Results

LATEST RESULTS

Strong year start with satisfactory growth in both segments

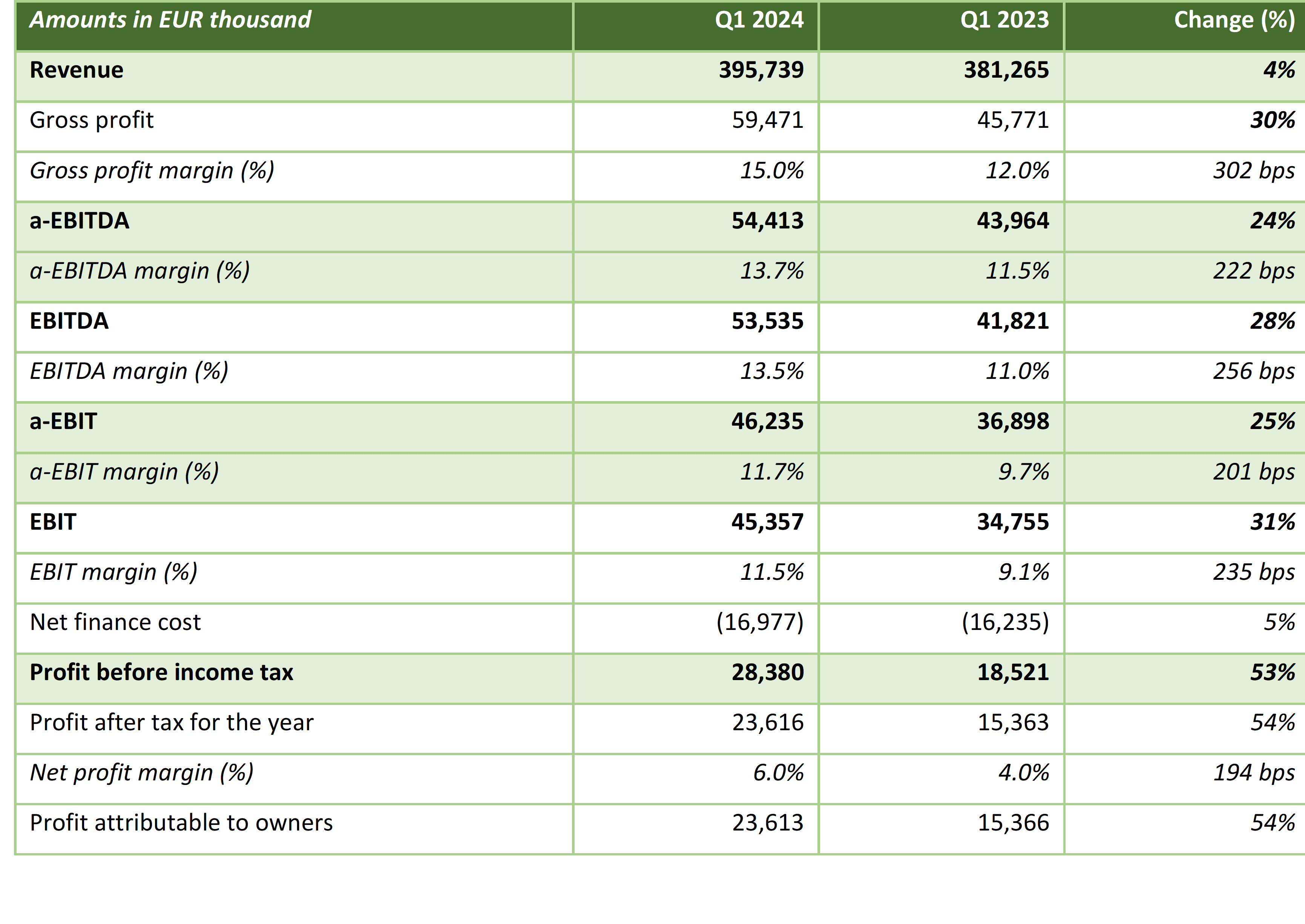

- Revenue for Q1 2024 reaches EUR 396 million (4% growth y-o-y).

- Operational profits (adjusted EBITDA) amount to EUR 54.4 million, 24% higher year-on-year, with steadily high margins at 13.7%; both segments delivered improved performance pushing consolidated net profit after tax to EUR 23.6 million versus EUR 4 million in Q1 2023 (+54%).

- Order backlog[1] is at EUR 3.1 billion as of 31 March 2024

- Expansion plans in all main factories are on track.

- We confirm the FY 2024 guidance for adjusted EBITDA in the range of EUR 230 – 250 million.

Commenting on the Group’s performance for the first-quarter of 2024, Alexis Alexiou, Cenergy Holdings’ Chief Executive Officer, said:

“The significant profitability improvement for the first quarter of 2024 is attributable to our well-balanced business portfolio and our ability to deliver demanding energy projects effectively. Our order backlog stabilized over the EUR 3 billion threshold with a strong potential for further increase during the current year. The necessary capacity expansion in all our main production plants is ongoing, supporting our strategy for organic growth and serving our vision to forge a dynamic path in the energy transmission infrastructure”.

Group financial review

Positive performance in both segments

Revenue grew by 4% on a yearly basis and reached EUR 396 million. This was mostly due to the cables segment, as revenue from energy projects has significantly risen, compared to Q1 2023. At the same time, demand for cables products remained strong, while the steel pipes segment, despite slightly lower revenues, secured higher adjusted EBITDA in euros with double-digit margins.

Consolidated adjusted EBITDA rose to EUR 54.4 million (+24% y-o-y) with both segments improving margins, keeping their focus on high value-added products, and leading to a more favourable sales mix. The Group’s a-EBITDA margin reached 13.7%, significantly higher than that achieved in Q1 2023. The successful execution of energy projects remains the main driver of such profitability, as it provides a steady basis in a challenging global macroeconomic environment

The key projects executed during the first quarter of the year were:

- Cables: The installation phase of Lavrio – Serifos / Serifos – Milos turnkey interconnection (phase 4 of the Cyclades’ interconnection in Greece, with a total cable length of 170 km) progressed significantly, while the production for the supply of 66kV cables for the Sofia OWF in the United Kingdom and for the first batches of Hai Long OWF was completed. The production of several other projects, such as OstWind 3 for 50Hertz, the Revolution OWF in the USA and the Sweden-Denmark interconnection, also progressed during Q1 2024.

- Steel pipes: The Tamar pipeline for Chevron (155km) and the onshore pipeline in Australia were the main projects executed during Q1. Overall, the projects mix executed by Corinth Pipeworks was more favourable in terms of profitability compared to last year, leading to improved operational profitability for the segment.

Interest rates remained at high levels throughout the first quarter with net finance costs at similar levels to the corresponding quarter of last year (EUR 17.0 million vs. EUR 16.2 million). Profit before income tax increased by more than 50% year-on-year and reached EUR 28.4 million (EUR 18.5 million in Q1 2023). Profit after tax followed at EUR 23.6 million (EUR 15.4 million in Q1 2023), representing 6.0% of revenue (vs. 4.0% last year).

Finally, the comprehensive investment program across all plants continued during the first three months of the year:

- The major expansion of the sophisticated subsea cable plant in Corinth, Greece is progressing as planned.

- Orders for additional lines and equipment in the Thiva plant in Greece were placed in time.

- The investments in Eleonas plant are also advancing, so the plant is expected to become fully operational during 2024.

- In Thisvi, Greece, several selective investments to improve the output capacity of the steel pipes plant were initiated.

Order backlog stabilizes over EUR 3 billion

Hellenic Cables and Corinth Pipeworks continued their successes in tendering, keeping total backlog at levels above EUR 3 billion. Projects awarded during the first months of the year include:

- the design, manufacturing, testing and supply of up to approx. 205km 66kV submarine inter array cables and related accessories for Bałtyk II and Bałtyk III offshore wind farms in Poland,

- the supply of 27km of High Frequency Welded (HFW) steel pipes for the Utsira High Project development project in the North Sea by AkerBP, as well as projects in Italy, Romania and US and

- two contracts with Amprion GmbH for 380kV AC underground cables systems in Germany for the projects Borgholzhausen (BHH, EnLAG16) and the Conneforde – Cloppenburg – Merzen (CCM, BBPIG6, Sections A and C), announced during April.

Development on the intended cables manufacturing facility in Maryland USA

On April 22, 2024, Cenergy Holdings announced that its US subsidiary, Hellenic Cables Americas, subject to a final investment decision, intends to build a new, state-of-the-art cable manufacturing facility in Baltimore, Maryland, of approx. value USD 300 million. In the context of this potential investment, Hellenic Cables Americas successfully applied to the Department of Energy and received an allocation letter from the Internal Revenue Service, granting its request for a Qualifying Advanced Energy Project transferable tax credit up to USD 58 million for its intended cables manufacturing facility in Baltimore, Maryland.

As a first step toward the implementation of this project, Hellenic Cables Americas is in the process of acquiring a 38-acre waterfront property at Wagners Point, Baltimore as an extensive due diligence process carry out during the last several months was successfully completed.

Upon the final investment decision, the new factory, will be manufacturing cables for Offshore Wind and Grid Modernization applications. It will address the 21st century, growing energy transition market with high-tech products made in a modern, clean, low-noise, ultra-low-emissions environment.

Outlook

The cables segment expects to benefit from continued resilient market demand in the products business unit, along with a set of secured orders for the projects business unit. Those opportunities, together with a high-capacity utilisation throughout the year in all plants and the initiation of operations in the Eleonas plant will foster profitability for the entire segment for 2024. At the same time, the e-mobility and electrification momentum in Europe and the increasing demand of grid connections are expected to further fuel the order book of the segment by the end of the year.

The steel pipes segment expects the gas fuel sector to continue the development of new networks in line with energy transition guidelines in combination with the necessity for energy security, driven by the continuation of exploration and exploitation of new and existing gas reserves. Carbon capture and storage (CCS) projects are proceeding as a reliable medium-term solution for the achievement of Paris Agreement temperature goals. At the same time, new pipelines, ready for the new hydrogen era, are gathering up pace. As market conditions continue their momentum, the order backlog is expected to grow, feeding into a positive outlook for 2024.

Cenergy Holdings results for Q1 2024 further confirmed the benefits generated by a well-positioned business portfolio, as well as our focus on serving our customers’ needs. Given the strong order backlog for both segments and the growing demand for energy infrastructure products worldwide, Cenergy Holdings confirms its expectation for adjusted EBITDA in the range of EUR 230 – 250 million for the FY 2024. This financial outlook is subject to several assumptions including (a) smooth execution of energy projects in both segments, (b) a continued strong demand for cables products and (c) limited financial impact from the global geopolitical and macroeconomic environment, which remains highly fluid.

[1] Backlog includes signed contracts, as well as contracts not yet enforced, for which the subsidiaries have either received a letter of award or been declared preferred bidder by the tenderers.