Regulatory News

2020 First Half Year Financial Results

Brussels, 23 September 2020

The enclosed information constitutes inside information and is to be considered regulated information as defined in the Belgian Royal Decree of 14 November 2007 regarding the duties of issuers of financial instruments which have been admitted for trading on a regulated market.

Cenergy Holdings S.A. (Euronext Brussels, Athens Stock Exchange: CENER), hereafter “Cenergy Holdings” or “the Group”, announces today its financial results for the first half year of 2020 together with the issuance of its Interim Report for the same period.

Resilience through hard times leads to profitability in H1 2020

Highlights

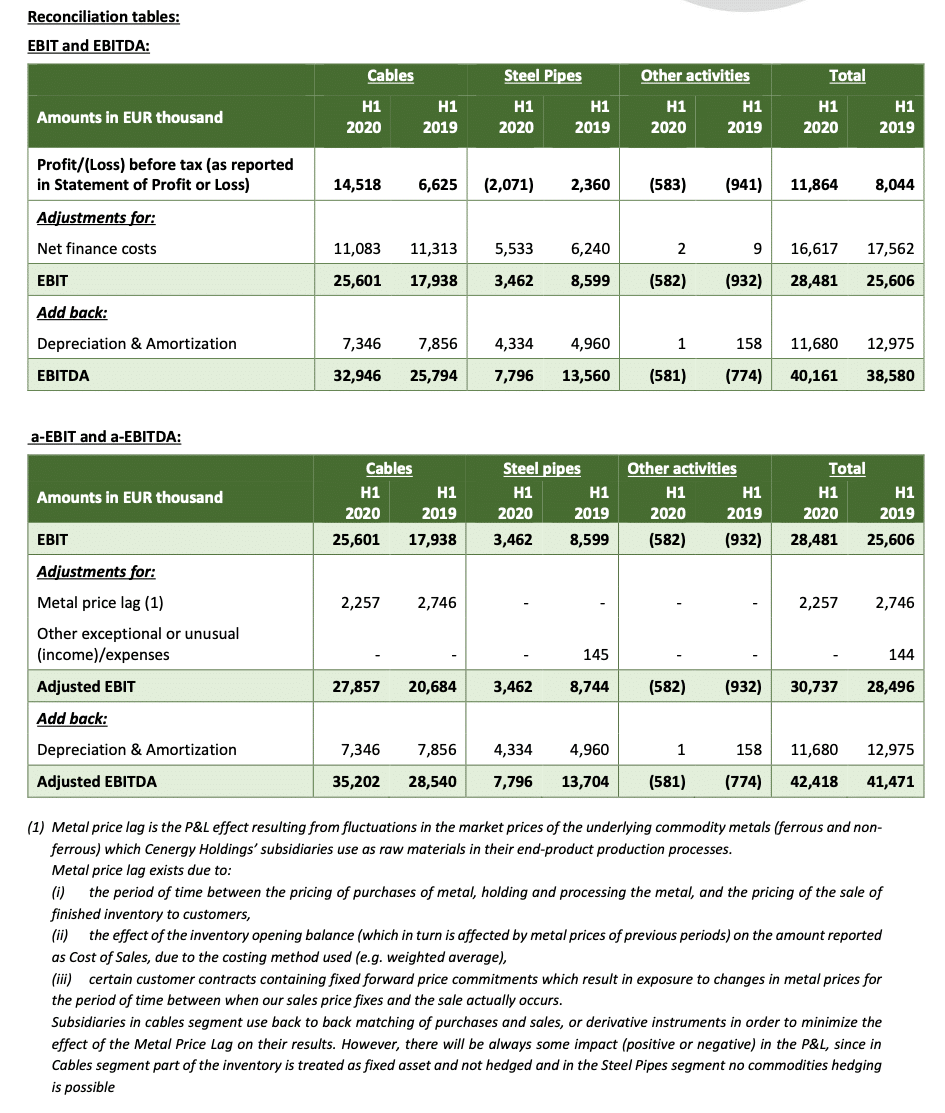

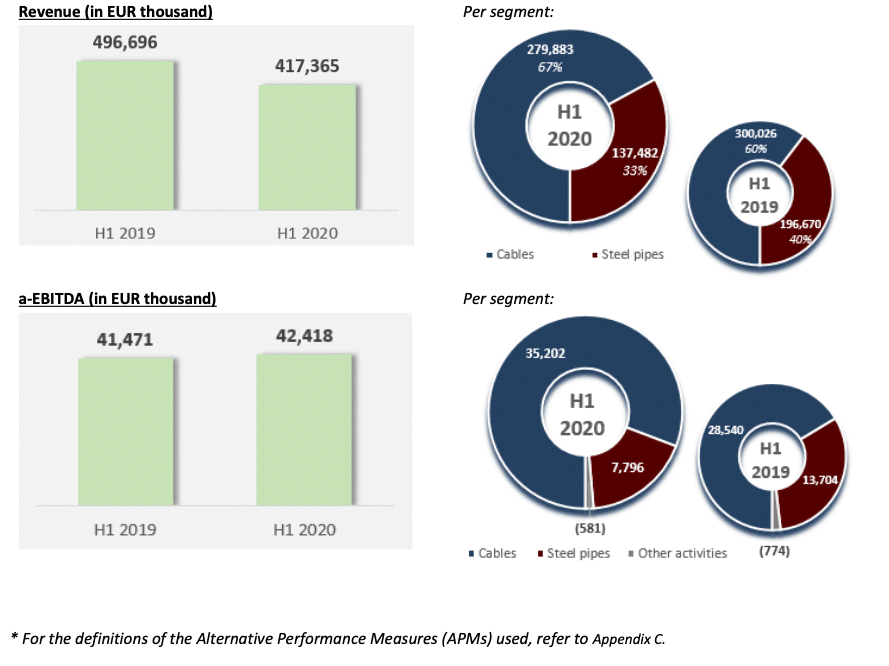

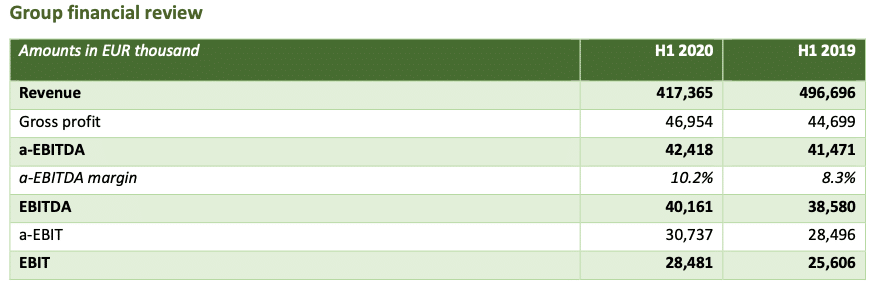

- Stable operational profitability despite sales drop – Cables projects business drove adjusted EBITDA to EUR 42.4 million (H1 2019: EUR 41.4 million).

- Substantial order backlog at EUR 640 million as of 30 June 2020 (31 December 2019: EUR 530 million).

- Consolidated profit before tax of EUR 11.8 million vs. EUR 8.0 million in H1 2019.

- Management’s top priority to protect and ensure employees’ health & safety, secure supply chain andguarantee production continuity.

Revenue (in EUR thousand)

Overview

As outlined in the Group’s 2019 Annual Report, 2020 started with cautious optimism as European markets continued to grow and both demand and prices in our operating markets demonstrated positive trends. The outbreak of the SARS-Cov-2 virus during the first quarter forced every company in the world to reconsider such estimations. Cenergy Holdings companies have immediately activated protection mechanisms for their human resources and their partners in compliance with health authorities’ guidelines, ensured availability of raw materials and liquidity for their smooth operation during the second quarter and closely monitored local and global developments.

The robust profitability the Group recorded during H1 2020 demonstrates both the resilience built throughout its recent history and the results of the above measures which allowed all plants to work at satisfactory levels throughout the first semester. As a result, operational profitability (adjusted EBITDA) was stable at the levels of H1 2019, despite the 16% decrease in sales revenue, as both segments successfully delivered high technology and high margin projects in the energy transfer markets. The tendering activity continued without disruptions with the total backlog as of 30 June 2020 reaching EUR 640 million.

In the cables segment, the good momentum of 2019 persisted during H1 2020 with the segment displaying a solid performance due to the high utilization of the submarine production lines and the smooth execution of projects. The demand in the products business was somehow shaken in April and May 2020 by the COVID-19 epidemic, leading to a lower turnover there. The focus in value added products, however, allowed higher profit margins and a lift in profitability, leading the entire segment to a healthy performance. This was further stimulated by initiatives to enter new geographical markets and continue improving the quality of industrial products (high value-added solutions).

On the other hand, the steel pipes segment was affected by the historical decrease in oil & gas prices observed from March to mid-May 2020, which was further amplified by the effects of the pandemic. Market conditions being highly volatile, a large number of exploration projects were postponed, if not cancelled, especially in the USA, narrowing the available tender opportunities for Corinth Pipeworks (hereafter “CPW”), the Group’s main company in the segment. Turnover fell by almost 30% compared to H1 2019, while operational profitability in terms of adjusted EBITDA also suffered a decrease by EUR 5.9 million. Nonetheless, CPW demonstrated considerable stamina throughout these hard times, strengthening its presence in existing and emerging markets (Europe, North Africa, Asia, Central America), winning important new onshore and offshore projects and securing an uninterrupted production process all throughout the semester.

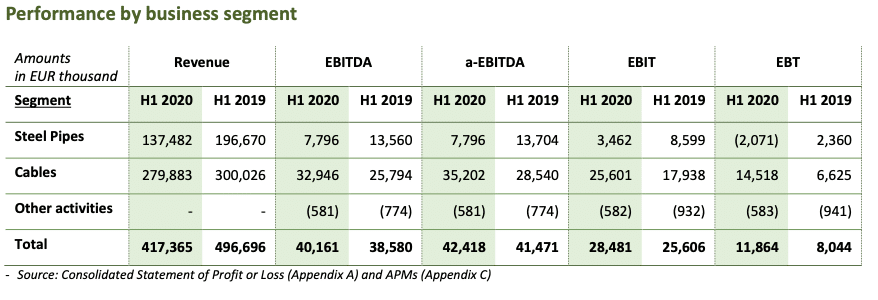

Consolidated revenue for 30 June 2020 stands at EUR 417 million, a 16% y-o-y decrease reflecting the slowdown of demand of steel pipes, mainly because of lower oil & gas prices.

Adjusted EBITDA remained stable at EUR 42.4 million (H1 2019: 41.5 million), with cables achieving a meaningful increase to EUR 35.2 million (from EUR 28.5 million in H1 2019) and covering the gap in steel pipes (EUR 7.8 million vs. EUR 13.7 million in H1 2019). Overall, the focus of the Group in value-added products is clear as the a-EBITDA margin increases to 10.2% compared to 8.3% during H1 2019, the larger part of this gain coming from demanding cables projects executed during the semester.

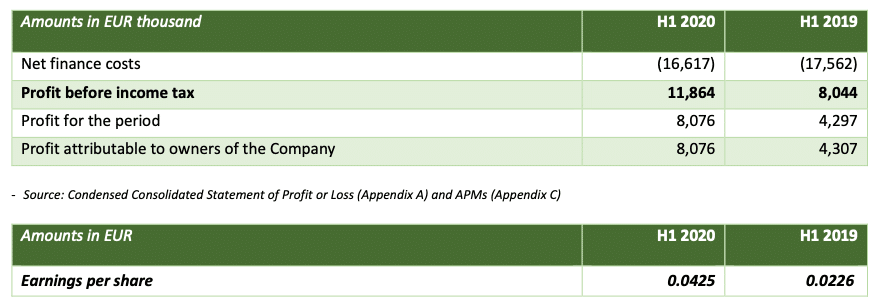

Net finance costs fell by 5.4% to EUR 16.6 million (-EUR 0.9 million compared to H1 2019), as net interest was EUR 1 million or 5% lower to its H1 2019 levels due both to lower rates and to a successful WC management by CPW.

Taken as a whole, Cenergy Holdings recorded a healthy profit before income tax of EUR 11.9 million in the first semester of this year compared to EUR 8.0 million in the corresponding 2019 semester.

Profit for the period amounted to EUR 8.1 million in H1 2020 compared to EUR 4.3 million in H1 2019.

Cables:

Cables’ segment’s results of the first half of the year are characterized by the steady growth of projects’ business and the financial resilience demonstrated during the COVID-19 crisis. As expected, the products business that is partially interconnected to the construction sector was impacted in Q2 2020 by the pandemic, although it had recorded a promising start in Q1 2020. Despite the challenges, cables companies achieved a high capacity utilisation level in all production units that drove operational profitability (adjusted EBITDA) higher by 23% compared to H1 2019.

Despite a full production schedule, Hellenic Cables continued its efforts in the tendering area, participating in several tenders across a number of geographical areas and succeeding to secure several awards, especially in the inter-array market. The orders backlog at 30 June 2020 amounted to EUR 440 million.

On the other hand, the products business units recorded a lower sales volume for both low voltage power and telecom cables (-6% compared to H1 2019), but succeeded in improving the sales mix towards higher value- added products. Hence, the negative impact of the COVID-19 crisis on the low voltage and telecom sectors during Q2 was counterbalanced by solid demand for medium voltage cables coming from Central Europe.

It is also worth noting that all plants, irrespective of their specific product range, remained fully operational throughout the COVID-19 crisis, since an action plan to adapt to stricter health and safety standards, secure an undisrupted supply chain and mitigate financial impact with liquidity preservation, was immediately put in place from mid-March 2020 onwards.

Driven by the above, the segment exhibited a EUR 6.7 million increase in adjusted EBITDA, reaching EUR 35.2 million in H1 2020, up from EUR 28.5 million in H1 2019.

Corresponding profit before income tax reached EUR 14.5 million, compared to EUR 6.6 million in H1 2019, while net profit after tax followed the same trend and reached EUR 11.1 million (EUR 4.3 million in H1 2019).

Steel pipes

The first half of 2020 was surely a difficult semester for the steel pipes segment. Energy markets were strongly shaken by the historic oil & gas price drop in early March 2020, its roots being in a price war between major supplier and leading to the postponement or even cancellation of many fossil fuel distribution projects. The breakup of the COVID 19 pandemic further disturbed energy demand due to extended lockdowns around the globe.

In these adverse market conditions, revenue for the segment declined considerably to EUR 137 million in H1 2020, 30% lower from its H1 2019 level of ca. EUR 200 million. Consequently, gross profit decreased to EUR 10 million in H1 2020 (from EUR 15.9 million in H1 2019) and adjusted EBITDA followed, down to EUR 7.8 million (EUR 13.7 million in H1 2019). As a result, the segment yielded a loss before tax of EUR 2.1 million, compared to profits of EUR 2.4 million in H1 2019.

Nonetheless, during this turbulent period, Corinth Pipeworks showed a lot of resilience, mainly illustrated by:

- Its important backlog, standing on June 30, 2020, at EUR 200 million;

- An effort to strengthen its presence in new markets like Europe, Americas, North Africa and Asia, andwinning new projects (e.g. Baltic Pipe Lot3 in Denmark, Anglo American slurry pipeline in Chile, etc.) andabove all,

- The safeguarding of its personnel safety, securing uninterrupted production for all its current projects.

Subsequent events

Please refer to the Notes of the Condensed Consolidated Financial Statements for the 6-month period ended 30 June 2020.

Outlook

As the world lives through a second wave of the COVID-19 disease, the prediction of the full extent and duration of its business and economic impact remains challenging. Consequently, the range of potential outcomes for the global economy are difficult to predict and the outlook for the remainder of the year, is itself subject to the manner in which this second wave of the epidemic will impact different geographical areas.

Regarding the cables projects business, given the existing backlog and the nature of projects assigned and based on currently available data and information, the impact from COVID-19 on long term business and/or short-term financial results is expected to be limited. Considering the strong forecast of new projects and the potential of expanding to new markets, the secured orders and the growth potential of the offshore cables sector, the overall outlook for cables segment remains positive for 2020. Fulgor’s plant (i.e., the submarine cables business unit) is expected to retain its high capacity utilisation throughout the year, continuing to drive the entire segment’s profitability.

Furthermore, in the cable products unit, some signs of demand stability in its main markets of Western Europe, Middle East and the Balkans, start to appear as demand from construction and industrial use shows signs of recovery, after being strongly hit during the first wave of the pandemic. Such markets, however, continue to experience competitive challenges and the segment subsidiaries will actively seek to geographically diversify their revenue streams. Finally, the focus for the cables segment always remains the successful execution of existing projects and the award of new ones, while optimising internal processes to take advantage of any arising new market opportunity.

In the steel pipes segment, the global economic environment in which Corinth Pipeworks operates remains volatile. Nevertheless, CPW has already showed a lot of strength throughout these hard times with uninterrupted production towards the fulfilment of its contractual obligations. Its focus remains the successful execution of existing projects and the award of new ones in both onshore and offshore markets worldwide. Seen from this angle, the outlook for 2020 remains positive as, for H2 2020, there remain considerable secured orders in Europe, Americas, North Africa and Asia that ensure the high utilization capacity of its Thisvi plant.

Overall, despite current world market volatility, Cenergy Holdings expects to maintain the positive momentum gained in 2019. Its companies’ diverse business model and solid organizational structure continue to provide resilience in this challenging environment, providing confidence for long-term sustainable growth.

Statement of the Auditor

The condensed consolidated interim financial statements for the six-month period ended 30 June 2020 have been subject to a review by the statutory auditor.

DISCLAIMER: Any forward-looking statements that may be included in this press release are statements regarding or based on current expectations, plans or understandings of our management relating to, inter alia, Cenergy Holdings’ future results of operations, financial position, liquidity, prospects, growth, strategies or developments in the markets in which its subsidiaries operate. Such forward-looking statements shall be treated as a reflection of information, data and understandings as of the date of the publication of this press release, so you are encouraged not to place undue reliance on them, given that by their nature, forward-looking statements are subject to risks, uncertainties and assumptions that could materially alter the actual results or future events from those expressed or implied thereby. The outcome and financial effects of the understandings, intentions, and events described herein could be adversely affected by these risks, uncertainties and assumptions. Forward- looking statements contained in this press release related to trends or current activities shall not to be taken as a report of the future status of such trends or activities. We undertake no obligation to update or revise any forward-looking statements, either as a result of new information or developments, future events or otherwise. The information contained in this press release is subject to change without notice. No re-report or warranty, express or implied, regarding the fairness, accuracy, reasonableness or completeness of the information contained herein and no reliance shall be placed on it.

This press release has been prepared in English and translated into French and Greek. In case of discrepancies between different language versions, the English one shall prevail.

About Cenergy Holdings

Cenergy Holdings is a Belgian holding company listed on both Euronext Brussels and Athens Stock Exchange, investing in leading industrial companies, focusing on the growing global demand of energy transfer, renewables and data transmission. The Cenergy Holdings portfolio consists of Corinth Pipeworks and Hellenic Cables, companies positioned at the forefront of their respective high growth sectors. Corinth Pipeworks is a world leader in steel pipe manufacturing for the oil and gas sector and major producer of steel hollow sections for the construction sector. Hellenic Cables is one of the largest cable producers in Europe, manufacturing power and telecom cables as well as submarine cables for the aforementioned sectors. For more information about our Company, please visit our website at www.cenergyholdings.com .

Contacts

For further information, please contact:

Sofia Zairi

Chief Investor Relations Officer Tel: +30 210 6787111, 6787773 Email: ir@cenergyholdings.com

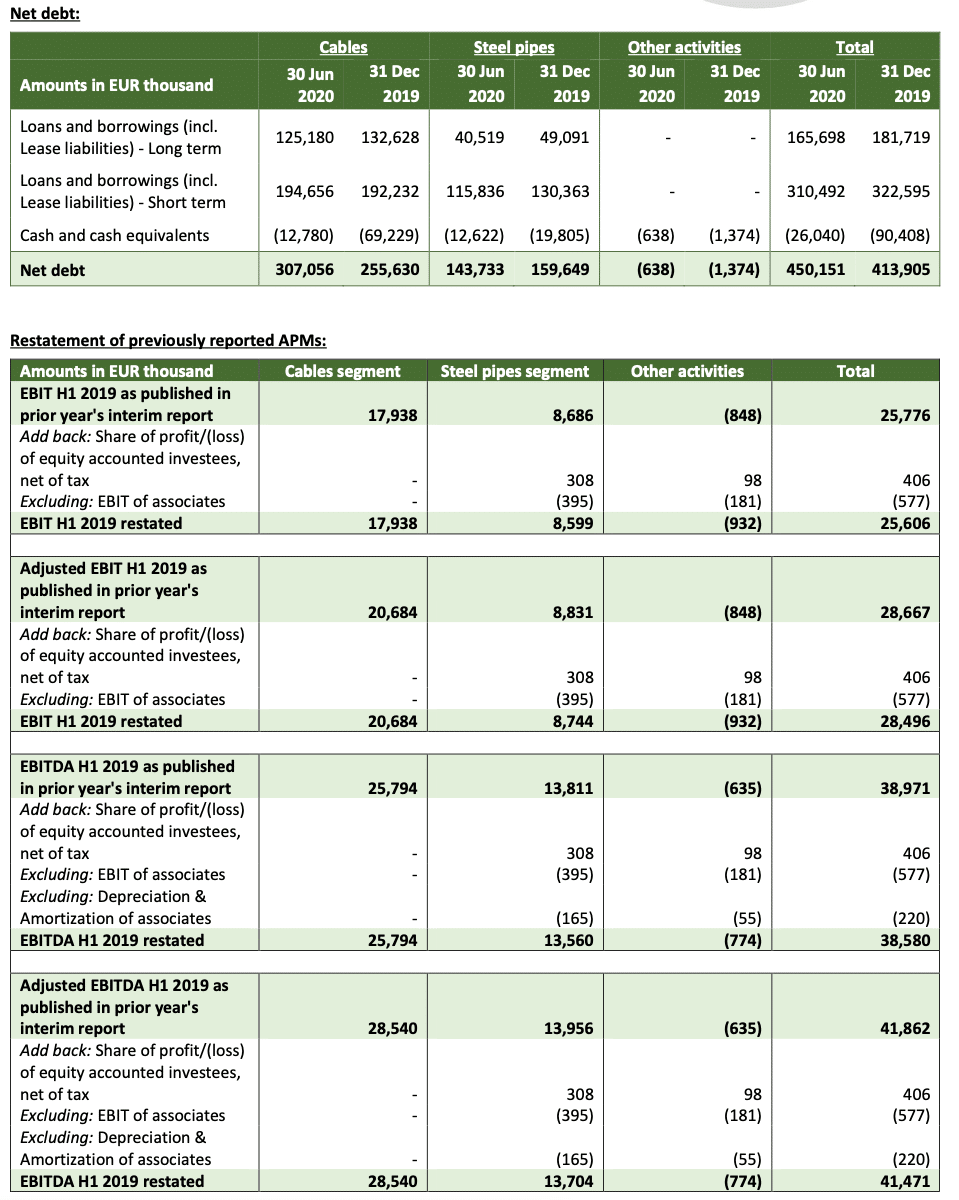

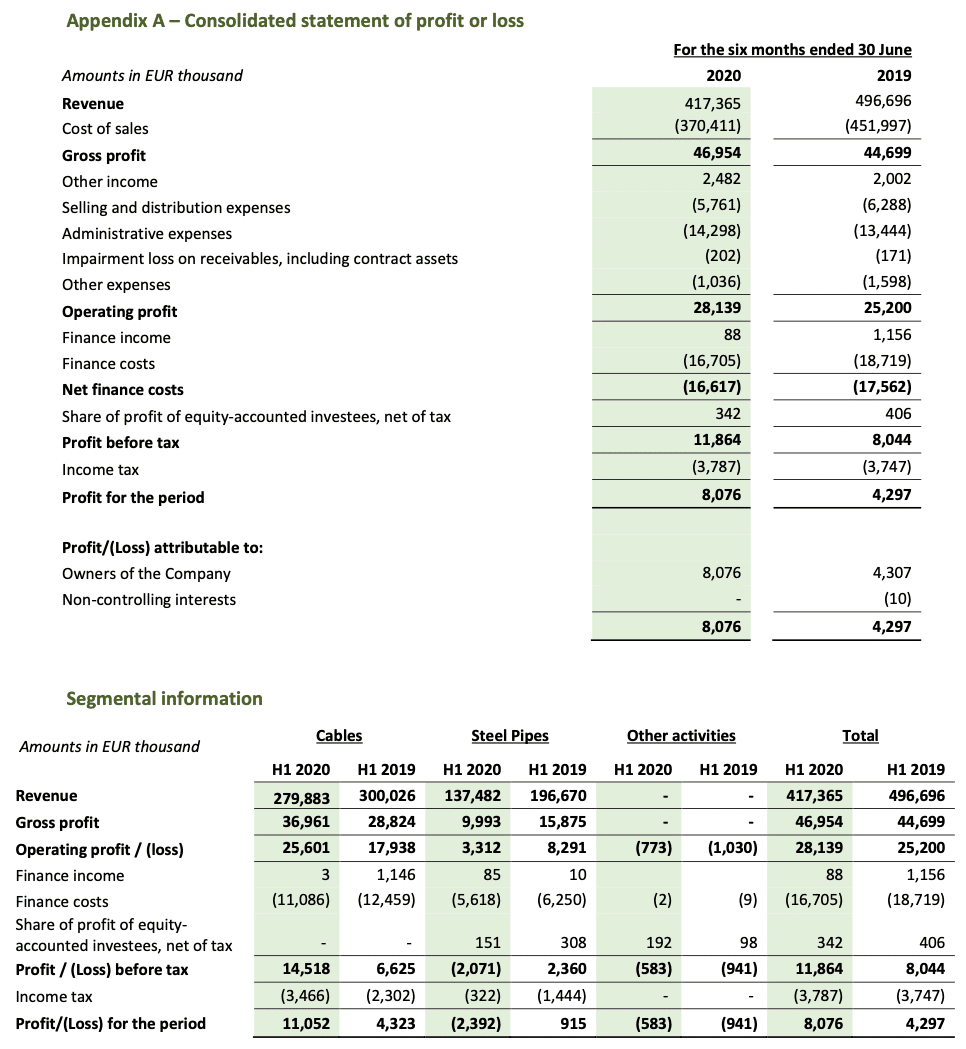

Appendix C – Alternative performance measures

In addition to the results reported in accordance with International Financial Reporting Standards (“IFRS”) as adopted by the European Union, this press release includes information regarding certain alternative performance measures which are not prepared in accordance with IFRS (“Alternative Performance Measures” or “APMs”). The APMs used in this press release are: Earnings Before Interest and Tax (EBIT), Adjusted EBIT, Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA), Adjusted EBITDA and Net debt. Reconciliations to the most directly comparable IFRS financial measures are presented below.

We believe these APMs are important supplemental measures of our operating and financial performance and are frequently used by financial analysts, investors and other interested parties in the evaluation of companies in the steel pipes and cables production, distribution and trade industries. By providing these measures, along with the reconciliations included in this appendix, we believe that investors will have better understanding of our business, our results of operations and our financial position. However, these APMs shall not be considered as an alternative to the IFRS measures.

These APMs are also key performance metrics on which Cenergy Holdings prepares, monitors and assesses its annual budgets and long-range (5 year) plans. However, it must be noted that adjusted items should not be considered as non- operating or non-recurring,

EBIT, Adjusted EBIT, EBITDA and Adjusted EBITDA have limitations as analytical tools, and investors should not consider it in isolation, or as a substitute for analysis of the operating results as reported under IFRS and may not be comparable to similarly titled measures of other companies,

The definitions of APMs are as follows:

EBIT is defined as result of the period (earnings after tax) before:

- income taxes,

- net finance costsEBITDA is defined as result of the period (earnings after tax) before:

- income taxes,

- net finance costs

- depreciation and amortisationa-EBIT and a-EBITDA are defined as EBIT and EBITDA, respectively, adjusted to exclude:

- metal price lag,

- impairment / reversal of impairment of fixed, intangible assets and investment property

- impairment / reversal of impairment of investments

- gains/losses from sales of fixed assets, intangible assets, investment property and investments,

- exceptional litigation fees and fines and,

- other exceptional or unusual itemsNet Debt is defined as the total of:

- Long term loans & borrowings and lease liabilities,

- Short term loans & borrowings and lease liabilities,Less:

- Cash and cash equivalentsAPM definitions have not been modified compared to those applied as at 31 December 2019.