News

2022 First Half Year Financial Results

Brussels, 21 September 2022

Cenergy Holdings S.A. (Euronext Brussels, Athens Stock Exchange: CENER), hereafter “Cenergy Holdings” or “the Group”, announces today its financial results for the first half year of 2022 together with the issuance of its Interim Report for the same period.

Profitable growth continues, further enhancing order backlog

Highlights

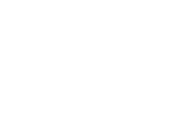

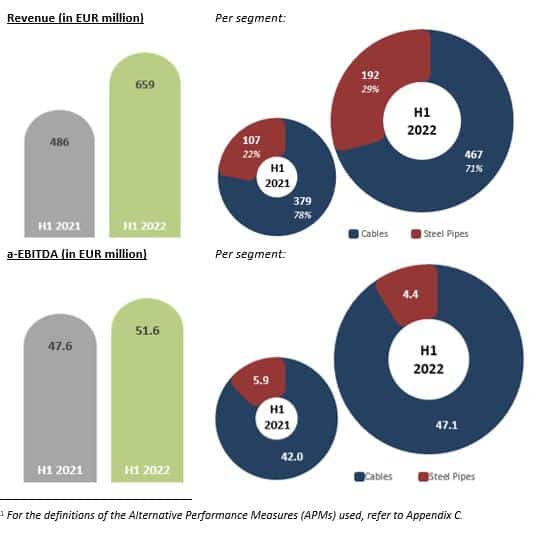

- Revenue reaches EUR 659 million, 36% higher than prior year’s corresponding semester (H1 2021: EUR 486 million).

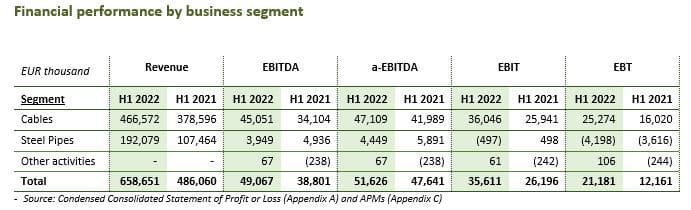

- Operational profitability improves pushing adjusted EBITDA[1] to EUR 52 million for the first half of 2022 (+8% y-o-y); the Cables segment is still the main driver.

- Order backlog attains new high at EUR 1.1 billion on June 30, 2022, indicating steady growth for both segments in the future.

Consolidated profit before tax rises considerably (+74% y-o-y) to EUR 21.2 million vs. EUR 12.2 million in H1 2021 with net profit after tax following at EUR 18.5 million (+59% y-o-y – EUR 11.6 million in H1 2021).

Commenting on the Group’s performance, Alexios Alexiou, Cenergy Holdings’ Chief Executive Officer, stated:

The signs of recovery in the global economy recorded at the beginning of the year were confirmed and intensified in the following months. Along with our accelerated efforts to focus on operations excellence across our entire supply chain, we achieved strong results for 2022 H1. Throughout the first semester, we saw increased activity across all production lines in the cables segment and a significantly improved output in the steel pipes one. Robust sales growth and steady profit margins drove our pre-tax profitability to a noteworthy 74% year-on-year growth. Furthermore, recent awards in both segments and a record-high backlog provide comfort for a positive ending of year.

Cenergy Holdings will continue to take advantage of the sustainability megatrends and remain an enabler towards the global green transformation. Backlog growth, strong sales and all profitability metrics for the first semester of 2022 are tangible proof of the potential awaiting us in the future.

Overview

During the first semester of 2022, Cenergy Holdings was able to take advantage of the improving demand in the energy sector: on the one hand, strong demand restarted for cables products, on the other, energy projects in both the cables and the steel pipes segments were executed smoothly and drove the profitability for the period.

All along, our companies benefited from a strong commercial momentum that brought in significant orders for energy projects around the globe and pushed the already healthy backlog even further to a record-high amount of EUR 1.1 billion as of June 30, 2022. Recent awards include 201km of desalinated water pipeline for a copper mine in Chile by Collahuasi, 360km of inter-array cables for the Sofia offshore wind farm in the UK, a hydrogen certified pipeline in Australia and the first award for the cables segment in the Asian market (inter-array cables to Hai Long Offshore Wind in Taiwan) and are proof of successful tendering activity during the first half of the year.

In the cables segment, high utilization of all production lines for products and smooth execution of high-profile submarine projects led to further growth and solid performance. As noted above, cables products experienced further demand during the first semester of 2022 and sales volume increased by 6%, covering a wide range of cable types. Volume recovery, coupled with production efficiencies, enabled the raw material price pressure effects to be mitigated and resulted in a significant improvement in adjusted EBITDA, reaching EUR 47 million. This was further stimulated by entering new geographical markets as well as an ongoing investment program to further improve the production capacity of the offshore business unit. In parallel to financial success, Hellenic Cables solidified its decarbonization strategy, with its mid and long-term greenhouse gas emissions reduction targets receiving official approval from the SBTi. Hence it became one of the first companies worldwide with approved SBTi targets, thus strongly progressing in the field of sustainable development.

After several quarters of weak demand, Corinth Pipeworks (hereafter “CPW”) finds itself in a stronger position with a current backlog exceeding EUR 450 million, the highest level since 2018. This comes as the result of intense commercial efforts in 2021 that led to significant project awards across the globe. During H1 2022, the steel pipes segment recorded its highest revenue since H1 2019, as turnover for H1 2022 amounted to EUR 192 million, +79% y-o-y. This growth mainly comes from much higher sales quantities, with volume growing by 43% compared to the last year’s first semester. Still, market conditions and steel prices remain highly volatile and many energy projects continue to either being postponed or abandoned, especially in the USA. As a result, operational profitability (adjusted EBITDA) deteriorated by EUR 1.3 million, due to an unfavourable sales mix. As oil prices and consequently demand recover, energy prices are pulled even higher and available tender opportunities for CPW steadily increase. Added to the orders already secured, a more favourable sales mix is expected towards the end of the year. On the financial side, rising raw material prices did not significantly affect net debt since the company continued its strict working capital management practices.

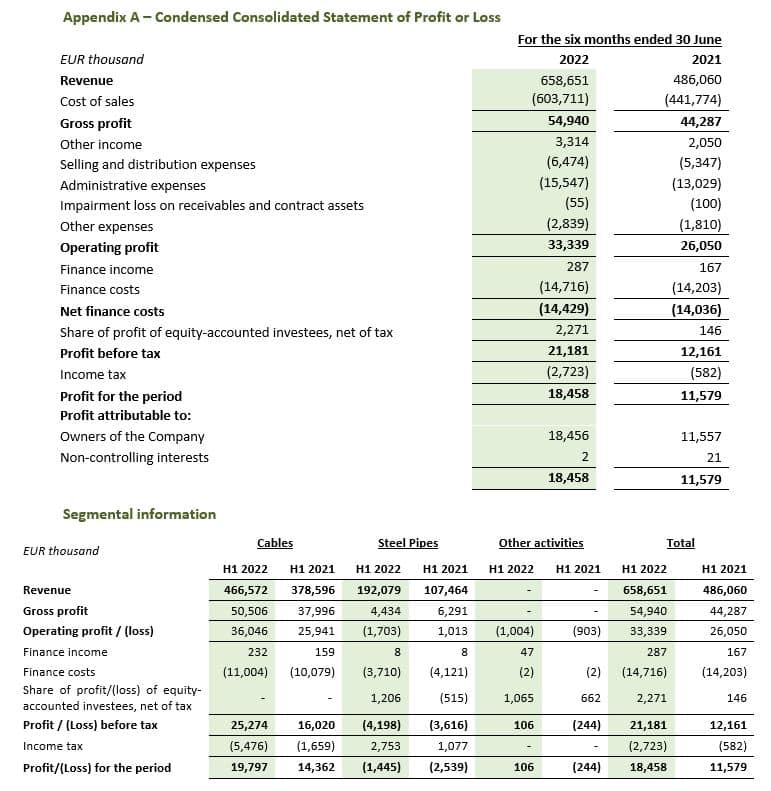

Revenue grew by 36% to EUR 659 million backed by a healthy order backlog in both segments, quality execution of energy projects, strong demand in cables products and increased metal prices. Sales volume grew in both segments, securing appropriate capacity utilization across all Group’s factories. Revenue during Q2 2022 was 20% higher than the previous quarter, showing the strong potential of the robust order backlog, which keeps on growing as we move forward to the end of the year.

Adjusted EBITDA increased by 8% to approx. EUR 52 million: satisfactory margins and higher volumes in cables products together with strong execution of cables projects allowed the cables segment to cover any gap created in the steel pipes one and push operational profitability to satisfactory levels. Subsidiaries continued to focus on value-added products and services and managed to largely maintain their margins despite cost inflation throughout the year. Group EBITDA amounted to EUR 49 million, a notable increase of EUR 10.3 million or +26% y-o-y, despite an accounting impairment of EUR 4.0 million logged in the cables segment due to lower raw material prices recorded on inventories upon the end of the six months period.

Net finance costs marginally increased by EUR 0.4 million (+3% y-o-y) to EUR 14.4 million for the first half of 2022, as increased working capital needs drove average debt levels higher versus last year. In consideration of interest rate pressures mounting as monetary policies around the globe are tightening, both companies have taken measures in the derivatives markets to hedge their finance costs.

Profit before income tax is very strong, at EUR 21.2 million, +74% compared to H1 2021, notwithstanding the aforementioned accounting impairment on cable inventories that decreased Q2 2022 profit before tax vs. its previous quarter. Profit after tax for the period also increased significantly to EUR 18.5 million (EUR 11.6 million in H1 2021) reaching 2.8% of sales (against 2.4% in H1 2021).

Total capital expenditure for the Group reached EUR 25.2 million in H1 2022, split between EUR 23.5 million for the cables and EUR 1.8 million for the steel pipes segment.

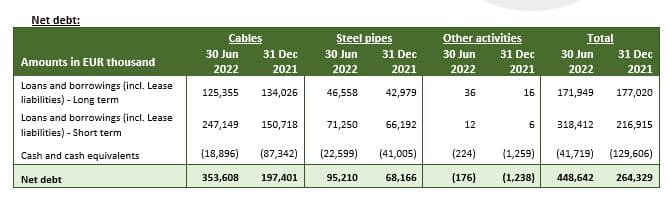

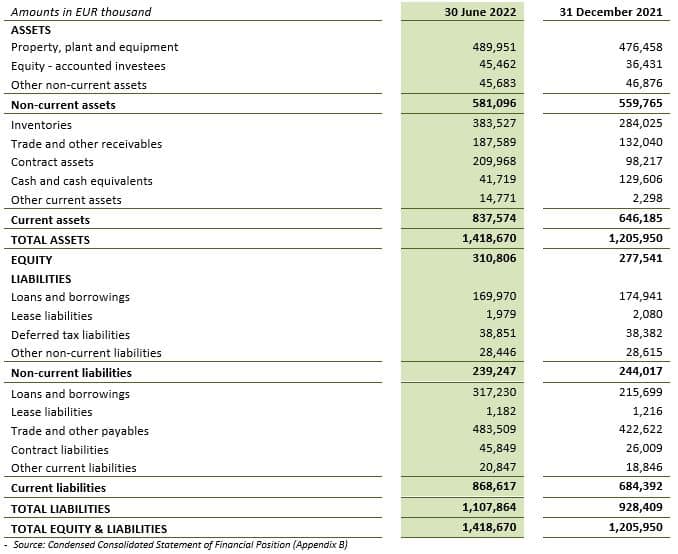

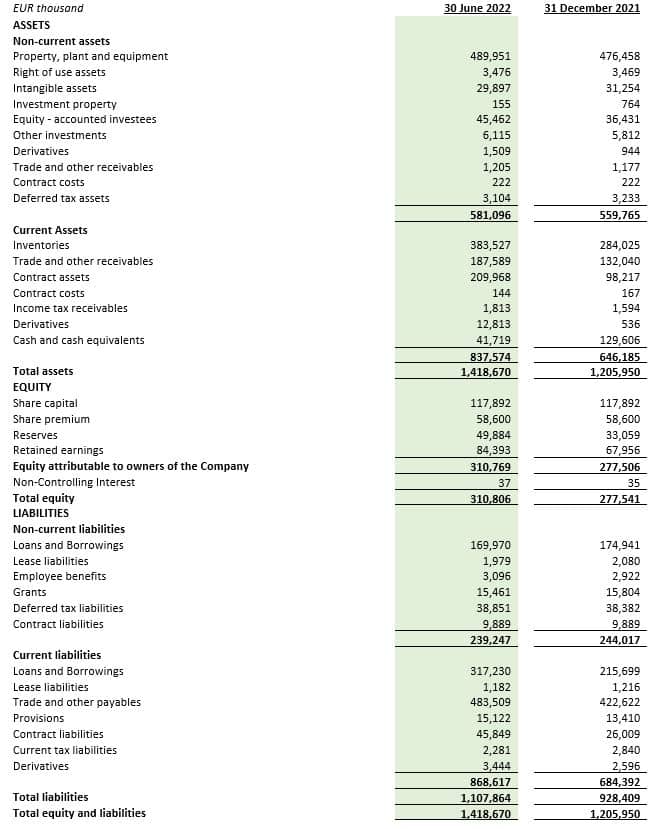

Higher raw material prices, as well as the timing of milestone payments for projects in execution steered total working capital significantly north, to EUR 226 million on June 30, 2022, vs. EUR 41 million on 31.12.2021. This surge is expected to reverse itself in the medium term as stricter negotiation of payment terms with supply chain partners and closer monitoring of raw material purchases can bring working capital back to more controlled levels. Consequently, net debt increased to EUR 449 million on June 30, 2022, up by EUR 184 million from 2021 year-end, entirely driven by working capital needs as capital expenditures were internally funded.

Cables

The cables segment’s revenue and profits in H1 2022 were driven by the solid growth in the cables products’ business. During the first six months of the year, the segment succeeded to materialize the demand upturn in both power and telecom cables in all its main geographical regions (i.e. Central Europe, Balkans and Southeast Mediterranean countries). Sales volume for products increased by 6% and, along with an improved sales mix and satisfactory margins, led to a 12% y-o-y higher a-EBITDA (+EUR 5.1 million). All cable plants had a full production schedule throughout the semester and revenue increased by 23% y-o-y amounting to EUR 467 million for H1 2022.

All along, the projects business continued to provide the stable support for the entire Group profitability, as orders awarded over recent years are smoothly carried out. Specifically, during H1 2022 the following projects were, in full or partially, successfully executed:

- the production of the 83 km-long submarine cable for the electrical interconnection between Naxos, Santorini and Thirasia islands was concluded. Installation is expected to be concluded according to schedule set until the end of 2022.

- The first batches of 66kV inter-array cables for the Doggerbank offshore wind farms in the UK, the world’s largest offshore wind farm, were completed, while remaining quantities for the same project will continue to be produced throughout 2022 and 2023.

- The production for 66kV XLPE insulated inter-array cables for Vesterhav Nord / Syd offshore wind farms was initiated.

- Installation of Kafireas II Wind Farm interconnection with Greece’s mainland grid was carried out on schedule.

- Hellenic Cables executed several onshore projects in the UK market that were awarded during 2021.

Tendering efforts were intensified during H1 2022, as high market activity in both offshore wind and interconnections continues without abate. In such a context, Hellenic Cables secured several awards for high voltage and inter-array cables projects driving the order backlog for the segment to approx. EUR 650 million as of 30 June 2022.

Thus, adjusted EBITDA for the segment reached EUR 47.1 million in H1 2022, up from EUR 42.0 million in H1 2021. As most of the revenue increase came from products rather than projects that offer significantly higher profitability, margins for H1 2022 were slightly lower compared to last year but remained over the 10% threshold.

Corresponding profit before income tax reached EUR 25.3 million, compared to EUR 16 million in H1 2021, due to all factors presented above along with an improved metal result for the semester, while net profit after tax followed the same trend and reached EUR 19.8 million (EUR 14.4 million in H1 2021).

Last but not least, capital expenditure for the cables segment reached EUR 23.5 million and mainly concerned the following:

- selective investments to increase the production capacity for submarine cables in Corinth plant;

- improvements in the port owed by Fulgor in Corinth and

- initial expenses of EUR 5.2 million needed to support the construction of a submarine cables factory in the USA.

Steel pipes

During H1 2022, the steel pipes segment witnessed a turnaround of the market. More specifically, the war in Ukraine caused further geopolitical turbulence and pushed higher the already high energy prices. As many countries, especially in Europe, had to face in a short notice, an urgent energy security issue, a number of gas transfer projects which were on hold for some time, were brought back on track, aided by a more favourable financial environment.

In these improving market conditions, revenue for the segment increased considerably to EUR 192 million in H1 2022, 79% higher from its H1 2021 level of EUR 107 million. A less profitable project mix during that period has, however, led to lower gross profit (EUR 4.4 million vs. EUR 6.3 million in the corresponding semester of 2021) and adjusted EBITDA followed, too (EUR 4.4 million from EUR 5.9 million in H1 2021). Consequently, the segment bore a loss before tax of EUR 4.2 million, slightly higher than the loss of EUR 3.6 million in H1 2021.

On the commercial front, Corinth Pipeworks exhibited significant resilience, mainly illustrated by the successful execution of pipeline projects and the significant awards secured during the first semester of the year.

Execution:

- Successful completion of 80km large diameter pipes for GAZ-SYSTEM SA Poland.

- Production of orders for the Snam high pressure network in Italy.

- Successful production of many offshore projects for the North and Norwegian Sea and the Gulf of Mexico.

Awards:

- Major contract award by Collahuasi for 201km of desalinated water pipeline in Chile, part of which was produced during H1 2022.

- New award for 163km of pipeline in West Macedonia, Greece by DESFA, certified to transport up to 100% of hydrogen.

- Hydrogen certified pipeline in Australia by Jemena for 13km pipes.

- 76km of gas pipeline in Mozambique by SASOL

along with other major offshore projects in S. America and Australia.

As a result of the above awards, current backlog hit the highest level since 2018 exceeding EUR 450 million.

Capital expenditure was limited to EUR 1.8 million in H1 2022 (H1 2021: EUR 4.1 million) related mainly to selected operational improvements in the Thisvi plant.

Subsequent events

There are no subsequent events affecting the Condensed Consolidated Interim Financial Statements.

Outlook

There is confidence that the cables segment can extend its performance momentum and benefit from the strong demand for cabling products, along with a set of secured orders for projects. High-capacity utilisation is expected to be retained throughout 2022 fostering the entire Group’s profitability. The proven potential of the offshore wind market and the ability to expand into new markets will remain the profitability drivers for the segment. Going forward, the high market activity and the acceleration of the energy transition scenario driven be the current energy crisis is expected to further fuel the orderbook of the segment. Provided that such awards will occur in the following months, management is currently assessing the initiation of an investment programme to expand the production capacity of the offshore business unit in Corinth by investing in additional production equipment. At the same time, all other growth opportunities created by the market’s positive potential are being explored. In that context and following previous announcements, discussions with Ørsted on the partnership for the construction of a submarine inter array cables factory in Maryland, are ongoing. The Company will inform the investment community for any significant development regarding all such investment plans.

The steel pipes segment is also looking forward to a positive year, as the solid backlog built during the last months blends together high-capacity utilization with better profit margins for the rest of the year. The execution of a more favourable projects mix in terms of operational profit is expected in the second half of the year and market conditions are expected to boost order backlog even more. Corinth Pipeworks continues its growth based on the following pillars:

- Continuing pursuit of new geographical markets, much like the recent years successful market development that spans the globe, from Europe and the North Sea to South Africa and from the Americas to Australia;

- New innovative products in energy transport networks, such as hydrogen-certified pipes, carbon capture and storage (CCS) solutions etc. as well as new products in the growing sector of offshore wind.

The pandemic crisis, which had a significant effect in the global competition map of gas fuel transport market, is now coming to an end, with Corinth Pipeworks in a much stronger position and high market attractiveness, as proven by the recent awards by major customers on a global scale.

Overall, Cenergy Holdings remains assured it can maintain and further improve its performance during 2022. The Group is actively pursuing its value growth rather than a high-volume strategy and works closely with its customers and partners to develop customers innovative value adding solutions in the high potential energy transition ecosystem.

Statement of the Auditor

The condensed consolidated interim financial statements for the six-month period ended 30 June 2022 have been subject to a review by the statutory auditor.

DISCLAIMER: Any forward-looking statements that may be included in this press release are statements regarding or based on current expectations, plans or understandings of our management relating to, inter alia, Cenergy Holdings’ future results of operations, financial position, liquidity, prospects, growth, strategies or developments in the markets in which its subsidiaries operate. Such forward-looking statements shall be treated as a reflection of information, data and understandings as of the date of the publication of this press release, so you are encouraged not to place undue reliance on them, given that by their nature, forward-looking statements are subject to risks, uncertainties and assumptions that could materially alter the actual results or future events from those expressed or implied thereby. The outcome and financial effects of the understandings, intentions, and events described herein could be adversely affected by these risks, uncertainties and assumptions. Forward-looking statements contained in this press release related to trends or current activities shall not to be taken as a report of the future status of such trends or activities. We undertake no obligation to update or revise any forward-looking statements, either as a result of new information or developments, future events or otherwise. The information contained in this press release is subject to change without notice. No re-report or warranty, express or implied, regarding the fairness, accuracy, reasonableness or completeness of the information contained herein and no reliance shall be placed on it.

This press release has been prepared in English and translated into French and Greek. In case of discrepancies between different language versions, the English one shall prevail.

About Cenergy Holdings

Cenergy Holdings is a Belgian holding company listed on both Euronext Brussels and Athens Stock Exchange, investing in leading industrial companies, focusing on the growing global demand of energy transfer, renewables and data transmission. The Cenergy Holdings portfolio consists of Hellenic Cables and Corinth Pipeworks, companies positioned at the forefront of their respective high growth sectors. Hellenic Cables is one of the largest cable producers in Europe, manufacturing power and telecom cables as well as submarine cables for the aforementioned sectors. Corinth Pipeworks is a world leader in steel pipe manufacturing for the oil and gas sector and major producer of steel hollow sections for the construction sector. For more information, please visit our website at www.cenergyholdings.com.

Contacts

For further information, please contact:

Sofia Zairi

Chief Investor Relations Officer

Tel: +30 210 6787111, +30 210 6787773

Email: ir@cenergyholdings.com

All figures and tables contained in these appendices have been extracted from the Condensed Consolidated Interim Financial Statements for the period ended 30 June 2022, which have been prepared in accordance with IAS 34 Interim Financial Reporting, as adopted by the European Union and authorised for issue by the Board of Directors on 21 September 2022. The statutory auditor PwC Bedrijfsrevisoren BV has reviewed these Condensed Consolidated Interim Financial Statements and concluded that based on the review, nothing has come to the attention that causes them to believe that the Condensed Consolidated Interim Financial Statements are not prepared, in all material respects, in accordance with IAS 34, as adopted by the European Union. For the Condensed Consolidated Interim Financial Statements for the period ended 30 June 2022 and the review report of the statutory auditor, please refer to www.cenergyholdings.com.

Appendix B – Condensed Consolidated Statement of Financial Position

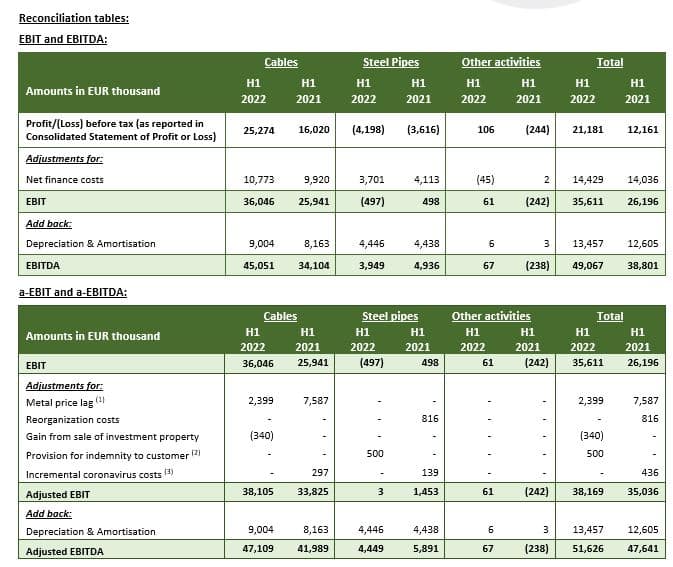

Appendix C – Alternative performance measures

In addition to the results reported in accordance with International Financial Reporting Standards (“IFRS”) as adopted by the European Union, this press release includes information regarding certain alternative performance measures which are not prepared in accordance with IFRS (“Alternative Performance Measures” or “APMs”). The APMs used in this press release are: Earnings Before Interest and Tax (EBIT), Adjusted EBIT, Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA), Adjusted EBITDA and Net debt. Reconciliations to the most directly comparable IFRS financial measures are presented below.

We believe these APMs are important supplemental measures of our operating and financial performance and are frequently used by financial analysts, investors and other interested parties in the evaluation of companies in the steel pipes and cables production, distribution and trade industries. By providing these measures, along with the reconciliations included in this appendix, we believe that investors will have better understanding of our business, our results of operations and our financial position. However, these APMs shall not be considered as an alternative to the IFRS measures.

These APMs are also key performance metrics on which Cenergy Holdings prepares, monitors and assesses its annual budgets and long-range (5 year) plans. However, it must be noted that adjusted items should not be considered as non-operating or non-recurring.

EBIT, Adjusted EBIT, EBITDA and Adjusted EBITDA have limitations as analytical tools, and investors should not consider it in isolation, or as a substitute for analysis of the operating results as reported under IFRS and may not be comparable to similarly titled measures of other companies.

APM definitions remained unmodified compared to those applied as of 31 December 2021. The definitions of APMs are as follows:

EBIT is defined as result of the period (earnings after tax) before:

- income taxes,

- net finance costs

EBITDA is defined as result of the period (earnings after tax) before:

- income taxes,

- net finance costs

- depreciation and amortisation

a-EBIT and a-EBITDA are defined as EBIT and EBITDA, respectively, adjusted to exclude:

- metal price lag,

- impairment / reversal of impairment of fixed, intangible assets and investment property

- impairment / reversal of impairment of investments

- gains/losses from sales of fixed assets, intangible assets, investment property and investments,

- exceptional litigation fees and fines and,

- other exceptional or unusual items

Net Debt is defined as the total of:

- Long term loans & borrowings and lease liabilities,

- Short term loans & borrowings and lease liabilities,

Less:

- Cash and cash equivalents

- Metal price lag is the P&L effect resulting from fluctuations in the market prices of the underlying commodity metals (ferrous and non-ferrous) which Cenergy Holdings’ subsidiaries use as raw materials in their end-product production processes,

Metal price lag exists due to:

(i) the period of time between the pricing of purchases of metal, holding and processing the metal, and the pricing of the sale of finished inventory to customers,

(ii) the effect of the inventory opening balance (which in turn is affected by metal prices of previous periods) on the amount reported as Cost of Sales, due to the costing method used (e.g. weighted average),

(iii) certain customer contracts containing fixed forward price commitments which result in exposure to changes in metal prices for the period of time between when our sales price fixes and the sale actually occurs,

Subsidiaries in cables segment use back to back matching of purchases and sales, or derivative instruments in order to minimise the effect of the Metal Price Lag on their results, However, there will be always some impact (positive or negative) in the P&L, since in Cables segment part of the inventory is treated as fixed asset and not hedged and in the Steel Pipes segment no commodities hedging is possible.

- In 2013, Corinth Pipeworks manufactured and supplied pipes for a pipeline in France. During 2015, the French client filed a quality claim against Corinth Pipeworks, its insurers and the subcontractors in charge for the welding of the pipeline. The commercial court of Paris rendered its decision on 7 July 2022 and ruled that Corinth Pipeworks should be held liable for the latent defects affecting the pipes it delivered to its French customer but that the latter was also responsible for its own loss. Consequently, given that 2013 sales were fully insured, Corinth Pipeworks recorded a provision of EUR 500 thousand during the six-month period ended on 30 June 2022 that corresponds to its maximum exposure for that specific claim, based on the insurance contracts in its possession.

Incremental coronavirus costs concern all incremental costs incurred due to the coronavirus outbreak. Such costs are directly attributable to the coronavirus outbreak and are incremental to costs incurred prior to the outbreak and not expected to recur once the crisis has subsided and operations return to normal, while they are clearly separable from normal operations. From January 1, 2022, onwards such costs are considered as part of the operational costs of each subsidiary.