News

2023 FIRST HALF YEAR FINANCIAL RESULTS

Brussels, 20 September 2023

Cenergy Holdings S.A. (Euronext Brussels, Athens Stock Exchange: CENER), hereafter “Cenergy Holdings” or “the Group”, announces today its financial results for the first half year of 2023 together with the issuance of its Interim Report for the same period.

Growth across all segments, a strong full year financial outlook

Expansion strategy on track to serve growing demand from energy transition.

Highlights

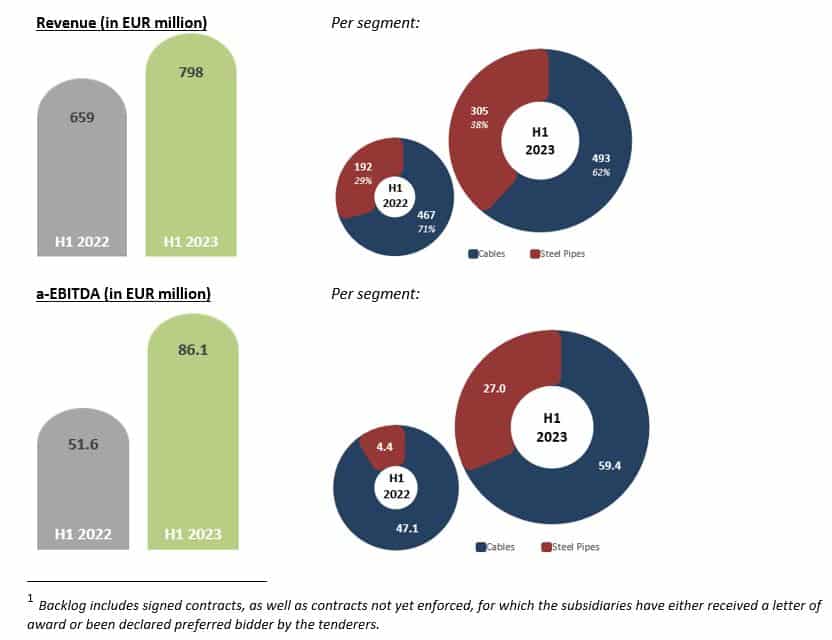

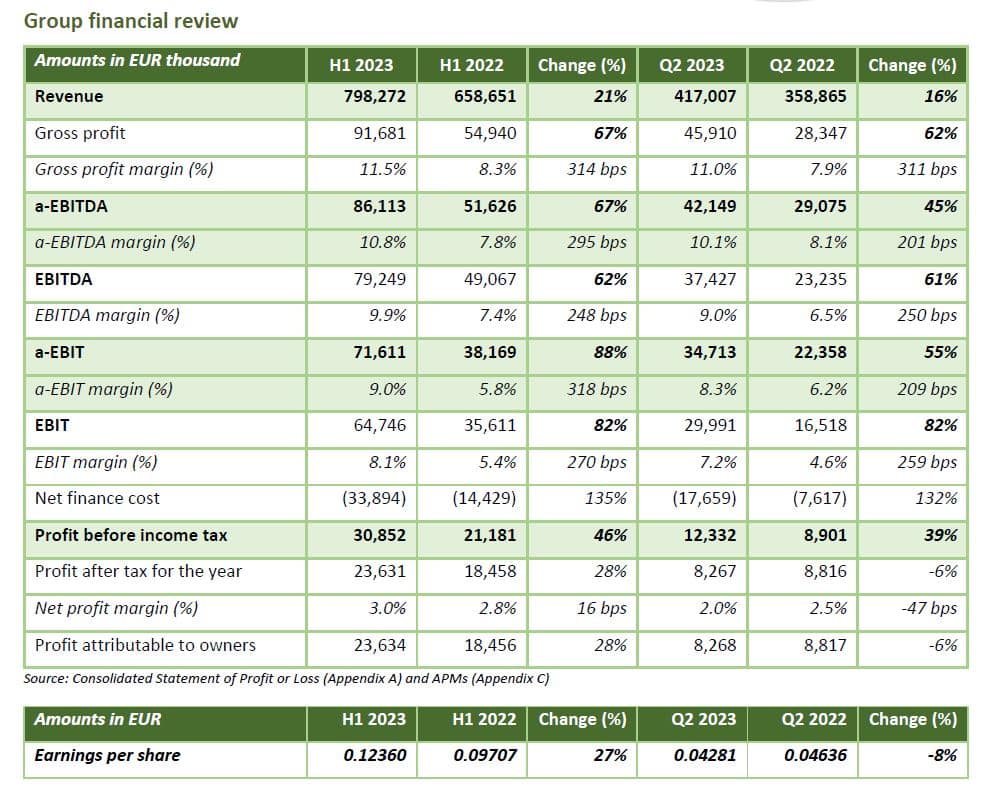

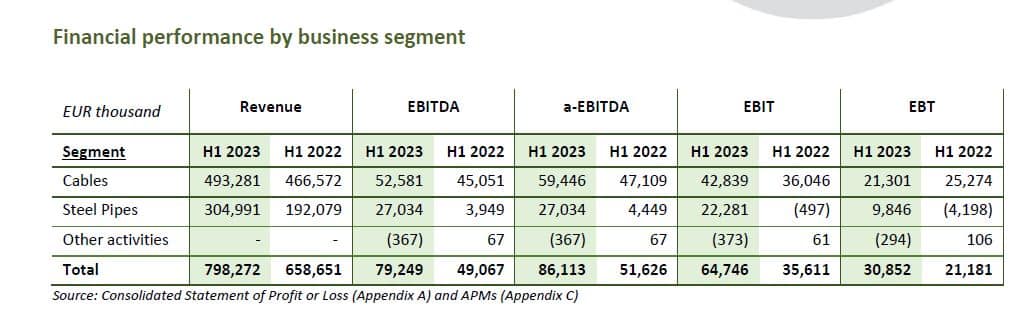

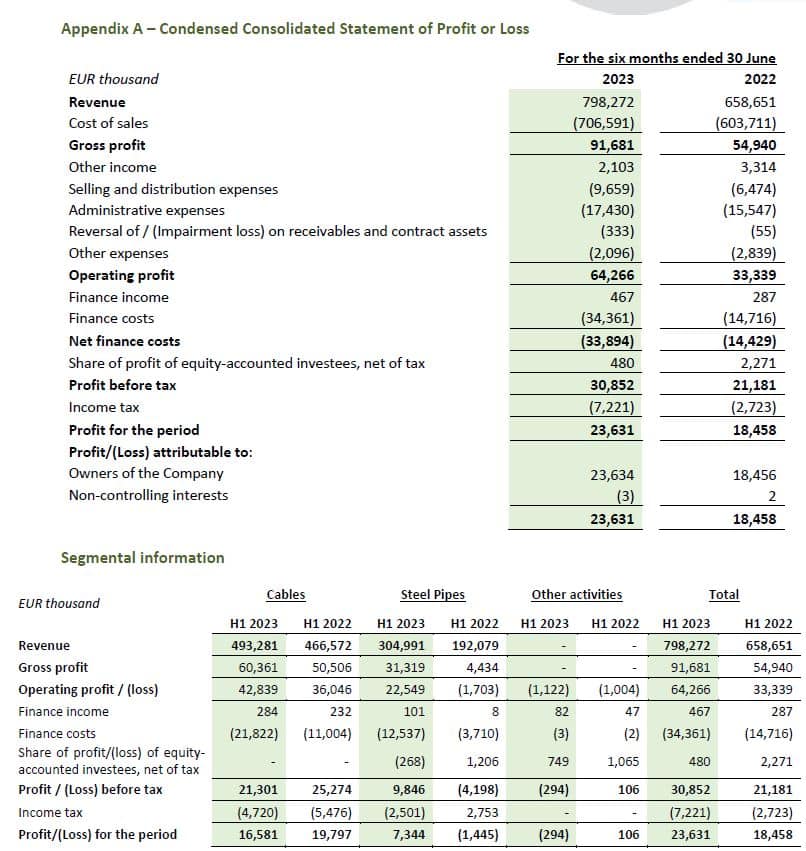

- Revenue reaches EUR 798 million, 21% higher than prior year’s corresponding semester (H1 2022: EUR 659 million).

- Improved margins in steel pipes and cables products business drove operational profitability (adjusted EBITDA) at EUR 86 million, based on strong projects execution. Consolidated profit before tax and net profit after tax grew to EUR 30.9 million and EUR 23.6 million respectively, substantially higher than H1 2022.

- Order backlog[1] kept growing on successful awards and reached EUR 2.5 billion as of 30 June 2023 (from EUR 2 billion on December 31st, 2022)

- The expansion of the Corinth submarine cables plant continues, contributing to total Capex for the first semester of 2023 of EUR 58.3 million.

- FY 2023 guidance for adjusted EBITDA in the range of EUR 180 – 200 million is confirmed.

Alexis Alexiou, Cenergy Holdings’ Chief Executive Officer, commented on the Group’s performance:

“Q2 2023 was another key quarter for Cenergy Holdings’ confirming its role as an enabler of energy transition. Our order backlog reached once again an all-time high as order intake exceeded EUR 900 million in the semester, while full production schedules across all plants contributed to strong profitability. The turnaround of steel pipes was confirmed in H1 2023, as the segment multiplied its profit margins, while the solid growth of the cables segment endures. At the same time, the expansion in offshore cables’ production capacity set off at the beginning of the year, fully supported by a strong financing partner such as EBRD.

We are confident we will achieve our 2023 profitability objectives in the range of EUR 180 – 200 million for adjusted EBITDA thanks to our proven commitment to successfully deliver demanding energy projects and products for energy transmission across the globe.”

Overview

Throughout the first half of 2023, Cenergy Holdings took advantage of the improving demand in the energy sector: on the one hand, demand for cables products stayed strong, driven by grid expansions and increased construction activity, on the other, energy projects in both the cables and the steel pipes segments were executed smoothly and laid the foundation for operational profitability for the period.

Both Hellenic Cables and Corinth Pipeworks preserved their strong commercial momentum and kept on succeeding in new project tenders, leading total backlog to EUR 2.5 billion. Recent awards include the 118km deep water Leviathan field project in the eastern Mediterranean run by Chevron, the contract with RWE for both export and inter-array cables for the Thor offshore wind farm, the largest in Denmark, the supply of approx. 155km of 20” longitudinally submerged arc welded steel pipes for the Tamar gas field optimization development near the Israeli coast as well as several awards for inter-array cables for wind farms in North Europe and the USA.

In the cables segment, the efficient execution of high-profile submarine projects combined with a high-capacity utilization of all production lines fostered growth and advanced performance. As noted above, low voltage and medium voltage power cables met strong demand during the first semester of 2023 and secured better profitability margins. The latter plus an improved product mix combined with timely and efficient project execution, resulting in a significant improvement in adjusted EBITDA (+26% y-o-y) that reached EUR 59.4 million. Along came several awards of new projects that further advanced the segment’s backlog to a new record of EUR 1.85 billion. Such a solid project pipeline in both the interconnection and the offshore wind farm (OFW) markets confirm Hellenic Cables’ key role in the energy transition fast-growing market. Given the growing demand for submarine cables already depicted in this rising backlog, the segment proceeded with a total capital expenditure of EUR 54.7 million during the first half of 2023, largely spent on the expansion of Hellenic Cables offshore cables plant in Corinth.

Following two years of deep disruption in oil and gas markets, 2022 ended as a turnaround year for the steel pipes segment and 2023 started with very strong dynamics from early on. Adjusted EBITDA for first half of the year surpassed 2019 levels and reached EUR 27 million, almost as much as the entire previous year. Such superior profitability was the result of high-capacity utilization as well as major new project awards. Together with all initiatives taken during the previous years, including (but not limited to) a thorough cost optimization plan and a Manufacturing Excellence and extensive RDI programme, Corinth Pipeworks solidified its competitive position and succeeded in increasing market share in the global market, taking a leadership position in energy transition technologies, such as hydrogen and Carbon Capture & Storage (CCS) pipelines. The significant recovery of the energy market and a series of important projects assigned, resulted in a backlog of EUR 0.63 billion. At the same time, the subsidiary committed to sustainability principles, set ambitious medium and long-term goals for carbon emissions of its overall supply chain, while securing certifications under the Environmental Product Declaration (EPD) for its steel products.

Revenue grew by 21% y-o-y to EUR 798 million, with Q2 2023 being 16% higher than the corresponding quarter of 2022 and 9% higher than Q1 2023. In the cables segment, an improved product mix pushed the segment’s revenue 6% higher (+15% in cables projects and +6% in power and telecom products), while steel pipes succeeded ca. 59% revenue growth compared to last year, a clear signal the segment is now on a growing trend.

Driven by the high increase in sales and improved margins in steel pipes, adjusted EBITDA reached EUR 86.1 million in H1 2023 (+67% y-o-y), while quarterly operational profitability grew by 45% y-o-y. The higher margins achieved during the first half of the year confirmed the focus on high value-added products in both segments and the ability of steel pipes to benefit from improved market conditions.

Net finance cost increased considerably and reached EUR 34 million in the first semester, compared with EUR 14.4 million during the same period last year. The increase is, to a large extent, due to higher cost of debt, as interest rate increases intensified with monetary policies tightening all around the globe for H1 2023. It is worth noting that, though credit spreads for all subsidiaries stayed fixed or even fell slightly during the first six months of the year, the reference rate of 3-month Euribor steeply rose (from -0.176% on 01/07/22 to 3.577% on 30/06/23).

To a lesser extent, the ongoing investments in the cables segment and a shift in the invoicing schedule for steel pipes, pushed net debt levels upwards and further added to the higher finance cost bill. The net debt increase is expected to reverse in the rest of the year, as payment milestones fall back on track.

Strong operational profitability obviously drove profit before income tax to levels 46% higher than last year (EUR 30.9 million), especially in steel pipes. Profit after tax followed at EUR 23.6 million, up from EUR 18.5 million in H1 2022 (2.9% of revenue).

Total capital expenditure for the Group reached EUR 58.3 million in H1 2023, split between EUR 54.7 million for the cables and EUR 3.6 million for the steel pipes segment (see details in the segments discussion).

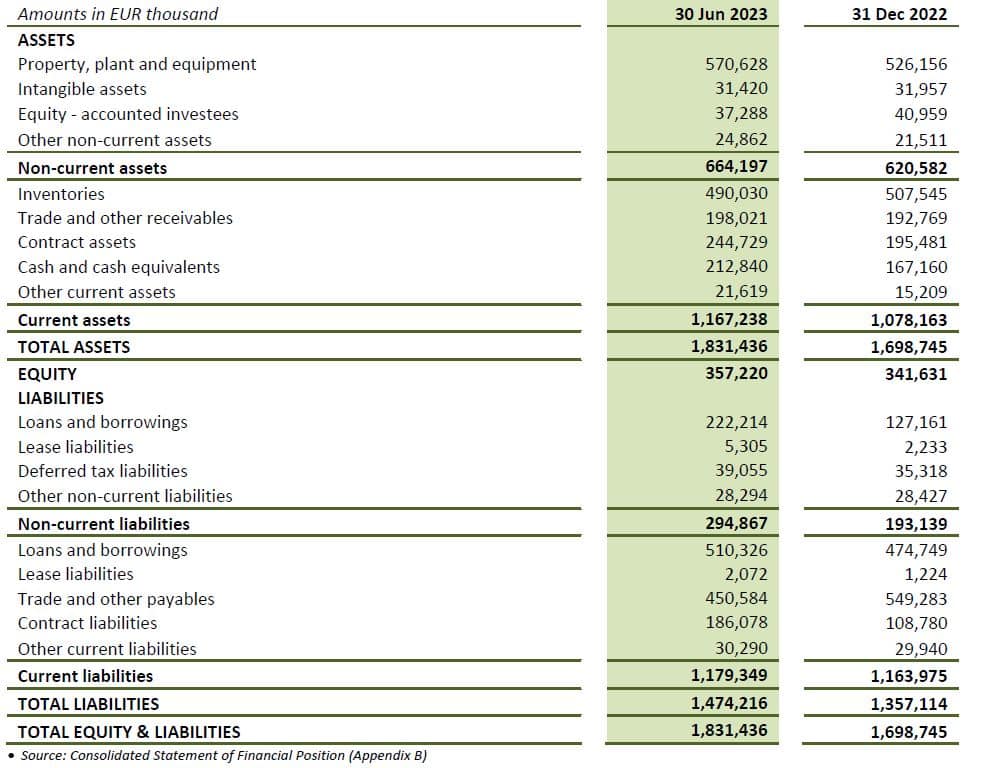

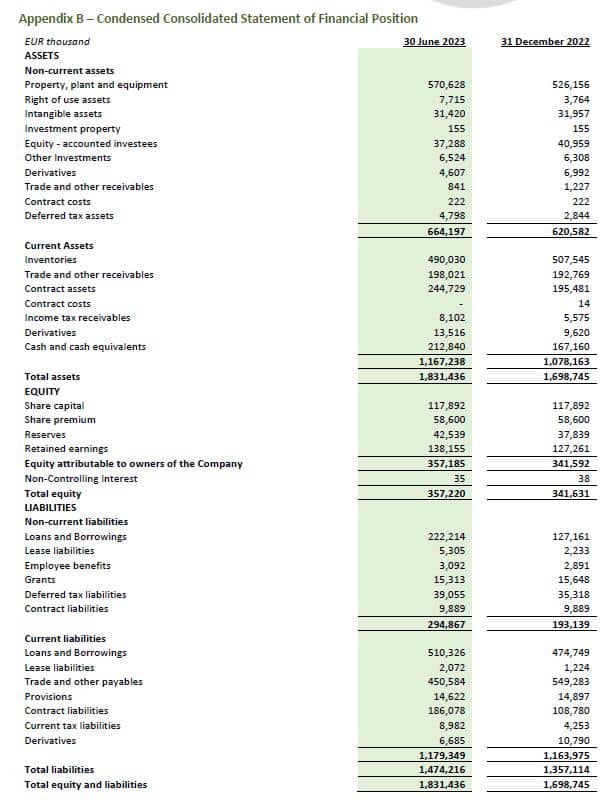

Total working capital (WC) increased by EUR 56 million, reaching EUR 271 million as of 30 June 2023 versus EUR 214 million as of 31 December 2022. This rise is mainly due to repayment of raw materials suppliers related to projects of steel pipe segment included in backlog, which will be fully delivered within 2023. The increase of WC is expected to be reversed for the year-end as significant contractual inflows will follow in the second half of the year as projects execution progresses and improved payment terms are secured with supply chain partners.

Though cash generated from operating activities was positive for H1 2023, net cash flow turned out negative as the positive earnings contribution (after adjustment for WC needs) was more than outweighed by elevated interest charges and related expenses. At the same time, capital expenditures related to the expansion of offshore cables business unit were fully financed through a loan facility of EUR 88 million provided by the EBRD combined with the Greek Recovery and Resilience Fund (RRF).

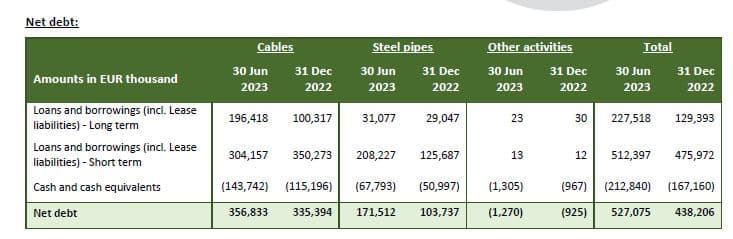

As a result of the above, net debt reached EUR 527 million, as of 30 June 2023, from EUR 438 million six months earlier (+EUR 89 million).

Cables

Revenue for the cables segment reached EUR 493 million (+6% y-o-y), the growth being driven mainly by the projects’ business (+15% revenue growth y-o-y). The solid demand for cables products in all geographical regions (i.e., Central Europe, United Kingdom, Balkans, Southeast Mediterranean) helped the Power & Telecom business unit improve its profit margins per ton of products sold. This, along with a full production schedule, an improved sales mix and steady high margins in projects, led to a 26% y-o-y growth in a-EBITDA (+EUR 12.3 million).

During the first semester of the year, the tendering activity of Hellenic Cables continued successfully with several new projects awards in the offshore wind and interconnection markets:

- In the offshore export cables market, new awards included:

- the turnkey interconnection project of a 275kV HVAC export cable system for Thor OWF in Denmark awarded by RWE to a consortium formed by Jan de Nul and Hellenic Cables;

- the supply contract awarded by Končar Group for approx. 30km of 110kV high voltage submarine cables to replace outdated cable lines in the Adriatic Sea; and

- the turnkey project awarded by TenneT to a consortium formed by Jan de Nul and Hellenic Cables for three high voltage alternating current (HVAC) offshore grid connection cables connecting wind farms to the DolWin Kappa convertor station in Germany.

- In the inter-array market, Hellenic Cables maintained its leading position, securing:

- the supply of 260km of 66kV XLPE-insulated subsea inter-array cables and associated accessories for South Fork Wind and Revolution Wind in the Northeast U.S., two offshore wind projects developed by Ørsted and Eversource;

- the supply of approx. 185km of 66kV aluminium and copper conductor cables to connect the wind turbines of four OWF sites in the German North Sea developed by RWE and Northland Power;

- the turnkey project for an inter-array cable system consisting of approx. 200km of submarine cables and associated accessories for the Thor OWF in Denmark awarded by RWE to a consortium formed by Jan de Nul and Hellenic Cables,

- a contract with Ørsted for the supply of inter-array cables for the Hornsea 3 OWF in the United Kingdom; and

- the inter-array cable supply agreement with Vattenfall for the Norfolk Offshore Wind Zone in the United Kingdom.

- EUR 36.6 million for the Corinth plant, mainly for the implementation of the planned offshore cables capacity expansion;

- EUR 5.6 million for selective investments in Hellenic Cables onshore cables plants in the area of Thiva;

- EUR 5.5 million for the Bucharest plant, including the acquisition of a neighboring property; and

- EUR 3.2 million to support the construction of a submarine cables factory in the USA.In the onshore sector, Hellenic Cables was awarded two turnkey projects by Greece’s Independent Power Transmission Operator (ADMIE – IPTO) to carry out diversion and undergrounding of transmission lines on Evia Island in central Greece and at the area of Messatida in the Northern Peloponnese, Greece.As a result of the above new order intake of ca. EUR 900 million, the order backlog of the segment reached EUR 1.85 billion by 30 June 2023, its highest level ever (EUR 1.35 billion on 31.12.22).At the same time, throughout 2023, several projects were successfully delivered, fully or partially. Among others:

- The production for the turnkey interconnection projects of Lavrio – Serifos / Serifos – Milos interconnection (phase 4 of the Cyclades’ interconnection in Greece, with a total cable length of 170km) started during H1 2023.

- The last batches of 66kV inter-array cables for phases A & B of the Doggerbank offshore wind farm in the UK were completed, while the production for the supply of 360km of 66kV cables and accessories for the Sofia OWF in the United Kingdom was initiated during the first semester of the year.

- The upgraded electrical interconnection between Kilini and Zakynthos was successfully electrified during the first semester, securing the energy supply of the Ionian Islands, Greece.

Profit margins for the products business unit increased due to solid demand in all main markets and a positive product mix. These factors eventually contributed further to the segment’s profitability.

Driven by the above, the a-EBITDA for cables segment reached EUR 59.5 million in H1 2023, up by EUR 12.3 million from H1 2022. This increase was able to counterbalance the rise in net finance costs (+EUR 10.8million vs. H1 2022). Corresponding profit before income tax reached EUR 21.3 million, compared to EUR 25.3 million in 2022, negatively impacted by the metal price lag. Net profit after tax followed the same trend and reached EUR 16.6 million (EUR 19.8 million in H1 2022).

The segment’s net debt increased by EUR 21 million reaching EUR 357 million on 30.06.2023. This increase is driven mainly by the ongoing investment programme in the submarine cable facility in Corinth.

H1 2023 capital expenditure for cables segment amounted to EUR 54.7 million and mainly concerned the following:

- Steel pipesThe end of 2022 showed that the steel pipes segment was on a turnaround path. This was confirmed in the first six months of this year, as revenue increased by 59% compared to prior year’s corresponding semester (EUR 305 million vs. EUR 192 million), and profitability followed with profit before income tax turning a positive EUR 9.8 million versus a loss of EUR 4.2 million in H1 2022.The gas fuel transportation market turned around in the beginning of 2023 with steadily higher energy prices coexisting with the urge for energy security faced by many European countries. Demand growth resulted in many pipeline projects being revived and hastily pushed to execution phase. In this positive commercial environment, Corinth Pipeworks consolidated its position as a Tier1 pipe manufacturer and a leader in new gas transportation technologies such as high-pressure pipelines for hydrogen and CCS pipelines. Within the year, it successfully executed several pipeline projects and was awarded significant new ones that included some of these new technologies:

- In January, Chevron Mediterranean Ltd. awarded to CPW 155km of steel pipes for the Tamar gas field optimization development, in the Southeastern Mediterranean.

- Later in the year, Equinor awarded a contract for 15km of pipes for IRPA field development project in the Norwegian sea.

- A new contract by ONE-Dyas B.V. to provide 16km of hydrogen certified steel pipes for the N05-A platform in the North Sea was won in March.

- Chevron Mediterranean Ltd. followed later in the year with an award of 118km of steel pipes for the 3rd gathering line of the Leviathan gas field, in the Southeastern Mediterranean.

These came on top of contracts in Italy, the Mediterranean region, the North & Norwegian Sea, Africa and U.S.A., and confirmed the segment’s robust profitability position, despite higher financing costs.

As a result of the abovementioned awards, the backlog at the end of H1 2023 reached EUR 630 million with a new intake of over EUR 220 million.

High-capacity utilization along with a higher-margin projects mix led to a notable improvement in profitability with gross profit equal to EUR 31.3 million in H1 2023 (from EUR 4.4 million in H1 2022) and adjusted EBITDA, following to EUR 27.0 million, more than five times the EUR 4.5 million achieved in H1 2022. The improvement in operational profitability translated to a net profit for the six-month period of EUR 7.3 million compared to a net loss of EUR 1.5 million in H1 2022.

Higher revenue and increased needs for raw materials related to significant projects in the order backlog to be executed within the second semester of the year, pushed working capital for the steel segment upwards by ca. EUR 78 million from its 2022 levels. Consequently, net debt climbed to EUR 171.5 million, EUR 68 million higher than its 31.12.22 level. Nevertheless, this increase is attributed mainly to phasing of milestone payments relating to projects in the order backlog and will be reversed until the end of the year as projects execution progresses.

Capital expenditure in steel pipes amounted to EUR 3.6 million, mostly related to operational improvements in the Thisvi plant.

Concurrently, Corinth Pipeworks continued its extensive R&D program in green hydrogen transportation expanding its laboratory capabilities into specialized high-pressure tests in hydrogen environments, as continuous innovation and improvement remains both a requirement for growth and an objective by itself for the subsidiary. Excellence was also pursued through a process digitalization roadmap and a vast number of qualifications by global energy companies. Process upgrade and geographical diversification is a path leading to a stronger competitive advantage.

Subsequent events

There are no subsequent events affecting the Condensed Consolidated Interim Financial Statements.

Outlook

The cables segment is confidently continuing its performance momentum in both business units, as demand for products remains strong while the projects backlog is growing. The set of secured project orders and high-capacity utilisation in all plants throughout 2023 remain the two profitability pillars of the segment. The electrification momentum in Europe and the increasing demand of grid connections are expected to further fuel the order book for land cables. Preparing for this, Hellenic Cables has already acquired an industrial area near its factory in Thiva to serve future expansion plans in order to serve that growing onshore demand. As for the offshore projects business unit, several awards were secured during the last months and more projects are expected to be awarded in the forthcoming year.

Hellenic Cables, through its two-year investment program in Corinth plant, aims to strengthen further its role as a key enabler of the Green Energy transition. Such investments will allow the Company to effectively execute a record high order backlog and serve the increasing expectations of customers and stakeholders. Last, and following previous announcements, the discussions with Ørsted on the partnership for the construction of a submarine inter array cables factory in Maryland, USA are continuing.

The steel pipes segment is building on its strengthened position and continues its profitability growth, based on high-capacity utilization until the end of the year. Strong operations are expected to bring back down any seasonal peaks in working capital observed during the semester and normalize leverage to far more sustainable levels. Looking ahead, Corinth Pipeworks expects the gas fuel industry to keep on evolving together with the other energy transition pillars. As market conditions improve, so is the order backlog, feeding into a positive outlook for next year, too.

Given the strong order backlog for both segments and the growing demand for energy infrastructure products worldwide, Cenergy Holdings confirms its FY 2023 guidance previously published and expects an adjusted EBITDA in the range of EUR 180 – 200 million for the FY 2023. The usual caveats published in our Q1 2023 trading update still hold.

As stated often in past financial results announcements, Cenergy Holdings remains focused on value growth over volume growth. Our strategy is to keep creating profit from our unique role in the new global energy framework and invest in our production ability to serve the growing energy infrastructure markets.

Statement of the Auditor

All figures and tables contained in this press release have been extracted from Cenergy Holdings’ unaudited condensed consolidated interim financial statements for the first six months of 2023, which have been prepared in accordance with IAS 34 Interim Financial Reporting, as adopted by the European Union.

The statutory auditor, PwC Bedrijfsrevisoren BV / Reviseurs d’Entreprises SRL, represented by Marc Daelman, has reviewed these condensed consolidated interim financial statements and concluded that based on the review, nothing has come to the attention that causes them to believe that the condensed consolidated interim financial information is not prepared, in all material respects, in accordance with IAS 34, as adopted by the European Union.

For the condensed consolidated interim financial statements for the first six months of 2023 and the review report of the statutory auditor, refer to Cenergy Holdings’ website www.cenergyholdings.com.

About Cenergy Holdings

Cenergy Holdings is a Belgian holding company listed on both Euronext Brussels and Athens Stock Exchange, investing in leading industrial companies, focusing on the growing global demand of energy transfer, renewables and data transmission. The Cenergy Holdings portfolio consists of Corinth Pipeworks and Hellenic Cables, companies positioned at the forefront of their respective high growth sectors. Hellenic Cables is one of the largest cable producers in Europe, manufacturing power and telecom cables as well as submarine cables. Corinth Pipeworks is a world leader in steel pipe manufacturing for the energy sector and major producer of steel hollow sections for the construction sector. For more information, please visit our website at www.cenergyholdings.com.

Contacts

For further information, please contact:

Sofia Zairi

Chief Investor Relations Officer

Tel: +30 210 6787111, +30 210 6787773

Email: ir@cenergyholdings.com

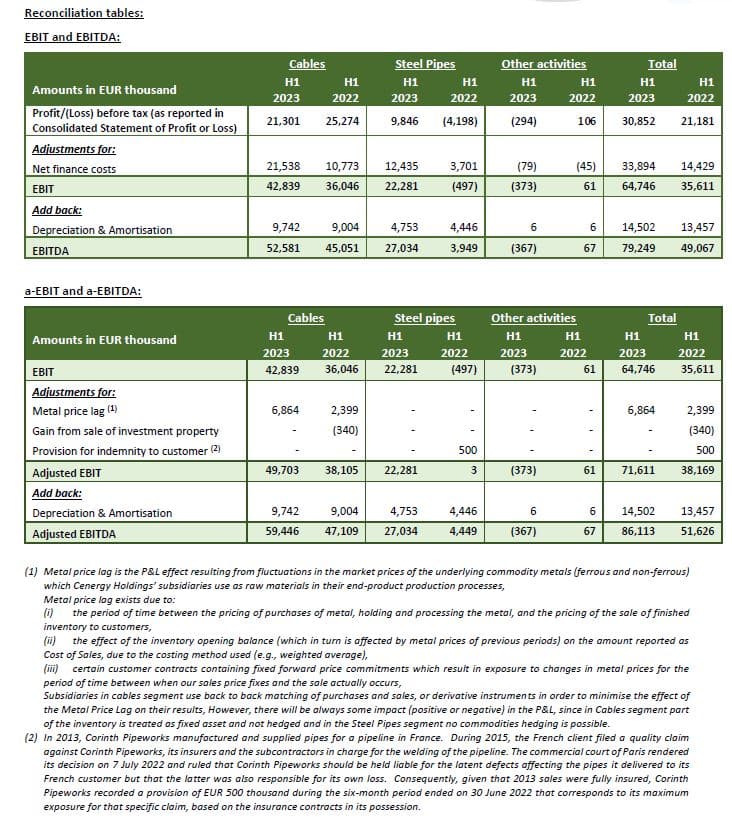

- Appendix C – Alternative performance measures In addition to the results reported in accordance with International Financial Reporting Standards (“IFRS”) as adopted by the European Union, this press release includes information regarding certain alternative performance measures which are not prepared in accordance with IFRS (“Alternative Performance Measures” or “APMs”). The APMs used in this press release are Earnings Before Interest and Tax (EBIT), Adjusted EBIT, Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA), Adjusted EBITDA and Net debt. Reconciliations to the most directly comparable IFRS financial measures are presented below.We believe these APMs are important supplemental measures of our operating and financial performance and are frequently used by financial analysts, investors and other interested parties in the evaluation of companies in the steel pipes and cables production, distribution and trade industries. By providing these measures, along with the reconciliations included in this appendix, we believe that investors will have better understanding of our business, our results of operations and our financial position. However, these APMs shall not be considered as an alternative to the IFRS measures.These APMs are also key performance metrics on which Cenergy Holdings prepares, monitors and assesses its annual budgets and long-range (5 year) plans. However, it must be noted that adjusted items should not be considered as non-operating or non-recurring.

EBIT, Adjusted EBIT, EBITDA and Adjusted EBITDA have limitations as analytical tools, and investors should not consider it in isolation, or as a substitute for analysis of the operating results as reported under IFRS and may not be comparable to similarly titled measures of other companies.

APM definitions remained unmodified compared to those applied as of 31 December 2022. The definitions of APMs are as follows:

EBIT is defined as result of the period (earnings after tax) before:

- income taxes,

- net finance costs

EBITDA is defined as result of the period (earnings after tax) before:

- income taxes,

- net finance costs

- depreciation and amortisation

a-EBIT and a-EBITDA are defined as EBIT and EBITDA, respectively, adjusted to exclude:

- metal price lag,

- impairment / reversal of impairment of fixed, intangible assets and investment property

- impairment / reversal of impairment of investments

- gains/losses from sales of fixed assets, intangible assets, investment property and investments,

- exceptional litigation fees and fines and,

- other exceptional or unusual items

Net Debt is defined as the total of:

- long term loans & borrowings and lease liabilities,

- short term loans & borrowings and lease liabilities,

Less:

- cash and cash equivalents