News

2024 FIRST HALF YEAR FINANCIAL RESULTS, STRATEGY UPDATE AND UPDATED GUIDANCE

Brussels, 27 August 2024

REGULATED INFORMATION

INSIDE INFORMATION

The enclosed information constitutes inside information as defined in Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse and regulated information as defined in the Belgian Royal Decree of 14 November 2007 regarding the duties of issuers of financial instruments which have been admitted for trading on a regulated market.

Cenergy Holdings S.A. (Euronext Brussels, Athens Stock Exchange: CENER), hereafter “Cenergy Holdings” or the “Group”, announces today its financial results for the first half year of 2024 together with the issuance of its Interim Report for the same period.

Cenergy Holdings also announces its intention to raise capital through a share capital increase of up to EUR 200 million (the “Potential Share Capital Increase”) for the purpose of accelerating its strategic plan.

Off the back of the Group’s strong trading, Cenergy Holdings also provides an update on guidance for full year 2024 and is introducing medium-term ambitions supported by the strategic plan.

Highlights

- Strong H1 2024 trading:

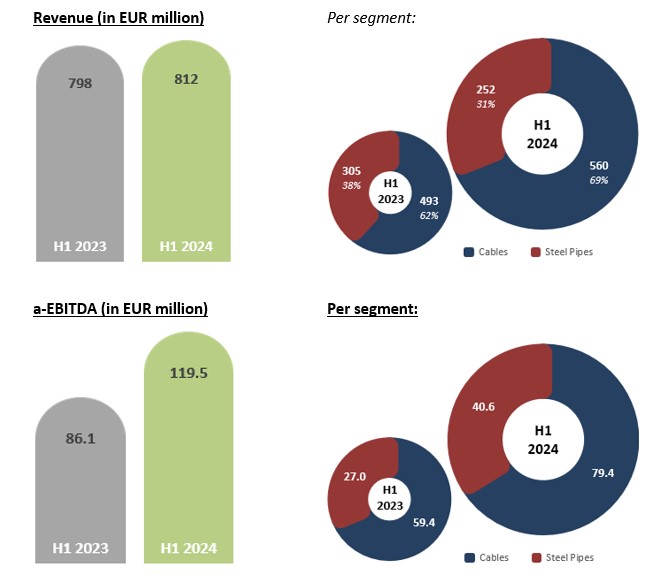

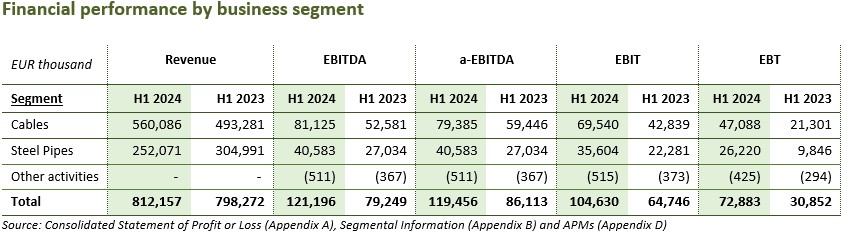

- Revenue reaches EUR 812 million with improved margins across all business units

- Adjusted EBITDA[1] reaches EUR 119.5 million (+39% y-o-y, 14.7% margin), reflecting the strong momentum in both the cables segment with a-EBITDA margin further increasing to 14.2% (H1 2023: 12.1%) and also in the steel pipes segment with a-EBITDA margin of 16.1%, almost double that of H1 2023.

- Order backlog[2] on 30 June 2024 increased to EUR 3.38 billion driven by significant order intake during the first half of the year.

- Potential EUR 200 million capital raise to accelerate strategic plan

- Potential Share Capital Increase to support US expansion and general corporate purposes, as well as to finance further improvements to the Group’s existing facilities in Greece

- An extraordinary shareholders’ meeting to take place in early October to authorise the Cenergy Holdings board of directors to decide on the Potential Share Capital Increase subject to customary conditions, including prevailing market conditions.

- Updated guidance and introduction of medium-term ambitions as per the strategic plan:

- FY 2024 guidance is updated to EUR 245 – 265 million for adjusted EBITDA (from EUR 230 – 250 million).

- In light of revised near-term guidance, record-level order backlog and positive market outlook, the Group is setting ambitions for the medium term that include a strong organic revenue growth and adjusted EBITDA in the range of EUR 380 – 420 million.

[1] Adjusted EBITDA, defined in Appendix D “Alternative Performance Measures (APMs)”.

[2] Backlog includes signed contracts, as well as contracts not yet enforced, for which the subsidiaries have either received a letter of award or been declared preferred bidder by the tenderers.

Alexis Alexiou, Cenergy Holdings’ Chief Executive Officer, commented:

“The continuous margins expansion and the strong profitability achieved during the first half of the year confirm Cenergy Holdings’ value driven strategy. The profitability margins of our steel pipes segment grew significantly, driving the Group’s margins to record high levels. At the same time, the cables segment continued to benefit from the expansion in power grids and booming RES projects and achieved, once more, a strong performance.

The updated guidance for the 2024 full year follows from such robust H1 results and a growing backlog, but also thanks to our disciplined focus on successfully delivering demanding energy projects and products for energy transmission across the globe.

Cenergy Holdings is now entering a new period of growth. The strong performance of the Group as a whole over recent quarters, and the appealing medium-term outlook specifically in the cables segment, supports our recently announced strategy of accelerating the capacity expansion in the US along with the potential share capital increase. The US market represents a large and fast-moving market with attractive megatrends in the cables sector and the decision to expand in the US is part of Group’s strategy to drive profitable, sustainable growth and maintain focus on creating profit from its distinct role in the new global energy landscape.”

Overview

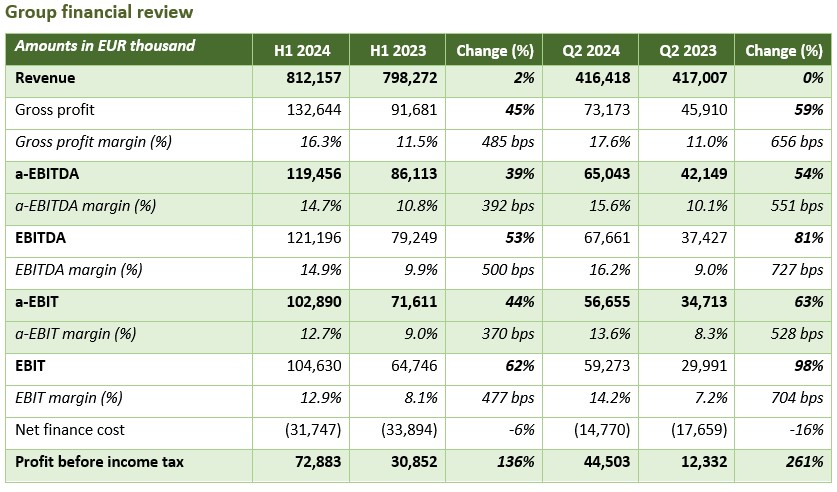

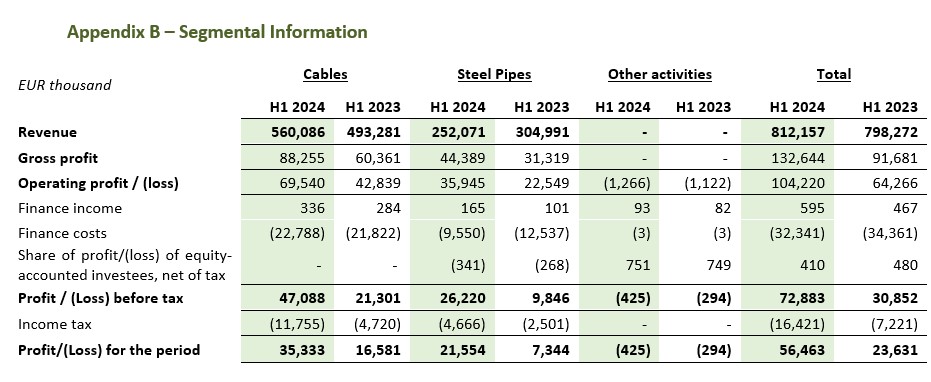

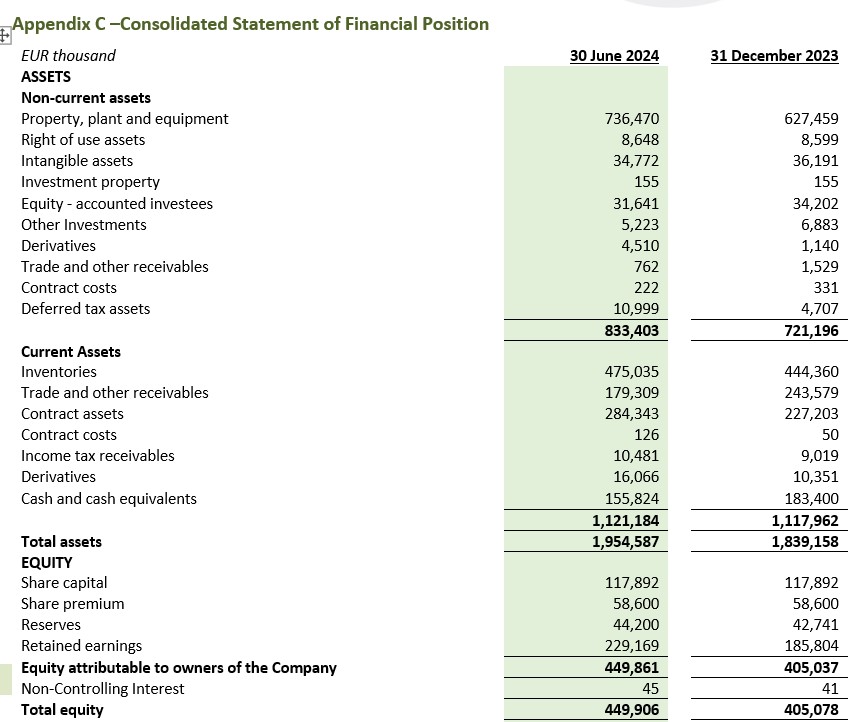

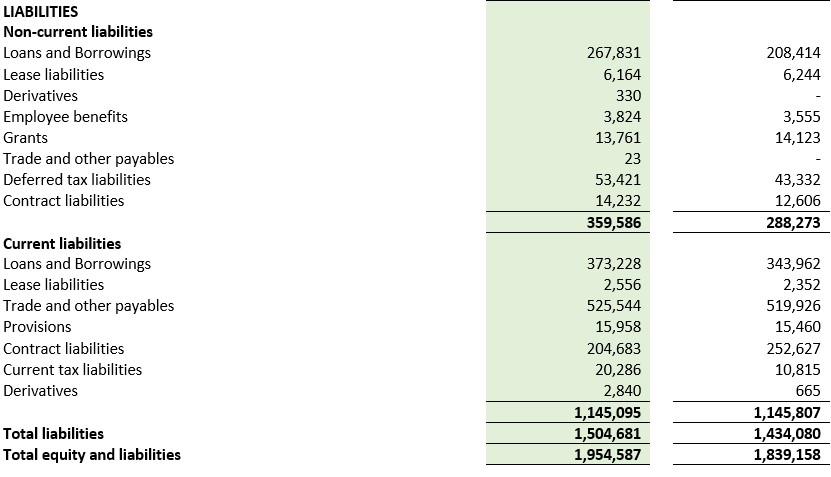

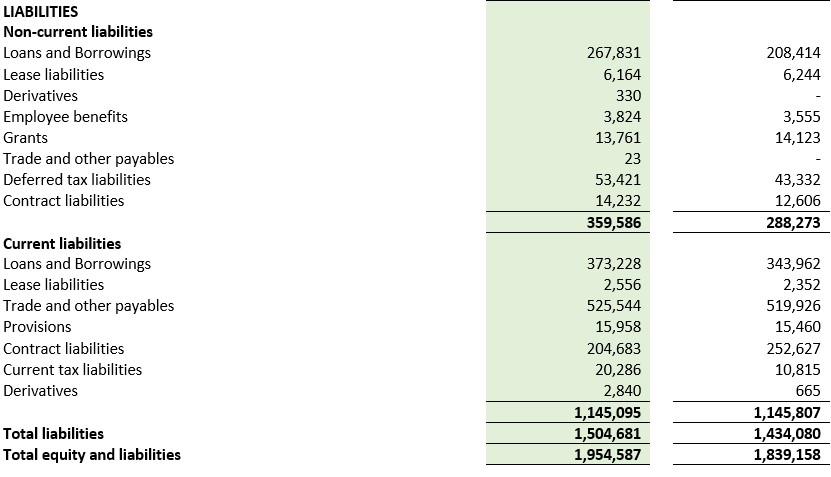

Cenergy Holdings continued its positive financial performance, realizing a 39% growth in terms of adjusted EBITDA in H1 2024, driven by contributions from both segments. Cables increased earnings as they continued successfully executing their record-high order backlog, while steel pipes build an even stronger performance than 2023, guided by improved margins resulting from the project mix executed during the first semester.

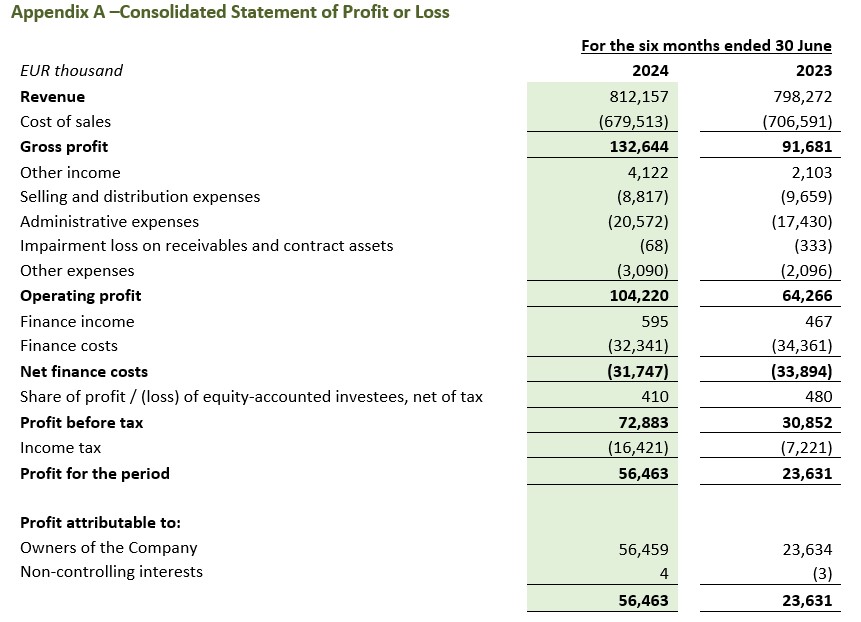

Demand for cables products remained satisfactory and supported prices, while energy projects in both segments were executed smoothly, being the main pillar of group’s profitability growth. Operational profitability (adjusted EBITDA) reached EUR 119.5 million, while profit after tax reached EUR 56.5 million.

Both Hellenic Cables and Corinth Pipeworks preserved their strong commercial momentum, securing new project awards that increased total backlog to EUR 3.38 billion on June 30th, 2024 (31 December 2023: EUR 3.15 billion). Recent awards include the 118km deep water Trion field project in the Gulf of Mexico by Woodside, the ca. €200 million contract with Elia for three 220kV offshore export cable systems of 165km in total length for the interconnection of Princess Elisabeth windfarm area in Belgium, the Utsira High pipeline in the North Sea awarded by TechnipFMC and two contracts with Amprion GmbH for turnkey cable transmission projects in Germany.

In the cables segment, such efficient execution of high-profile offshore and onshore projects combined with high-capacity utilization of all production lines supported growth and fostered performance. Revenue from the projects business increased by 70% reflecting the “value-over-volume” strategy followed by the Group. At the same time, low voltage and medium voltage power cables kept their profitability margins at 2023 levels. All these resulted in a significant improvement of adjusted EBITDA (+33.5% y-o-y) that reached EUR 79.4 million. Several new awards, both for subsea and land cables, further advanced the segment’s backlog to a new record of EUR 2.82 billion. This solid conduit of projects enhances Hellenic Cables’ key role in the fast-growing energy transition market and underpins further expansion plans to serve both offshore and onshore cables markets. Accordingly, the segment proceeded with a total capital expenditure of EUR 105.2 million during H1 2024, divided between the expansion of the offshore cables plant in Corinth, the onshore cables plants in Thiva and Eleonas and the new manufacturing facility in Baltimore, Maryland.

In the steel pipes segment, 2024 started with a vigorous first half start following a strong 2023. Even though the turnover was slightly lower (EUR 252 million) compared to the EUR 305 million of H1 2023, operational profits (a-EBITDA) clearly improved to EUR 40.6 million (+50.1% y-o-y). Such superior profitability was the result of a higher margin project mix and high-capacity utilization. Throughout the first half of 2024, the steel pipes focused on the successful execution of highly demanding projects like Chevron’s deep water offshore Tamar pipeline in Israel, an offshore pipeline project in Australia, a CCS project in the US and others. Additionally, the HSAW capacity enhancement and the LSAW optimization initiative are progressing, resulting in capital expenditure of EUR 17.1 million. Corinth Pipeworks retains its strong focus on targeted projects for hydrocarbon, CCS and hydrogen pipelines, along with its improved competitive position in the global energy transition technologies marketplace. The significant recovery of the gas energy markets and a series of important projects awarded, resulted in a strong backlog of EUR 561 million that provides a positive outlook for the rest of 2024 and a large part of 2025.

Revenue grew moderately to EUR 812 million, with Q2 2024 being at the same levels as Q2 2023. The increase is due to higher revenue generated from cables projects (+EUR 104 million vs H1 2023 or 70,5% y-o-y), which covered the decrease in revenue from Power & telecom cables and steel pipes.

The improved project mix executed in steel pipes segment and the increased contribution of cables projects in total revenue contributed to a significant increase in adjusted EBITDA margins. This steered adjusted EBITDA to significantly higher levels of EUR 119.5 million (39% higher than H1 2023). Profitability margins for the second quarter exceeded 15%, adding an extra EUR 65.0 million (+81% y-o-y and +20% q-o-q) to that of Q1 2024.

Net finance costs were affected by the decrease in credit spreads for all subsidiaries and by the slight decrease in reference rates. Specifically, they decreased by 6% compared to last year’s first semester, reaching EUR 31.7 million in H1 2024, compared with EUR 33.9 million during H1 2023. This decrease was mainly felt in the steel pipes segment, whereas increased capital expenditure by the cables segment added to its financing charges.

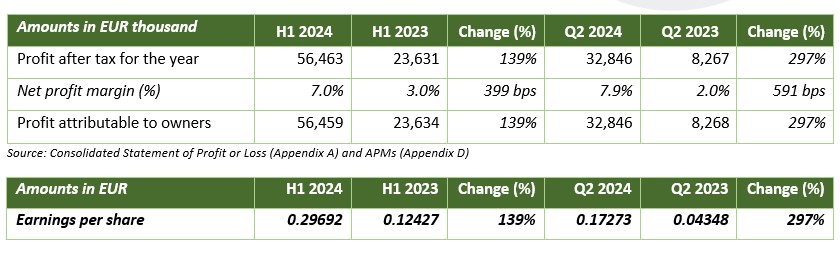

Strong operational profitability in H1 2024 more than doubled profit before income tax, with profit after tax following at EUR 56.5 million (7.0% of revenue).

Total capital expenditure for the Group reached EUR 122.3 million in H1 2024, split between EUR 105.2 million for the cables segment and EUR 17.1 million for the steel pipes segment (see details in the segments discussion).

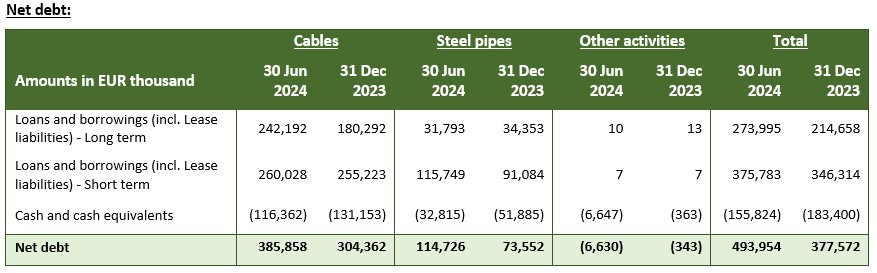

Total working capital (WC) also increased by EUR 55.8 million, reaching EUR 168.6 million as of 30 June 2024 vs. EUR 112.8 million as of 31 December 2023. Such increase is due to higher inventories to serve upcoming deliveries and the timing of milestone payments for projects in execution. The increased capital expenditure during the first semester of the year along with increased WC needs led net debt to EUR 494 million on June 30, 2024, more than EUR 100 million higher from its 2023 year-end level.

Cables

Revenue for the cables segment reached EUR 560 million (+13.5% y-o-y), with growth being driven by the projects’ business, as already mentioned (+70.5% revenue growth y-o-y). Adjusted EBITDA reached EUR 79.4 million (+33.5% a-EBITDA growth y-o-y) with margins at 14.2% versus 12.1% in H1 2023. The increased revenue contribution of projects’ business along with steadily high margins were the main drivers of the improved profitability recorded by the segment. On the cables products business, solid demand helped the business unit retain satisfactory profit margins achieved during 2023.

Throughout 2024, the tendering activity of Hellenic Cables continued its successful path with several new awards in the offshore wind and interconnection markets:

- Seaway7 appointed Hellenic Cables as the key subcontractor for the design, manufacturing, testing and supply of up to approx. 205km 66kV submarine inter array cables and related accessories for Bałtyk II and III wind farms, located in the southwestern Baltic Sea within Polish waters.

- Amprion GmbH, one of Europe’s leading transmission system operators (TSOs), awarded two 380 kV AC underground transmission systems in Germany for the projects Borgholzhausen (BHH, EnLAG16) and the Conneforde-Cloppenburg-Merzen (CCM, BBPIG6, Sections A and C).

- Elia Asset NV/SA awarded to a consortium formed by Hellenic Cables and DEME a contract for the engineering, procurement, construction and installation (EPCI) of three 220kV offshore export cable systems of 165km in total length to connect the Princess Elisabeth windfarm area with the shore.

Overall, Hellenic Cables secured over EUR 600 million of new orders both for projects and framework contracts. As a result, the order backlog of the segment reached EUR 2.82 billion by 30 June 2024, its highest level ever (EUR 2.5 billion on 31.12.23).

At the same time, throughout the first semester, several projects were successfully fully or partially delivered. Among others, the installation for the turnkey interconnection projects of the Lavrio – Serifos / Serifos – Milos (phase 4 of the Cyclades’ interconnection in Greece, with a total cable length of 170km) was completed, while the production of the first batches of 66kV inter-array cables for phase C of the Doggerbank OWF in the UK started. Furthermore, the production of several other projects, such as OstWind 3 for 50Hertz, the Sweden-Denmark interconnection and the Hai Long OWF in Taiwan progressed as planned and the production for Revolution OWF in the US was completed.

Net finance costs slightly increased (4.2% y-o-y) to EUR 22.5 million because of the increased needs to finance the ongoing investment programmes in several plants. Profit before income tax more than doubled, to EUR 47.1 million vs. EUR 21.3 million in H1 2023. Net profit after tax followed the same trend and reached EUR 35.3 million (EUR 16.6 million in H1 2023).

The cables segment’s net debt increased by EUR 81.5 million, reaching EUR 386 million on 30 June 2024, mainly due to the ongoing investment programmes, as WC slightly increased.

Capital expenditure for the segment amounted to EUR 105.1 million in H1 2024 and concerned:

- EUR 49.0 million, largely for the implementation of the planned capacity expansion in the offshore cables plant in Corinth;

- EUR 23.2 million for the onshore cables’ plants in Greece. Specifically, new production lines and new equipment are added to the Thiva plant to ensure a best-in-class ground and underground MV, HV, and EHV cables production facility. Completion is expected by end of 2025. At the same time, investments in the Eleonas plant are also advancing so that it is converted into a manufacturing centre of excellence for LV power cables until the end of 2024;

- EUR 3.5 million for the Bucharest plant; and

- EUR 29.4 million for the land plot intended for the new cables facility in the US and relative expenditure necessary for its development

Steel pipes

Following a strong 2023, 2024 started with a robust backlog of approx. EUR 650 million, which eventually led to a profitable first semester of the year. Turnover reached EUR 252 million, lower than the same period last year, but with much more solid profitability (in terms of a-EBITDA) of EUR 40.6 million, 50.1% higher than last year. This jump in profitability is attributed to the execution of projects with significantly higher margin compared to the project mix executed in H1 2023, a fact that led average margins for the semester to a record-high of 16.1%. In turn, the ability to secure such high-profile energy projects with healthy margins is a tangible proof of Corinth Pipeworks earning the place of a Tier1 pipe manufacturer.

The gas fuel transportation market maintains its positive momentum of 2024 with steadily higher energy prices coexisting with the urge for energy security. Energy demand growth resulted in many pipeline projects being revived and hastily pushed to execution phase. In this positive commercial environment, the steel pipes segment consolidated its position as a leader in new gas transportation technologies such as high-pressure pipelines for hydrogen and CCS pipelines.

Within the first half of the year, the segment successfully executed several prestigious projects such as:

- Chevron’s Tamar project in Israel, a 152Km deep water offshore gas pipeline with outside diameter of 20” manufactured in the Longitudinal Submerged Arc Welding pipe mill (LSAW);

- A Carbon Capture and Storage project in the US, with 46Km of 20” of High Frequency Welded (HFW) steel pipes; and

- The production of a major pipeline project in Australia, with outside diameter of 26” manufactured in the LSAW pipe mill.

During the second half of the year, the production lines of steel pipes segment are expected to maintain a high utilization rate with the production of steel pipes for the following projects:

- Chevron’s Leviathan in Israel, a 118Km deep water offshore gas pipeline with outside diameter of 20” manufactured in the LSAW mill;

- Several projects in Italy for Snam, the majority of which are certified to transport up to 100% of hydrogen;

- Several offshore pipelines for projects in the North Sea and Norwegian sea of HFW steel pipes;

- OMV Petrom’s Neptun deep in Romania, a 162Km offshore gas pipeline with outside diameter of 20” manufactured in the LSAW mill; and

- large and medium size projects in the US, Africa, Europe and Greece.

At the same time, Corinth Pipeworks secured significant new projects during H1 2024, including:

- Utsira High Project development project in the North Sea awarded by TechnipFMC, a 27 km offshore pipeline of HFW steel pipes and

- An award by Woodside Energy of a significant contract for Trion deepwater field in the Gulf of Mexico with 118 kms of HFW steel pipes.

These came on top of new contract awards in Italy, Romania, the North & Norwegian Sea and US, and confirmed the segment’s robust profitability position.

As a result of the abovementioned awards, the backlog at the end of H1 2024 reached EUR 561 million with a new intake of approx. EUR 200 million.

As several projects are either ongoing or to be executed until the end of the year, WC needs are higher by ca. EUR 37 million from its 2023 levels. Consequently, net debt increased to EUR 115 million, EUR 41 million higher than its 31.12.23 level. This increase is, however, attributed to the phasing of milestone payments of projects in execution and will be reversed until the end of the year.

Capital expenditure of first half of 2024 amounted to EUR 17.1 million, linked to strategic capacity upgrades in the Thisvi plant. More specifically, the segment implemented:

- an extensive optimisation and productivity enhancement program of the LSAW pipe mill that has already resulted in improved production figures, and

- a number of production capacity upgrades of its HSAW mill, expected to be completed in the second half of the year.

On another front, Corinth Pipeworks remains steadfast to its sustainability strategy and continues the initiatives in line with its mid-term announced targets. Committed to responsible sourcing initiatives, it improved its Ecovadis scoring and was also able to offer lower carbon emissions steel solutions to its customers.

Strategy update

Potential Share Capital Increase for the funding of Cenergy Holdings’ Strategic Plan

On August 27th, 2024, the Board of Directors of Cenergy Holdings has approved the decision to start preparations for a Potential Share Capital Increase, by a maximum amount of EUR 200 million (including issue premium), by way of a potential issuance of newly issued ordinary shares of no nominal value (“New Shares”), subject to customary conditions.

In the event that Cenergy Holdings proceeds with the Potential Share Capital Increase, it is intended that the New Shares would be offered (i) in Belgium and Greece, through an offer to the public within the meaning of Article 2(d) of the Regulation (EU) 2017/1129 of the European Parliament and of the Council of 14 June 2017 as amended and in force (“Prospectus Regulation”); and (ii) outside Belgium and Greece, through a private placement book-building process, in reliance on one or more exemptions from the requirement to publish or passport a prospectus under the Prospectus Regulation and/or other national law provisions in relevant jurisdictions, including the United States under Rule 144A (the “Institutional Offer”). Cenergy Holdings, subject to further review and approval by its Board of Directors, intends to grant a priority allocation to existing minority shareholders participating in the Potential Share Capital Increase. Apart from this priority allocation to existing minority shareholders, the ultimate objective of the Company will be to expand its free float and increase liquidity of the stock.

In the event that Cenergy Holdings proceeds with the Potential Share Capital Increase, it is intended that the proceeds will be used to finance the first phase of the planned construction of a cable manufacturing facility in Baltimore, Maryland, US, as well as for general corporate purposes and, to the extent deemed required, further improvements to existing facilities in Greece.

Cenergy Holdings sees a significant opportunity in the US, which represents a large and fast-moving market, with similar long-term megatrends to existing core markets, such as a growing population, urbanisation, and rising number of datacentres, which are increasing the overall demand for energy. Cenergy Holdings believes it is well positioned to capture this promising market opportunity in the US given its established technological capabilities and proven track record.

The expansion programme is line with the Group’s clearly defined strategy of (i) value over volume, (ii) growing export sales and (iii) optimising operational excellence, efficiently serving the growing energy infrastructure markets.

The launch of the Potential Share Capital Increase, as well its terms, are subject to various factors, including, inter alia, the grant of authorised capital by the Cenergy Holdings’ extraordinary shareholders’ meeting, which will be convened in the coming days, approval by Cenergy Holdings’ Board of Directors and the publication of a prospectus in accordance with the Prospectus Regulation, as well as prevailing market conditions.

Further information regarding Cenergy Holdings, the New Shares and the Potential Share Capital Increase will be provided in due course, and included in the relevant prospectus (if any). In the event that the Company proceeds with the Potential Share Capital Increase, investors will be informed by way of a separate announcement regarding the launch of the Potential Share Capital Increase, and the approval and distribution of the relevant prospectus.

Goldmans Sachs International is acting as a Sole Global Coordinator and HSBC and Alpha Bank as Joint Bookrunners in relation to the Potential Share Capital Increase.

Outlook and Medium-Term Ambitions

As outlined in recent years, the cables segment will continue to execute on its record high order backlog, which is the main pillar for the strong financial outlook of the segment for the medium term. Furthermore, the segment expands all its business lines and selectively invests in the promising US market. Increased RES generation, growing electricity demand and enhancements in power grids are some of the major trends for at least the next decade. They all have significantly increased the strategic role of cables industry in the global economy and are, in turn, directly driving the ongoing plans for expansion of the manufacturing capabilities of cables segment, by fuelling the segment’s order book. Finally, the demand for cables products (LV & MV power and telecom cables) remains strong and orders are also growing through the award of long-term framework contracts. All the above shape a positive outlook for the segment for the rest of 2024 and the medium term.

The steel pipes segment is building on its strengthened position and continues its profitability growth, based on high-capacity utilization and new investments for productivity enhancement and capacity increase until the end of the year. Looking ahead, Corinth Pipeworks expects the gas fuel industry to keep on evolving as the main transitional fuel, followed in the short term, by CCS projects and in the mid-term, by Hydrogen infrastructure projects. As market conditions improve, so is the order backlog, feeding into a positive outlook for the second half of the year.

Given the strong order backlog for both segments providing visibility for future performance and the strong profitability recorded in H1 2024, Cenergy Holdings expects an adjusted EBITDA in the range of EUR 245 – 265 million for the FY 2024. The financial outlook is subject to several assumptions including (a) smooth execution of energy projects in both segments, (b) timely and satisfactory execution of planned capacity expansions, (c) a strong demand for cables products and (d) limited financial impact from an uncertain global geopolitical and macroeconomic environment, high inflationary pressures and/or supply-chain challenges and/or potential disruptions.

In addition, supported by the Group’s strong business performance, positive market outlook, long-term megatrends in electrification and green energy and a solid order backlog, Cenergy Holdings is setting itself ambitions for the medium-term, which include organic revenue growth in excess of 12% per annum and an adjusted EBITDA in the range of EUR 380 – 420 million.

Subsequent events

On July 23, 2024, the Board of Directors of Cenergy Holdings approved to proceed with a share buy-back program on Euronext Brussels and on Athens Stock Exchange of a maximum of 120,000 Company’s shares, to be acquired from time to time in one or several transactions, as required, and for a maximum aggregate amount of EUR 1.3 million, to be executed in the next six (6) months. The share buyback program is currently implemented in accordance with industry best practices and in compliance with the applicable buyback rules and regulations. To this end, two independent financial intermediaries have been appointed to repurchase on the basis of a discretionary mandate. The precise timing of the repurchase of shares pursuant to the program will depend on a variety of factors including market conditions.

During the share buyback program, the Company regularly publishes press releases with updates on the progress made (if any) as required by law. This information is also available on the Company’s website under the “Investors” section (https://cenergyholdings.com/investors/). The Company’s current intention is to hold the shares acquired as treasury shares to allow for granting remuneration in shares on the basis of predetermined performance criteria, as is set out in the Company’s approved remuneration policy. The program is executed under the powers granted at the General Meeting of Shareholders on 28 May 2024, and article 7bis of the Bylaws.

Statement of the Auditor

All figures and tables contained in this press release have been extracted from Cenergy Holdings’ unaudited condensed consolidated interim financial statements for the first six months of 2024, which have been prepared in accordance with IAS 34 Interim Financial Reporting, as adopted by the European Union.

The statutory auditor, PwC Bedrijfsrevisoren BV / Reviseurs d’Entreprises SRL, represented by Alexis Van Bavel, has reviewed these condensed consolidated interim financial statements and concluded that based on the review, nothing has come to the attention that causes them to believe that the condensed consolidated interim financial information is not prepared, in all material respects, in accordance with IAS 34, as adopted by the European Union.

For the condensed consolidated interim financial statements for the first six months of 2024 and the review report of the statutory auditor, refer to Cenergy Holdings’ website www.cenergyholdings.com.

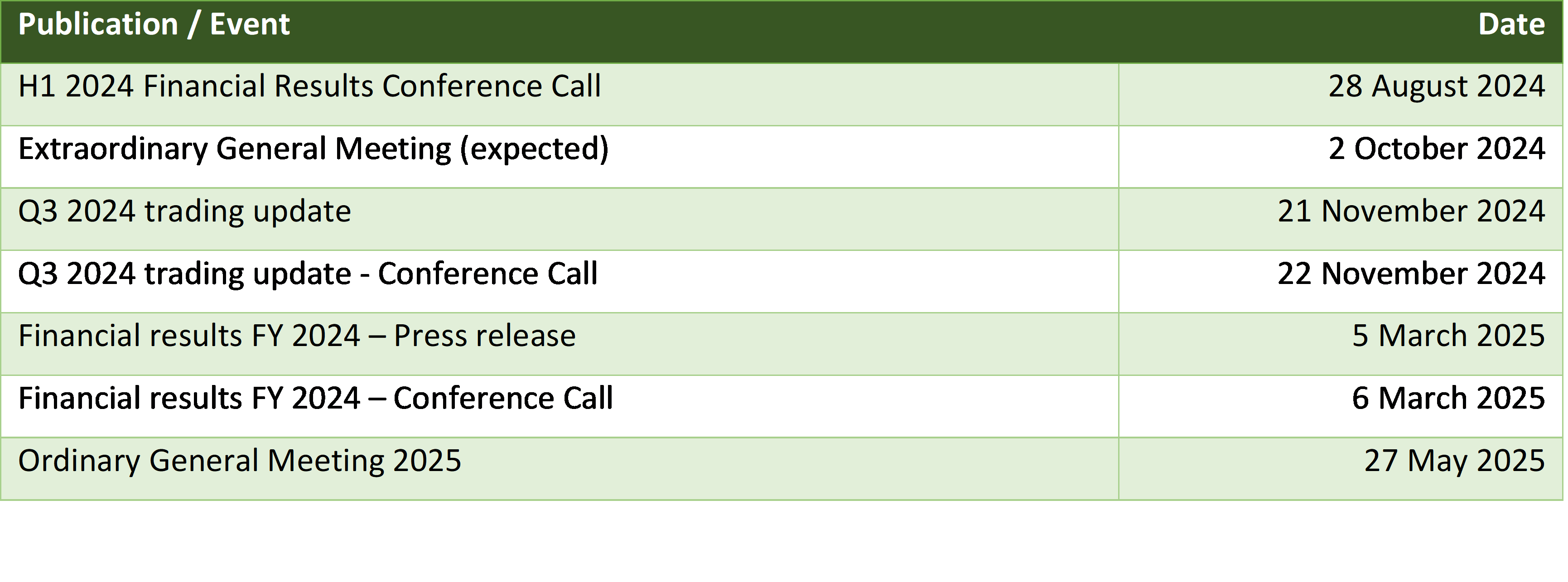

Financial Calendar

DISCLAIMER: Any forward-looking statements that may be included in this press release are statements regarding or based on current expectations, plans or understandings of our management relating to, inter alia, Cenergy Holdings’ future results of operations, financial position, liquidity, prospects, growth, strategies or developments in the markets in which its subsidiaries operate. Such forward-looking statements shall be treated as a reflection of information, data and understandings as of the date of the publication of this press release, so you are encouraged not to place undue reliance on them, given that by their nature, forward-looking statements are subject to risks, uncertainties and assumptions that could materially alter the actual results or future events from those expressed or implied thereby. The outcome and financial effects of the understandings, intentions, and events described herein could be adversely affected by these risks, uncertainties and assumptions. Forward-looking statements contained in this press release related to trends or current activities shall not to be taken as a report of the future status of such trends or activities. We undertake no obligation to update or revise any forward-looking statements, either as a result of new information or developments, future events or otherwise. The information contained in this press release is subject to change without notice. No re-report or warranty, express or implied, regarding the fairness, accuracy, reasonableness or completeness of the information contained herein and no reliance shall be placed on it. This press release has been prepared in English and translated into French and Greek. In case of discrepancies between different language versions, the English one shall prevail.

This document is not an offer of securities for sale or the solicitation of an offer to purchase securities in the United States, Canada, Australia, Japan or in any jurisdiction in which such offer is unlawful. Securities may not be offered or sold in the United States absent registration under the US Securities Act of 1933, as amended (the “Securities Act”) or an exemption from registration. Subject to certain exceptions, the securities referred to herein may not be offered or sold in Australia, Canada, or Japan or to, or for the account or benefit of, any national, resident or citizen of Australia, Canada, or Japan. The securities referred to herein have not been and will not be registered under the Securities Act or under the applicable securities laws of Australia, Canada, or Japan.

This press release and the information contained herein are not intended and shall not constitute a public offer or advertisement of securities in Belgium or Greece, or an invitation to make offers to purchase any securities in Belgium or Greece within the meaning of Art. 2(1)(d) of the Prospectus Regulation or Article 2(k) of the Prospectus Regulation (read together with relevant domestic implementing legislation), respectively, or outside Belgium and Greece. In the event that Cenergy Holdings proceeds with the Potential Share Capital Increase, an investment in the New Shares can only be based on a prospectus Cenergy Holdings would issue in connection with the Potential Share Capital Increase in accordance with the Prospectus Regulation (the “Prospectus”). Potential investors must read the Prospectus, if and when published, before making an investment decision in order to fully understand the potential risks and rewards associated with the decision to invest in any New Shares.

The information in this document regarding the New Shares is only addressed to and directed at persons (i) in Belgium and Greece or (ii) in member states of the European Economic Area (other than Belgium and Greece) and the United Kingdom (each a “Relevant State”) who are “qualified investors” within the meaning of Article (2)(e) of Regulation (EU) 2017/1129 (as amended) (“Prospectus Regulation”), in the case of the United Kingdom as the Prospectus Regulation forms part of retained EU law by virtue of the European Union (Withdrawal) Act 2018 (“Qualified Investors”). In addition, in the United Kingdom, the information in this document regarding the New Shares is being distributed only to, and is directed only at, Qualified Investors who are persons (i) having professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) (ii) falling within Article 49(2)(a) to (d) of the Order, or (iii) to whom it may otherwise lawfully be communicated (all such persons together being referred to as “Relevant Persons”). Such information must not be acted on or relied on (i) in the United Kingdom, by persons who are not Relevant Persons, and (ii) in any Relevant State, by persons who are not Qualified Investors. Any investment or investment activity to which the information in this document regarding the New Shares is available only to or will be engaged in only with, (i) persons resident or located in Belgium and Greece, (ii) Relevant Persons in the United Kingdom, and (iii) Qualified Investors in any Relevant State.

About Cenergy Holdings

Cenergy Holdings is a Belgian holding company listed on both Euronext Brussels and Athens Stock Exchange, investing in leading industrial companies, focusing on the growing global demand of energy transfer, renewables and data transmission. The Cenergy Holdings portfolio consists of Corinth Pipeworks and Hellenic Cables, companies positioned at the forefront of their respective high growth sectors. Hellenic Cables is one of the largest cable producers in Europe, manufacturing power and telecom cables as well as submarine cables. Corinth Pipeworks is a world leader in steel pipe manufacturing for the energy sector and major producer of steel hollow sections for the construction sector. For more information, please visit our website at www.cenergyholdings.com.

Contacts

For further information, please contact:

Sofia Zairi

Chief Investor Relations Officer

Tel: +30 210 6787111, +30 210 6787773

Email: ir@cenergyholdings.com

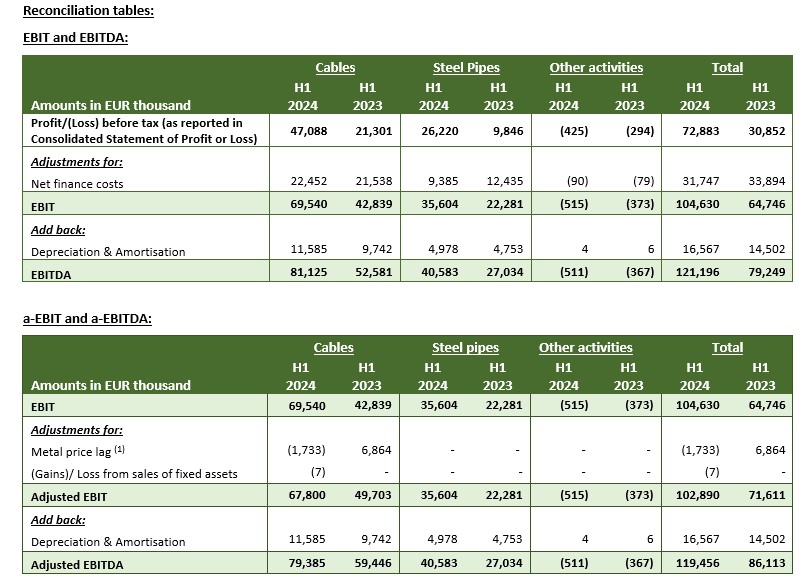

Appendix D – Alternative performance measures

In addition to the results reported in accordance with International Financial Reporting Standards (“IFRS”) as adopted by the European Union, this press release includes information regarding certain alternative performance measures which are not prepared in accordance with IFRS (“Alternative Performance Measures” or “APMs”). The APMs used in this press release are Earnings Before Interest and Tax (EBIT), Adjusted EBIT, Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA), Adjusted EBITDA and Net debt. Reconciliations to the most directly comparable IFRS financial measures are presented below.

We believe these APMs are important supplemental measures of our operating and financial performance and are frequently used by financial analysts, investors and other interested parties in the evaluation of companies in the steel pipes and cables production, distribution and trade industries. By providing these measures, along with the reconciliations included in this appendix, we believe that investors will have better understanding of our business, our results of operations and our financial position. However, these APMs shall not be considered as an alternative to the IFRS measures.

These APMs are also key performance metrics on which Cenergy Holdings prepares, monitors and assesses its annual budgets and long-range (5 year) plans. However, it must be noted that adjusted items should not be considered as non-operating or non-recurring.

EBIT, Adjusted EBIT, EBITDA and Adjusted EBITDA have limitations as analytical tools, and investors should not consider it in isolation, or as a substitute for analysis of the operating results as reported under IFRS and may not be comparable to similarly titled measures of other companies.

APM definitions remained unmodified compared to those applied as of 31 December 2023. The definitions of APMs are as follows:

EBIT is defined as result of the period (earnings after tax) before:

- income taxes,

- net finance costs

EBITDA is defined as result of the period (earnings after tax) before:

- income taxes,

- net finance costs

- depreciation and amortisation

a-EBIT and a-EBITDA are defined as EBIT and EBITDA, respectively, adjusted to exclude:

- metal price lag,

- impairment / reversal of impairment of fixed, intangible assets and investment property

- impairment / reversal of impairment of investments

- gains/losses from sales of fixed assets, intangible assets, investment property and investments,

- exceptional litigation fees and fines and,

- other exceptional or unusual items

Net Debt is defined as the total of:

- long term loans & borrowings and lease liabilities,

- short term loans & borrowings and lease liabilities,

Less:

- cash and cash equivalents

- Metal price lag is the P&L effect resulting from fluctuations in the market prices of the underlying commodity metals (ferrous and non-ferrous) which Cenergy Holdings’ subsidiaries use as raw materials in their end-product production processes,

Metal price lag exists due to:

(i) the period of time between the pricing of purchases of metal, holding and processing the metal, and the pricing of the sale of finished inventory to customers,

(ii) the effect of the inventory opening balance (which in turn is affected by metal prices of previous periods) on the amount reported as Cost of Sales, due to the costing method used (e.g., weighted average),

(iii) certain customer contracts containing fixed forward price commitments which result in exposure to changes in metal prices for the period of time between when our sales price fixes and the sale actually occurs,

Subsidiaries in cables segment use back to back matching of purchases and sales, or derivative instruments in order to minimise the effect of the Metal Price Lag on their results, However, there will be always some impact (positive or negative) in the P&L, since in Cables segment part of the inventory is treated as fixed asset and not hedged and in the Steel Pipes segment no commodities hedging is possible.