Regulatory News

2018 First Half Year Financial Results

Brussels, 27 September 2018

The enclosed information constitutes inside information and is to be considered regulated information as defined in the Belgian Royal Decree of 14 November 2007 regarding the duties of issuers of financial instruments which have been admitted for trading on a regulated market.

Cenergy Holdings S.A. (Euronext Brussels, Athens Stock Exchange: CENER), hereafter “Cenergy Holdings” or “the Company”, today announces its financial results for the period ended 30 June 2018 together with the issuance of its Interim Report for the six-month period end.

Dynamic penetration to new markets and products

- 17% year-on-year increase in revenue with the award of large projects

- 14% year-on-year increase in adjusted EBITDA.

- Order backlog currently stands at EUR 690 million.

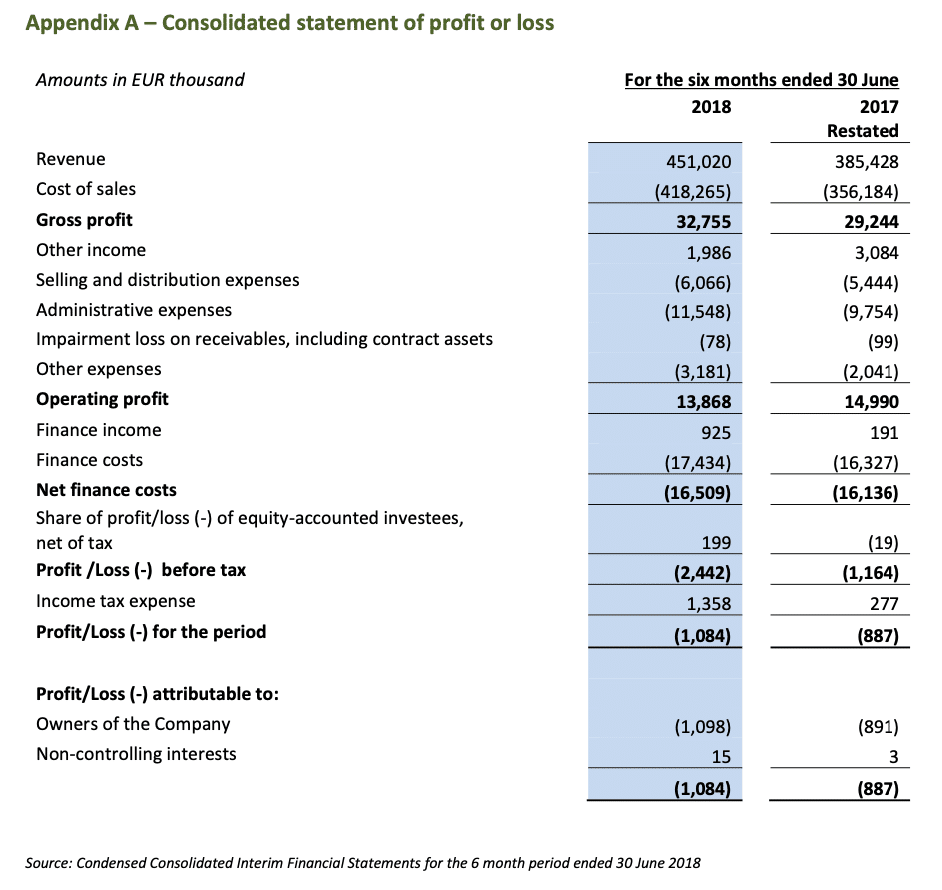

- Financial Overview

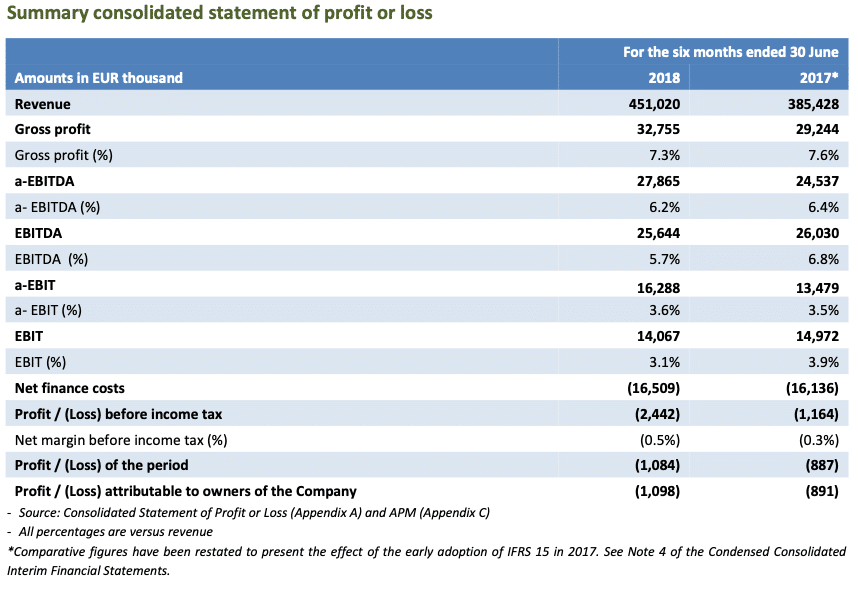

- Consolidated revenue increased by 17% year-on-year to EUR 451 million (H1 2017: EUR 358 million). This is mainly driven by improved sales volumes and the execution of several energy projects during 2018.

- The above, along with an improved project mix versus H1 2017, resulted in an adjusted EBITDA* of EUR 27.9 million in H1 2018 (H1 2017: EUR 24.5 million).

- Adjusted EBIT* of EUR 16.3 million (H1 2017: EUR 13.5 million).

- Loss before income tax of EUR 2.4 million, compared to a loss of EUR 1.2 million in H1 2017;

- Loss for the period of EUR 1.1 million, compared to a loss of EUR 0.9 million in H1 2017;

- Netdebt* up 19.3% to EUR 453 million to finance ongoing energy projects and the planned investment program to increase capacity of the Fulgor plant.

* For the definitions, see Appendix C – APMs.

Operational Overview

- Several significant energy projects were executed during H1 2018:

- Corinth Pipeworks Pipe Industry S.A. (hereafter “Corinth Pipeworks” or CPW) pipes connected Asia to Europe through the TANAP offshore pipeline.

- Corinth Pipeworks commenced delivery of 125.027 metric tons of 26” HFW steel pipes for the Cactus II pipeline covering approximately 750 km, the supply of which was commissioned by a subsidiary of Plains All American Pipeline LP.

- Hellenic Cables SA (hereafter “Hellenic Cables”) and its subsidiary Fulgor SA (hereafter “Fulgor”) began the execution of a contract worth approximately EUR 70 million with Dredging International NV, member of DEME Group, for the supply of high voltage submarine systems. This is intended to connect the planned offshore windfarms in the Belgian part of the North Sea with the onshore high voltage grid on the mainland at Zeebrugge (the “MOG” project).

- Hellenic Cables progressed the installation of significant offshore cable connections in North Europe and completed the delivery of cables for the interconnection of a UK offshore wind farm.

- New energy projects awarded:

- Corinth Pipeworks signed an agreement with TechnipFMC for the manufacture and supply of the steelpipes for Energean’s Karish gas field development located in the South Eastern Mediterranean. This project is considered to be of significant importance as it is the first deep offshore project awarded to CPW.

- The association of economic operators Hellenic Cables SA – Fulgor SA was awarded a turnkey project for phase 2 of the interconnection of Cyclades Islands in Greece worth approximately EUR 40 million. No other significant projects relating to high-voltage markets were awarded in H1 2018 as certain projects were postponed to H2 2018.

- Subsequently, Hellenic Cables was awarded two contracts by TenneT for the supply and installation of export cable systems for the Hollandse Kust (zuid) Alpha and Beta Sea Cable Projects in the Netherlands Wind Farm Zone (HKZWFZ) – a joint venture with Van Oord. Hellenic Cables contracts’ value will be approximately EUR 105 million. Furthermore, in September the Independent Hellenic Transmission Operator (ADMIE) awarded Fulgor a contract of approx. 140 mil. EUR to supply and install one of the two submarine cables to connect the island of Crete to the national power transmission grid in Peloponnese, as well as all required underground cables to connect both submarine cables to the national power transmission grid on the side of Peloponnese. Hellenic Cables was also awarded by ADMIE a contract of approx. 41 mil. Euro for the supply and installation of required underground cables for the connection of the two submarine cables to the power grid of Crete.The successful execution of these projects reflects the ability of the Company to meet the growing demand for energy transfer in an increasingly competitive market.Cenergy Holding’s order backlog currently stands at EUR 690 million, comprising a number of significant new projects secured in the past months. Several other tender procedures are still pending and the company expects additional new projects to be awarded during H2 2018.

- Market trends:

- Stronger than expected growth in energy projects and telecoms across European markets; growingdemand reflected in positive price development.

- Signs of improvement in the commodities business in Europe, following a slowdown during the last 18months.

- Uncertainty in steel pipes business due to ongoing anti-dumping duty investigation between the US,Greece and five other countries, as well as tariffs imposed under Section 232 on steel and aluminium products. Yet, actions and initiatives have already been undertaken to secure Corinth Pipeworks’ competitive and financial position and mitigate any adverse effects.Cenergy Holdings and its companies remain well placed to take advantage of improving market conditions in the energy sector aiming to strengthen their position among technology leaders in energy transfer and data transmission solutions. Supported by recent investments, the strategic penetration plan for new offshore projects is progressing as expected.

Group financial review

In H1 2018, the following developments had an impact in Cenergy Holdings’ main markets:

- Cables projects:The onshore and offshore European market was impacted by the postponement of turnkey projects which led to low utilization of the Fulgor plant.

- Cables products: Key continental European markets experienced a slow recovery with improvements observed in the German and Italian medium voltage markets. Meanwhile, the UK market remained challenging due to political uncertainty.

- Steel pipes: Production and execution of projects in H1 2018 progressed as planned.

Revenue in H1 2018 amounted to EUR 451 million, an increase of 17% year-on-year (H1 2017: 385 million).

Gross profit increased by 12% year-on-year to EUR 32.8 million in H1 2018 (H1 2017: EUR 29.2 million).

Adjusted EBITDA increased to EUR 27.9 million in H1 2018 (H1 2017: EUR 24.5 million).

The 14% year-on-year growth in profitability is largely attributable to a positive project mix together with the improved performance of the commodities business in Europe.

Net finance costs increased by 2.3% to EUR 16.5 million, as a result of increased net debt to finance capital expenditure, working capital and project finance needs.

During H1 2018, metal price lag was marginally negative (EUR -0.3 million) compared to strong gains recorded in H1 2017 (EUR 1.7 million).

Loss before income tax amounted to EUR 2.4 million in H1 2018 compared to a loss of EUR 1.2 million in H1 2017 as a result of aforementioned factors.

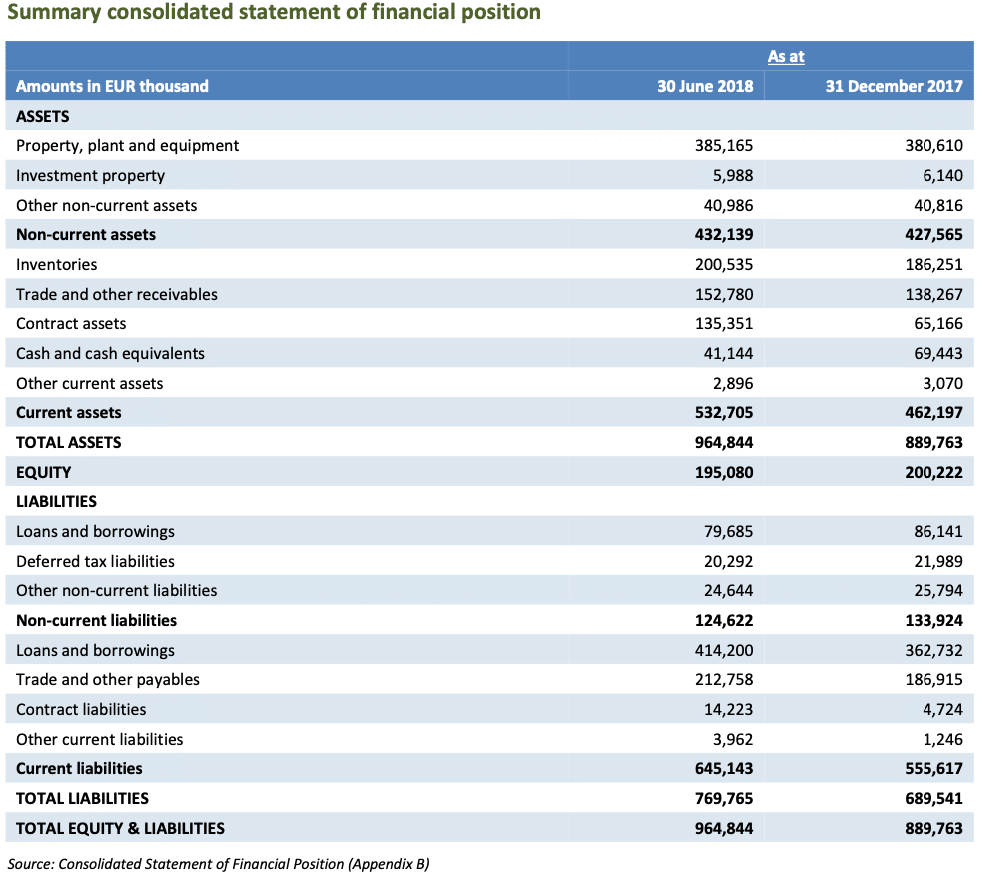

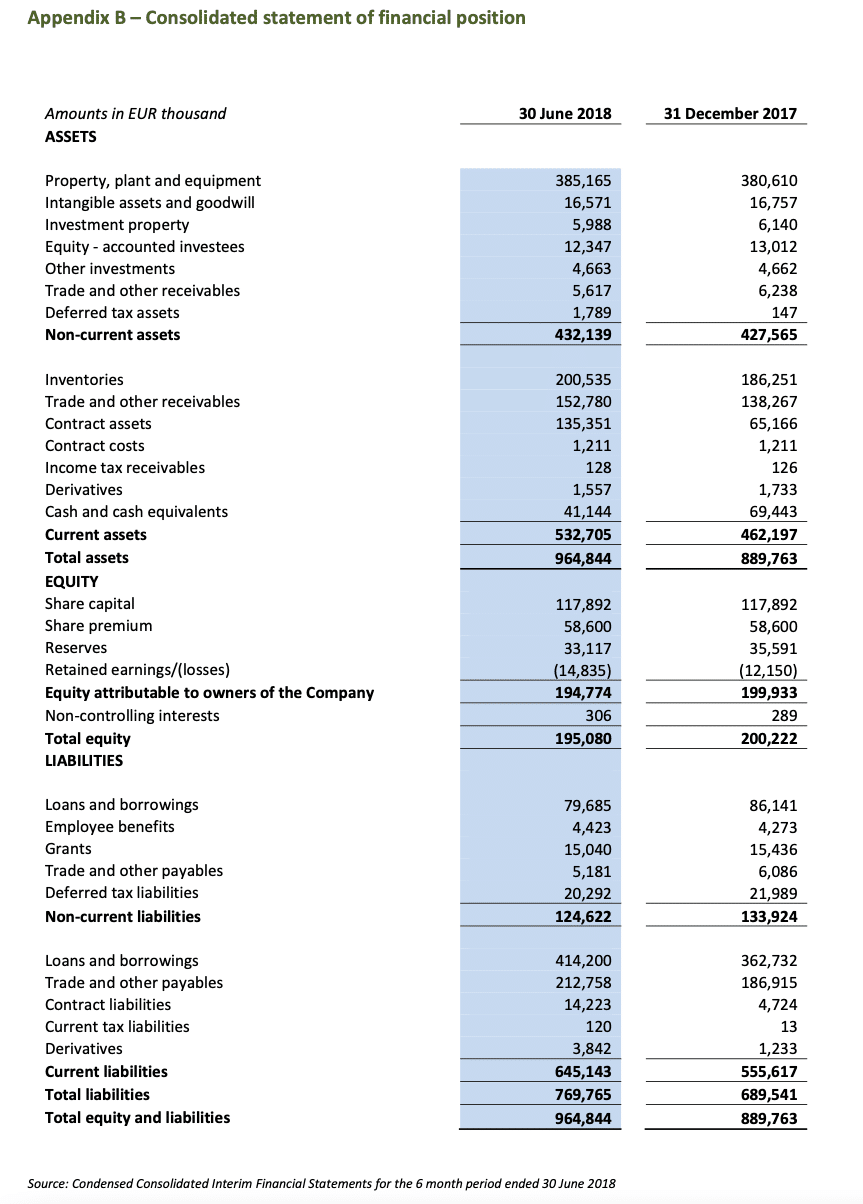

Non-current assets increased from EUR 427 million at 31 December 2017 to EUR 432 million at 30 June 2018. Capital expenditure during H1 2018 amounted to EUR 14 million for the cables segment and EUR 2.2 million for the steel pipes segment, while consolidated depreciation and amortization amounted to EUR 12 million.

Investments in the cables segment are mainly related to the expansion and upgrade of the submarine business unit in Fulgor’s plant.

Current assets increased by 15% to EUR 533 million at 30 June 2018 from EUR 462 million at 31 December 2017, mainly due to higher amounts of unbilled receivables (contract assets), as for both turnkey cables projects and customized steel pipes & cables products, amounts are billed as work progresses in accordance with agreed-upon contractual terms, either upon achievement of contractual milestones, or at the final delivery and acceptance of the products.

Liabilities increased by 12% from EUR 689 million at 31 December 2017 to EUR 770 million at 30 June 2018. Trade and other payables increased following a rise in inventories that will be used in ongoing projects.

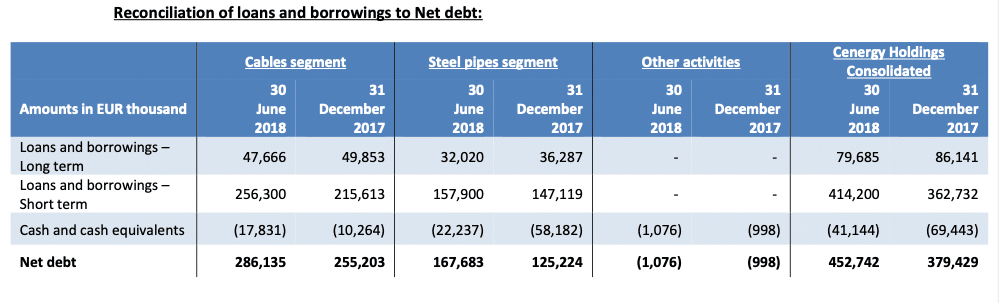

Net debt increased to EUR 453 million at 30 June 2018 (31 December 2017: EUR 379 million) to cover the financing of ongoing projects and investments.

As of 30 June 2018, Cenergy Holdings companies’ debt comprised long- and short-term facilities, at 16% and 84%, respectively. The process of reprofiling of Cenergy companies’ debt is ongoing. Short-term facilities are predominately revolving credit facilities that finance working capital needs and specific ongoing projects.

Short-term borrowings as of 30 June 2018 include EUR 85.8 million related to the syndicated bond loans received by Corinth Pipeworks and Hellenic Cables in 2013, originally payable in 2018. During August 2018, Corinth Pipeworks (CPW) has received approval from a bank syndicate for the conversion of EUR 30.8 million to long-term borrowing. This amount originally represented bonds issued by CPW in 2013 with an initial maturity during 2018. The new bonds have a life of 5 years and carry improved pricing terms for CPW.

Likewise, during September 2018, Hellenic Cables also received approval from a bank syndicate for the conversion of EUR 55 million into a new syndicated bond loan with 5-year life and improved pricing terms.

Covenants and collaterals included in both syndicated bond loans are similar to the terms of the previous loans.

Furthermore, negotiations with banks are ongoing regarding the conversion of an additional portion of short-term borrowings to long-term borrowing.

The management of the subsidiaries expect the debt reprofiling process to be finalized by the end 2018.

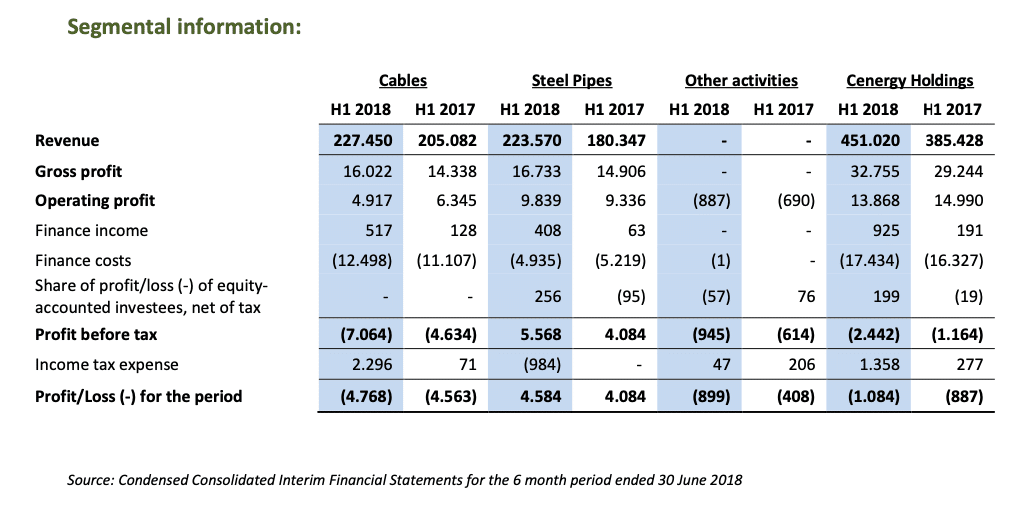

Performance by business segment

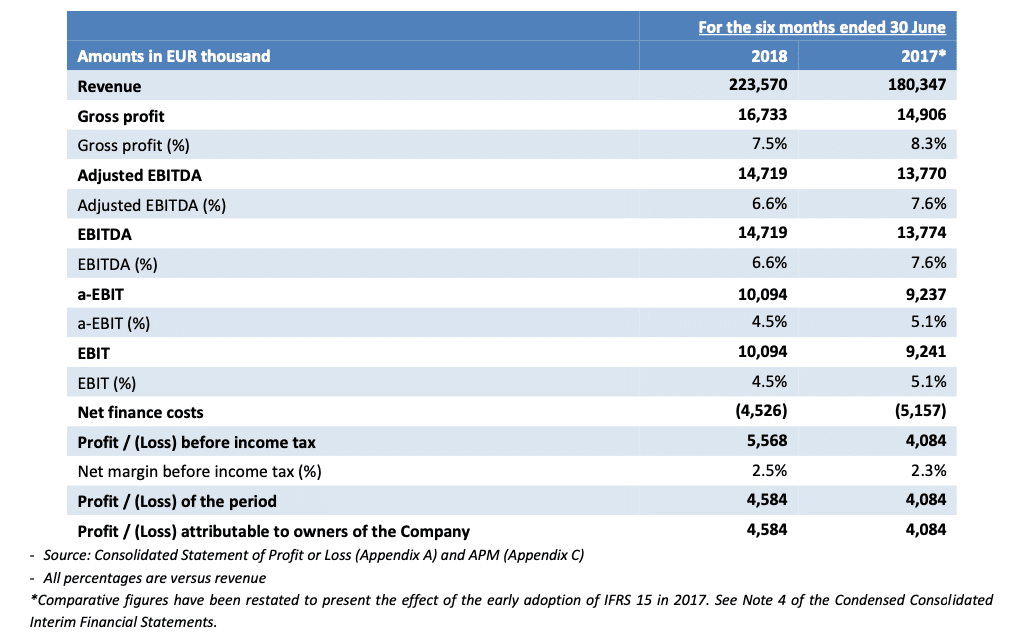

Steel pipes

Revenue amounted to EUR 224 million in H1 2018, a 24% increase year-on-year (H1 2017: EUR 180 million). During this period, Corinth Pipeworks executed a series of significant projects, mainly for the offshore market, delivering pipes for off-shore pipeline constructions in the East Mediterranean area as well as for the connection of Estonia with Finland.

Gross profit amounted to EUR 16.7 million in H1 2018, a 12% increase compared to H1 2017 (EUR 14.9 million).

The increase in revenue and gross profit resulted in a 7% increase in adjusted EBITDA, amounting to EUR 14.7 million in

H1 2018 (H1 2018: EUR 13.7 million).

Profit before income tax amounted to EUR 5.6 million in H1 2018 (H1 2017: EUR 4.1 million). This increase is attributable to the above-mentioned factors.

Capital expenditure in H1 2018 amounted to EUR 2.2 million. This was dedicated to specific investments for productivity improvements in the Thisvi plant.

During H1 2018, two offshore projects with concrete coating have been successfully delivered, (Williams NESE in USA and Noble Leviathan in Israel). On June 5th, 2018 a deep offshore project (max water depth 1.750 meters) was awarded to CPW from TechnipFMC for the manufacture and supply of the steel pipes for Energean’s Karish gas field development located in the South Eastern Mediterranean. Finally, CPW established a strong presence in the North Sea, being awarded approx. 20K metric tons of offshore reeling pipes from various customers.

The summary consolidated statement of profit or loss for the steel pipes segment is as follows:

The strong performance of the steel pipes business is expected to continue into the second half of the year supported by the considerable backlog of projects and a clear delivery schedule for H2 2018.

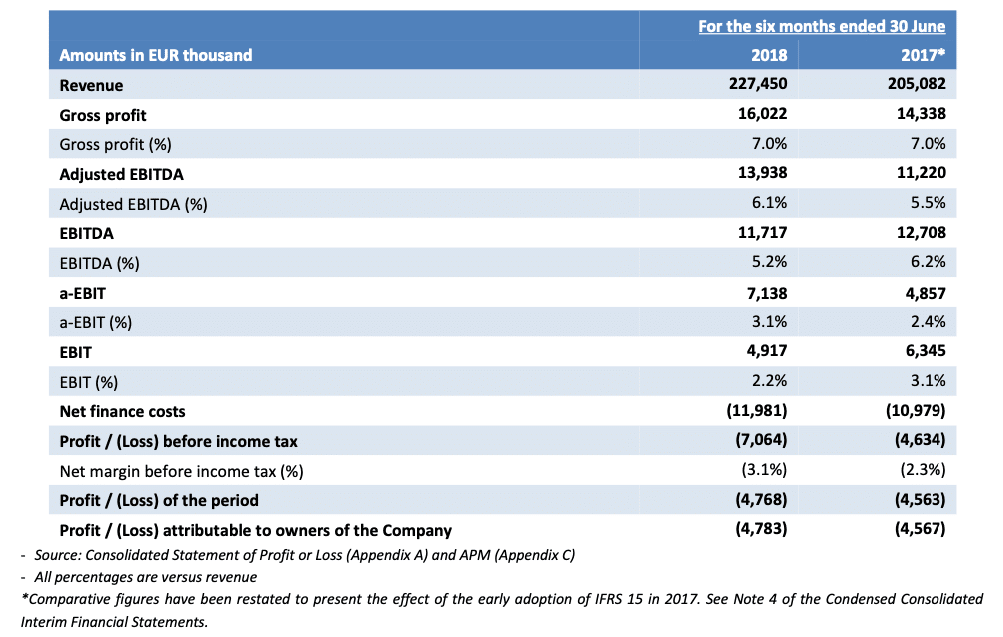

Cables

During H1 2018, revenue contribution from projects was in line with results achieved in the same period of 2017 as a number of previously scheduled projects remained in the tendering phase. As a result, the Fulgor plant continued to operate at low utilization capacity during H1 2018, which adversely affected results for the period. Fulgor, however, has a strong track record in providing cost-effective, reliable and innovative solutions that meet the changing needs of the offshore sector and allow the Company to leverage market opportunities. With the recent award of new contracts and the growth potential of the offshore cables business, the short-term outlook for the business is positive.

The commodities business achieved higher sales volumes compared to H1 2017 (+2.4%) along with an improved sales mix. The main drivers of the improved performance included:

-

- Better than expected performance in the Greek market due to increased demand from contractors and the building sector;

- A moderate increase in our traditional markets of Germany and Central Europe, and further penetration into new markets such as the Nordic countries and the Middle East;

- Solid demand for telecom and signaling cables in Europe.

As a result of the above, adjusted EBITDA in the segment grew by 24% year-on-year.Revenue in H1 2018 increased by 11% year-on-year to EUR 227 million, (H1 2017: EUR 205 million), whilst adjusted EBITDA amounted to EUR 14 million (H1 2017: EUR 11.2 million).

During H1 2018, the metal price lag was marginally negative (EUR -0.3 million) compared to strong gains recorded in H1 2017 (EUR 1.7 million). As a result, EBITDA amounted to EUR 11.7 million versus EUR 12.7 million in H1 2017.

Net finance costs increased by EUR 1 million compared to H1 2017 amounting to EUR 12 million, as a result of an increase in net debt to finance working capital requirements and project financing.

Loss before income tax in H1 2018 was EUR 7 million, compared to loss before income tax of EUR 4.6 million recorded in H1 2017.

Investments in H1 2018 reached EUR 14 million in the cables segment, largely attributable to the expansion and upgrade of the submarine business unit in Fulgor’s plant to meet expected future demand levels and improve productivity at the Hellenic Cables and Icme Ecab plants.

Net debt increased by EUR 31 million to EUR 286 million as at 30 June 2018, driven by increased working capital requirements, project financing and finance of capital expenditure.

The summary consolidated statement of profit or loss for the cables segment is as follows:

The execution of new projects, including phase two of the interconnection of the Cyclades Islands and the ongoing MOG project, together with improved profitability in the commodities business, are expected to drive our results in H2 2018.

Other key milestones for the cables segment in H2 2018 are expected to be the completion of the ongoing re-profiling of its debt structure, and the completion of the new investment program in Fulgor aimed at supporting future growth.

Looking ahead, high demand for new offshore projects in Europe, primarily in the North Sea and South Europe, is expected to drive growth in the cables segment. This projection is supported by the recent award of several new projects in Europe.

Subsequent events

Please refer to the Notes of the Condensed Consolidated Financial Statements for the 6-month period ended 30 June 2018.

Outlook

High demand for new offshore projects in Europe, mainly in the North Sea and South Europe, is expected to drive growth in the cables segment. Hellenic Cables is currently in negotiations regarding several new projects which, alongside successful completion of ongoing and new projects, remain the key focus for the Company.

In the commodities business, there are signs of recovery in the low and medium voltage cables markets in Western Europe which were constrained by competitive challenges in 2017. Nevertheless, risks to recovery persist, such as uncertainty in the EU’s political environment, potential major changes in trade policies, as well as the broader impact of UK’s decision to leave the EU. To mitigate against these risks in the cables segment’s main markets, initiatives have been undertaken to enter into new geographical markets and improve the product portfolio through the development of high added value projects.

The stabilization of oil and gas prices at high levels compared to those observed in the past is also expected to boost investment in the energy sector, increasing the likelihood that many of the planned oil and gas pipelines will be implemented.

Thanks to its significant production capacity and product diversification, Corinth Pipeworks is well positioned to leverage such opportunities in the energy market.

Despite a volatile operating environment, Cenergy Holdings’ companies remain well-positioned to execute their longer- term growth strategies through a continued focus on innovation and product diversification, the penetration of new geographical and product markets and the strengthening of customer relationships. Successful execution of these strategic priorities will support plans for international expansion and the pursuit of large-scale projects in high growth segments.

Statement of the Statutory Auditor

The condensed consolidated interim financial statements for the six-month period ended 30 June 2018 have been subject to a review by the statutory auditor.

About Cenergy Holdings

Cenergy Holdings is a Belgian holding company listed on both Euronext Brussels and the Athens Stock Exchange, investing in leading industrial companies focusing on the growing global demand of energy transfer, renewables and data transmission. The Cenergy Holdings portfolio consists of Corinth Pipeworks and Hellenic Cables, two companies positioned at the forefront of their respective high growth sectors. Corinth Pipeworks is a world leader in steel pipe manufacturing for the oil and gas sector and a major producer of steel hollow sections for the construction sector. Cablel® Hellenic Cables is one of the largest cable producers in Europe, manufacturing power and telecom cables as well as submarine cables for the aforementioned sectors. For more information about the Company, please visit our website at www.cenergyholdings.com

Contacts

For further information, please contact:

Sofia Zairi

Head of Investor Relations

Tel: +30 210 6787111, 6787773 Email: ir@cenergyholdings.com

Appendix C – Alternative performance measures

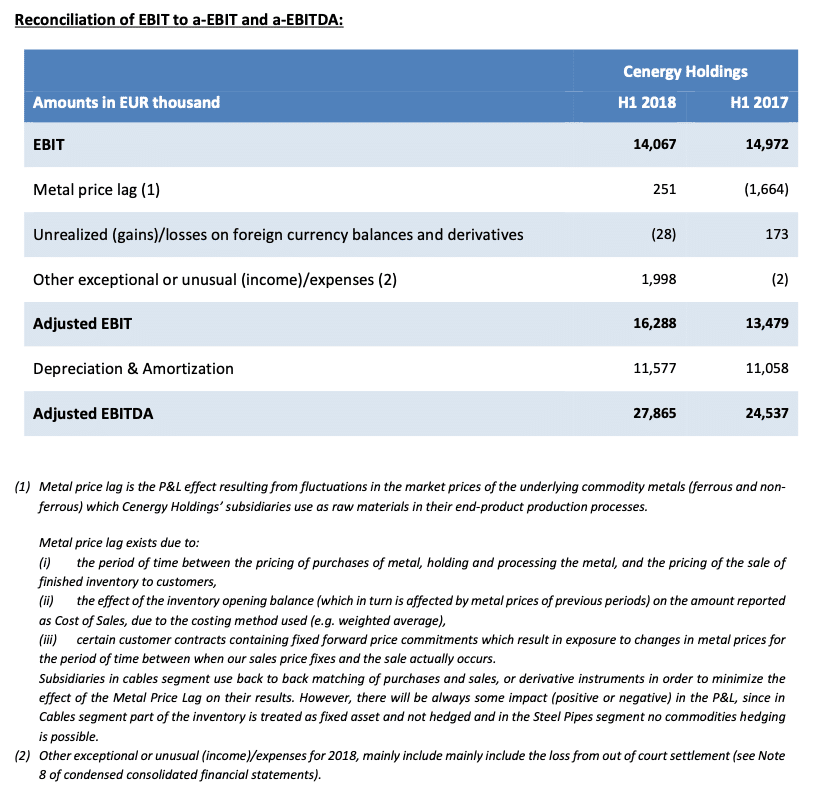

In addition to the results reported in accordance with International Financial Reporting Standards (“IFRS”) as adopted by the European Union, this press release includes information regarding certain alternative performance measures which are not prepared in accordance with IFRS (“Alternative Performance Measures” or “APMs”). The APMs used in this press release are: Earnings Before Interest and Tax (EBIT), Adjusted EBIT, Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA), Adjusted EBITDA and Net debt. Reconciliations to the most directly comparable IFRS financial measures are presented below.

We believe these APMs are important supplemental measures of our operating and financial performance and are frequently used by financial analysts, investors and other interested parties in the evaluation of companies in the steel pipes and cables production, distribution and trade industries. By providing these measures, along with the reconciliations included in this appendix, we believe that investors will have better understanding of our business, our results of operations and our financial position. However, these APMs shall not be considered as an alternative to the IFRS measures.

EBIT, Adjusted EBIT, EBITDA, Adjusted EBITDA have limitations as analytical tools, and investors should not consider it in isolation, or as a substitute for analysis of the operating results as reported under IFRS and may not be comparable to similarly titled measures of other companies.

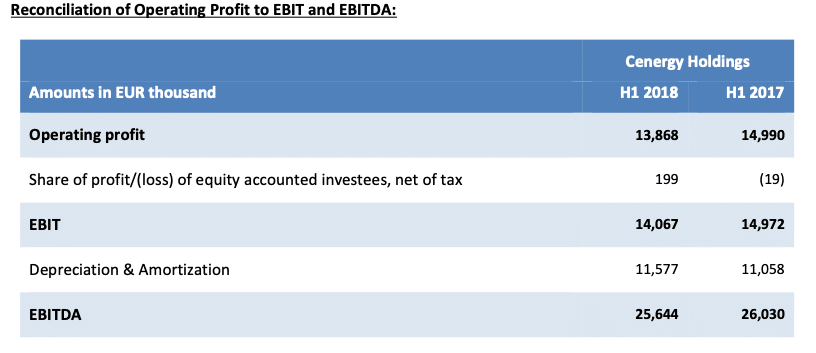

EBIT is defined as the Operating result as reported in the Consolidated statement of profit or loss plus Share of profit/(loss) of equity accounted investees, net of tax.

Adjusted EBIT is defined as EBIT excluding restructuring costs, metal price lag, unrealised (gains)/losses on foreign currency balances and derivatives and other exceptional or unusual (income)/expenses.

EBITDA is defined as EBIT plus depreciation and amortisation.

Adjusted EBITDA is defined as EBITDA excluding restructuring costs, metal price lag, unrealised (gains)/losses

on foreign currency balances and derivatives and other exceptional or unusual (income)/expenses. All APMs are consistently calculated year by year.

Reconciliation of Operating Profit to EBIT and EBITDA: