Regulatory News

2019 First Half Year Financial Results

Brussels, 25 September 2019

The enclosed information constitutes inside information and is to be considered regulated information as defined in the Belgian Royal Decree of 14 November 2007 regarding the duties of issuers of financial instruments which have been admitted for trading on a regulated market.

Cenergy Holdings S.A. (Euronext Brussels, Athens Stock Exchange: CENER), hereafter “Cenergy Holdings” or “the Company”, announces today its financial results for the first half year of 2019 together with the issuance of its Interim Report for the same period.

Improved profitability in H1 2019 coupled with sizable backlog

Highlights

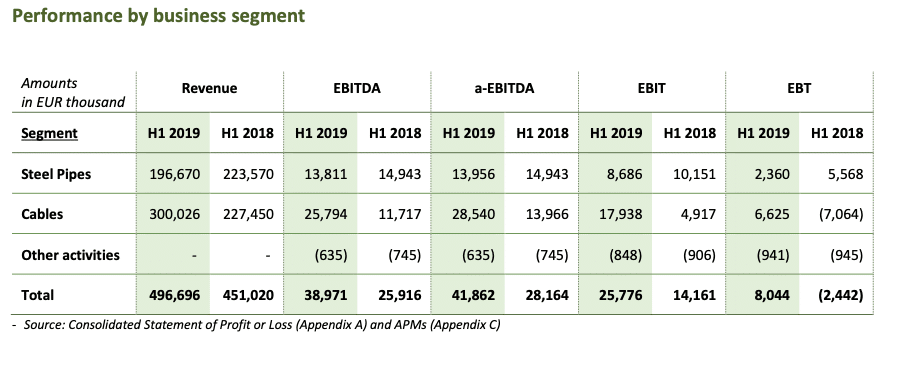

- Strong operational profitability reflected in 49% adjusted EBITDA growth year-on-year

- Substantial order volume (EUR 620 million) and number of upcoming projects secured as of 30 June2019

- 10% revenue growth year-on-year driven by higher sales volume mainly in cables projects business

- Consolidated net profit before tax of EUR 8.0 million vs. a EUR 2.4 million loss before tax in H1 2018

Overview

2019 started very positively for Cenergy Holdings as was presumed given the record order backlog of December 2018 for both the cables and the steel pipes segments. In a tricky global economic environment, the Group displayed a remarkable operational profitability growth of 49% over the corresponding semester of last year, mainly due to its strategy of focusing and successfully delivering high margin, high technology, challenging projects in the energy transfer markets. Strong commercial teams secured new orders with the total backlog as of 30 June 2019 reaching EUR 620 million, in parallel with revenue climbing a reasonable 10% year-on-year.

The steel pipes segment performed with resilience in volatile market conditions characterised by intense competition. Corinth Pipeworks’ growth prospects remained unaffected by strong protectionist measures, such as the antidumping order and steel tariffs imposed in the USA. The company established a significant geographical spread and product diversification, as it was awarded and has executed both offshore and onshore projects for the supply of pipes for pipelines across Europe, the Middle East, North Africa and North America.

For the cables segment, H1 2019 is considered as milestone as, for the first time after the completion of the investment programme in the offshore business that started in 2011, the segment demonstrates a solid performance due to the high utilization of all available production lines. The award during the H2 2018 of several projects boosted early 2019 performance demonstrating the segment’s ability to provide cost-effective, reliable and innovative solutions to meet changing market needs. At the same time, the products business also delivered satisfactory results while demand in traditional markets stabilised, despite the challenges faced (e.g. Brexit). The cables’ solid performance was further encouraged by recent initiatives to enter into new geographical markets as well as industrial improvements in the product portfolio (high value-added solutions).

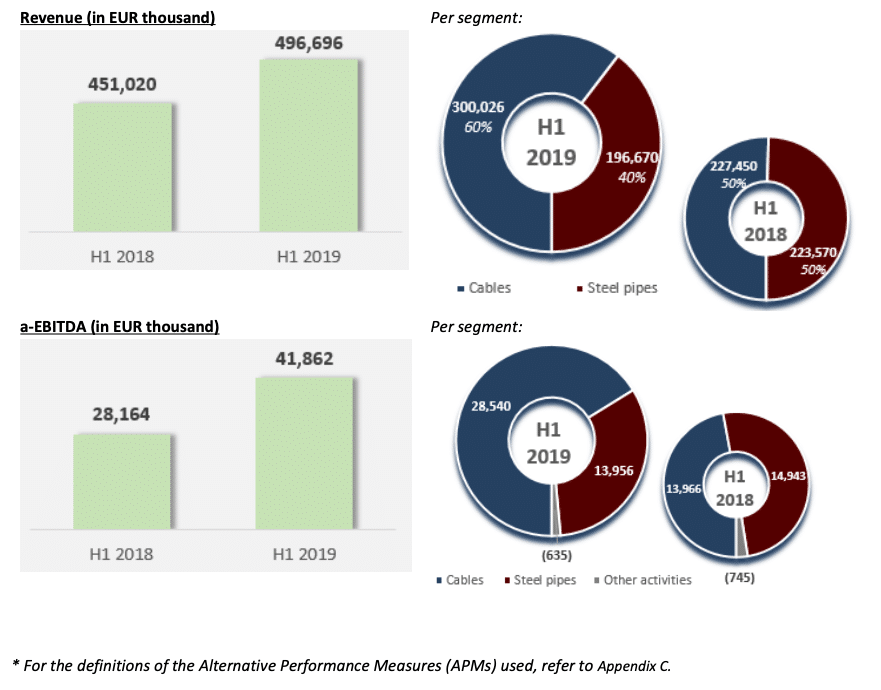

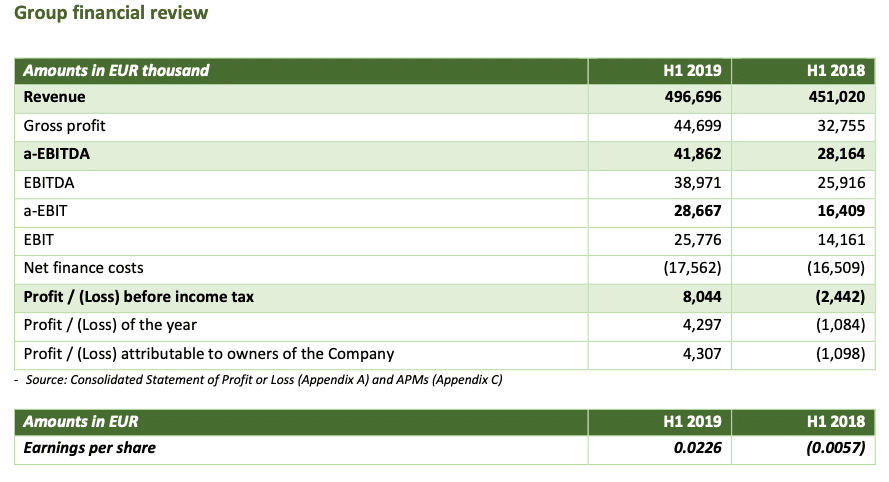

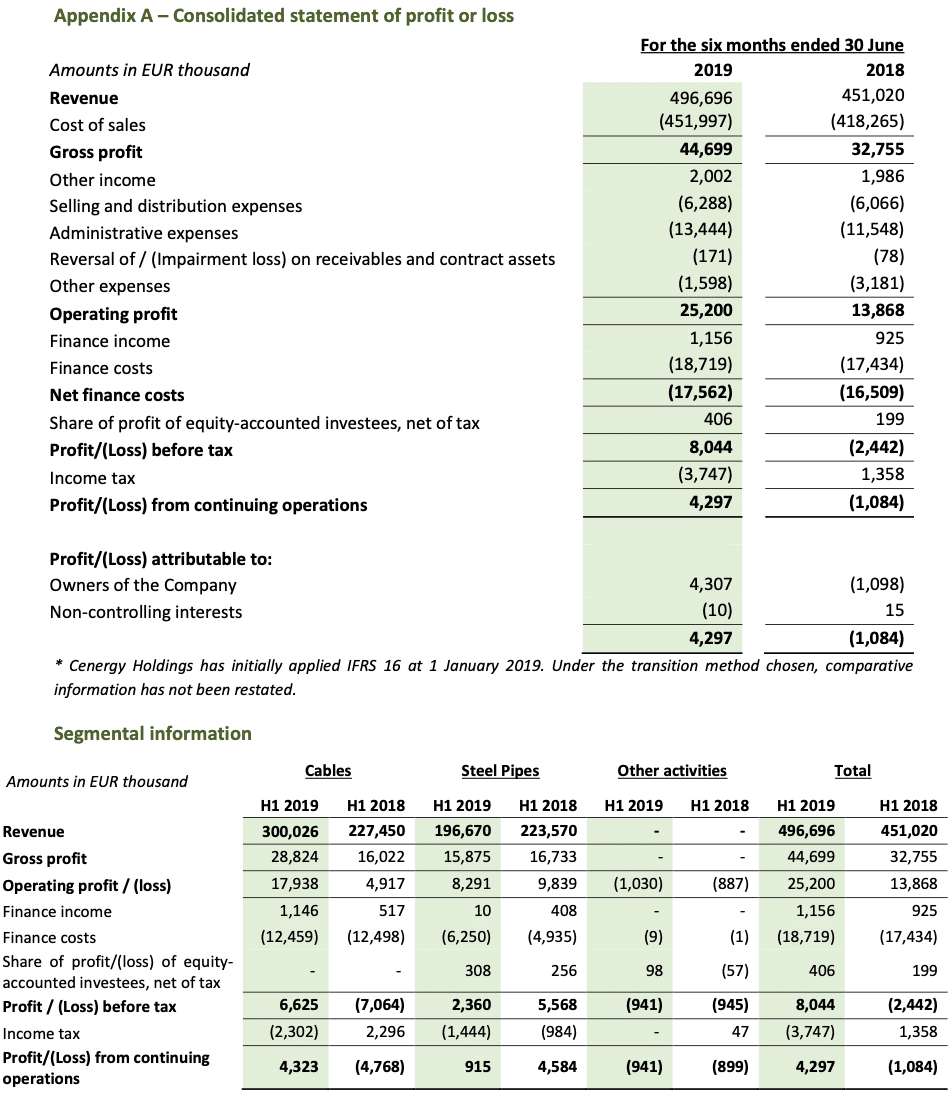

Consolidated revenue for 30 June 2019 stands at EUR 497 million, a 10% y-o-y increase reflecting first deliveries of a significant order backlog at the end of 2018, notably in the cables’ projects business.

Adjusted EBITDA increased by 49% y-o-y to EUR 41.9 million in the first semester of the year, with the cables segment realizing a considerable increase to EUR 28.5 million (EUR 14.0 million in H1 2018). The steel pipes segment stayed constant, close to its record sales 2018 operating profitability levels (EUR 14.0 million vs. EUR 14.9 million in H1 2018).

Net finance costs are marginally higher at EUR 17.6 million (+ EUR 1.1 million over H1 2018) due to higher FX losses recorded in H1 2019 and higher debt related to working capital for steel pipes projects. However, following prior year’s debt reprofiling of EUR 118.7 million and the improved interest rates achieved, the overall financing position of the Group is improving.

Cenergy Holdings succeeded to record a healthy profit before income tax of EUR 8.0 million in the first semester of this year compared to a loss before tax of more than EUR 2.4 million in the corresponding 2018 semester. This is the second consecutive semester recording a solid profit before income tax, as in H2 2018 a profit of EUR 3.2 million was recorded.

Profit for the period amounted to EUR 4.3 million in H1 2019 compared to a loss after tax of EUR 1.1 million in H1 2018.

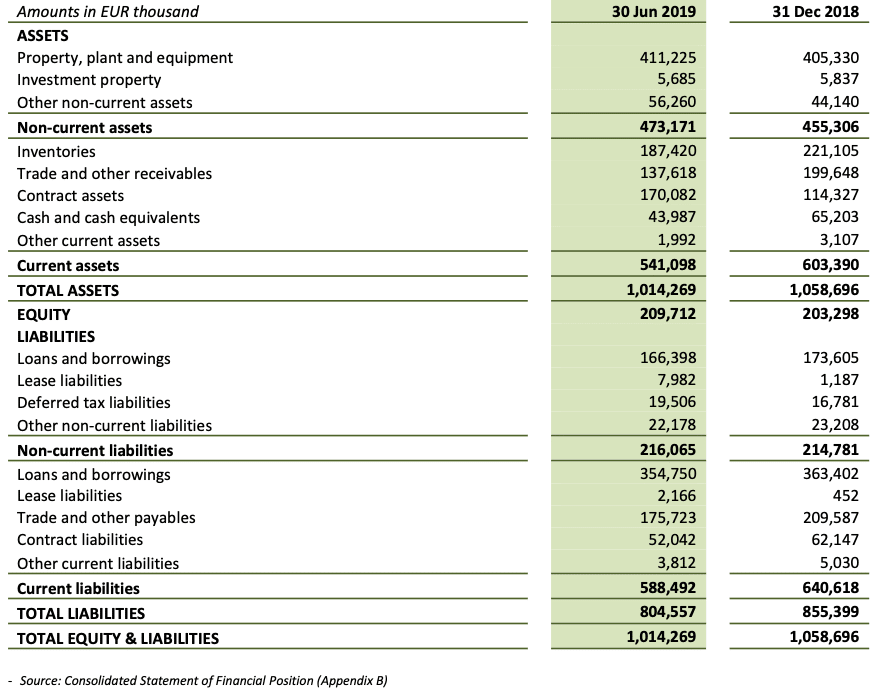

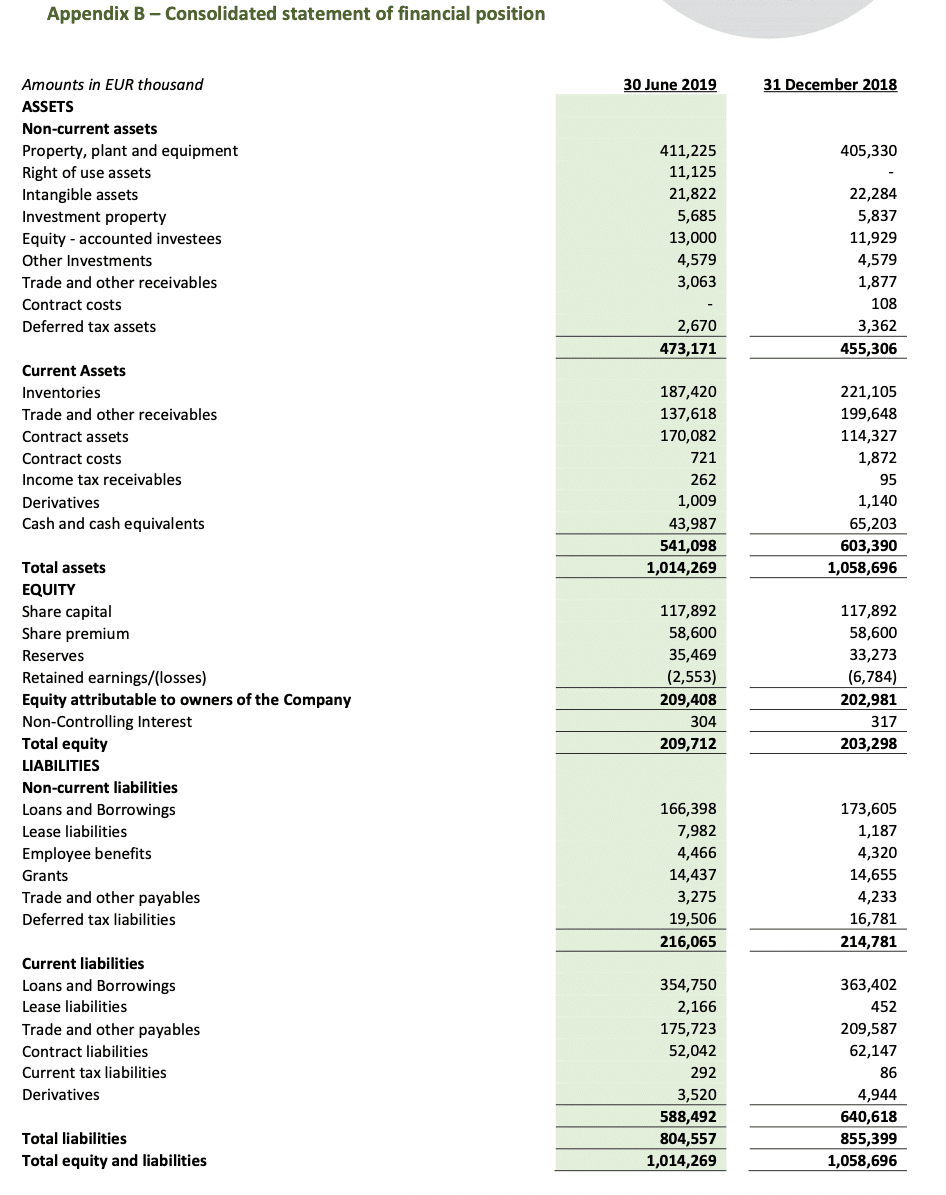

Non-current assets increased from EUR 455 million as of 31 December 2018 to EUR 473 million on 30 June 2019. Capital expenditure during the semester amounted to EUR 21.6 million for the cables segment and EUR 3.6 million for the steel pipes segment, as large, capacity enhancing investment programs are now completed. Given the Management’s resolve towards a lower leverage ratio in the medium term, any new investments will be financed operationally without recourse to further borrowing.

Working capital (incl. contract assets & liabilities) rose by 2% compared to 31/12/2018 to EUR 267 million as of 30 June 2019, driven by the increased needs of projects scheduled for 2019.

Net debt increased slightly to EUR 487 million on 30 June 2019 (31.12.2018: EUR 473 million). Cenergy Holdings companies’ debt (incl. lease liabilities) on that date comprised of long term and short-term facilities, at 33% and 67% respectively, a constant mix compared to prior year’s end. Short-term facilities are predominately revolving credit facilities, which finance working capital needs and specific ongoing projects.

The adoption of IFRS 16 resulted to an increase in non-current assets and net debt by EUR 3.5 million.

Steel pipes

Revenue for the steel pipes segment amounted to EUR 197 million in H1 2019, a 12% decrease year-on-year (H1 2018: EUR 224 million) with profit before income tax falling to EUR 2.4 million, compared to EUR 5.6 million in H1 2018.

In the first half of 2019, Corinth Pipeworks (CPW) is progressing in the execution of its first deep-sea offshore pipes project (Karish). This is a strategic project in the Southeastern Mediterranean at a maximum depth of 1,750m and a highly demanding engineering endeavor only very few companies worldwide could deliver.

New awards, such as Midia Gas Development Project (MGD) in Romania that involves anti-corrosion and concrete weight coating applied at the same location as pipe manufacturing, are proving further Corinth Pipeworks’ clear competitive advantage in offshore projects. Still, the onshore business grew as well since Snam S.p.A., Europe’s leading gas utility with main operations in Italy, awarded 150km of onshore gas pipeline to CPW through their longstanding Frame Agreement.

Finally, a number of other offshore projects in the North Sea and the USA were successfully executed along with large-scale onshore projects in mature markets across Europe and the USA.

Gross profit decreased slightly to EUR 15.9 million in H1 2019, compared to H1 2018 (EUR 16.7 million), mainly driven by the decrease in revenue that was partially offset by the improved gross profit margin (8.1% in H1 2019 vs. 7.5% in H1 2018). The decrease in gross profit converted into a slight decrease in adjusted EBITDA to EUR 14.0 million (EUR 14.9 million in H1 2018). In H1 2019 profit before tax was EUR 2.4 million, mainly attributable to the factors stated above, as well as to the increase in net finance costs of EUR 1.7 million.

The higher needs in working capital that usually appear in the middle of the financial year due to the production cycle, coupled by reduced cash and cash equivalents by EUR 18 million led to an increase in net debt by EUR 12.8 million to EUR 196 million as of June 30 2019. No major capital expenditures were undertaken during the same period, with investments relating mainly to operational improvements of machinery in Thisvi CPW plant.

Cables

The financial performance in H1 2019 was driven, as expected, by the high capacity utilization levels of all production units. This fact led the cables segment to double its operational profitability compared to H1 2018 in terms of adjusted EBITDA.

Revenue for the cables segment increased by 32% year-on-year to EUR 300 million in H1 2019, driven mainly by the execution of high and extra-high voltage onshore & offshore projects.

As for the project business, during H1 2019:

- the expansion of the 400 kV cable system in the Peloponnese is in accordance with the timetable, as the production of the extra-high voltage submarine cables was executed and during August the installation of the first 400 kV submarine extra-high voltage cable in Greece, in Rio-Antirio was completed.

- the production for the Seamade-Mermaid project in Belgium, Hollandze Kust Alpha project in the Netherlands and the interconnection of Crete – Peloponnese was initiated, while the production for the second phase of Cyclades islands interconnection project continued.

- the successful installation of the submarine cables for the Modular Offshore Grid (‘MOG’) project in the North Sea, Belgium and the submarine cable interconnection of Kafireas wind park in Evia, Greece, with the national power network.During H1 2019, a limited number of high-voltage projects were awarded in the market, while Hellenic Cables and Fulgor participated in several tenders across geographical areas and markets. The current backlog of the cables segment stands at EUR 320 million.The cables product business achieved 6% higher sales volumes compared to H1 2018 along with an improved sales mix. The main drivers were the solid demand from Balkans, Middle East and the Nordic countries, which counterbalanced the slight lag in the markets of Germany and Central Europe.The remarkable increase in the project-based business along with the steady growth in the product business translated into an EUR 14.6 million increase in adjusted EBITDA, reaching EUR 28.5 million in H1 2019, up from EUR 14 million in H1 2018.

Net finance costs for H1 2019 amounted to EUR 11.3 million, decreased by 6% compared to H1 2018, as a result of improved interest rates, while depreciation & amortization for H1 2019 amounted to EUR 8.2 million. The metal price lag has negatively affected segment’s profitability by EUR -2.7 million.

Profit before income tax in H1 2019 was EUR 6.6 million, compared to a loss before income tax of EUR 7.1 million recorded in H1 2018. Finally, net profit after tax amounted to EUR 4.3 million versus losses after tax of EUR 4.8 million in H1 2018.

Investments in the cables segment in H1 2019 reached EUR 21.6 million, largely attributable to:

- the expansion and upgrade of the high voltage submarine cables business unit in Fulgor’s plant in order to meet expected future demand levels, which started during 2018 and is expected to be concluded by the end of 2019, and

- selected investments for productivity improvements at other companies’ plants.

Net debt remained stable at EUR 292.3 million compared to EUR 291.2 million as at 31 December 2018, as capital expenditure was financed mainly through segment’s inflows from operating activities.

Subsequent events

Please refer to the Notes of the Condensed Consolidated Financial Statements for the 6-month period ended 30 June 2019.

Outlook

In the steel pipes segment, the global economic environment in which Corinth Pipeworks operates remains volatile, as a result of the imposition of tariffs and antidumping duties by the USA. Despite these headwinds, Corinth Pipeworks remains focused on maintaining its leading position, through new investments and the penetration of new geographical and product markets. CPW maintains its positive outlook for the second half of 2019 with major project awards expected in the North and Baltic Sea as well as in the USA.

In the cables segment, given the strong forecast of new projects and the potential of expanding to new markets, the considerable backlog of orders and the growth potential of the offshore cables sector, the overall outlook remains positive, despite the volatility noticed in the global economic environment. Fulgor’s return to high utilization capacity during 2019 will drive the segment’s profitability until the end of the year. The Thiva plant is also expected to operate at high utilization levels throughout 2019. Furthermore, in the cables’ products, there are signs of recovery in the low and medium voltage cables markets in Western Europe, which were constrained by competitive challenges during the last years. Closing, the main focus for the remaining year is on the successful execution of existing projects and the improvement of internal processes in order to take advantage of any arising market opportunity.

Despite the current market volatility, Cenergy Holdings expects to maintain the positive momentum noticed in H1 2019. Looking ahead, the Company will benefit from the solid order backlog generated and remains well placed to take advantage of improving market conditions in the energy sector and further its companies’ ambitions of remaining significant world players in energy transfer and data transmission solutions.

Statement of the Auditor

The condensed consolidated interim financial statements for the six-month period ended 30 June 2019 have been subject to a review by the statutory auditor.

About Cenergy Holdings

Cenergy Holdings is a Belgian holding company listed on both Euronext Brussels and Athens Stock Exchange, investing in leading industrial companies, focusing on the growing global demand of energy transfer, renewables and data transmission. The Cenergy Holdings portfolio consists of Corinth Pipeworks and Cablel® Hellenic Cables, companies positioned at the forefront of their respective high growth sectors. Corinth Pipeworks is a world leader in steel pipe manufacturing for the oil and gas sector and major producer of steel hollow sections for the construction sector. Cablel® Hellenic Cables is one of the largest cable producers in Europe, manufacturing power and telecom cables as well as submarine cables for the aforementioned sectors. For more information about our Company, please visit our website at www.cenergyholdings.com.

Contacts

For further information, please contact:

Sofia Zairi

Head of Investor Relations

Tel: +30 210 6787111, 6787773 Email: ir@cenergyholdings.com

Appendix C – Alternative performance measures

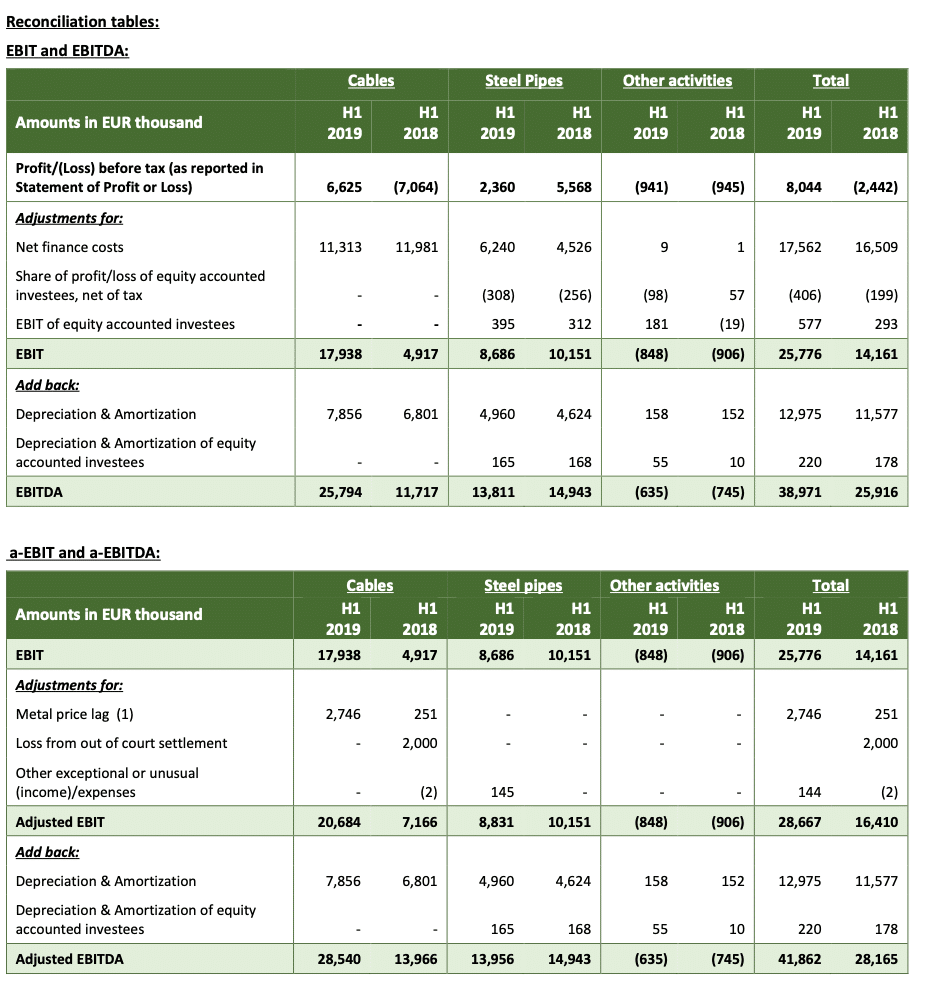

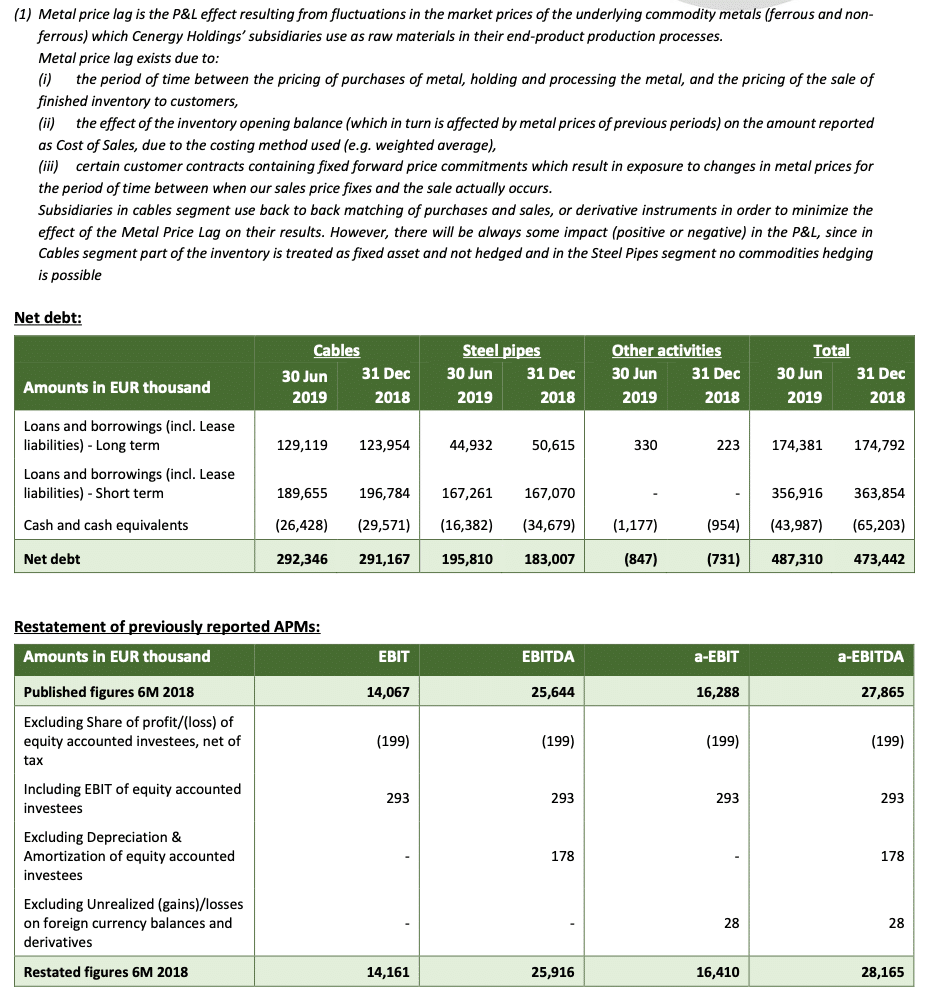

In addition to the results reported in accordance with International Financial Reporting Standards (“IFRS”) as adopted by the European Union, this press release includes information regarding certain alternative performance measures which are not prepared in accordance with IFRS (“Alternative Performance Measures” or “APMs”). The APMs used in this press release are: Earnings Before Interest and Tax (EBIT), Adjusted EBIT, Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA), Adjusted EBITDA and Net debt. Reconciliations to the most directly comparable IFRS financial measures are presented below.

We believe these APMs are important supplemental measures of our operating and financial performance and are frequently used by financial analysts, investors and other interested parties in the evaluation of companies in the steel pipes and cables production, distribution and trade industries. By providing these measures, along with the reconciliations included in this appendix, we believe that investors will have better understanding of our business, our results of operations and our financial position. However, these APMs shall not be considered as an alternative to the IFRS measures.

These APMs are also key performance metrics on which Cenergy Holdings prepares, monitors and assesses its annual budgets and long-range (5 year) plans. However, it must be noted that adjusted items should not be considered as non- operating or non-recurring.

EBIT, Adjusted EBIT, EBITDA and Adjusted EBITDA have limitations as analytical tools, and investors should not consider it in isolation, or as a substitute for analysis of the operating results as reported under IFRS and may not be comparable to similarly titled measures of other companies.

APM definitions have been modified compared to those applied as at 31 December 2018. The modifications are minor and have been made in order to align with the presentation applied by the parent company Viohalco SA/NV and assist in reflecting business performance more accurately. Comparatives have been restated. The impact of such modifications was rather limited and is presented below.

The changes in definitions are the following:

- Inclusion of EBIT and EBITDA of equity accounted investees, instead of the share of profit/loss of equity accountedinvestees, net of tax.

- The adjustment related to “Unrealized gains/losses on derivatives and on foreign exchange differences” has beenremoved from the calculation of a-EBIT and a-EBITDA, since it was concluded that these amount are connected with the business performance of Cenergy Holdings companies.The current definitions of APMs are as follows:EBIT is defined as result of the period (earnings after tax) before:

- income taxes,

- net finance costs

- share of profit/loss of equity accounted investees plus EBIT of equity accounted investees.EBITDA is defined as result of the period (earnings after tax) before:

- income taxes,

- net finance costs

- share of profit/loss of equity accounted investees

- depreciation and amortization

plus EBITDA of equity accounted investees.

a-EBIT and a-EBITDA are defined as EBIT and EBITDA, respectively, adjusted to exclude:

- metal price lag,

- impairment / reversal of impairment of fixed, intangible assets and investment property

- impairment / reversal of impairment of investments

- gains/losses from sales of fixed assets, intangible assets, investment property and investments,

- exceptional litigation fees and fines and,

- other exceptional or unusual itemsNet Debt is defined as the total of:

- Long term loans & borrowings and lease liabilities,

- Short term loans & borrowings and lease liabilities,Less:

- Cash and cash equivalents

Detailed reconciliation between APMs as published in H1 2018 and comparatives of this press release, is presented below.

Reconciliation tables: EBIT and EBITDA: