Regulatory News

2017 First Half Year Financial Results

Brussels, 28 September 2017

The enclosed information constitutes inside information and is to be considered regulated information as defined in the Belgian Royal Decree of 14 November 2007 regarding the duties of issuers of financial instruments which have been admitted for trading on a regulated market.

Cenergy Holdings S.A. (Euronext Brussels, Athens Stock Exchange: CENER), hereafter “Cenergy Holdings” or “the Company”, today announces its financial results for the period ended 30 June 2017 together with the issuance of its Interim Report for the six month period end.

Key highlights

Financial highlights

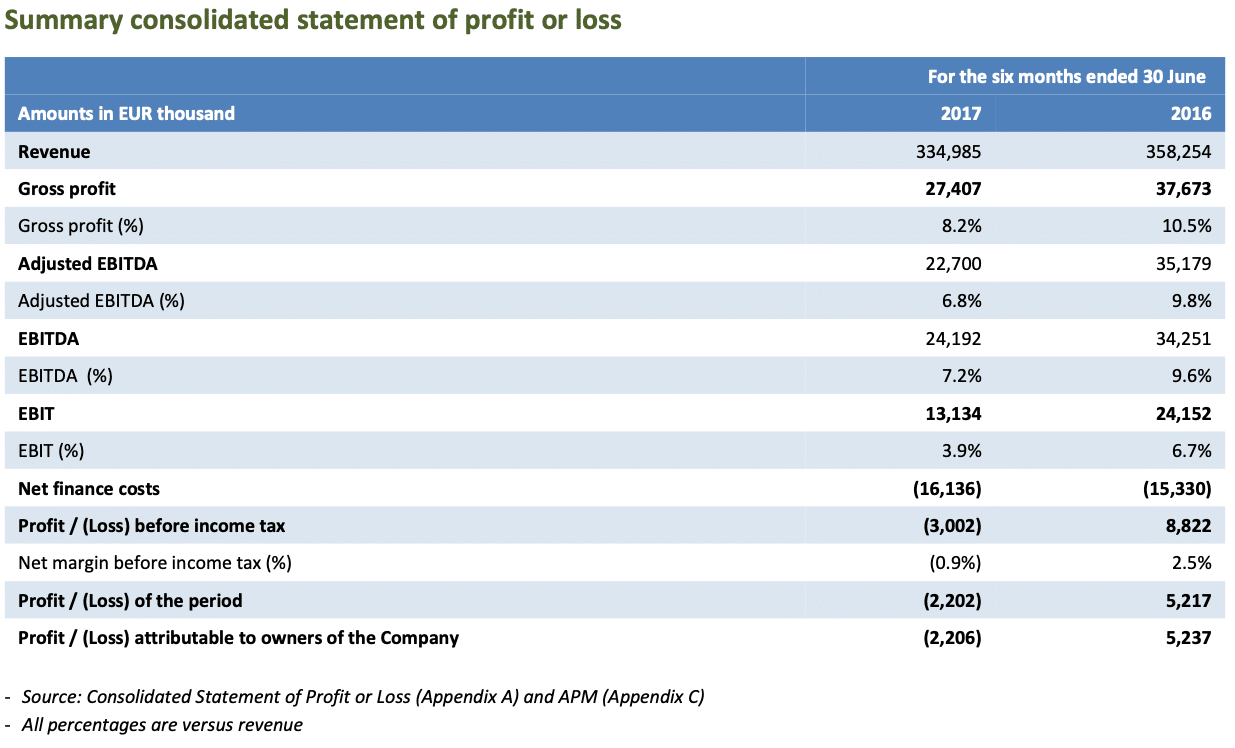

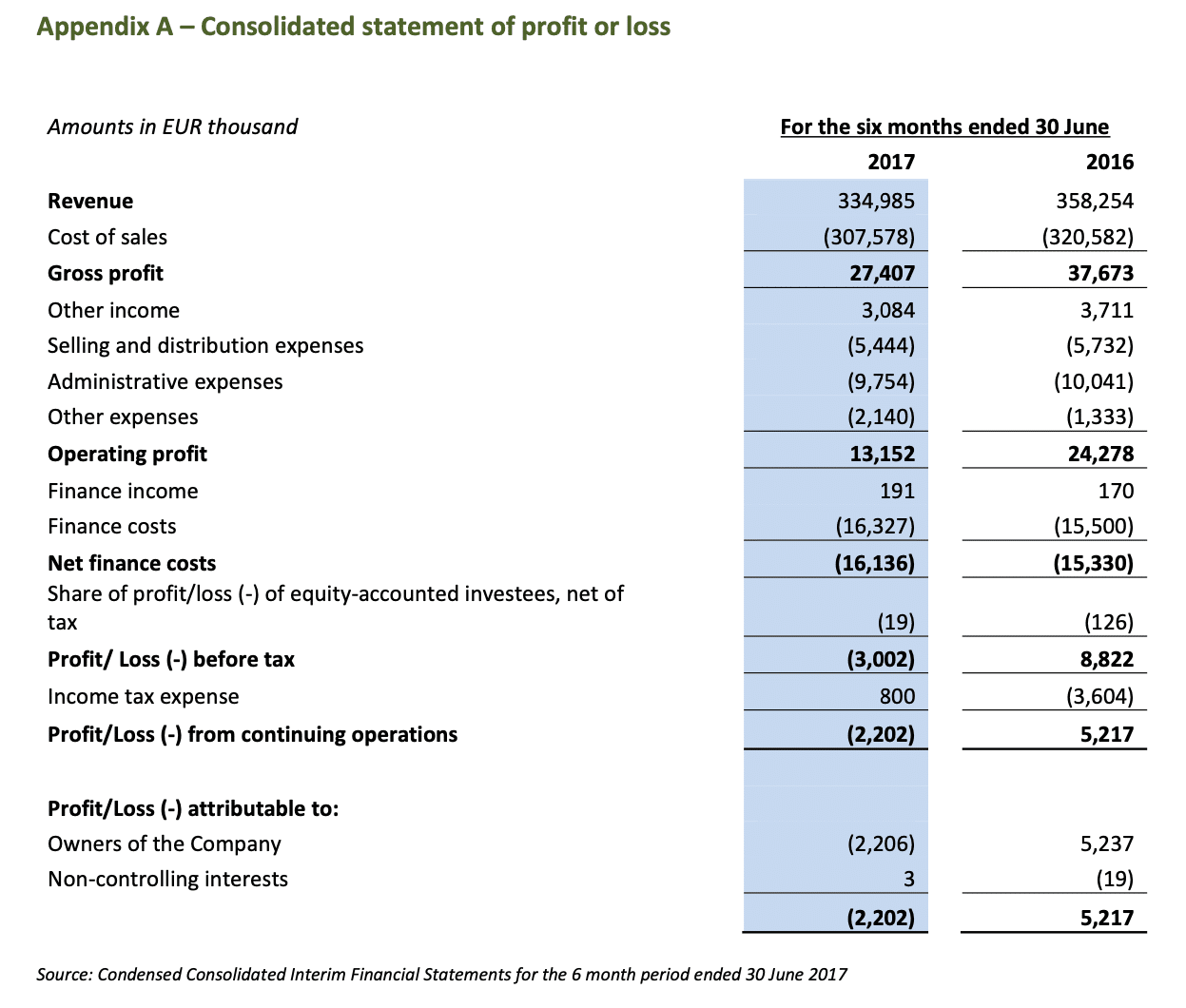

- In the first half of 2017, consolidated revenue declined by 6.5% year-on-year to EUR 335 million (H1 2016: EUR 358 million). This decrease is due to delays in commencement of signed projects and invoice timing for projects under execution.

- The above, along with a different project mix versus H1 2016, resulted in EBIT* of EUR 13 million in H1 2017, compared to EUR 24 million in the first half of 2016;

- Adjusted EBITDA* of EUR 23 million, compared to EUR 35 million in the first half of 2016;

- Loss before income tax of EUR 3 million, compared to profit before income tax of EUR 8.8 million in the firsthalf of 2016;

- Loss of the period of EUR 2.2 million, compared to a profit of EUR 5.2 million in the first half of 2016;

- Net debt* up 5.1 % to EUR 395 million as at 30 June 2017.* For the definitions of the APMs used, refer to Appendix C.

Supported by recent investments, the strategic penetration plan especially for new offshore projects is progressing as expected.

Group financial review

During the first half of 2017, the following developments had an impact in Cenergy Holdings’ main markets:

- Cables projects: The delay in the execution of various onshore and offshore turnkey projects already signed along with some big offshore European projects that were put on hold led to low levels of utilization of the Fulgor plant.

- Cables products: A slowdown was witnessed in main European markets. Indicatively, the German medium voltage market, which performed well in H1 2016, slowed down as expected in H1 2017, while the UK market continues to be challenging due to uncertainty associated with Brexit.

- Steel pipes: Further delays in steel pipes’ projects globally, due to low oil and natural gas prices.

The execution of significant contracts continued throughout H1 2017, including the Trans Adriatic Pipeline (“TAP”) project and contracts for cable connections on behalf of the German electricity transmission system operator, TenneT, and the Danish TSO, Energinet.dk.

Revenue for the first half of 2017 amounted to EUR 335 million, a decrease of 6.5% compared to EUR 358 million in the first half of 2016.

Gross profit decreased by 27.3% to EUR 27 million in H1 2017, from EUR 38 million in H1 2016. Adjusted EBITDA decreased to EUR 23 million in H1 2017 from EUR 35 million in the first half of 2016.

The delay in the commencement of signed projects, invoice timing of projects under execution and a different project mix in the cables segment resulted in lower revenue and profitability versus H1 2016.

Net finance costs increased by 5.3%, amounting to EUR 16 million, as a result of increased net debt to finance working capital needs.

Loss before income tax amounted to EUR 3 million in H1 2017 compared to profit before tax of EUR 8.8 million in the first half of 2016, as a result of the above-mentioned factors.

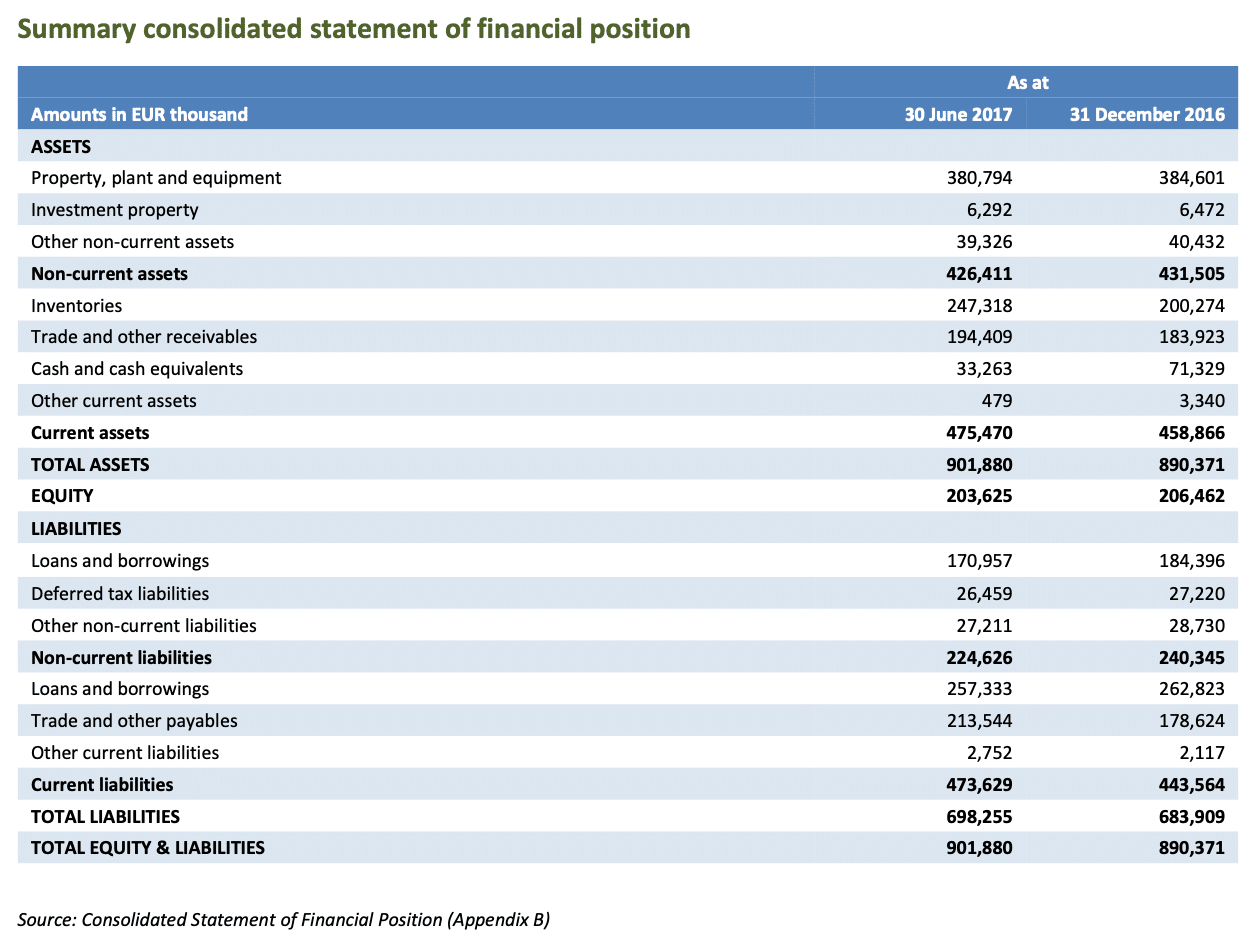

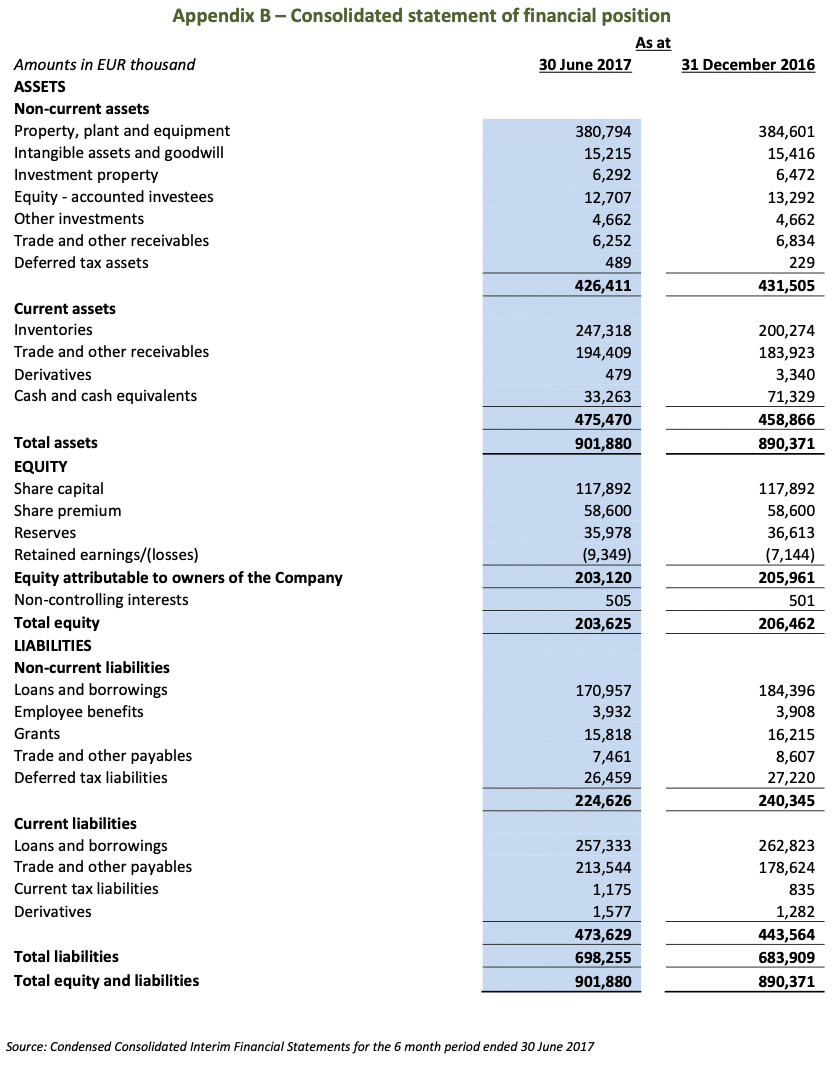

Non-current assets decreased from EUR 432 million at 31 December 2016 to EUR 426 million at 30 June 2017, as capital expenditure during the year amounted to EUR 6 million for the cables segment and EUR 1.5 million for the steel pipes segment, while depreciation of PP&E for 2016 amounted to EUR 11.5 million.

Current assets increased by 3.6% to EUR 475 million at 30 June 2017 from EUR 459 million at 31 December 2016, mainly due to higher inventory levels (EUR 47 million) for the execution of current steel pipe segment projects and increased amounts due from customers for construction contracts in progress in the cables segment. This was partially offset by lower levels of cash and cash equivalents held (EUR 38 million).

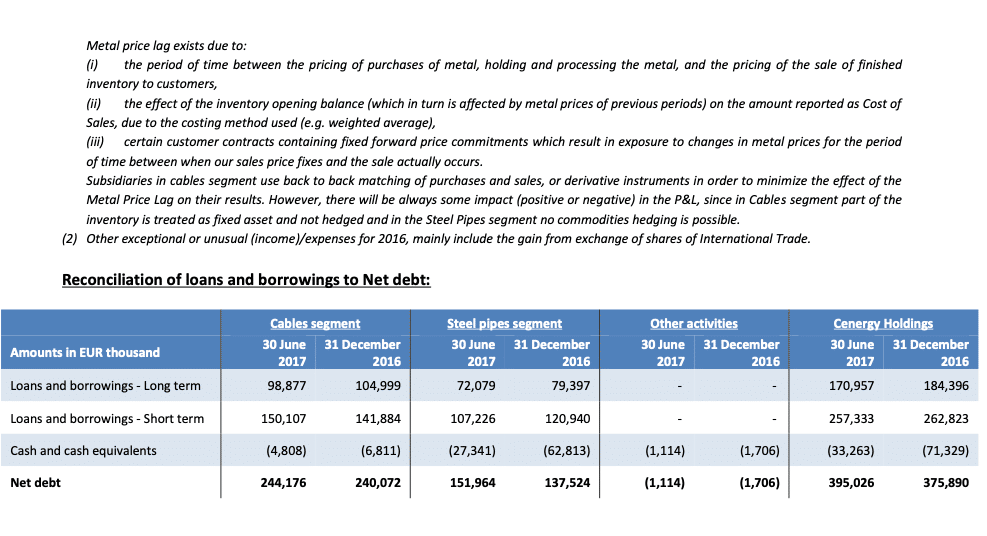

Liabilities increased by 2.1% from EUR 684 million at 31 December 2016 to EUR 698 million at 30 June 2017. Trade and other payables increased following the increase of inventories that will be used in the ongoing projects. Current & non- current loans and borrowings decreased by EUR 19 million. Cenergy Holdings companies’ debt at 30 June 2017 comprised long term and short term facilities, at 40% and 60%, respectively. Short term facilities are predominately revolving credit facilities which finance working capital needs and specific ongoing projects.

Net debt increased to EUR 395 million at 30 June 2017 (31/12/2016: EUR 376 million), driven by the utilisation of cash and cash equivalents for the increased working capital requirements for ongoing projects.

Performance by business segment

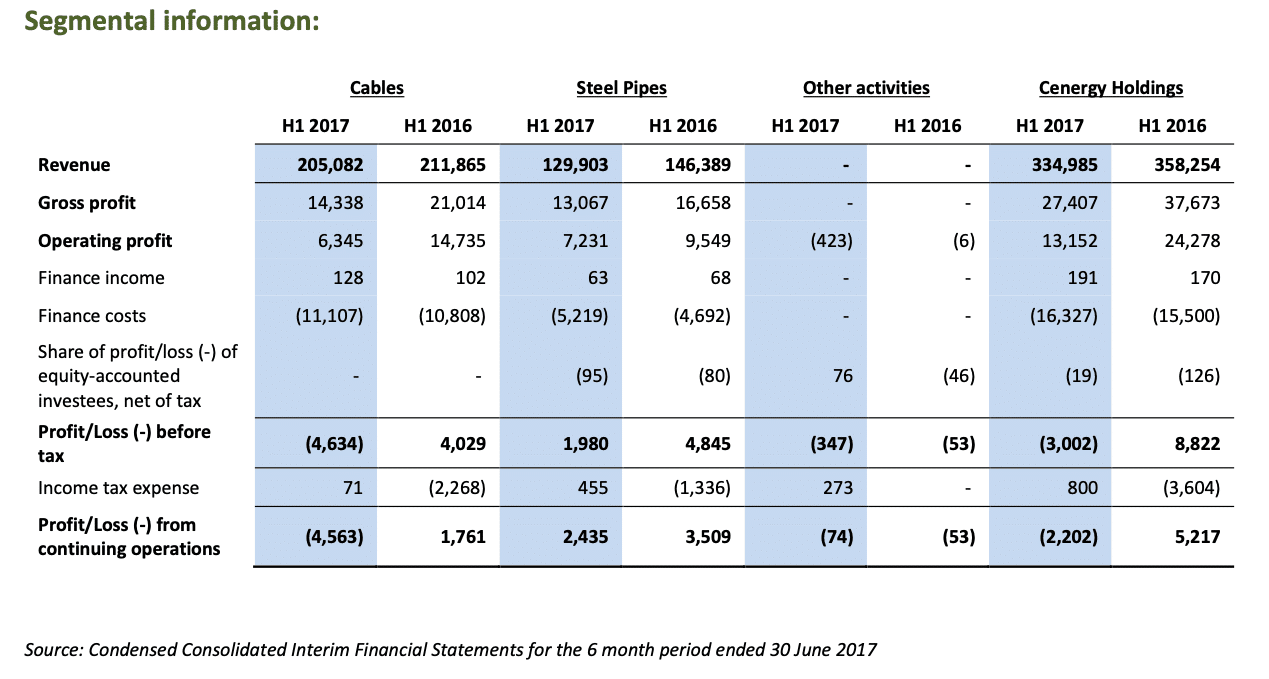

Steel pipes

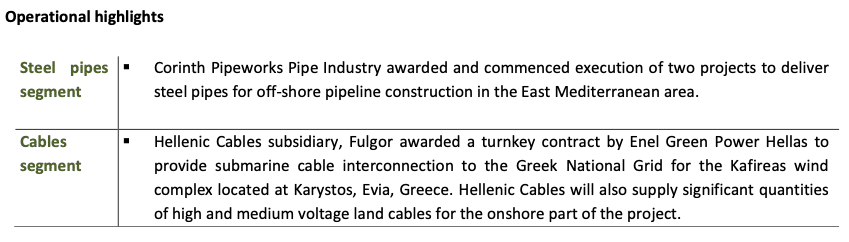

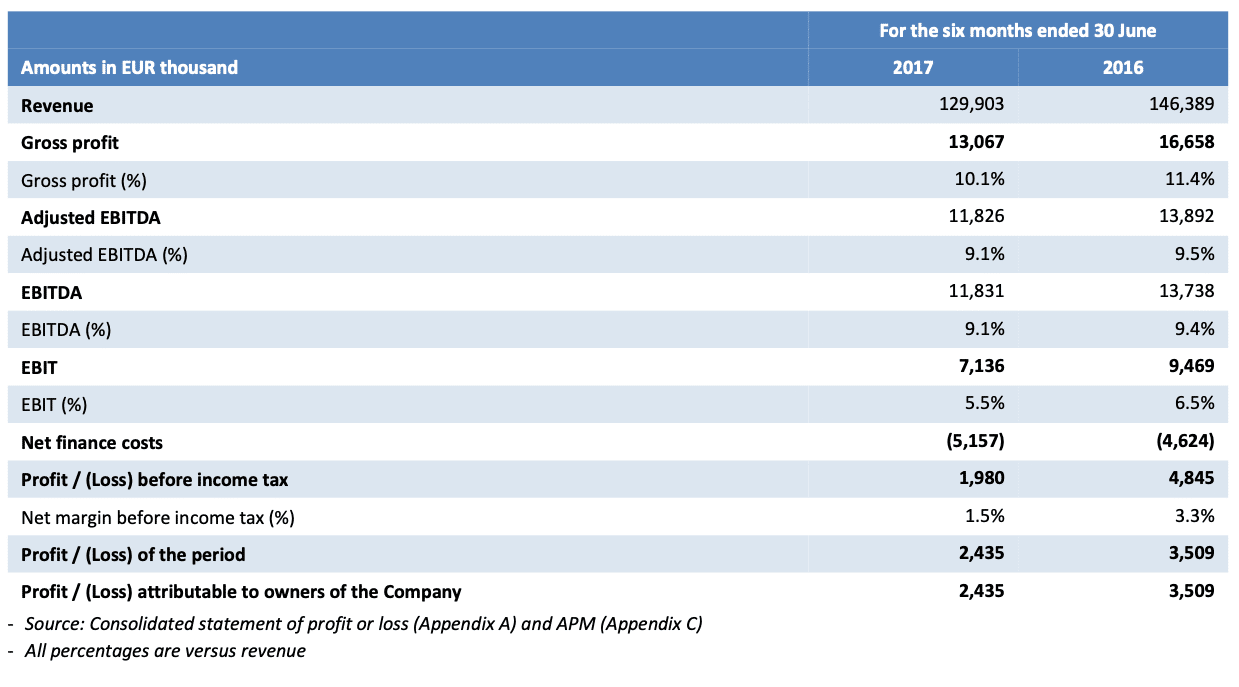

Revenue amounted to EUR 130 million in H1 2017, an 11% decrease year-on-year (H1 2016: EUR 146 million). During H1 2017, Corinth Pipeworks continued to execute the TAP project, the biggest project in its history, completion of which is expected by the end of Q3 2017. The second reeling project for pipes up to 20m in length was also successfully completed during the period. In addition to this, Corinth Pipeworks was awarded and began execution of two projects to deliver steel pipes for off-shore pipeline construction in the East Mediterranean area.

Gross profit amounted to EUR 13 million in H1 2017, a 22% decrease compared to H1 2016 (EUR 16.6 million), mainly driven by changes to the steel pipes delivery schedule for certain energy projects. The decrease in revenue and gross profit resulted in a 14% decrease in adjusted EBITDA, which amounted to EUR 12 million in H1 2017, compared to EUR 14 million in H1 2016. Profit before income tax amounted to EUR 2.0 million in the first half of 2017, compared to EUR 4.8 million in H1 2016. This decline is attributable to the above-mentioned factors, as well as increased finance costs.

Capital expenditure for the first six months of 2017 amounted to EUR 1.5 million and mainly concerned the installation of the concrete weight coating facility, which will be used for offshore applications, and the purchase of various machinery for the Thisvi plant.

The summary consolidated statement of profit or loss for the steel pipes segment is as follows:

Cables

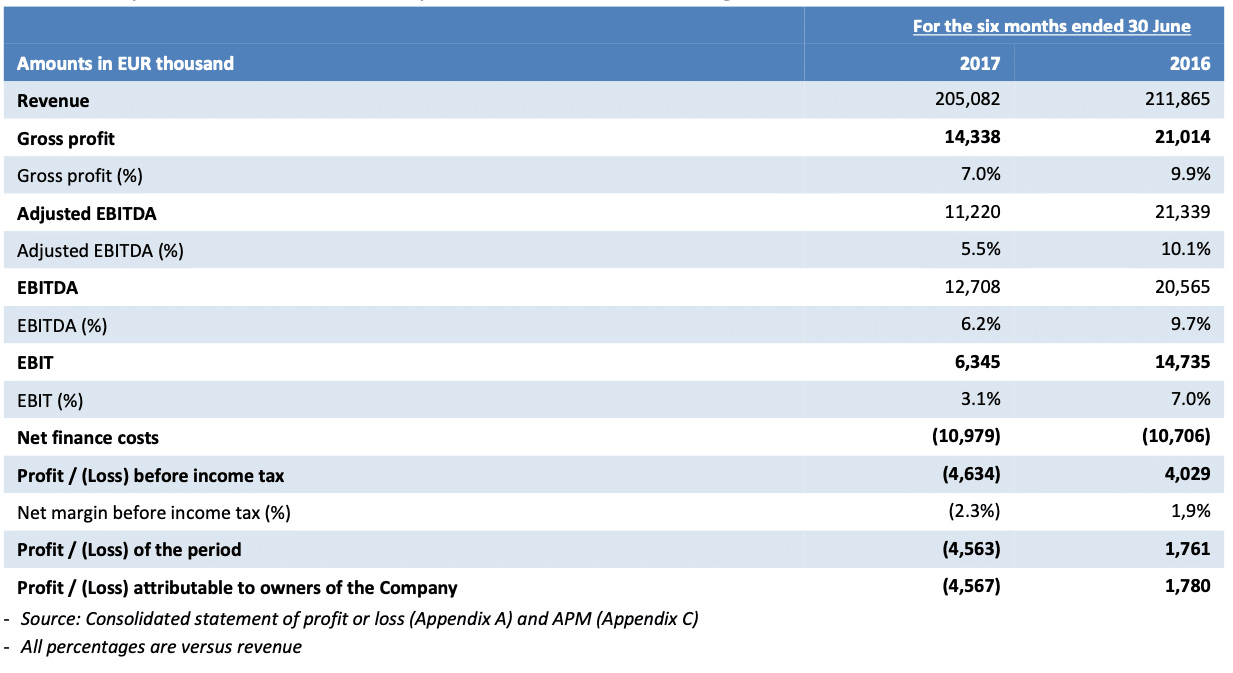

During H1 2017, the cables business continued to face customer project delays and low sales volumes in its main markets. Also, the execution of different types of construction contract resulted in changes to the product mix compared to the previous year. This, as well as significant sales volume contraction in medium and low voltage power cables in Germany, the UK, Austria, Italy and Romania, adversely affected results for the period.

In addition, delays in the execution of various onshore and offshore turnkey projects already signed along with some big offshore European projects that were put on hold, which led to low utilisation of the Fulgor plant, negatively influenced results. Finally, strong market demand for telecom and signalling cables in Europe had a positive effect on the segment’s margins.

Revenue for the period was down 3.2% year-on-year amounting to EUR 205 million, (H1 2016: EUR 212 million), whilst adjusted EBITDA amounted to EUR 11 million versus EUR 21 million in H1 2016, as a result of pressures outlined above. As a result, loss before income tax amounted to EUR 4.6 million in H1 2017, compared to profit before income tax of EUR 4 million in H1 2016.

In the first half of the year, Hellenic Cables and Fulgor progressed significant contracts on behalf of TenneT, for the supply of offshore wind farm export cable connections, and Energinet.dk. for cable connection between Denmark and Sweden and the replacement of overhead lines within Denmark. In addition to this, the cable interconnection of an offshore wind farm in the UK was concluded in April 2017.

Investments during the period reached EUR 6 million in the cables segment, largely attributable to productivity improvement projects at the Fulgor, Hellenic Cables, and Icme Ecab plants.

The summary consolidated statement of profit or loss for the cables segment is as follows:

Subsequent events

There were no subsequent events affecting the consolidated financial information presented in this announcement.

Outlook

High demand for new offshore projects in Europe, mainly in the North Sea and South Europe, is expected to drive growth in the cables segment. The assignment of new projects (for which Hellenic Cables has already entered into negotiations) and the successful completion of ongoing projects (the Kafireas project for Enel and Oresund project for Energinet) are a key focus for the cables segment.

In the cables products business, there are signs of recovery in low and medium voltage cables markets in Western Europe, which were negatively impacted by competitive challenges in the first half of 2017. However, risks to recovery, such as the EU’s economic and political environment and potential major changes in trade policies, as well as the impact of Brexit on the European economy and on the financing of major infrastructure projects in the UK, persist.

In the steel pipes segment, the latest world oil and gas rig count data confirms a rebound in the OCTG market, evidenced by increasing drilling and exploration activity in the US. This supports an expected increase in energy sector investment from lows reached in 2016, from which Corinth Pipeworks Pipe Industry is well positioned to benefit. Furthermore, the planned delivery schedule of products in the second half of 2017 indicates positive prospects for the year overall.

Despite a volatile operating environment, Cenergy Holdings’ companies remain well-positioned to execute their longer- term strategies for growth through a continued focus on innovation and product diversification, the penetration of new geographical and product markets and the strengthening of customer relationships. A continued focus on these key areas supports plans for international expansion and the pursuit of large-scale projects in high growth segments.

Statement of the Auditor

The condensed consolidated interim financial statements for the six-month period ended 30 June 2017 have been subject to a review by the auditors.

About Cenergy Holdings

Cenergy Holdings is a Belgian holding company listed on both Euronext Brussels and Athens Stock Exchange, investing in leading industrial companies, focusing on the growing global demand of energy transfer, renewables and data transmission. The Cenergy Holdings portfolio consists of Corinth Pipeworks and Hellenic Cables, companies positioned at the forefront of their respective high growth sectors. Corinth Pipeworks is a world leader in steel pipe manufacturing for the oil and gas sector and major producer of steel hollow sections for the construction sector. Cablel® Hellenic Cables is one of the largest cable producers in Europe, manufacturing power and telecom cables as well as submarine cables for the aforementioned sectors. For more information about our company, please visit our website at www.cenergyholdings.com

Contacts

For further information, please contact:

Sofia Zairi

Head of Investor Relations

Tel: +30 210 6787111, 6787773 Email: ir@cenergyholdings.com

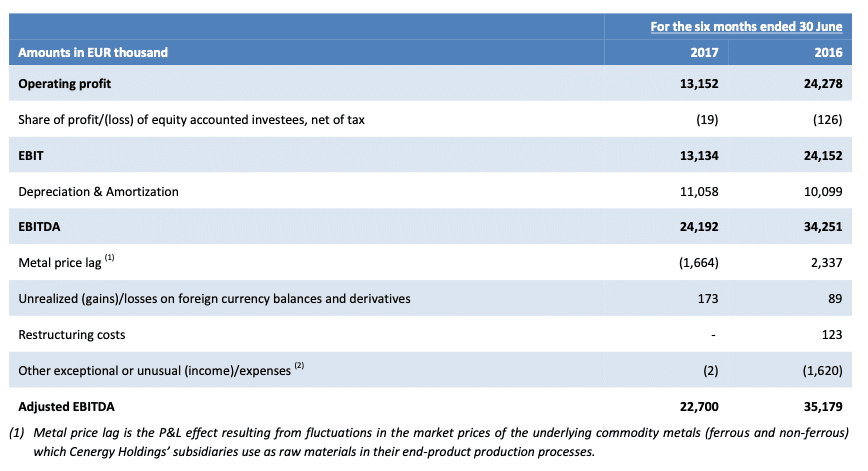

Appendix C – Alternative performance measures

In addition to the results reported in accordance with International Financial Reporting Standards (“IFRS”) as adopted by the European Union, this press release includes information regarding certain alternative performance measures which are not prepared in accordance with IFRS (“Alternative Performance Measures” or “APMs”). These APMs used in this press release are: Earnings Before Interest and Tax (EBIT), Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA), Adjusted EBITDA and Net debt. Reconciliations to the most directly comparable IFRS financial measures are presented below.

We believe these APMs are important supplemental measures of our operating and financial performance and are frequently used by financial analysts, investors and other interested parties in the evaluation of companies in the steel pipes and cables production, distribution and trade industries. By providing these measures, along with the reconciliations included in this appendix, we believe that investors will have better understanding of our business, our results of operations and our financial position. However, these APMs shall not be considered as an alternative to the IFRS measures.

EBIT, EBITDA, Adjusted EBITDA have limitations as analytical tools, and investors should not consider them in isolation, or as a substitute for analysis of the operating results as reported under IFRS and they may not be comparable to similarly titled measures of other companies.

EBIT is defined as the Operating result as reported in the Consolidated statement of profit or loss plus Share of profit/(loss) of equity accounted investees, net of tax.

EBITDA is defined as EBIT plus depreciation and amortization (net of the amortization of grants).

Adjusted EBITDA is defined as EBITDA excluding restructuring costs, metal price lag, unrealised (gains)/losses on foreign currency balances and derivatives and other exceptional or unusual (income)/expenses.

Net debt is defined as the total of long term loans and borrowings and short term loans and borrowings less cash and cash equivalents.

Reconciliation of Operating Profit to EBIT, EBITDA and Adjusted EBITDA: