News

Financial Results for the year ended 31 December 2023

Brussels, 6 March 2024

Cenergy Holdings S.A. (Euronext Brussels, Athens Stock Exchange: CENER), hereafter “Cenergy Holdings” or “the Group”, announces today its consolidated financial results for the year ended 31 December 2023.

Profitability exceeds expectations. Strong cash generation and solid sales

Highlights

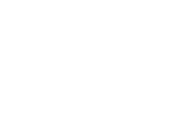

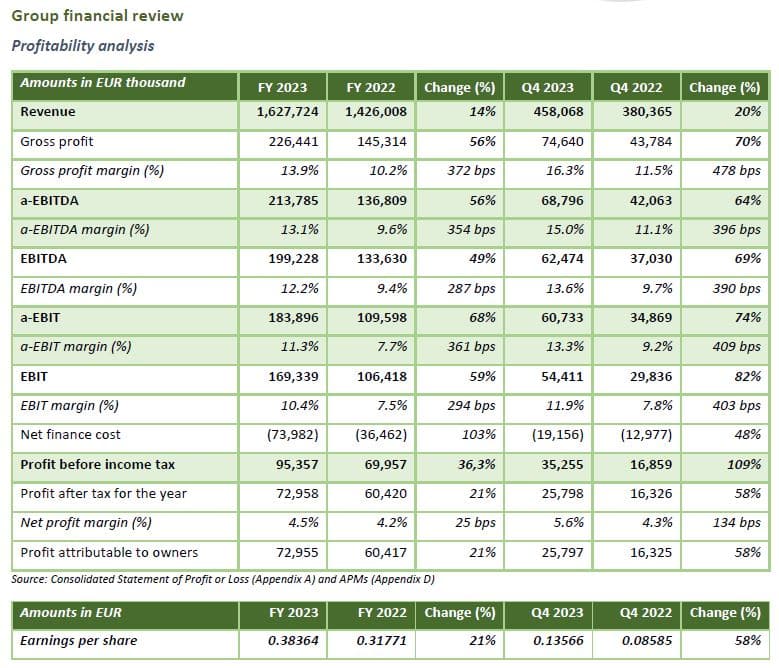

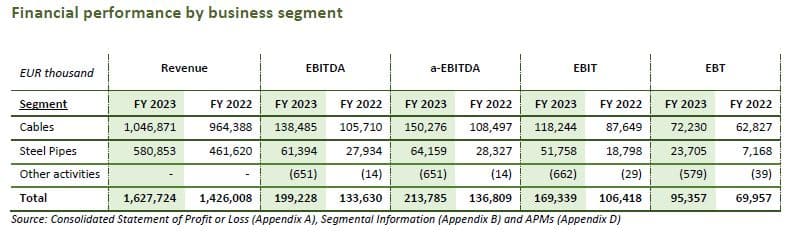

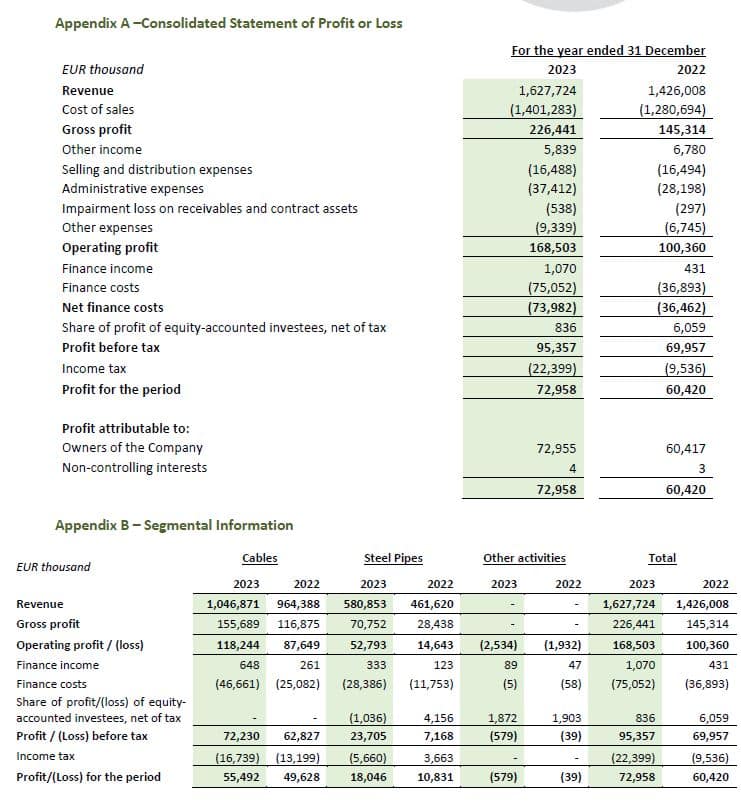

- Revenue reaches EUR 1.63 billion (+14% y-o-y) with improved margins across all business units.

- Operational profitability[1] reaches EUR 213.8 million (+56% y-o-y), as efficient execution of awarded energy infrastructure projects remains the top priority of both segments.

- Consolidated net profit after tax increases to EUR 73.0 million allowing for a proposed dividend 60% higher than last year at EUR 0.08 per share.

- Order backlog[2] stabilizes above EUR 3 billion driven by significant order intake in both segments (EUR 3.15 billion as of 31.12.2023).

- The capacity expansion of the submarine cables plant is on track, which is only a part of an ongoing comprehensive investment program across all plants (EUR 138.4 million total Capex in 2023) to secure our position in the new energy transition era.

- Free cash flow[3] for 2023 reaches EUR 76 million, while net debt drops significantly from last year’s levels to EUR 377.5 million.

- Full year 2024 guidance for adjusted EBITDA is between EUR 230 and 250 million.

[1] Adjusted EBITDA, defined in Appendix D “Alternative Performance Measures (APMs)”.

[2] Backlog includes signed contracts, as well as contracts not yet enforced, for which the subsidiaries have either received a letter of award or been declared preferred bidder by the tenderers.

[3] Free cash flow is defined as net cash inflows from operating activities minus cash outflows used for the acquisition of property, plant and equipment & intangible assets.

Alexis Alexiou, Cenergy Holdings’ Chief Executive Officer, commented on the Group’s performance:

“Our customer-centric approach along with our proven capabilities to execute demanding energy infrastructure projects allowed us to fully seize the potential offered by energy transition megatrends, enabling us to report results that exceeded our expectations. The Steel Pipes segment, especially, achieved record-high operational profitability which confirmed its strong potential, while the Cables segment remained the pillar of our Group’s profitability.

Strong sales growth was accompanied by an increase of 21% in net profit, excellent free cash flow generation and debt reduction. As a result, we reinforced our financial structure and net debt fell below 2 times EBITDA.

These satisfactory financial results fuel our way ahead, as our order backlog, steadily above the EUR 3 billion threshold, ensures full production schedules across all factory plants for the next year. At the same time, we remain focused on our vision to facilitate the new energy transition era by a comprehensive investment program across all plants planned for 2024 and onward, always respecting sustainability principles and ESG targets for both segments.”

Overview

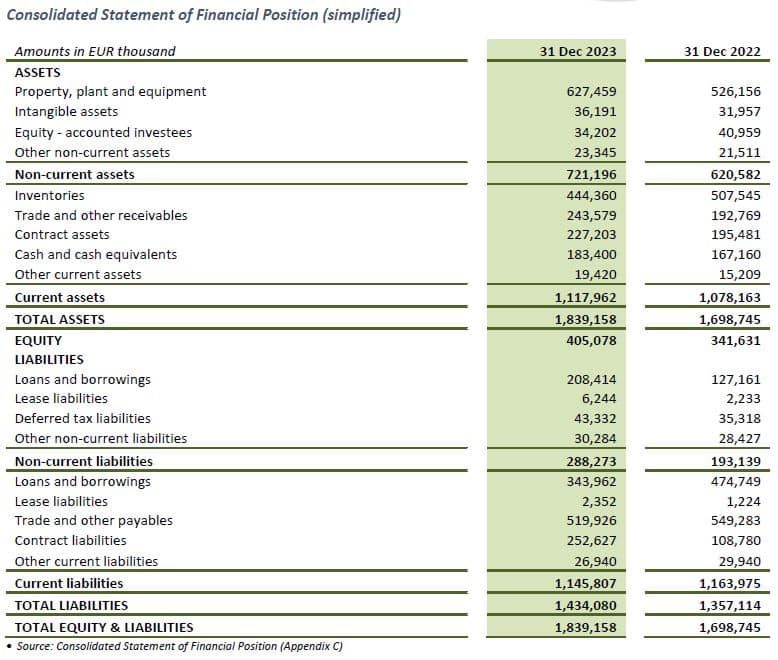

Throughout 2023 Cenergy Holdings took advantage of improving demand in the energy sector: demand for cables products remained robust, driven by grid expansions and increased construction activity while energy projects in both segments were awarded and executed smoothly, laying the ground for good operational profitability for the year. Operational profitability (adjusted EBITDA) reached EUR 213.8 million, 56% higher than 2022, while profit after tax reached EUR 73.0 million. This performance allows the Company’s Management to propose to the Ordinary General Shareholders’ meeting the approval of a dividend distribution of EUR 0.08 per share, which is 60% higher than last year.

Both Hellenic Cables and Corinth Pipeworks preserved their strong commercial momentum, securing new project awards that lead to total backlog of EUR 3.15 billion as at December 31st, 2023. Recent successes include the 56km of 30-inch longitudinally welded steel pipes (LSAW) for the development of the Greek section of the Natural Gas Interconnector between Greece and North Macedonia (IGNM), the 400kV cable system for the Sweden-Denmark interconnection, the 160km pipeline for OMV Petrom’s Neptun Deep Project in the Black Sea and the contract for 275km of 66kV three-core Inter Array submarine cables for East Anglia THREE offshore windfarm (OWF) in the UK. Such awards came on top of several more contracts secured earlier in 2023.

In the cables segment, the efficient execution of high-profile offshore and onshore projects combined with high-capacity utilization of all production lines supported growth and fostered performance. Low voltage and medium voltage power cables met strong demand throughout 2023 and secured better profitability margins. This together with an improved product mix combined with timely and efficient project execution resulted in significant improvement in adjusted EBITDA (+39% y-o-y), which reached EUR 150.3 million. Several new awards, both for interconnections and OWFs, further advanced the segment’s backlog to a new record of EUR 2.5 billion. This solid pipeline confirms Hellenic Cables’ key role in the fast-growing energy transition market and underpins further expansion plans to serve both offshore and onshore cables markets. Accordingly, the segment proceeded with a total capital expenditure of EUR 121.1 million during 2023, largely spent on the expansion of Hellenic Cables offshore cables plant in Corinth.

After two years of deep disruption in the oil and gas markets, 2023 was a landmark year for our steel pipes segment. 2022 ended as a turnaround year and 2023 sealed that positive momentum, leading the segment to record-high profitability levels that were more than double those of 2022. Adjusted EBITDA for 2023 reached EUR 64.2 million, or an increase of 126% y-o-y. Such profitability was the result of high capacity utilization and new profitable awards. Strategic initiatives taken during prior years improved the competitive position of Corinth Pipeworks, placing it among the leaders in new energy transition technologies, such as hydrogen and carbon capture and storage (CCS) pipelines. Demand for natural gas and the necessity to continue towards the new energy paradigm while guaranteeing energy security, led to a series of high-margin new contracts and an important order backlog of approx. EUR 650 million by the end of the year.

Revenue grew by 14% y-o-y to EUR 1,628 million, with Q4 2023 being the strongest quarter for revenue and profitability. All cables plants operated at close to full production capacity throughout the year pushing the segment’s revenue 9% higher, while steel pipes produced a record 26% y-o-y revenue increase.

Those factors contributed to adjusted EBITDA of EUR 213.8 million in 2023 (56% higher than 2022), while profitability margins for the last quarter reached 15%, adding an extra EUR 69 million (+64% y-o-y and 17% q-o-q). Improved double-digit margins achieved in H2 2023 confirm our focus on high value-added products in both segments and the ability of the steel pipes segment to benefit from improved market conditions.

As interest rates stayed high in the second semester of the year, net finance cost increased considerably from last year, reaching EUR 74 million in 2023, compared with EUR 36.5 million during 2022. This doubling of finance charges came despite credit spreads for all subsidiaries falling during 2023, as reference rates increased considerably: the average interest rate charged on Group’s debt at the end of 2023 was 177bps higher than the corresponding figure at prior year’s end. Capacity expansion in the cables segment and increased needs for working capital in the middle of the year kept average debt levels high and further added to higher finance costs.

Despite higher interest costs, strong operational profitability in 2023 pushed profit before income tax 36% higher than last year (EUR 95.4 million), with profit after tax following at EUR 73 million (4.5% of revenue, up from EUR 60.4 million in 2022).

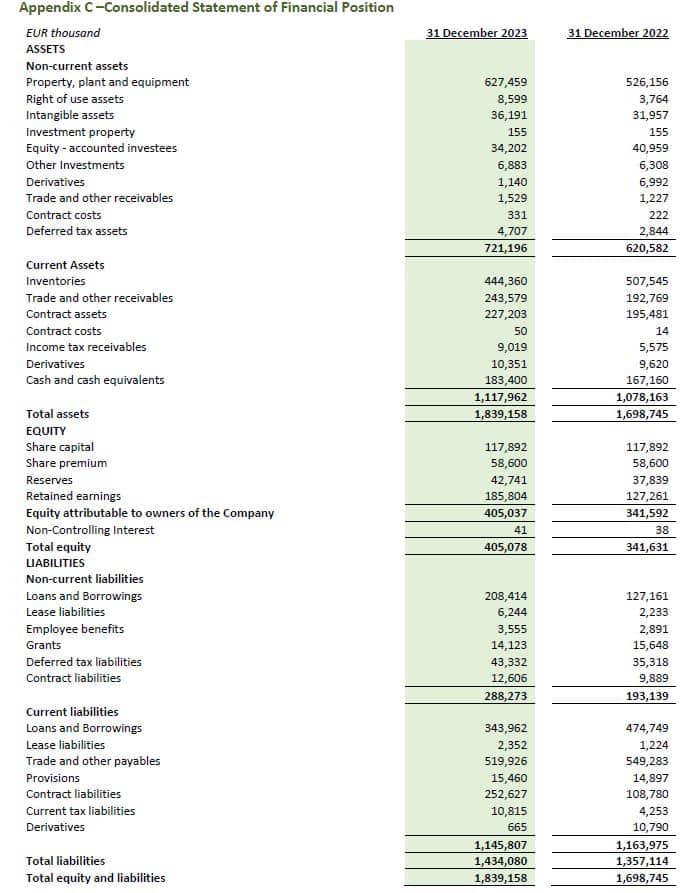

Our investments needed to increase cable plant capacity pushed total capital expenditure to EUR 138.4 million in 2023 (2022: EUR 79.0 million), which was split between EUR 121.1 million for the cables and EUR 17.3 million for the steel pipes segment.

Total working capital (WC) decreased by almost EUR 100 million to EUR 112.8 million as of 31 December 2023. This translates to 6.5% – 7.5% of sales in both segments, a level probably sustainable in the long-run for the cables segment, but rather low relative to competition in the steel pipes business. The future evolution of working capital will depend on the timing of advance and milestone payments in energy projects as well as the evolution of raw material prices.

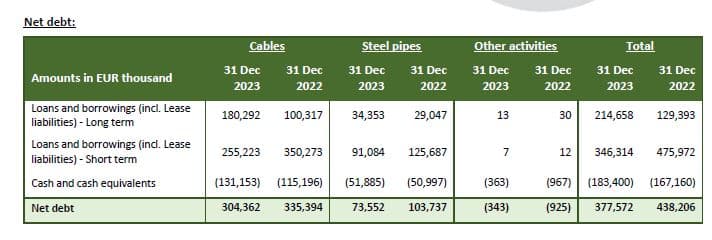

As a result of the improved cash generating capacity of both segments, net debt fell by EUR 60.6 million from the 2022 level of EUR 438 million, further proving the Group’s commitment to deleveraging.

Cables

Revenue for the cables segment reached EUR 1,047 million (+9% y-o-y), with growth being driven mainly by the projects’ business (+26% revenue growth y-o-y). The solid demand for cables products in all regions (i.e. Central Europe, United Kingdom, Balkans, Southeast Mediterranean) helped the Power & Telecom business unit improve its profit margins per ton of products sold. This, along with a full production schedule, an improved sales mix and steady high margins in projects, led to a 39% y-o-y growth in segment’s a-EBITDA (+EUR 41.8 million).

Throughout 2023, the tendering activity of Hellenic Cables continued its successful path with several new awards in the offshore wind and interconnection markets:

- In the offshore export cables market:

- the EPCI contract by 50Hertz for the grid interconnection of the Western Offshore Sub Station of the Gennaker Offshore Wind Farm in Baltic Sea, Germany, which includes two export cable systems (80km of 220kV submarine and 210km of 220kV underground cables) with a value of approx. EUR 450 million;

- the supply of export cables for the Baltica 2 Offshore Wind Farm in Poland;

- the turnkey interconnection project of a 275kV HVAC export cable system for the Thor OWF in Denmark awarded by RWE to a consortium led by Jan de Nul and Hellenic Cables;

- the 400kV cable system for the Sweden-Denmark interconnection;

- the turnkey projects awarded to consortiums led by Jan de Nul and Hellenic Cables for a package of four 220 kV export cables for the Polish offshore wind farms Baltyk II and Baltyk III, with a combined length of 256km;

- the supply contract awarded by Končar Group for approx. 30km of 110kV high voltage submarine cables to replace outdated cable lines in the Adriatic Sea; and

- the turnkey project awarded by TenneT to a consortium led by Jan de Nul and Hellenic Cables for three high voltage alternating current (HVAC) offshore grid connection cables connecting wind farms to the DolWin Kappa convertor station in Germany.

- In the inter-array market, Hellenic Cables secured:

- the supply of 275km of 66kV three-core Inter Array submarine cables for the East Anglia THREE OWF in the UK;

- the supply of 260km of 66kV XLPE-insulated subsea inter-array cables and associated accessories for South Fork Wind and Revolution Wind in the Northeast U.S., two offshore wind projects developed by Ørsted and Eversource;

- the supply of approx. 185km of 66kV aluminium and copper conductor cables to connect the wind turbines of four OWF sites in the German North Sea developed by RWE and Northland Power;

- the turnkey project for an inter-array cable system consisting of approx. 200km of submarine cables and associated accessories for the Thor OWF in Denmark awarded by RWE to a consortium led by Jan de Nul and Hellenic Cables,

- a contract with Ørsted for the supply of inter-array cables for the Hornsea 3 OWF in the United Kingdom; and

- the inter-array cable supply agreement with Vattenfall for the Norfolk Offshore Wind Zone in the United Kingdom.

- In the onshore sector, Hellenic Cables was awarded frame contracts from European utilities for the supply of a wide range of power cables, along with two turnkey projects by Greece’s Independent Power Transmission Operator (ADMIE – IPTO) to carry out diversion and undergrounding of transmission lines on Evia Island in central Greece and at the area of Messatida in the Northern Peloponnese, Greece.

As a result of the above, the order backlog of the segment reached EUR 2.5 billion by 31 December 2023, its highest level ever (EUR 1.35 billion on 31.12.22).

At the same time, throughout 2023, several projects were successfully fully or partially delivered. Among others, the production for the turnkey interconnection projects of the Lavrio – Serifos / Serifos – Milos interconnection (phase 4 of the Cyclades’ interconnection in Greece, with a total cable length of 170km), the last batches of 66kV inter-array cables for phases A & B of the Doggerbank OWF in the UK and the production for the project in Croatia were completed. Furthermore, the production for the supply of 360km of 66kV cables for the Sofia OWF in the United Kingdom ran at full pace and the upgraded electrical interconnection between Kilini and Zakynthos was successfully electrified during the first semester of the year, securing the energy supply of those Ionian Islands. The production of several other projects, such as OstWind 3 for 50Hertz, the Hai Long OWF in Taiwan, the Revolution OWF in the USA and the Sweden-Denmark interconnection, also began during the final months of 2023.

Driven by all the above, a-EBITDA for cables segment reached EUR 150.3 million in 2023, up by EUR 41.8 million from 2022. This increase offset the rise in net finance costs (+EUR 21.2 million vs. 2022) and allowed profit before income tax to reach EUR 72.2 million, compared to EUR 62.8 million in 2022 despite a negative metal price lag and a write-off of EUR 3.5 million. The latter concerns expenditure realized in the USA and deemed non-recoverable based on management’s current plans for this potential investment. Net profit after tax followed the same trend and reached EUR 55.5 million (EUR 49.6 million in 2022).

Cables’ net debt decreased by EUR 31 million reaching EUR 304 million on 31 December 2023, due to improved operating cash generation.

Capital expenditure for the segment amounted to EUR 121.1 million in 2023 and mainly concerned:

- EUR 82.6 million for the offshore cables business, largely for the implementation of the planned capacity expansion in the Corinth plant;

- EUR 18.8 million for selective investments in Hellenic Cables onshore cables plants near Thiva;

- EUR 12.2 million for the Bucharest plant, including the acquisition of a neighbouring property; and

- EUR 7.4 million to support the construction of a cables factory in the USA.

Steel pipes

The steel pipes segment started its turnaround in the second half of 2022, so 2023 proved to be a very strong year with high-capacity utilization, improved profitability and major new project awards. Revenue increased by 26% compared to 2022 (EUR 581 million vs. EUR 462 million), while operating profitability hit record high levels, as a-EBITDA stood at EUR 64.2 million at the end of the year, 126% or EUR 35.8 million higher than 2022.

The market for gas fuel transport projects remained strong due to high energy prices and the need for increased energy security in Europe (cf. geopolitical turbulence in Ukraine). New gas reserves required extended gas networks globally and the pace towards the future of energy accelerated. Corinth Pipeworks was awarded such innovative projects with its order backlog rising to approximately EUR 650 million at the end of 2023. Based on initiatives taken during previous difficult years, the company solidified its competitive position and succeeded in increasing its global market share, taking a leadership position in technologies, such as hydrogen and Carbon Capture & Storage (CCS) pipelines.

In addition, Corinth Pipeworks continued its cost optimization plans, advancing its productivity and performance with Manufacturing Excellence and extensive research, development, and innovation (RDI) programs. Alongside production enhancements, the segment, devoted to sustainability principles, set ambitious medium and long-term goals for carbon emissions for its entire supply chain, undertook market initiatives towards responsible sourcing, and secured certifications under the Environmental Product Declaration (EPD) for all its product categories. All of the above, helped Corinth Pipeworks consolidate its label as a Tier 1 pipe manufacturer and its leading position in new energy transition technologies.

During 2023, the segment successfully executed several pipeline projects and was awarded significant new ones. Worth noting are those mentioned below:

- The 155km Tamar gas field optimization development in the SE Mediterranean by Chevron Mediterranean Ltd.;

- The 118km Leviathan gas field third gathering line, also by Chevron Mediterranean Ltd.;

- A 15km IRPA field development project in the Norwegian sea by Equinor;

- 16km of 100% hydrogen certified steel pipes for the N05-A platform in the N. Sea by ONE-Dyas B.V.;

- 22km of offshore CCS pipeline (Porthos) in the Netherlands, the first offshore CCS project globally using welded pipes;

- An 82km pipeline in the south of Italy by Società Gasdotti Italia (SGI);

- The OMV Petrom’s 160km Neptun Deep Project in the Black Sea; and

- 56km of hydrogen certified pipeline in Northern Greece by DESFA.

The above awards came over and above several contracts secured in Italy, the Mediterranean, the North & Norwegian Seas, Australia, Africa and the U.S.A., confirming the segment’s robust profitability position.

High-capacity utilization and higher-margin projects led to a notable profitability improvement with gross profit more than tripling in a year (EUR 70.8 million) and adjusted EBITDA at EUR 64.2 million, more than double the EUR 28.3 million achieved in 2022. This improvement translated to a net profit of EUR 18.0 million for the year, i.e. 67% higher compared to 2022 (EUR 10.8 million).

As expected, cash generated during the last quarter of the year pushed working capital for the steel segment down by EUR 14 million from its 2022 levels and, consequently, net debt dropped to EUR 73.5 million, EUR 30.2 million lower than its 31.12.2022 level. Capital expenditure in steel pipes amounted to EUR 17.3 million, mostly related to operational improvements in the Thisvi plant.

Subsequent events

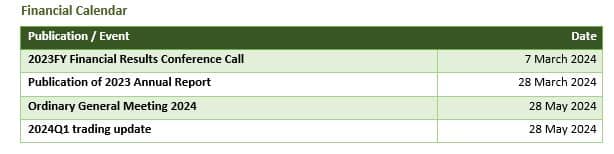

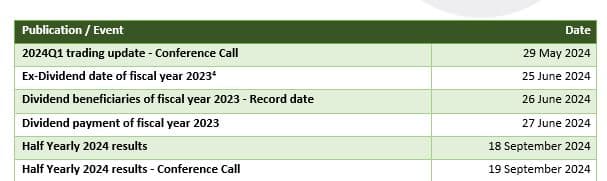

On March 6th, 2024, the Board of Directors of Cenergy Holdings decided to propose to the Ordinary General Shareholders’ meeting to be held on May 28th, 2024, the distribution of a gross dividend of EUR 0.08 per share.

Outlook

The cables segment momentum continues in both business units: demand for cables products remains strong and the cables projects portfolio is growing. Electrification and energy security, the major megatrends for at least the next decade, are directly driving the need for all types of cables and expected to further fuel the order book of the segment. With the expansion plan for the submarine cable factory in Corinth on track and most of that extra capacity already booked, Hellenic Cables is addressing the onshore business growth by (i) creating value in the Thiva plant through additional lines and equipment and (ii) planning a Centre of Excellence for low voltage cables in the industrial area of Eleonas (near its factory in Thiva), acquired during 2022. The ongoing investment program will allow Hellenic Cables to effectively execute a record high order backlog and serve the increasing expectations of customers and stakeholders. Last, and following previous announcements, planning for a potential development of a cables factory in Maryland, USA is continuing.

The steel pipes segment is building on its strengthened position and expects profitability growth for 2024, based on the increased visibility provided by a strong backlog that guarantees high-capacity utilization for at least the next year. Looking ahead, Corinth Pipeworks expects the gas fuel demand to keep on growing in the short-term, together with the other two “green energy pillars” (hydrogen and Carbon Capture & Storage), feeding into higher demand for large diameter steel pipes. Order backlog is expected to follow suit, with onshore gas and hydrogen networks gradually coming into front stage and supporting this positive outlook.

Given the strong order backlog for both segments and the growing demand for energy infrastructure products worldwide, Cenergy Holdings expects an adjusted EBITDA in the range of EUR 230 – 250 million for the FY 2024. The financial outlook is subject to several assumptions including (a) smooth execution of energy projects in both segments, (b) a strong demand for cables products and (c) limited financial impact from an uncertain global geopolitical and macroeconomic environment, high inflationary pressures and/or supply-chain challenges and/or potential disruptions.

As stated often in past financial results announcements, Cenergy Holdings remains focused on value over volume growth. Our strategy is to keep creating profit from our unique role in the new global energy framework and invest in our production ability to serve the growing energy infrastructure markets.

Statement of the Auditor

The statutory auditor, PwC Bedrijfsrevisoren bv, represented by Marc Daelman, has confirmed that the audit, which is substantially complete, has not to date revealed any material misstatement in the draft consolidated statement of financial position and consolidated income statement of profit or loss, and that the accounting data reported in the press release is consistent, in all material respects, with the draft consolidated statement of financial position and consolidated income statement of profit, from which it has been derived. The accounting data with respect to Q4 2023 or Q4 2022 as included in this press release are unaudited.

The Annual Report for the period 1 January 2023 – 31 December 2023 will be posted on the Company’s website, www.cenergyholdings.com, on the website of the Euronext Brussels www.euronext.com, as well as on the Athens Stock Exchange website www.athexgroup.gr.

DISCLAIMER: Any forward-looking statements that may be included in this press release are statements regarding or based on current expectations, plans or understandings of our management relating to, inter alia, Cenergy Holdings’ future results of operations, financial position, liquidity, prospects, growth, strategies or developments in the markets in which its subsidiaries operate. Such forward-looking statements shall be treated as a reflection of information, data and understandings as of the date of the publication of this press release, so you are encouraged not to place undue reliance on them, given that by their nature, forward-looking statements are subject to risks, uncertainties and assumptions that could materially alter the actual results or future events from those expressed or implied thereby. The outcome and financial effects of the understandings, intentions, and events described herein could be adversely affected by these risks, uncertainties and assumptions. Forward-looking statements contained in this press release related to trends or current activities shall not to be taken as a report of the future status of such trends or activities. We undertake no obligation to update or revise any forward-looking statements, either as a result of new information or developments, future events or otherwise. The information contained in this press release is subject to change without notice. No re-report or warranty, express or implied, regarding the fairness, accuracy, reasonableness or completeness of the information contained herein and no reliance shall be placed on it. This press release has been prepared in English and translated into French and Greek. In case of discrepancies between different language versions, the English one shall prevail.

About Cenergy Holdings

Cenergy Holdings is a Belgian holding company listed on both Euronext Brussels and Athens Stock Exchange, investing in leading industrial companies, focusing on the growing global demand of energy transfer, renewables and data transmission. The Cenergy Holdings portfolio consists of Corinth Pipeworks and Hellenic Cables, companies positioned at the forefront of their respective high growth sectors. Hellenic Cables is one of the largest cable producers in Europe, manufacturing power and telecom cables as well as submarine cables. Corinth Pipeworks is a world leader in steel pipe manufacturing for the energy sector and major producer of steel hollow sections for the construction sector. For more information, please visit our website at www.cenergyholdings.com.

Contacts

For further information, please contact:

Sofia Zairi

Chief Investor Relations Officer

Tel: +30 210 6787111, +30 210 6787773

Email: ir@cenergyholdings.com

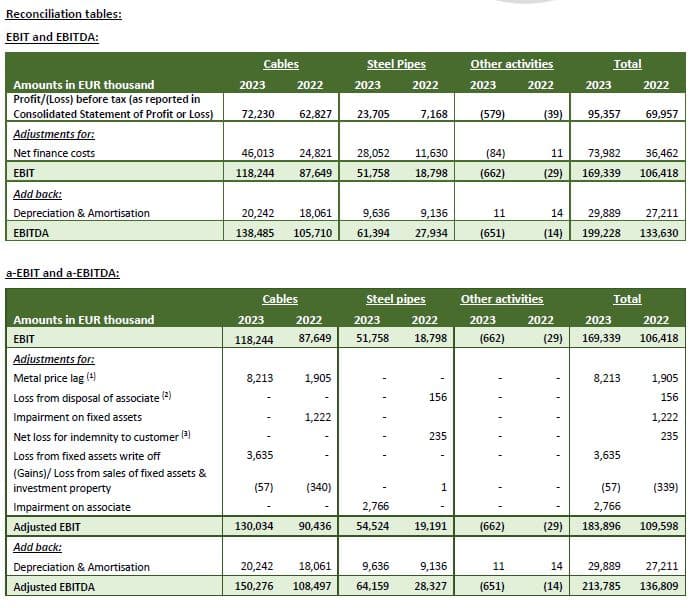

Appendix D – Alternative performance measures

In addition to the results reported in accordance with International Financial Reporting Standards (“IFRS”) as adopted by the European Union, this press release includes information regarding certain alternative performance measures which are not prepared in accordance with IFRS (“Alternative Performance Measures” or “APMs”). The APMs used in this press release are Earnings Before Interest and Tax (EBIT), Adjusted EBIT, Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA), Adjusted EBITDA and Net debt. Reconciliations to the most directly comparable IFRS financial measures are presented below.

We believe these APMs are important supplemental measures of our operating and financial performance and are frequently used by financial analysts, investors and other interested parties in the evaluation of companies in the steel pipes and cables production, distribution and trade industries. By providing these measures, along with the reconciliations included in this appendix, we believe that investors will have better understanding of our business, our results of operations and our financial position. However, these APMs shall not be considered as an alternative to the IFRS measures.

These APMs are also key performance metrics on which Cenergy Holdings prepares, monitors and assesses its annual budgets and long-range (5 year) plans. However, it must be noted that adjusted items should not be considered as non-operating or non-recurring.

EBIT, Adjusted EBIT, EBITDA and Adjusted EBITDA have limitations as analytical tools, and investors should not consider it in isolation, or as a substitute for analysis of the operating results as reported under IFRS and may not be comparable to similarly titled measures of other companies.

APM definitions remained unmodified compared to those applied as of 31 December 2022. The definitions of APMs are as follows:

EBIT is defined as result of the period (earnings after tax) before:

- income taxes,

- net finance costs

EBITDA is defined as result of the period (earnings after tax) before:

- income taxes,

- net finance costs

- depreciation and amortisation

a-EBIT and a-EBITDA are defined as EBIT and EBITDA, respectively, adjusted to exclude:

- metal price lag,

- impairment / reversal of impairment of fixed, intangible assets and investment property

- impairment / reversal of impairment of investments

- gains/losses from sales of fixed assets, intangible assets, investment property and investments,

- exceptional litigation fees and fines and,

- other exceptional or unusual items

Net Debt is defined as the total of:

- long term loans & borrowings and lease liabilities,

- short term loans & borrowings and lease liabilities,

Less:

- cash and cash equivalents

- Metal price lag is the P&L effect resulting from fluctuations in the market prices of the underlying commodity metals (ferrous and non-ferrous) which Cenergy Holdings’ subsidiaries use as raw materials in their end-product production processes,

Metal price lag exists due to:

(i) the period of time between the pricing of purchases of metal, holding and processing the metal, and the pricing of the sale of finished inventory to customers,

(ii) the effect of the inventory opening balance (which in turn is affected by metal prices of previous periods) on the amount reported as Cost of Sales, due to the costing method used (e.g., weighted average),

(iii) certain customer contracts containing fixed forward price commitments which result in exposure to changes in metal prices for the period of time between when our sales price fixes and the sale actually occurs,

Subsidiaries in cables segment use back to back matching of purchases and sales, or derivative instruments in order to minimise the effect of the Metal Price Lag on their results, However, there will be always some impact (positive or negative) in the P&L, since in Cables segment part of the inventory is treated as fixed asset and not hedged and in the Steel Pipes segment no commodities hedging is possible.

- During 2022, the participation in Belleville Tube Company was disposed.

- In 2013, Corinth Pipeworks manufactured and supplied pipes for a pipeline in France. During 2015, the French client filed a quality claim against Corinth Pipeworks, its insurers and the subcontractors in charge for the welding of the pipeline. The commercial court of Paris rendered its decision on 7 July 2022 and ruled that Corinth Pipeworks should be held liable for the latent defects affecting the pipes it delivered to its French customer but that the latter was also responsible for its own loss. Consequently, given that 2013 sales were fully insured, Corinth Pipeworks recorded a liability of EUR 515 thousand during 2022 that corresponds to its maximum exposure for that specific claim, while an income of EUR 280 thousand was recorded as a respective amount was received as indemnity from an insurance company for the certain case.