Regulatory News

Financial results for the year ended 31 December 2017

Brussels, 22 March 2018

FINANCIAL RESULTS FOR THE YEAR ENDED 31 DECEMBER 2017

Building for the future – A year of transition

Cenergy Holdings S.A. (Euronext Brussels, Athens Stock Exchange: CENER), hereafter “Cenergy Holdings” or “the Company”, today announces its financial results for the year ended 31 December 2017.

Key highlights

- Turnover increased by 10% driven by increased sales volume.

- Dynamic market penetration, especially in the offshore sector.

- Operational profitability, in terms of adjusted EBITDA, at almost the same level compared to 2016. Overall loss, mainly due to an exceptional impairment loss on long standing receivables.

- Order backlog currently stands at EUR 480 million.

Financial overview

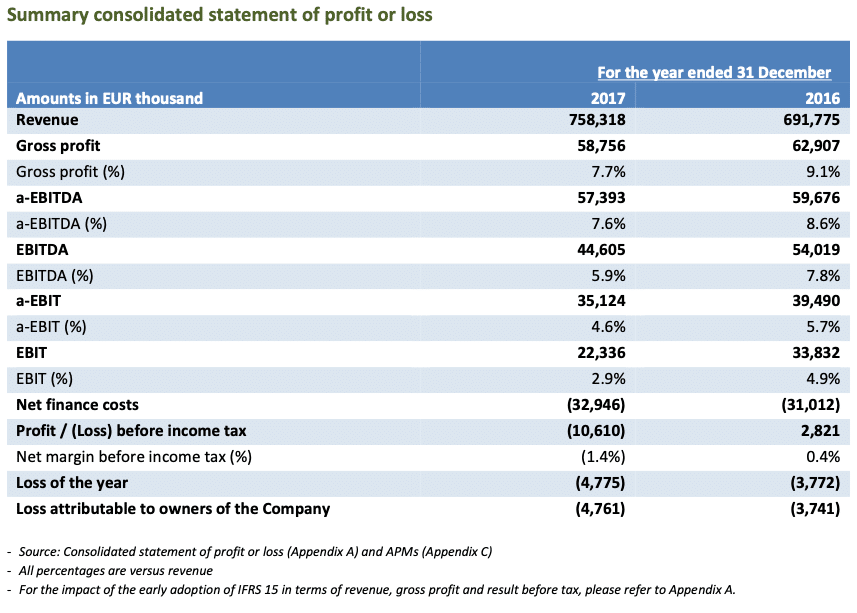

- Consolidated revenue amounted to EUR 758 million, increased by 10%, compared to EUR 692 million in 2016, mainly due to higher sales volume;

- Adjusted EBITDA* of EUR 57.3 million compared to EUR 59.7 million in 2016;

- Significant improvement during the second semester of the year in Company’s operational performance, since a-EBITDA for H2 2017 amounted to EUR 34.6 million versus EUR 22.7 million for H1 2017;

- Adjusted EBIT* of EUR 35.1 million compared to EUR 39.5 million in 2016;

- Consolidated loss before income tax of EUR 10.6 million, compared to consolidated profit before income tax of EUR 2.8 million in 2016, mainly due to an exceptional impairment loss on receivables of EUR 8.9 million; excluding this one-off item consolidated loss before income tax would have been EUR 1.7 million;

- Loss for the year of EUR 4.78 million (2016: loss of EUR 3.77 million);

- Operating cash flow of EUR 19.8 million, up EUR 24.2 million versus 2016;

- Net debt* of EUR 379 million as at 31 December 2017, slightly up (1%) compared to 31 December 2016.

* For the definitions of the APMs used, refer to Appendix C.

Operational Overview

-Several significant energy projects were executed during 2017:

- Pipe production for the Trans Adriatic Pipeline (TAP) completed, the largest project ever commissioned to the Corinth Pipeworks Pipe Industry S.A. (hereafter “Corinth Pipeworks”).

- Hellenic Cables S.A. (hereafter “Hellenic Cables”) and Fulgor S.A. (hereafter “Fulgor”) continued execution of significant offshore cable connections, projects on behalf of Tennet and Energinet in North Europe and begun the execution of new projects, such as the Kafireas project in Greece on behalf of Enel.

Hellenic Cables participated in the project of the interconnection of the Cyclades islands, which was inaugurated on March 2018, by executing the part of the project concerning the interconnections of Syros-Tinos, Syros-Paros and Syros-Mykonos.

-New energy projects awarded:

- Corinth Pipeworks was awarded two projects to deliver steel pipes for the construction of off-shore pipelines in the East Mediterranean area.

- Agreement signed to manufacture and supply steel pipes for the Balticconnector offshore pipeline project.

- Supply contract to provide submarine cable systems for the Modular Offshore Grid (MOG) Project in the North Sea awarded to Cablel® Hellenic Cables. The successful execution of such projects reflects the ability of the Company to meet the growing demands of the energy transfer sector in an increasingly competitive market.

Cenergy Holdings order backlog currently stands at EUR 480 million, comprising a number of significant new projects secured in the past few months, while several other tender procedures are still pending, and more new projects are expected to be awarded during 2018.

-Market trends:

- Stronger than expected growth in energy projects and telecoms across European markets; positive trends in both price and demand.

- Surge in metals prices; rebound in oil and gas prices in latter portion of 2017.

- Slowdown of the commodities business in Europe, continuing a trend which emerged in the second half of 2016.

- At the beginning of 2018, the protectionist sentiment in US market expressed through the anti-dumping duty investigation of large diameter welded pipe (nominal diameter above 16.4”) against Greece and five other countries and the tariffs imposed under Section 232 on steel and aluminium products create an uncertain environment in steel pipes business. Despite the ongoing macroeconomic concerns, such as the UK’s decision to leave the EU, the aforementioned developments in USA and the unpredictable nature of metal price fluctuations, we expect that actions and initiatives undertaken in order to secure Company’s competitive and financial position will mitigate any adverse effect.

Cenergy Holdings and its companies continue to be well placed to take advantage of improving market conditions in the Energy sector and to further their ambitions to become world leaders in energy transfer solutions and data transmission.

Group financial review

During 2017, the following developments had an impact on Cenergy Holdings’ main markets:

- Cables projects: The delay in the execution of various turnkey projects along with some big offshore European projects that were put on hold led to low levels of utilization of the Fulgor plant.

- Cables products: A slowdown was witnessed in main European markets. As expected, the German medium voltage market slowed down in 2017, while the UK market continues to be challenging due to uncertainty associated with Brexit.

- Steel pipes: Further delays in steel pipes projects globally, due to low oil and natural gas prices.

The execution of significant contracts continued throughout 2017, including the Trans Adriatic Pipeline (“TAP”) project and contracts for cable connections on behalf of the German electricity transmission system operator, TenneT, and the Danish TSO, Energinet.dk, while new projects such as Kafireas wind farm in Greece on behalf of Enel has started during the current year.

Cenergy Holdings has early adopted IFRS 15 Revenue from Contracts with Customers with a date of initial application of 1 January 2017. Cenergy Holdings applied IFRS 15 using the cumulative effect method, i.e. by recognising the cumulative effect of initially applying IFRS 15 as an adjustment to the opening balance of equity at 1 January 2017. Therefore the comparative information has not been restated and continues to be reported under IAS 18 and IAS 11. For the impact of the early adoption of IFRS 15 in terms of revenue, gross profit and result before tax, please refer to Appendix A.

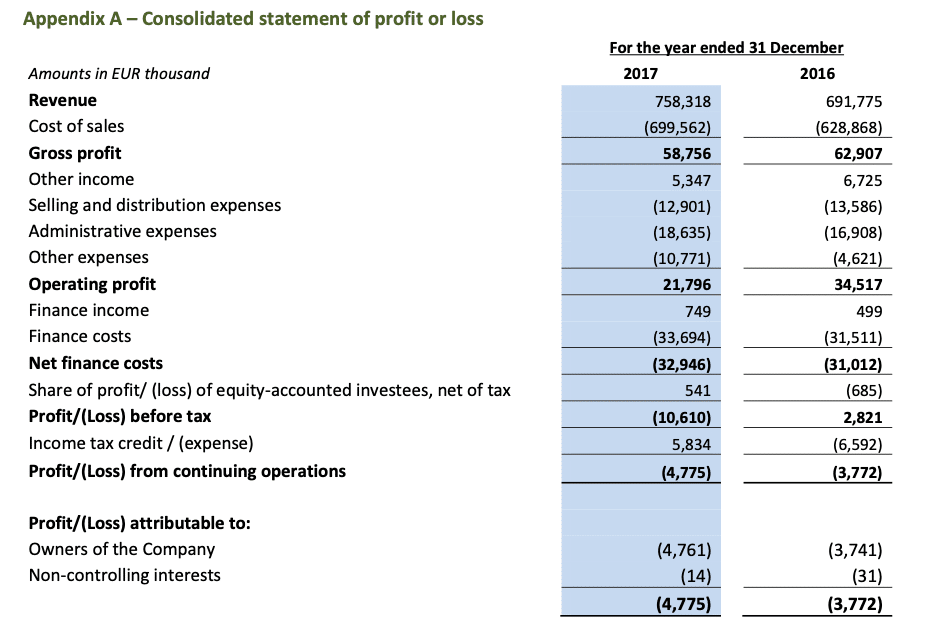

Consolidated revenue for 2017 amounted to EUR 758 million, an increase of 10% from the EUR 692 million recorded in 2016, reflecting strong sales of steel pipes and submarine cables for Energy projects and higher LME metals prices.

Adjusted EBITDA decreased by 4% to EUR 57.4 million in 2017 from EUR 59.7 million in 2016.

Pressure on the profit margins of the cable commodity business, together with a different project mix in the steel pipes segment, resulted in lower profitability than 2016.

Net finance costs increased by 6% to EUR 33 million as a result of increased net debt throughout the year in order to finance working capital needs for projects executed during 2017.

Loss before income tax amounted to EUR 10.6 million in 2017 compared to profit before tax of EUR 2.8 million in 2016. This was due to the above-mentioned factors, as well as an exceptional impairment loss on receivables of EUR 8.9 million recorded by Corinth Pipeworks. This exceptional impairment loss derives from an increase in the impairment for a receivable generated in 2010 amounting to USD 24.8 million (EUR 20.8 million). The subsidiary had already booked an impairment of EUR 10.4 million for such a receivable at 31 December 2016. The subsidiary decided to book an additional impairment of EUR 8.9 million to reflect the prospected recoverability of that receivable, as of today. However, the subsidiary will continue any and all actions required to collect the full amount of that receivable.

Loss for the period amounted to EUR 4.8 million in 2017 compared to a loss before tax of EUR 3.8 million in 2016. This was attributable to an income tax credit of EUR 5.8 million for the period, compared to a significant income tax charge of EUR 6.6 million recorded in 2016. This income tax credit for 2017 relates to the expected tax benefit of the impairment loss mentioned above, and the recognition of a deferred tax asset for previously unrecognised tax credit on the aforementioned impairment recorded in prior periods. The increased income tax expense for 2016 was mainly related to the derecognition of previously recognised deferred tax assets on tax losses incurred during the prior period.

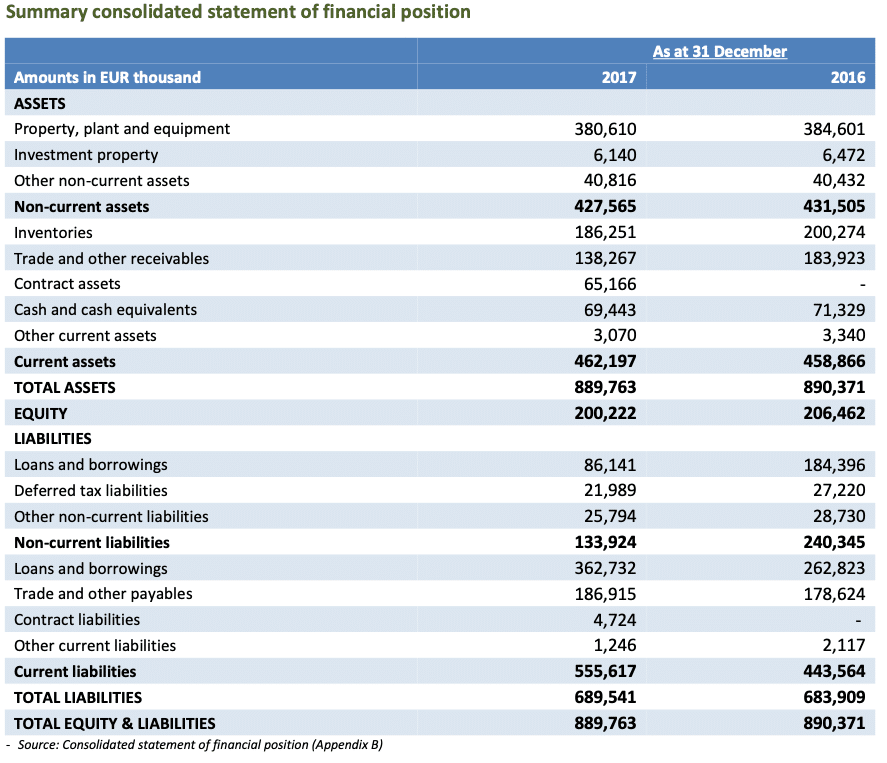

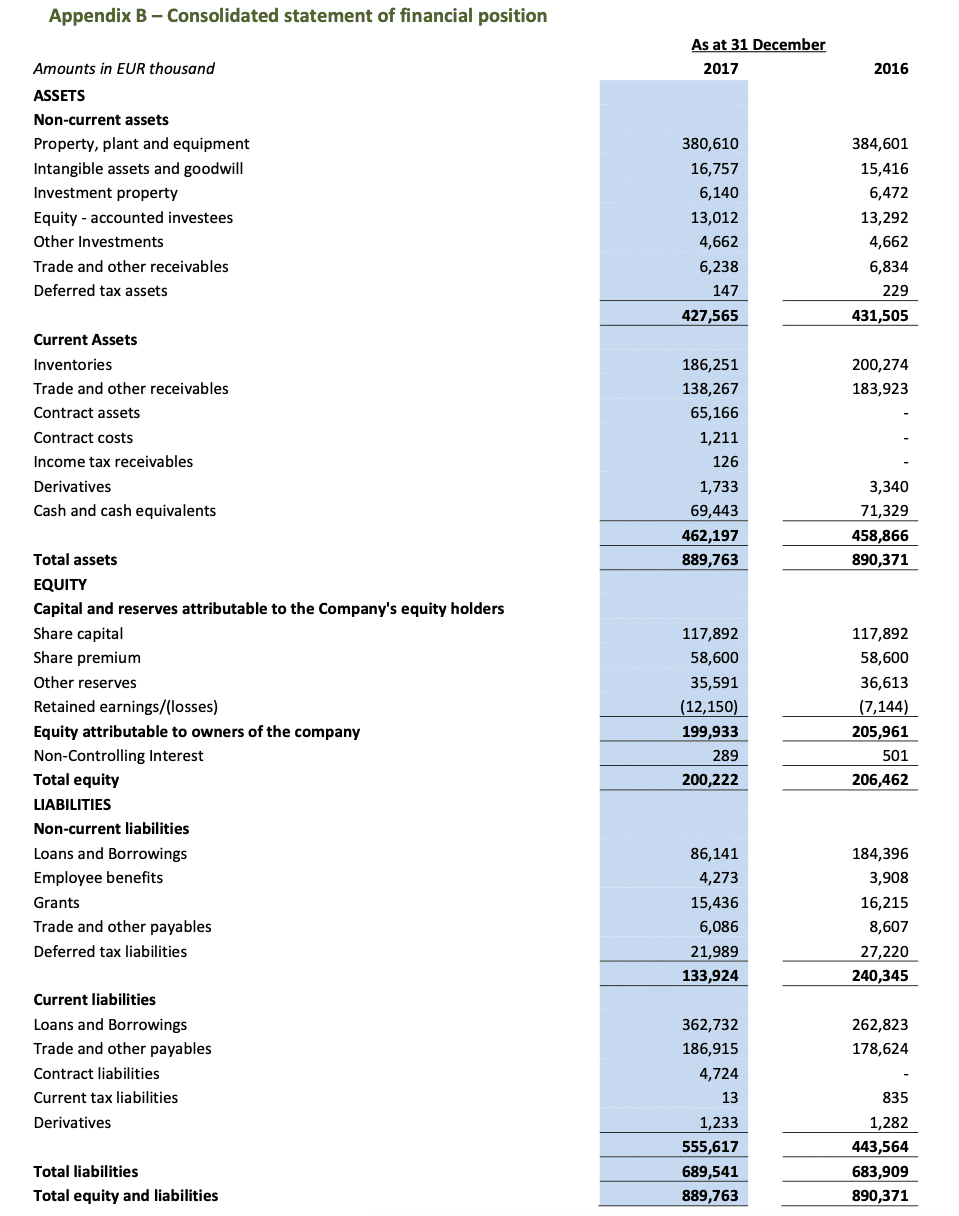

Non-current assets decreased from EUR 432 million at 31 December 2016 to EUR 428 million at 31 December 2017.

Capital expenditure during the year amounted to EUR 17.8 million for the cables segment and EUR 3.2 million for the steel pipes segment, while consolidated depreciation & amortization for 2017 amounted to EUR 23 million.

Current assets increased by 1% to EUR 462 million at 31 December 2017, up from EUR 459 million at 31 December 2016. As of 31 December 2016, assets related to construction contracts in progress were included in trade and other receivables, while based on IFRS 15 as of 31 December 2017, contract assets are separately disclosed. Therefore, the variation in these lines should be considered in that context, with the main reason for the increase being contract assets recognised for the execution of current energy projects in progress as of 31 December 2017. Inventories decreased by EUR 14 million, mainly as a result of ongoing projects for optimization of inventory. Cash and cash equivalents held remained at the same levels (EUR 69 million) and represent 15% of current assets.

Liabilities increased by 1% from EUR 684 million at 31 December 2016, to EUR 689 million at 31 December 2017.

Net debt increased slightly to EUR 379 million at 31 December 2017 (31/12/2016: EUR 376 million). Cenergy Holdings companies’ debt at 31 December 2017 comprised long term and short term facilities, at 23% and 77%, respectively. Short term facilities are predominately revolving credit facilities which finance working capital needs and specific ongoing

Source: Consolidated statement of financial position (Appendix B) projects. At the end of 2017, an amount of EUR 89 million related to the syndicated bond loans, received by Corinth Pipeworks and Hellenic Cables in 2013, was transferred to short term borrowings as based on the repayment plans is payable during 2018. Corinth Pipeworks and Hellenic Cables are currently in the final stage of negotiations with the banks in order to achieve the conversion of a significant portion of its short-term borrowings to long term. Management of both subsidiaries consider that these negotiations will be successfully concluded in 2018.

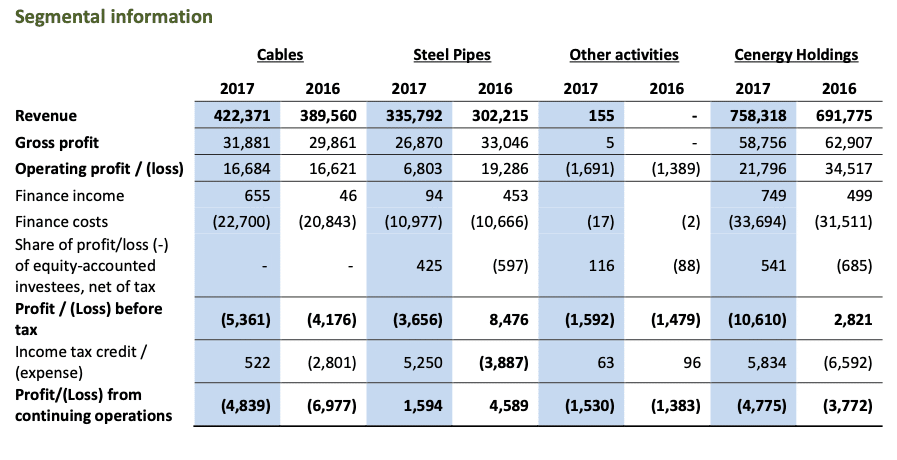

Performance by business segment

Cenergy Holdings’ financial results are influenced by the performance of its subsidiaries, which in turn, is significantly affected by market conditions in each subsidiary’s respective segment. Cenergy Holdings’ portfolio operates under the following organisational structure which includes three business segments:

- Steel pipes: Corinth Pipeworks engages in the production of steel pipes for the transportation of natural gas, oil and water networks, as well as steel hollow sections which are used in construction projects.

- Cables: Hellenic Cables, its subsidiaries, and Icme Ecab S.A. (hereafter “Icme Ecab”) constitute one of the largest cable producers in Europe, manufacturing power, telecommunication and submarine cables, as well as enamelled wires and compounds.

- Other activities: The segment includes the activities of both the holding company and subsidiary VET S.A. – which only holds investment property – that do not apply to either the steel pipes or cables segment.

Steel pipes

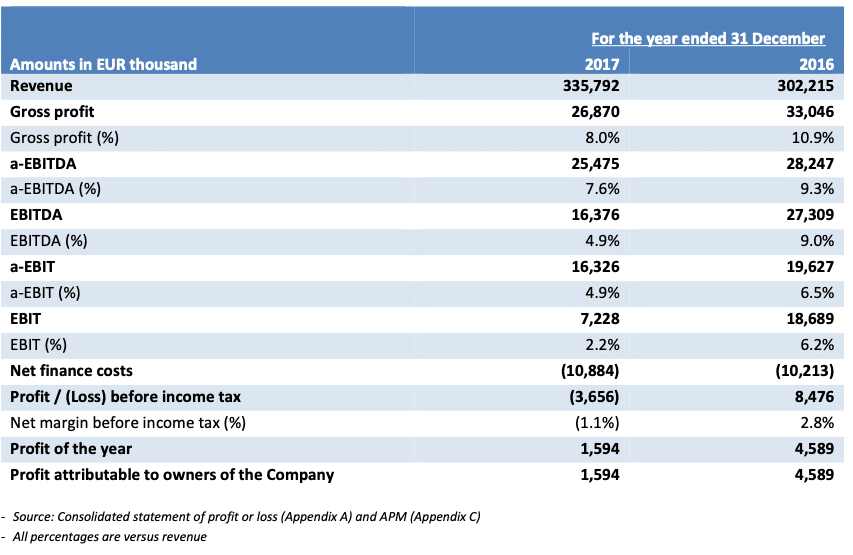

Revenue amounted to EUR 336 million in 2017, an 11% increase year-on-year (2016: EUR 302 million).

Gross profit amounted to EUR 27 million in 2017, a 19% decrease compared to 2016 (EUR 33 million), mainly driven by a different mix of energy projects and the severe change in the USD – EUR exchange rate which put significant pressure on profit margins in markets dominated by the US Dollar. The decrease in gross profit resulted in a 10% decrease in adjusted EBITDA, which amounted to EUR 25.5 million in 2017, down from EUR 28.2 million in 2016. A loss before income tax of EUR 3.7 million was recorded for 2017, compared to a profit of EUR 8.5 million in 2016. This decline is attributable to the above-mentioned factors, the increased finance costs and the exceptional impairment loss on receivables of EUR 8.9 million, as mentioned in page 5. The impact of this impairment loss on the annual results was partially offset by the recognition of a deferred tax asset on the total amount of impairment booked for the certain receivable, which amounted to EUR 5.6 million. Net debt decreased by EUR 12 million to EUR 125 million at the year’s end, driven by increased cash inflows from operating activities.

During 2017, long-term planning and strategic investments were completed at Corinth Pipeworks, with the aim of providing high added value products.

Within only two years of completing the new LSAW pipe mill investment, an intensive qualification programme by a number of large Oil and Gas companies commenced and is still ongoing. Over a short period of time, these qualifications have enabled the segment to effectively compete for important projects globally in an intensely competitive environment.

Pipe production for the Trans Adriatic Pipeline (TAP), the biggest project ever commissioned to Corinth Pipeworks, was completed during the year, with the 28,600 pipes to be laid along 495 km manufactured and coated at Corinth Pipeworks’ facilities at both the HSAW and LSAW pipe mills.

An investment in a concrete weight coating facility, which provides a competitive advantage in the offshore pipeline market, was completed in 2017, and its first project has already concluded.

Corinth Pipeworks’ project to provide LSAW pipes to connect the Bosporus Straits, part of the TANAP pipeline to supply Europe with natural gas, was completed. A second LSAW offshore project, as part of the Leviathan pipeline in the Southeastern Mediterranean, was also completed, further strengthening the subsidiary’s position as a supplier of high quality pipes for offshore projects.

The Baltic region will be an area of increased focus for the subsidiary going forward. This was demonstrated by the signing of an agreement with Baltic Connector and Elering to manufacture and supply steel pipes for the Balticconnector offshore pipeline project. The project, which includes the supply of pipe material for the 77km offshore pipeline from Finland to Estonia, is one of the biggest within the Balticconnector project. The pipes for the offshore pipeline will be manufactured in 2018 at Corinth Pipeworks’ plant in Greece with installation work expected to commence in 2019.

Recently, Corinth Pipeworks was awarded two offshore projects by Subsea 7 for the manufacture and supply of steel pipes for 39km pipelines in the North Sea area. The pipes will be manufactured during 2018 at Corinth Pipeworks’ plant in Greece with installation scheduled in 2019-2020.

The summary consolidated statement of profit or loss of the steel pipes segment is as follows:

The global economic environment remains volatile and low oil and natural gas prices, although higher than 2016 levels, do not support the implementation of significant projects in the energy sector. However, in 2018 Corinth Pipeworks will continue its focus on achieving growth through the penetration of new geographical and product markets.

Corinth Pipeworks is now a significant supplier for offshore pipelines, and projects are expected in regions such as the North Sea and Norwegian Sea, as well as the SE Mediterranean area, in the year ahead.

Projects secured for 2018 signal a positive outlook for the year. The TAP pipeline to transport Azeri gas to Europe and its interconnections to various countries is expected to present further opportunities throughout the year. Although the protectionist sentiment expressed in some markets may present uncertainty, the subsidiary is monitoring this closely and is prepared to meet this challenge positively. Raw materials prices remain high, which may negatively affect profit margins.

Corinth Pipeworks is well positioned to utilise its significant production capacity and focus on product diversification to enter new markets.

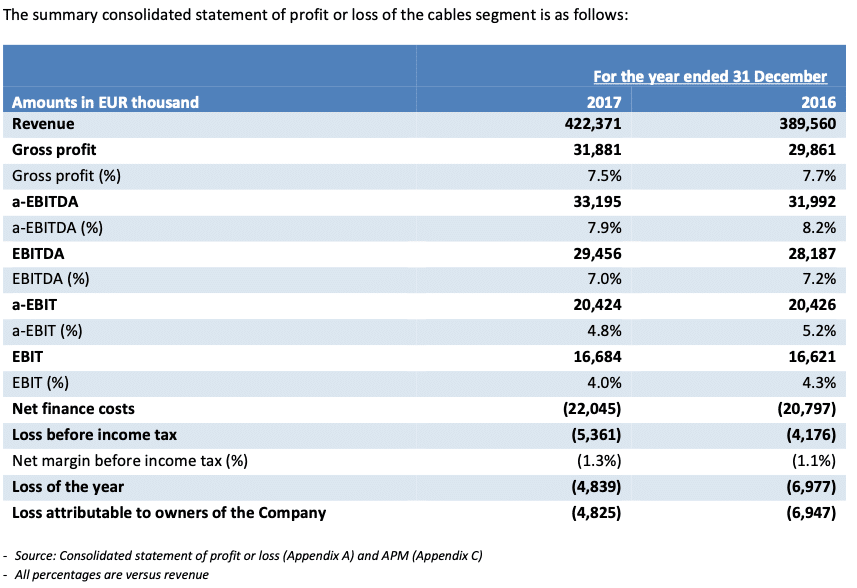

Cables

During 2017, the cables project-based business performed better than in 2016 despite delays in the award of certain already scheduled projects, which are currently still in the tendering phase. The commodities business was affected by low sales volumes in its main markets. The profitability of the segment, in terms of adjusted EBITDA, saw a 4% increase year- on-year.

The execution of new projects, including the Kafireas project and several other submarine projects during the second half of 2017, led to a notable improvement in results from the first half of the year (H2 2017 adjusted EBITDA: EUR 22 million while in H1 2017 a-EBITDA: EUR 11 million). However, a significant contraction in the sales volumes of medium and low voltage power cables in Germany, the UK, Austria, Italy and Romania, continued to affect the performance for the period.

Despite improved profitability in the second half of the year, and the commencement of various onshore and offshore projects, Fulgor’s plant operated at low utilization capacity during 2017 which adversely affected the full year results. However, the recent award to Hellenic Cables of a contract to supply 220kV submarine cables for the Modular Offshore Grid (MOG) in the Belgian part of the North Sea on behalf of the Belgian transmission system operator Elia, indicates the segment’s ability to provide cost-effective, reliable and innovative solutions to meet the changing needs of the offshore sector and take advantage of the marked shift in submarine power transmission requirements from 150kV to 220kV.

Finally, strong market demand for telecom and signalling cables in Europe had a positive effect on the segment’s margins.

Revenue for the period increased by 8.4% year-on-year to EUR 422 million, (2016: EUR 390 million), whilst adjusted EBITDA amounted to EUR 33.2 million versus EUR 32 million in 2016. Net finance costs increased by EUR 1.2 million compared to 2016 amounting to EUR 22 million. As a result, loss before income tax for 2017 was EUR 5.3 million in 2017, compared to loss before income tax of EUR 4.2 million recorded in 2016.

Throughout this period, Hellenic Cables and Fulgor continued the execution of significant contracts on behalf of TenneT for the supply of offshore wind farm export cable connections, and Energinet.dk. for a cable connection between Denmark and Sweden and the replacement of overhead lines within Denmark. In addition to this, the cable interconnection of an offshore wind farm in the UK was concluded in April 2017, and in November 2017 a second contract for the supply of an additional cable for this project was signed. Fulgor was awarded a turnkey contract by Enel Green Power Hellas to provide a submarine cable interconnection to the Greek National Grid from the Kafireas wind complex located at Karystos, Evia, Greece. Hellenic Cables will also supply significant quantities of high and medium voltage land cables for the onshore part of this project.

Investments in 2017 reached EUR 17.8 million in the cables segment, largely attributable to capacity improvements at Fulgor’s plant in order to meet the expected future needs and productivity improvement projects at the Hellenic Cables, and Icme Ecab plants.

Net debt increased by EUR 15 million to EUR 255 million as at 31 December 2017, driven by increased working capital requirements for ongoing energy projects.

Looking forward, high demand for new offshore projects in Europe, primarily in the North Sea and Southern Europe, is expected to drive growth in the cables segment. This projection is supported by Hellenic Cables’ aforementioned contract win for the supply of submarine cables for the Modular Offshore Grid (MOG) project in the Belgian part of the North Sea.

The assignment of new projects (for which Hellenic Cables has already entered negotiations) and the successful completion of ongoing projects (the Kafireas project for Enel, BR2 & Trianel for Tennet and Oresund project for Energinet) remain key areas of focus for the cables segment.

In the cables products business, there are signs of recovery in the low and medium voltage cables markets in Western Europe which were constrained by competitive challenges in 2017. However, risks to recovery, such as uncertainty in the EU’s political environment and potential major changes in trade policies, as well as the broader impact of Brexit, persist.

To counterbalance challenges in the cables segment’s main markets, initiatives have been undertaken in order to enter into new geographical markets and improve the product portfolio through the development of high added value projects.

Subsequent events

At the beginning of 2018, an anti-dumping duty (AD) investigation of large diameter welded pipe (nominal diameter above 16.4”) against Greece and five other countries (Canada, China, India, Korea and Turkey) was initiated by the U.S. Department of Commerce based on petitions filed by six U.S. producers. Subsequently as a result of the above petitions, the United States International Trade Commission (USITC) determined affirmatively that there is a reasonable indication of material injury to the domestic U.S. industry by reason of imports of large diameter welded pipe from Canada, China, India, Korea and Turkey. For imports of large diameter welded pipe from Greece the USITC determined that there is a reasonable indication of threat of material injury to the domestic U.S. industry. Corinth Pipeworks is actively participating in and subject to the AD investigation as the sole producer of large diameter welded pipe in Greece. Furthermore, it is mentioned that in the ordinary course of things the antidumping investigations are normally lengthy, taking more than eight months to complete. Any assessment of the impact of the above investigation on Corinth Pipeworks’, Cenergy Holdings’ subsidiary, financial results is considered as premature.

On 8 March 2018, the US administration exercised its authority under Section 232 of the Trade Expansion Act of 1962 to impose a 25 percent tariff on steel imports and a 10 percent tariff on aluminum imports in United States of America, with exemptions for Canada and Mexico. Based on these proclamations US Customs and Border Protection will begin collecting the applicable tariffs on 23 March 2018. On 18 March 2018, the U.S. Department of Commerce (DOC) announced the process for submission of requests for products exclusion from the tariffs on steel and aluminum product imports. The DOC published the procedures in the Federal Register and started accepting exclusion requests from U.S. industry on 19 March 2018.

Cenergy Holdings is closely monitoring the situation and the new market conditions, as it does on a regular basis, since Corinth Pipeworks is an established supplier in the US steel pipes market. It is noted that the subsidiary mainly supplies products to its US customers that cannot be manufactured in the US, such as 26-inch pipelines. Corinth Pipeworks has already initiated all actions required in cooperation with its US customers in order for them to obtain relief from the tariffs on imports of steel pipes since the products sold in the US market by Corinth Pipeworks are customized unique products which are not produced by local US pipe mills.

Despite the uncertainty surrounding the steel market today, based on the current assessment of available information, the above facts will have limited impact on Corinth Pipeworks’, Cenergy Holdings’ subsidiary, financial results, due to the actions undertaken in order to secure Company’s financial position and mitigate any potential adverse effects.

There are no subsequent events affecting the consolidated financial information presented in this press release.

Outlook

Improvements in Cenergy Holdings’ operating environment are expected to continue to drive demand for new offshore projects in Europe in 2018. Hellenic Cables has already entered into negotiations for several new projects and the cables segment will maintain its current focus on undertaking new projects and entering new markets.

Although risks, such as uncertainty in the EU’s political environment, remain, the recovery of the cables products market in Western Europe is encouraging and is expected to present further opportunities.

Despite persistently low oil and natural gas prices, which may continue to have an adverse effect on the implementation of large energy sector projects, Corinth Pipeworks will maintain a disciplined approach to growing its footprint and has already secured a number of significant projects for 2018.

Regarding the finance of project-based activities, the Company has secured the necessary funds through project finance facilities, while as mentioned earlier, Corinth Pipeworks and Hellenic Cables are currently in the final stage of negotiations with the banks in order to achieve the conversion of a significant portion of its short-term borrowings to long term.

Finally, 2018 is expected to be a year of consolidation and growth for the Company. Although challenges remain, overall the operating environment is expected to gradually improve as European markets continue to grow, and positive trends in demand and price continue.

Cenergy Holdings and its portfolio companies are very well placed to take advantage of improving market conditions and further their ambitions to become world leaders in energy transfer solutions and data transmission.

Statement of the Auditor

The statutory auditor, KPMG Bedrijfsrevisoren – Réviseurs d’Entreprises, represented by Benoit Van Roost, has confirmed that the audit procedures on the consolidated financial statements, which have been substantially completed, have not revealed any material misstatement in the accounting information included in the Company’s annual announcement.

The Annual Financial Report for the period 1 January 2017 – 31 December 2017 shall be published on 30 April 2018 and will be posted on the Company’s website, www.cenergyholdings.com, on the website of the Euronext Brussels europeanequities.nyx.com, as well as on the Athens Stock Exchange website www.helex.gr.

About Cenergy Holdings

Cenergy Holdings is a Belgian holding company listed on both Euronext Brussels and Athens Stock Exchange, investing in leading industrial companies, focusing on the growing global demand of energy transfer, renewables and data transmission. The Cenergy Holdings portfolio consists of Corinth Pipeworks and Hellenic Cables, companies positioned at the forefront of their respective high growth sectors. Corinth Pipeworks is a world leader in steel pipe manufacturing for the oil and gas sector and major producer of steel hollow sections for the construction sector. Cablel® Hellenic Cables is one of the largest cable producers in Europe, manufacturing power and telecom cables as well as submarine cables for the aforementioned sectors. For more information about our company, please visit our website at www.cenergyholdings.com

Contacts

For further information, please contact:

Sofia Zairi

Head of Investor Relations

Tel: +30 210 6787111, 6787773 Email: ir@cenergyholdings.com

Cenergy Holdings has early adopted IFRS 15 Revenue from Contracts with Customers with a date of initial application of 1 January 2017. Cenergy Holdings applied IFRS 15 using the cumulative effect method, i.e. by recognising the cumulative effect of initially applying IFRS 15 as an adjustment to the opening balance of equity at 1 January 2017. Therefore the comparative information has not been restated and continues to be reported under IAS 18 and IAS 11. The impact of the early adoption on consolidated key figures is as follows:

- Revenue for 2017: EUR +38.7 million

- Gross profit for 2017: EUR +5.1 million

- Result before tax for 2017: EUR +5.1 million

- Result after tax for 2017: EUR +3.8 million

- Equity as of 1 January 2017: EUR -0.1 million

The details of the significant changes and quantitative impact will be set out in the annual report.

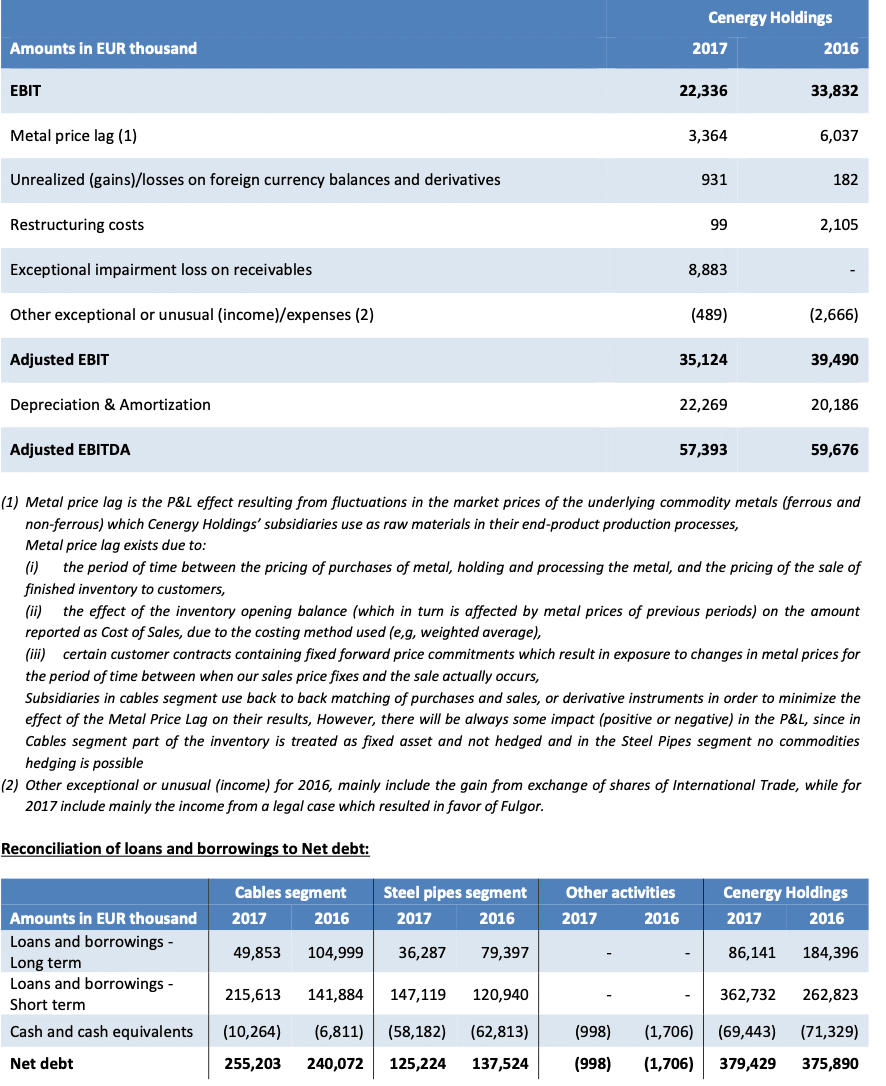

Appendix C – Alternative performance measures

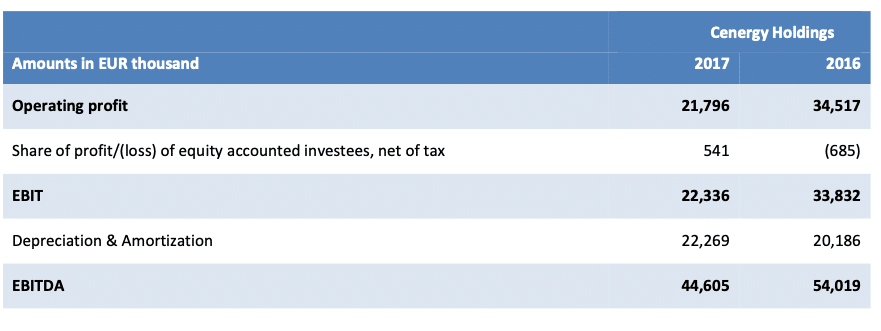

In addition to the results reported in accordance with International Financial Reporting Standards (“IFRS”) as adopted by the European Union, this press release includes information regarding certain alternative performance measures which are not prepared in accordance with IFRS (“Alternative Performance Measures” or “APMs”). The APMs used in this press release are: Earnings Before Interest and Tax (EBIT), Adjusted EBIT, Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA), Adjusted EBITDA and Net debt. Reconciliations to the most directly comparable IFRS financial measures are presented below.

We believe these APMs are important supplemental measures of our operating and financial performance and are frequently used by financial analysts, investors and other interested parties in the evaluation of companies in the steel pipes and cables production, distribution and trade industries. By providing these measures, along with the reconciliations included in this appendix, we believe that investors will have better understanding of our business, our results of operations and our financial position. However, these APMs shall not be considered as an alternative to the IFRS measures.

EBIT, Adjusted EBIT, EBITDA and Adjusted EBITDA have limitations as analytical tools, and investors should not consider it in isolation, or as a substitute for analysis of the operating results as reported under IFRS and may not be comparable to similarly titled measures of other companies.

EBIT is defined as the Operating result as reported in the Consolidated statement of profit or loss plus Share of profit/(loss) of equity accounted investees, net of tax.

Adjusted EBIT is defined as EBIT excluding restructuring costs, metal price lag, unrealised (gains)/losses on foreign currency balances and derivatives and other exceptional or unusual (income)/expenses.

EBITDA is defined as EBIT plus depreciation and amortisation.

Adjusted EBITDA is defined as EBITDA excluding restructuring costs, metal price lag, unrealised (gains)/losses on foreign currency balances and derivatives and other exceptional or unusual (income)/expenses. This year Adjusted EBIT is also presented, as it is considered as an additional relevant APM. All APMs are consistently calculated year by year.

Reconciliation of Operating Profit to EBIT and EBITDA:

Reconciliation of EBIT to a-EBIT and a-EBITDA: