Regulatory News

Financial results for the year ended 31 December 2018

Brussels, 20 March 2019

Record year for revenue, strong pipeline for 2019

Cenergy Holdings S.A. (Euronext Brussels, Athens Stock Exchange: CENER), hereafter “Cenergy Holdings” or “the Company”, today announces its financial results for the year ended 31 December 2018.

Highlights

- 27% revenue growth driven by higher sales volume in all key product categories

- EUR 640 million order backlog as at 31 December 2018

- Enhanced operational profitability reflected in 9% adjusted EBITDA growth

- Consolidated net profit after tax of EUR 6.9 million vs. a EUR 4.8 million loss after tax in 2017 Improved financing terms following successful reprofiling of EUR 118.7 million debt

* For the definitions of the APMs used, refer to Appendix C.

Overview

2018 was a turnaround year for Cenergy Holdings. Despite a number of external headwinds, the Company achieved record sales volumes in all key product categories. The 27% year-on-year revenue growth allowed Cenergy Holdings to return to profitability and improve financing terms on a portion of its debt.

The steel pipes segment celebrated its 50th anniversary in 2018 with record sales and production output, demonstrating resilience in volatile market conditions characterised by intense competition. Corinth Pipeworks’ growth prospects remained unaffected by strong protectionist measures, such as the antidumping investigation and the tariffs in the USA. The segment leveraged its strong reputation and focused strategy to remain at the forefront of technological innovation in the sector, allowing Corinth Pipeworks to not only maintain its position as a top-quality producer, but also increase its market share.

In the offshore cables business, delays in the award of various turnkey projects in submarine cables caused the Fulgor plant to operate at low capacity utilization levels for most of 2018. This trend reversed in the second semester of the year, resulting in Hellenic Cables and Fulgor winning a large number of submarine cables projects in Greece, the Netherlands and Belgium and returning to full capacity utilization for 2019. Demand for cable products was better than expected in the Greek market and saw a moderate increase in other traditional markets in Central Europe.

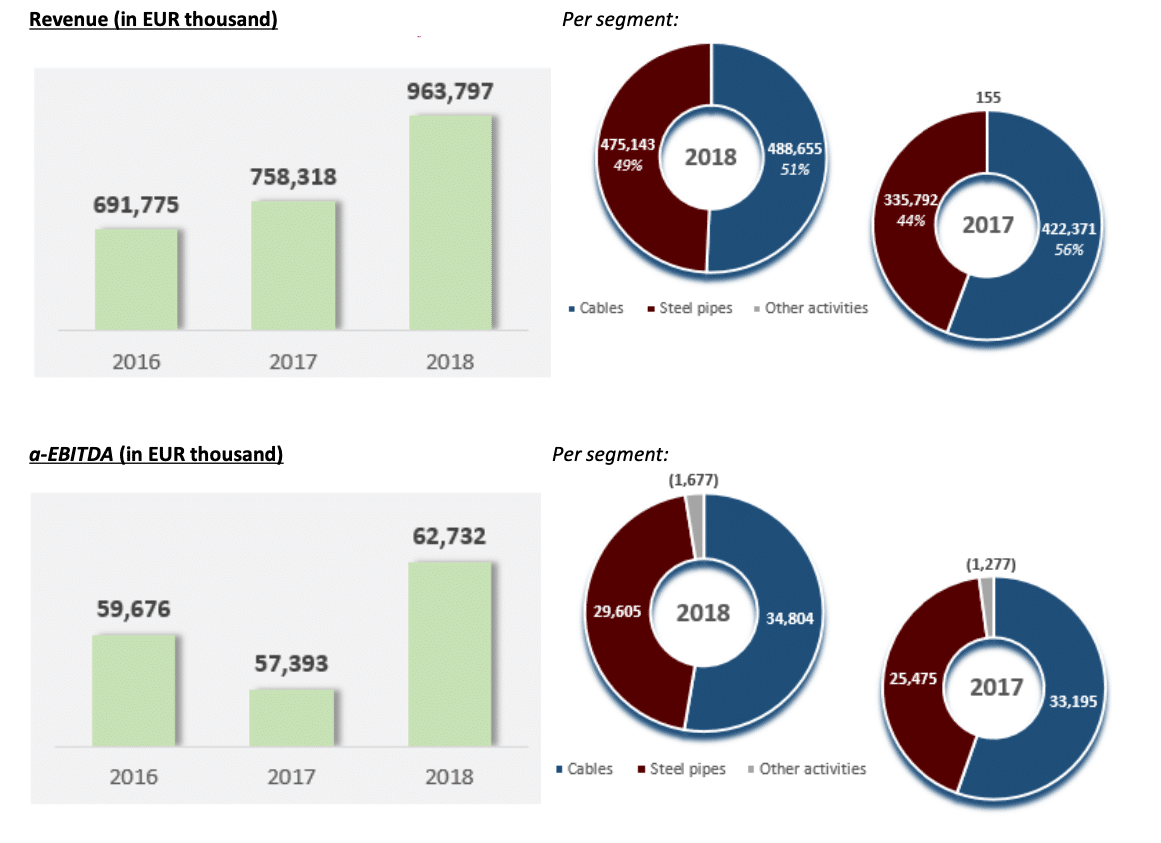

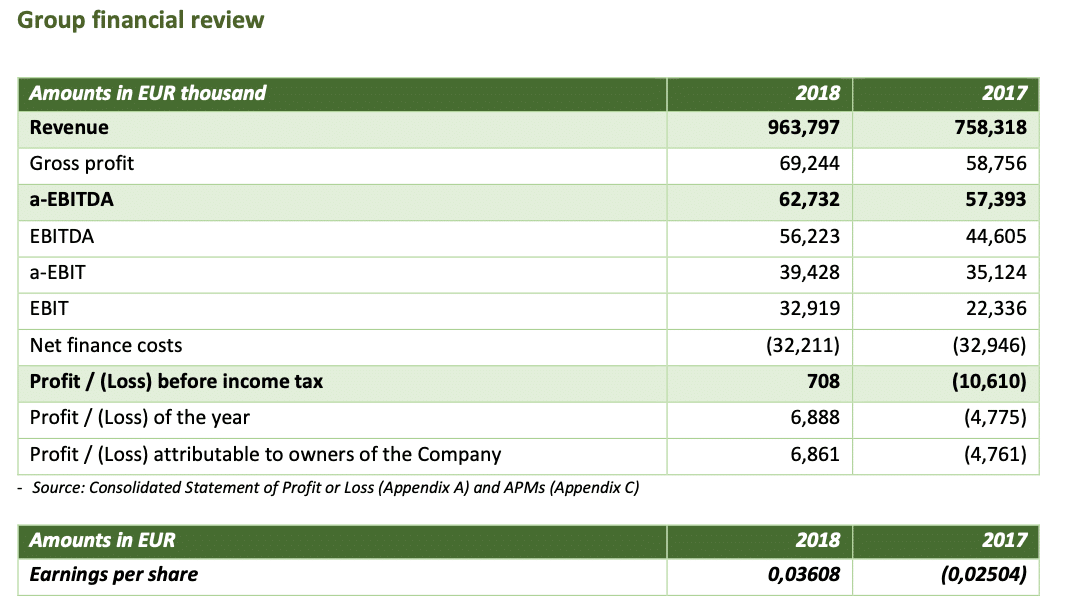

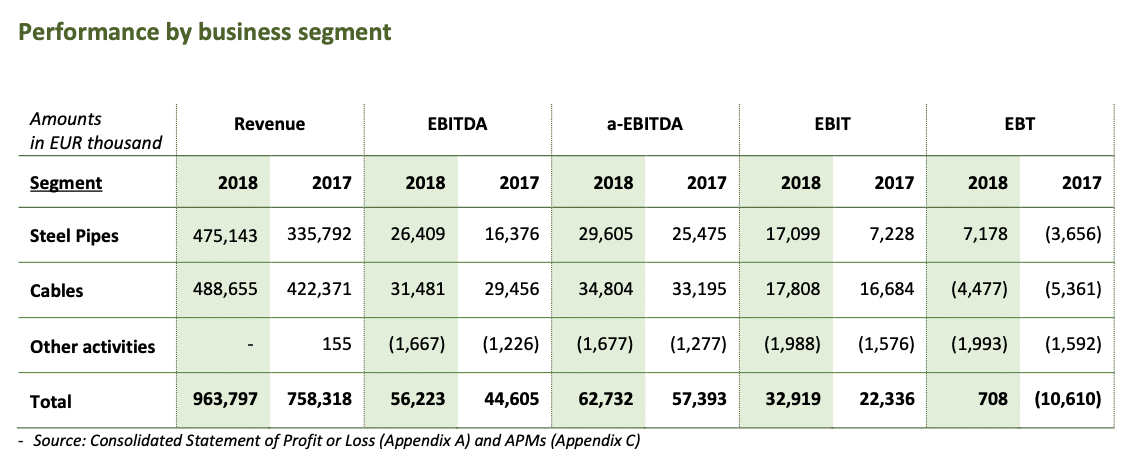

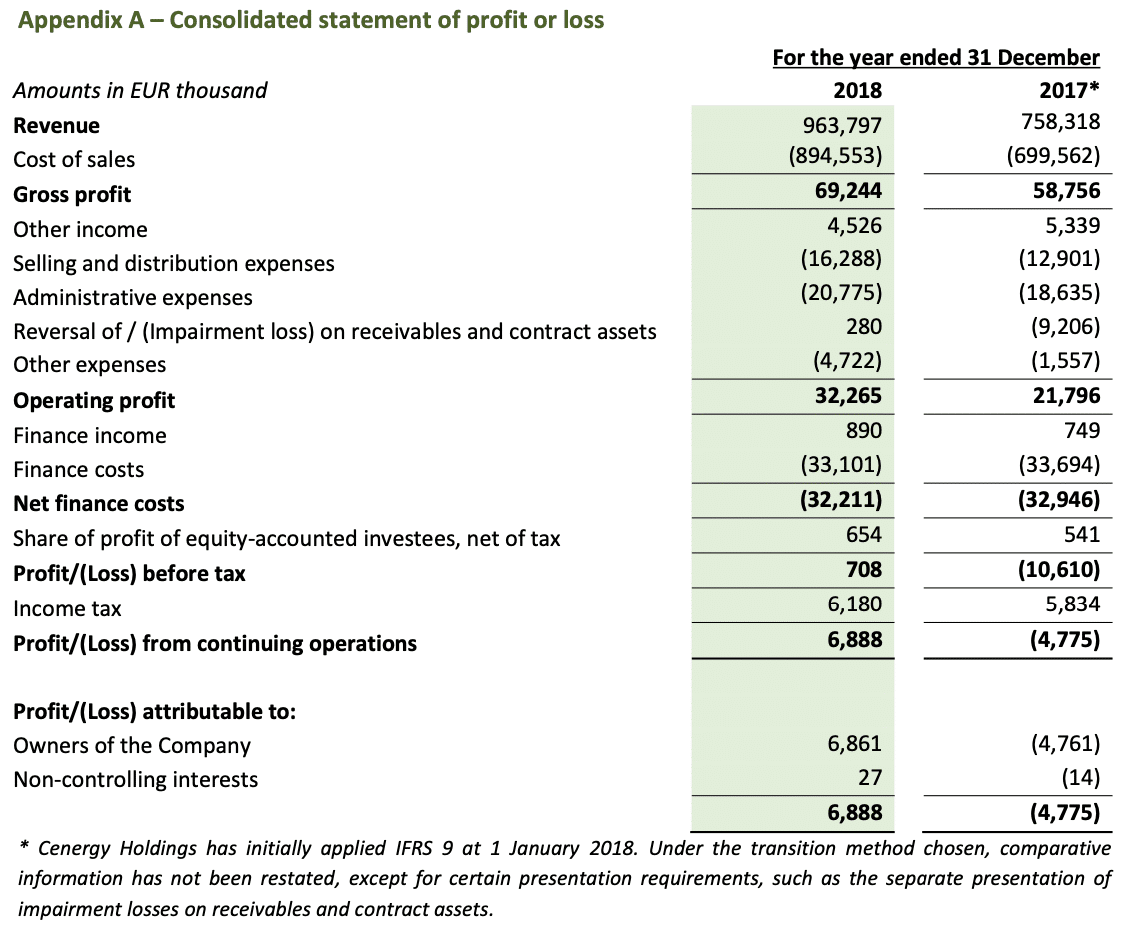

Consolidated revenue for 2018 increased by 27% to EUR 964 million, reflecting strong sales of steel pipes for energy projects and higher sales volume of cables products.

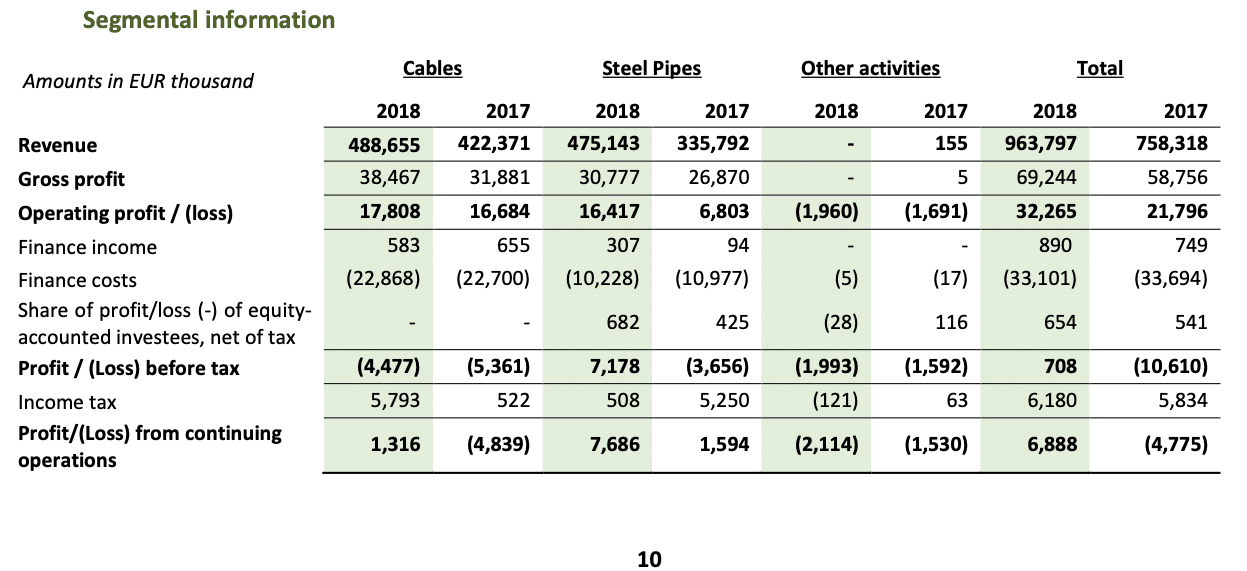

Adjusted EBITDA increased by over 9% to EUR 62.7 million in 2018. The steel pipes segment more than doubled its operational profit before financing costs to EUR 16.4 million in 2018. That of the cables segment also saw a marginal increase to EUR 17.8 million, from EUR 16.7 million in 2017.

Through the reprofiling of EUR 118.7 million of debt during 2018, Cenergy Holdings achieved longer maturities and lower interest costs, allowing the Company to keep its net finance costs virtually unchanged at EUR 32.2 million (2017: EUR 32.9 million) despite the 25% higher net debt at EUR 473 million on December 31, 2018 driven by the capital expenditure programme implemented during 2018 and higher working capital related to record sales.

Consequently, the Company recorded a modest profit before income tax of EUR 0.7 million in 2018 compared to a loss before tax of more than EUR 10.6 million in 2017.

Profit for the period amounted to EUR 6.9 million in 2018 compared to a loss after tax of EUR 4.8 million in 2017. The income tax credit for the period amounts to EUR 6.2 million mainly due to deferred tax credit of EUR 3.5 million deriving from the recalculation of deferred tax following the change in tax rates from 2019 onwards in Greece and the use of tax losses for which no deferred tax asset was previously recognised by subsidiaries in the cables segment.

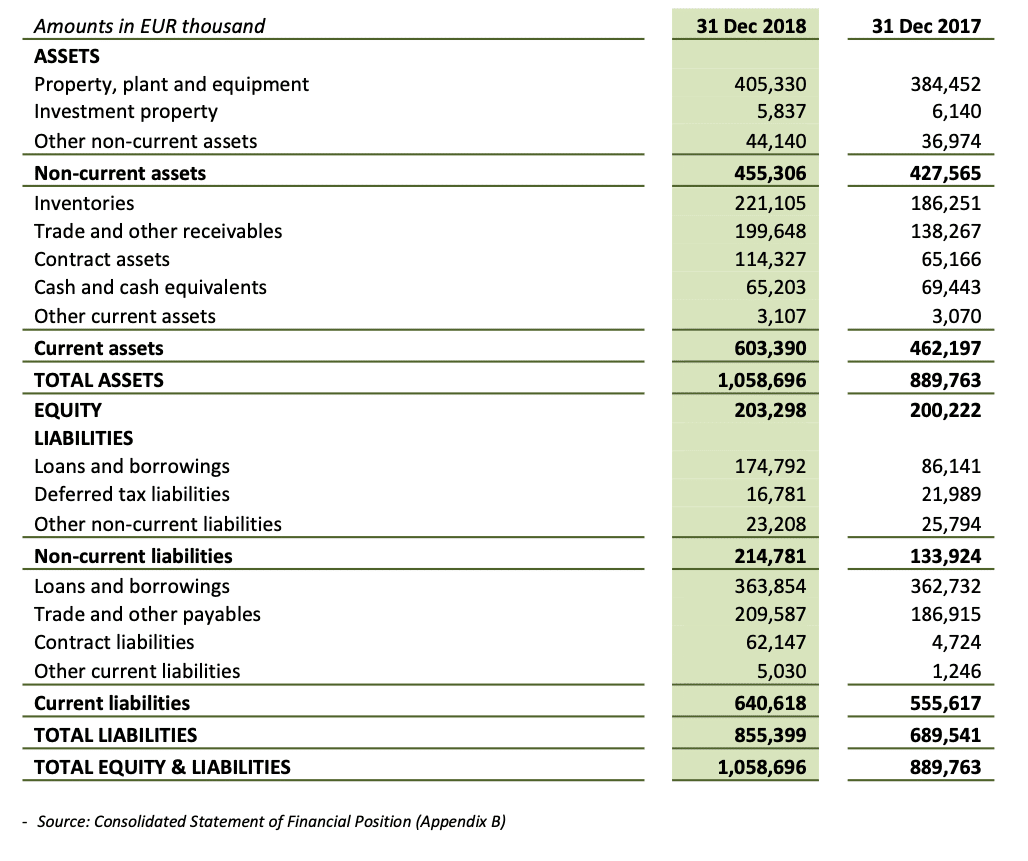

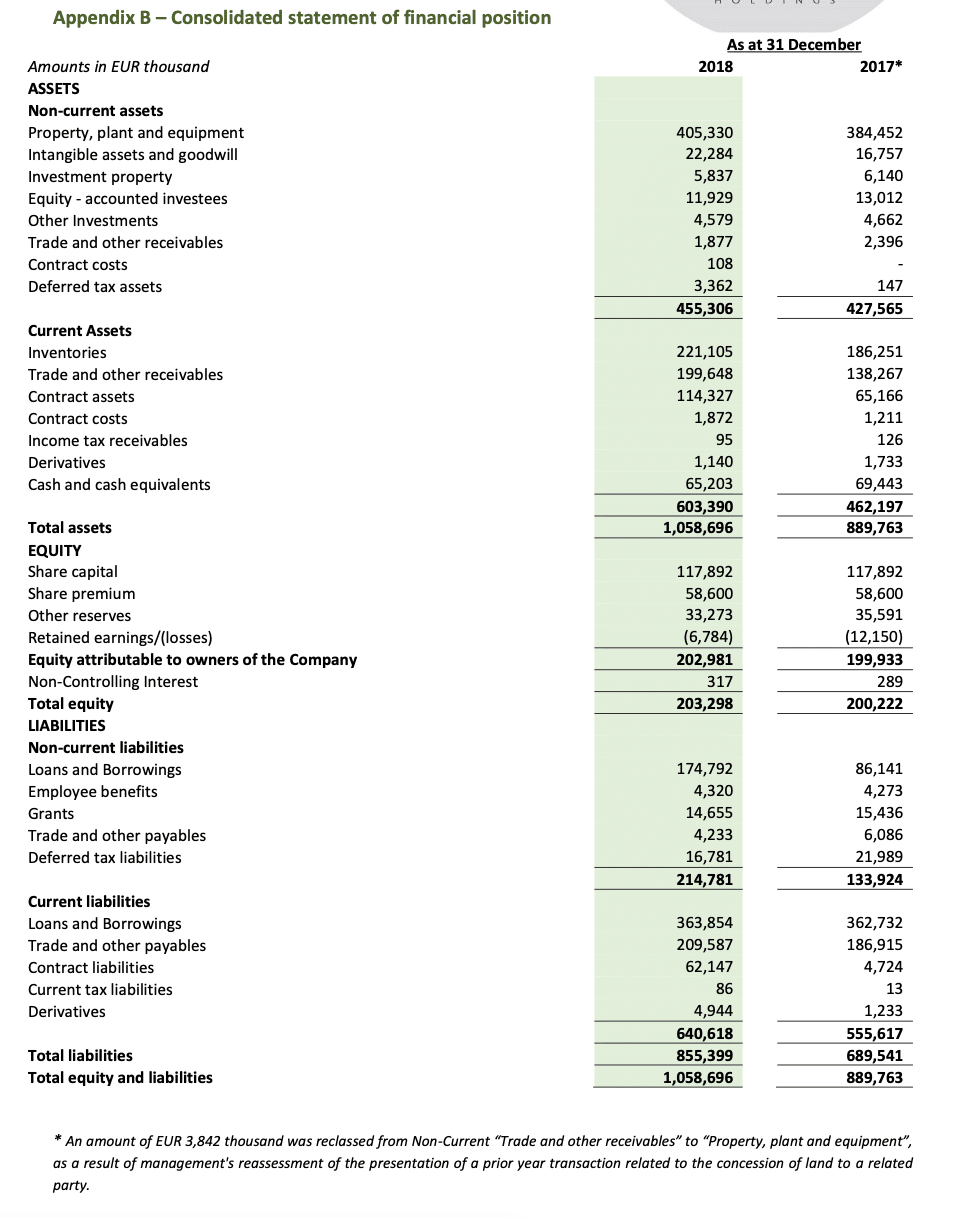

Non-current assets increased from EUR 428 million as of 31 December 2017 to EUR 455 million at 31 December 2018.

Capital expenditure during the year amounted to EUR 44 million for the cables segment and EUR 6 million for the steel pipes segment, while consolidated depreciation & amortization for 2018 amounted to EUR 24 million.

Working capital (incl. contract assets & liabilities) rose considerably by 33% year-on-year to EUR 263 million at 31 December 2018. This increase was driven by inventories necessary to execute the orders scheduled for 2019 and increased revenue during the last quarter of 2018.

Net debt increased to EUR 473 million at 31 December 2018 (31.12.2017: EUR 379 million). Cenergy Holdings companies’ debt on 31 December 2018 comprised of long term and short-term facilities, at 32% and 68%, respectively, an improvement versus last year’s mix. Short term facilities are predominately revolving credit facilities which finance working capital needs and specific ongoing projects.

During 2018, the negotiations with several banks regarding the conversion of a significant portion of short-term borrowings to long-term ones were successfully concluded. As a result, debt amounting to EUR 118.7 million (EUR 87.9 million related to cables and EUR 30.8 million related to the steel pipes segment) was successfully reprofiled. This reprofiling concerned several entities (Hellenic Cables, Icme Ecab and Corinth Pipeworks) and involved improved pricing terms as well as maturities longer than five (5) years.

Steel pipes

Revenue for the steel pipes segment amounted to EUR 475 million in 2018, a 41% increase year-on-year (2017: EUR 336 million).

Gross profit amounted to EUR 31 million in 2018, a 15% increase compared to 2017 (EUR 27 million), mainly driven by the significant increase in revenue but partially offset by the increased costs related to the execution of complex offshore projects. The increase in gross profit translated into a 16% increase in adjusted EBITDA, which amounted to EUR 29.6 million in 2018, up from EUR 25.5 million in 2017. Compared to a loss before tax

of EUR 3.7 million in 2017, in 2018 a profit before tax of EUR 7.2 million was recorded, attributable to all the factors stated above.

Net debt increased by EUR 58 million to EUR 183 million at the year-end, driven by the significant working capital needed for the execution of the increased number of projects for the year. During 2018, Corinth Pipeworks achieved a debt reprofiling of EUR 30.8 million through a 5-year extension of the syndicated bond loan initially received in 2013 with improved pricing terms.

Throughout 2018, Corinth Pipeworks operated in a business environment characterized by strong competition and volatile market conditions caused by import duties imposed by a number of countries worldwide. The company’s ability to maintain its position as a top-quality steel pipe producer and achieve market share growth in such adverse market conditions are testimony to its long track record in the industry, its strong reputation and focus on technological innovation.

In 2018, the company was awarded its first deep sea offshore pipes project and production started. “Karish” is both a strategic project for the South-eastern Mediterranean and a highly demanding engineering task (a pipeline at a maximum depth of 1,750m) that only a few companies worldwide can accomplish.

During the year, it also successfully manufactured steel pipes for the Balticconnector offshore project, a 77 km offshore pipeline from Finland to Estonia and one of the biggest within the Baltic region. The Company also manufactured and supplied steel pipes for two major oil pipeline projects in North America, both by Plains All American: the Cactus II pipeline (750 km) and a pipeline from Wink to McCamey (127 Km).

At the same time, Corinth Pipeworks was able to re-establish its presence in the North African market with the supply of pipes for a gas pipeline project in Algeria, and to increase its presence in Europe, with the implementation of a series of projects, mainly in Italy and Poland.

The Company’s market position was further reinforced by qualifications received from major companies in the energy sector, including BP, Shell and Technip, as well as the manufacture of products for new applications, such as HFI pipes for reel-lay applications and LSAW pipes for offshore projects. In conjunction with the addition of the concrete weight coating facility in Corinth Pipeworks’ plant, these achievements give the Company a distinct competitive advantage with respect to offshore projects.

Cables

Revenue for the cables segment increased by 16% year-on-year to 489 million in 2018, driven mainly by the increased sales volumes in the cable product business.

As for the project business, 2018 saw the successful completion of significant assignments, such as the interconnection of the wind parks Borkum Riffgrund 2 and Trianel (on behalf of TenneT). In contrast, a number of high-voltage project awards expected in H1 2018 were postponed, causing the Fulgor plant to operate at low utilization capacity during 2018. This adversely affected results for the entire fiscal year. During H2 2018, however, a significant number of projects were secured in the submarine cables segment, allowing Fulgor to return to high capacity utilization for 2019. These awards are testament to Hellenic Cables’ and Fulgor’s ability to provide cost-effective, reliable and innovative solutions that meet the changing needs of the offshore sector and allow the companies to leverage market opportunities.

Consequently, the cables segment recovered from a moderate first half, with adjusted EBITDA and earnings before tax for H2 2018 of EUR 20.8 million (H1 2018: EUR 14 million) and EUR 2.5 million (H1 2018: EUR -7 million), respectively. Overall, adjusted EBITDA increased by 5% year-on-year to EUR 34.8 million in 2018 and was coupled with stable operational profitability.

The cables product business achieved 6.3% higher sales volumes compared to 2017 along with an improved sales mix. The main drivers of such an improved performance include:

- Better than expected performance in the Greek market, due to increased demand from contractors and the building sector;

- A moderate increase in the traditional markets (Germany and Central Europe), and further penetration into new markets (Nordic countries and the Middle East); and

- Solid demand for telecom and signalling cables in Europe and the Middle East.

During 2018, the metal price lag remained negative (EUR -1.7 million) but improved compared to strong losses recorded in 2017 (EUR -3.1 million).

Net finance costs for 2018 amounted to EUR 22.3 million, in line with the previous year, while depreciation & amortization for 2018 amounted to EUR 14.5 million.

Loss before income tax in 2018 was EUR 4.5 million, compared to a loss before income tax of EUR 5.3 million recorded in 2017. Finally, net profit after tax amounted to EUR 1.3 million versus losses after tax of EUR 4.8 million in 2017.

Investments in the cables segment in 2018 reached EUR 44 million, largely attributable to the expansion and upgrade of the submarine business unit in Fulgor’s plant to meet expected future demand levels and improve productivity at the Hellenic Cables and Icme Ecab plants.

Net debt increased by EUR 36 million to EUR 291 million as at 31 December 2018, mainly due to the financing of the aforementioned capital expenditure programme.

During 2018, a major debt re-profiling (EUR 87.9 million) was completed and achieved:

- a 5-year extension of the syndicated bond loan initially received in 2013 with a remaining balance of EUR 55.1 million;

- a new 7-year bond loan of EUR 25 million by a major Greek bank; and

- a new 5-year secured bank loan of EUR 7.8 million by a major Romanian bank to Icme Ecab.

The above reprofiling carries improved pricing terms for all the aforementioned facilities and is expected to benefit the segment’s future liquidity and profitability.

Subsequent events

On February 21st, 2019, the U.S. Department of Commerce (the ‘DoC’) announced its affirmative final determinations in the antidumping duty investigations initiated in early 2018 on imports of large diameter welded pipe from Canada, Greece, Korea and Turkey. Similar determinations about imports from China and India were announced in December 2018. In the Greece investigation, the DoC assigned an antidumping duty rate of 9.96% for Corinth Pipeworks S.A.

The U.S. International Trade Commission (the ‘ITC’) is scheduled to make its final determinations on or about April 5, 2019. If the ITC makes an affirmative final determination that imports of large diameter welded pipe from Greece threaten material injury to the domestic industry, the DoC will issue an anti-dumping order with the above percentage. If, however, the ITC makes a negative determination of injury, the investigation will be terminated.

Outlook

In the steel pipes segment, Corinth Pipeworks enters the second fifty years of its history with excellent prospects for sustainable growth based on emerging market opportunities, a strong backlog of orders, the highly advanced production base and experienced and motivated personnel.

Looking ahead to 2019, the increased level of protectionism in countries until recently committed to free trade has increased the level of uncertainty in the market. Despite this, Corinth Pipeworks remains focused on generating revenue growth through penetration of new geographical and product markets. The solid backlog of orders from 2018 and new orders secured for the supply of pipes in both offshore and onshore pipeline projects worldwide, give rise to cautious optimism for the coming year.

As for the cables segment, high demand for new offshore projects in Europe, primarily in the North Sea and South Europe, is expected to drive growth. Given the strong forecast of new projects, the considerable backlog of orders from 2018, and the growth potential of the offshore cables sector, the outlook for the business is positive. Fulgor’s return to high utilization capacity in 2019 is expected to drive the segment’s profitability for the coming year. As the execution of high voltage and extra high voltage orders secured during 2018 starts, the Thiva plant is also expected to operate at high utilization levels in 2019. The main focus for 2019 will, therefore, be on successful execution of existing projects.

Furthermore, in the cables products, there are signs of recovery in the low and medium voltage cables markets in Western Europe which were constrained by competitive challenges during the last two years.

Despite the current market volatility, Cenergy Holdings expects to maintain the positive momentum gained in 2018. Looking ahead, the Company will benefit from a solid order backlog generated during 2018 and remains well placed to take advantage of improving market conditions in the energy sector to further its companies’ ambitions of becoming world leaders in energy transfer solutions and data transmission.

Statement of the Auditor

The statutory auditor, KPMG Bedrijfsrevisoren – Réviseurs d’Entreprises, represented by Benoit Van Roost, has confirmed that the audit procedures on the consolidated financial statements, which have been substantially completed, have not revealed any material misstatement in the accounting information included in the Company’s annual announcement.

The Annual Financial Report for the period 1 January 2018 – 31 December 2018 shall be published on 24 April 2019 and will be posted on the Company’s website, www.cenergyholdings.com, on the website of the Euronext Brussels europeanequities.nyx.com, as well as on the Athens Stock Exchange website www.helex.gr.

About Cenergy Holdings

Cenergy Holdings is a Belgian holding company listed on both Euronext Brussels and Athens Stock Exchange, investing in leading industrial companies, focusing on the growing global demand of energy transfer, renewables and data transmission. The Cenergy Holdings portfolio consists of Corinth Pipeworks and Cablel® Hellenic Cables, companies positioned at the forefront of their respective high growth sectors. Corinth Pipeworks is a world leader in steel pipe manufacturing for the oil and gas sector and major producer of steel hollow sections for the construction sector. Cablel® Hellenic Cables is one of the largest cable producers in Europe, manufacturing power and telecom cables as well as submarine cables for the aforementioned sectors. For more information about our Company, please visit our website at www.cenergyholdings.com.

Contacts

For further information, please contact:

Sofia Zairi

Head of Investor Relations

Tel: +30 210 6787111, 6787773 Email: ir@cenergyholdings.com

Appendix C – Alternative performance measures

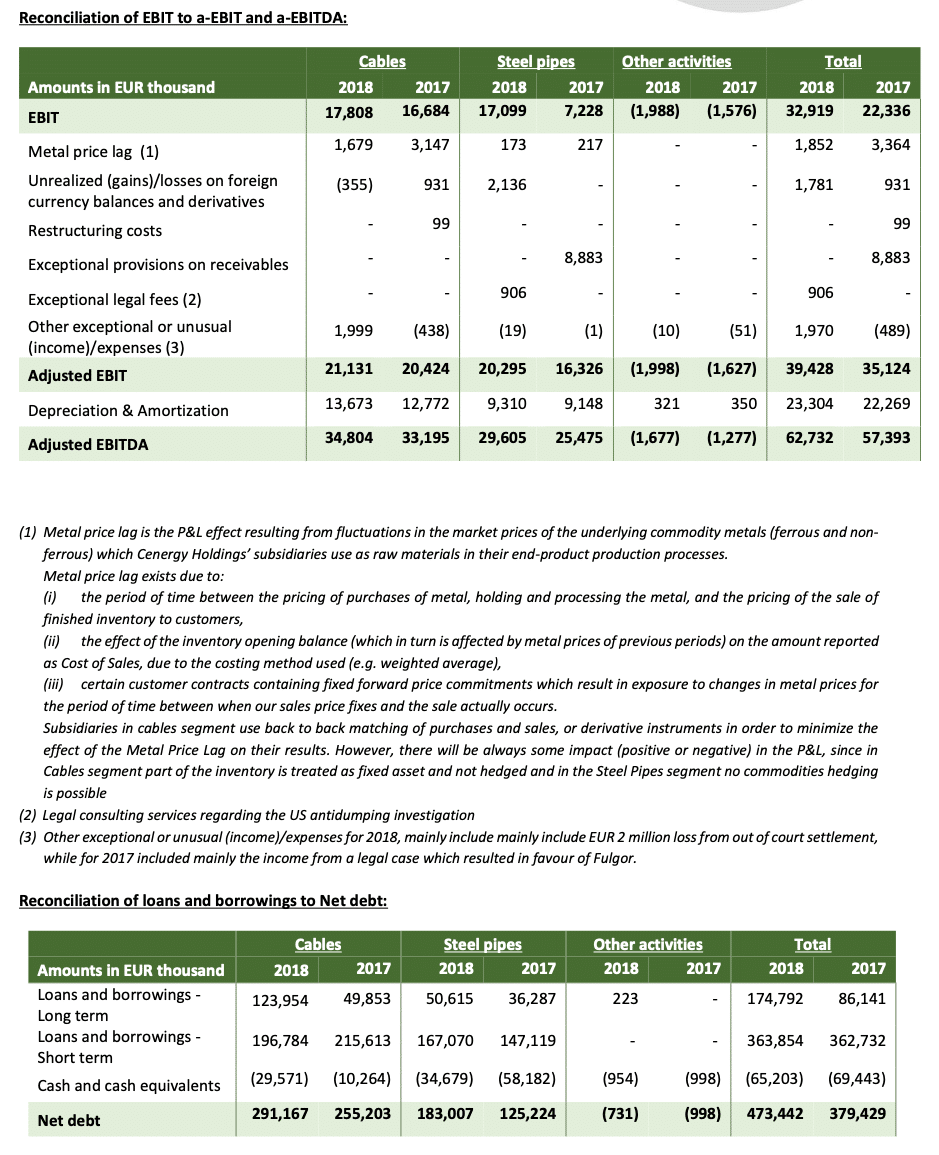

In addition to the results reported in accordance with International Financial Reporting Standards (“IFRS”) as adopted by the European Union, this press release includes information regarding certain alternative performance measures which are not prepared in accordance with IFRS (“Alternative Performance Measures” or “APMs”). The APMs used in this press release are: Earnings Before Interest and Tax (EBIT), Adjusted EBIT, Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA), Adjusted EBITDA and Net debt. Reconciliations to the most directly comparable IFRS financial measures are presented below.

We believe these APMs are important supplemental measures of our operating and financial performance and are frequently used by financial analysts, investors and other interested parties in the evaluation of companies in the steel pipes and cables production, distribution and trade industries. By providing these measures, along with the reconciliations included in this appendix, we believe that investors will have better understanding of our business, our results of operations and our financial position. However, these APMs shall not be considered as an alternative to the IFRS measures.

EBIT, Adjusted EBIT, EBITDA and Adjusted EBITDA have limitations as analytical tools, and investors should not consider it in isolation, or as a substitute for analysis of the operating results as reported under IFRS and may not be comparable to similarly titled measures of other companies.

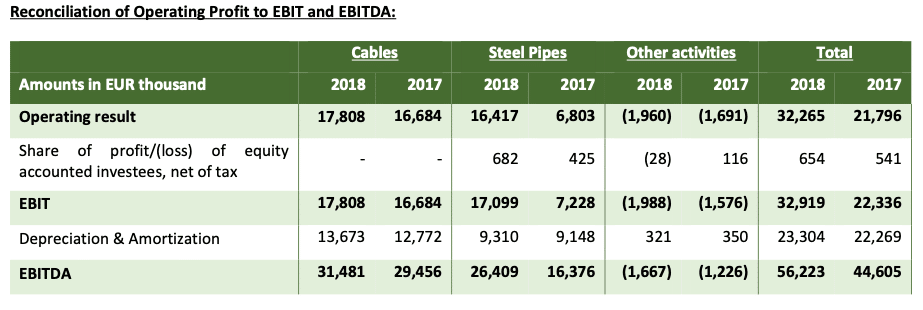

EBIT is defined as the Operating result as reported in the Consolidated statement of profit or loss plus Share of profit/(loss) of equity accounted investees, net of tax.

Adjusted EBIT is defined as EBIT excluding restructuring costs, metal price lag, unrealised (gains)/losses on foreign currency balances and derivatives and other exceptional or unusual (income)/expenses.

EBITDA is defined as EBIT plus depreciation and amortisation.

Adjusted EBITDA is defined as EBITDA excluding restructuring costs, metal price lag, unrealised (gains)/losses on foreign currency balances and derivatives and other exceptional or unusual (income)/expenses. All APMs are consistently calculated year by year.

Reconciliation of Operating Profit to EBIT and EBITDA: