News

Trading Update Q1 2023

REGULATED INFORMATION

INSIDE INFORMATION

Brussels, 17 May 2023

Cenergy Holdings S.A. (Euronext Brussels, Athens Stock Exchange: CENER), hereafter “Cenergy Holdings” or “the Company”, announces today its consolidated financial information for the first quarter of 2023.

Record high first quarter results with strong full year financial outlook

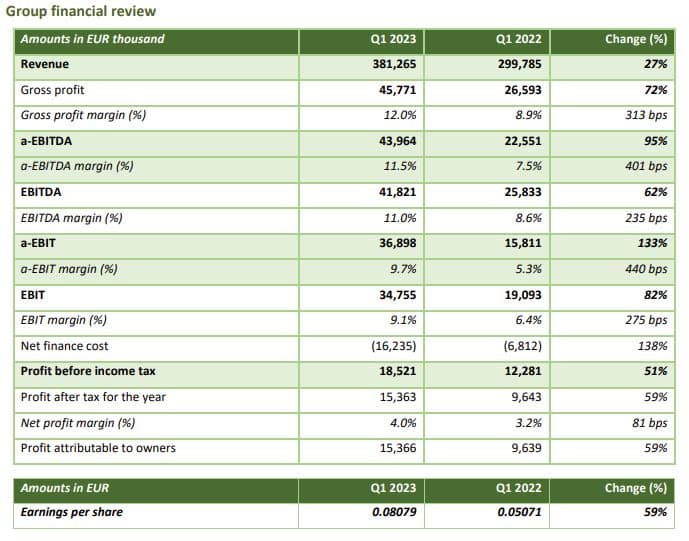

- Revenue for Q1 2023 reaches EUR 381 million (27% growth y-o-y).

- Operational profitability for Q1 hits record-high levels with adjusted EBITDA at EUR 44 million, 95% higher year-on-year, pushed by the strong performance of both segments; consolidated net profit after tax at EUR 15.4 million versus EUR 6 million in Q1 2022 (+59%).

- Following significant recent project awards, the order backlog[1] reached EUR 2.27 billion as of 31 March 2023 from EUR 2 billion three months earlier

- The expansion plan in Corinth submarine cables plant is on track; financing was secured through a EUR 88 million loan, under EBRD’s Greek RRF co-Financing Framework.

- Adjusted EBITDA for FY2023 expected in the range of EUR 180 – 200 million.

Commenting on the Group’s performance for the first-quarter of 2023, Alexis Alexiou, Cenergy Holdings’ Chief Executive Officer, said:

“Full production schedules across all plants and several new project awards marked an excellent start of the year and allowed us to record the best ever first quarter period. Our order backlog stabilized over the EUR 2 billion threshold with the growing demand for electrification remaining the key driver of the Group’s growth. The necessary expansion in the offshore cables capacity is fully supported by a strong financing partner such as EBRD. At the same time, the visibility provided by orders already secured allows the Group to expect an operational profitability target for FY 2023, in terms of adjusted EBITDA, in the range of EUR 180 – 200 million”.

[1] Backlog includes signed contracts, as well as contracts not yet enforced, for which the subsidiaries have either received a letter of award or been declared preferred bidder by the tenderers.

Outstanding operational performance in both segments

Revenue grew by 27% on a yearly basis and reached EUR 381 million. This increase was mainly due to the steel pipes segment, currently executing energy projects from orders secured during 2022. Demand for cables products remained strong and margins improved, while the cables projects business continued to deliver a strong foundation for the segment’s profitability.

Adjusted EBITDA rose to EUR 44.0 million (+95% y-o-y) as both segments improved margins, keeping their focus on high value-added products, which in turn led to a more favourable sales mix. The Group’s a-EBITDA margin reached a double-digit figure (11.5%), significantly higher than the margin achieved in Q1 2022. The successful execution of energy projects remains the main driver of such profitability, as it provides a steady basis in a challenging global macroeconomic environment.

The key projects executed in the reporting period were:

- Cables: The turnkey interconnection projects of Lavrio – Serifos / Serifos – Milos interconnection (phase 4 of the Cyclades’ interconnection in Greece, with a total cable length of 170 km) and Zakynthos – Kilini interconnection progressed significantly, while the final batches of 66kV inter-array cables for phase B of the Doggerbank offshore wind farm in the UK were produced.

- Steel pipes: The West Macedonia pipeline project for DESFA (163km) and the Alexandroupolis FSRU project for Saipem (28km) were initiated during the year, while the production for Fenix offshore gas field in Argentina awarded by TotalEnergies continued and is expected to be completed by the end of the year.

Increased activity along with the timing of payment milestones for ongoing projects keep working capital needs and consequently, net debt, at high levels. In addition to higher interest rates driven by an increased EURIBOR caused net finance costs to attain significantly higher levels, at EUR 16.2 million vs. EUR 6.8 million during the corresponding quarter of last year.

Despite such higher costs, profit before income tax increased more than 50% year-on-year and reached EUR 18.5 million (EUR 12.3 million in Q1 2022). Profit after tax followed suit at EUR 15.4 million (EUR 9.6 million in Q1 2022), representing 4.0% of revenue (vs. 3.2% last year).

Finally, during Q1 2023, a capital expenditure plan in the cables segment of ca. EUR 80 million over two-years was announced; this prepares the segment for the ever-growing demand for electrification caused by the accelerating transition to a low-carbon economy. The plan includes a major expansion of the sophisticated subsea cable plant in Corinth, Greece that will double production capacity of submarine cables, provide additional storage as well as extensively upgrade the plant’s port facilities.

In this context, the segment combined the Greek Recovery and Resilience Fund (RRF) co-Financing Framework with a loan facility by the EBRD. EUR 88 million, made up from EUR 25.2 million as an RRF loan channelled through the Greek Ministry of Finance, and the remaining EUR 62.8 million from the EBRD, will finance a wider investment program of EUR 110 million that includes the abovementioned Corinth plant’s expansion along with the associated working capital outlays once the new production capacity is available, as well as research & development (R&D) initiatives to be undertaken in the following years. The remaining EUR 22 million will be covered by own funds.

Order backlog rose to EUR 2.27 billion

Hellenic Cables and Corinth Pipeworks continued their successes in tendering, keeping total backlog at levels above EUR 2 billion. Projects awarded during the first quarter include:

- 260 km of 66 kV XLPE-insulated subsea inter-array cables and associated accessories for South Fork Wind and Revolution Wind in the Northeast U.S.,

- the supply of approx. 155km of 20” longitudinally submerged arc welded steel pipes for the Tamar gas field optimization development, in the South-eastern Mediterranean,

- the supply and installation of 400 kV and 150 kV underground cable systems in the context of two turnkey projects in Greece for ADMIE – IPTO,

- the supply of 16km of 20” diameter High Frequency Welded (HFW) steel pipes for the N05-A platform in the North Sea,

- the supply of approx. 30 Km of 110 kV High Voltage submarine cables, accessories, and related services as part of a project by the Croatian Transmission System Operator (HOPS) to replace outdated cable lines in the Adriatic Sea.

Outlook

The cables segment expects to retain both an improved product mix and comfortable margins in the products business unit, along with a set of secured orders for the projects business unit. The latter and high-capacity utilisation in all plants throughout the year will foster profitability for the entire segment for 2023. At the same time, the electrification momentum in Europe and the increasing demand of grid connections are expected to further fuel the order book of the segment. Following previous announcements, the discussions with Ørsted on the partnership for the construction of a submarine inter array cables factory in Maryland, USA are continuing.

The steel pipes segment expects the gas fuel sector to continue its dynamic growth, in line with the energy transition pillars. The quest for energy security along with currently high energy prices, press for the exploitation of new and existing gas reserves and drive the demand for new interconnectors, while new pipelines that are ready for the new hydrogen era and Carbon capture and storage (CCS) projects are gathering up pace. As market conditions improve, so is the order backlog, feeding into a positive outlook for the 2023.

Given the strong order backlog for both segments and the growing demand for energy infrastructure products worldwide, Cenergy Holdings expects an adjusted EBITDA in the range of EUR 180 – 200 million for the FY 2023. The financial outlook is subject to several assumptions including (a) smooth execution of energy projects in both segments, (b) a strong demand for cables products and (c) limited financial impact from an uncertain global geopolitical and macroeconomic environment, high inflationary pressures and/or supply-chain challenges and/or potential disruptions.

DISCLAIMER: Any forward-looking statements that may be included in this press release are statements regarding or based on current expectations, plans or understandings of our management relating to, inter alia, Cenergy Holdings’ future results of operations, financial position, liquidity, prospects, growth, strategies or developments in the markets in which its subsidiaries operate. Such forward-looking statements shall be treated as a reflection of information, data and understandings as of the date of the publication of this press release, so you are encouraged not to place undue reliance on them, given that by their nature, forward-looking statements are subject to risks, uncertainties and assumptions that could materially alter the actual results or future events from those expressed or implied thereby. The outcome and financial effects of the understandings, intentions, and events described herein could be adversely affected by these risks, uncertainties and assumptions. Forward-looking statements contained in this press release related to trends or current activities shall not to be taken as a report of the future status of such trends or activities. We undertake no obligation to update or revise any forward-looking statements, either as a result of new information or developments, future events or otherwise. The information contained in this press release is subject to change without notice. No re-report or warranty, express or implied, regarding the fairness, accuracy, reasonableness or completeness of the information contained herein and no reliance shall be placed on it. This press release has been prepared in English and translated into French and Greek. In case of discrepancies between different language versions, the English one shall prevail.

About Cenergy Holdings

Cenergy Holdings is a Belgian holding company listed on both Euronext Brussels and Athens Stock Exchange, investing in leading industrial companies, focusing on the growing global demand of energy transfer, renewables and data transmission. The Cenergy Holdings portfolio consists of Corinth Pipeworks and Hellenic Cables, companies positioned at the forefront of their respective high growth sectors. Hellenic Cables is one of the largest cable producers in Europe, manufacturing power and telecom cables as well as submarine cables. Corinth Pipeworks is a world leader in steel pipe manufacturing for the energy sector and major producer of steel hollow sections for the construction sector. For more information, please visit our website at www.cenergyholdings.com.

Contacts

For further information, please contact:

Sofia Zairi

Chief Investor Relations Officer

Tel: +30 210 6787111, +30 210 6787773

Email: ir@cenergyholdings.com