News

Trading Update Q3 2023

Brussels, 16 November 2023

Cenergy Holdings S.A. (Euronext Brussels, Athens Stock Exchange: CENER), hereafter “Cenergy Holdings” or “the Company”, announces today its financial information for the nine months period ended on 30 September 2023 and the third quarter of 2023.

Solid performance in both segments continues and confirms full year profitability guidance

Record high backlog fuels our investment plans

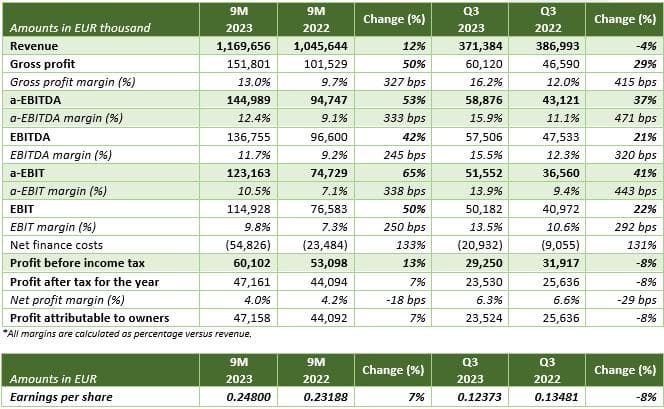

- Revenue reaches EUR 1.17 billion, 12% higher than prior year’s corresponding period (9M 2022: EUR 1.05 billion).

- Operational profitability improves significantly during Q3 pushing adjusted EBITDA to EUR 145 million for the first nine months of 2023 (+53% y-o-y); profitability margins for Q3 2023 exceed 15% due to improved products and projects mix in both segments.

- Order backlog[1] breaks the EUR 3 billion threshold on September 30, 2023 (from EUR 2.5 billion on June 30 and EUR 2 billion nine months earlier); submarine cable capacity expansion is on track and selective upgrades in steel pipes segment are planned to address backlog growth.

- Consolidated profit before tax rises by 13% y-o-y to EUR 60.1 million (EUR 53.1 million in 9M 2022) with net profit after tax at EUR 47.2 million (+7% y-o-y from EUR 44.1 million in 9M 2022).

- FY 2023 guidance updated to a range of EUR 190 – 200 million for adjusted EBITDA

Commenting on the Group’s performance, Alexis Alexiou, Cenergy Holdings’ Chief Executive Officer, stated:

I am pleased to announce a new record-high quarterly EBITDA for Q3 2023 along with a record-high backlog which exceeds EUR 3 billion for the first time in Group’s history. The strong performance recorded throughout these last three months confirms Cenergy Holdings’ ability for value creation in energy transition markets. Throughout the quarter, we maintained high-capacity utilization across all our production lines in both segments and ensured strong project execution. The improved profit margins achieved during Q3 provide confidence for the achievement of our 2023 profitability objectives, while at the same time allow us to plan new investments and both take advantage of the sustainability megatrends while enforcing our position as an enabler towards global green energy transformation.

[1] Backlog includes signed contracts, as well as contracts not yet enforced, for which the subsidiaries have either received a letter of award or been declared preferred bidder by the tenderers.

Financial Overview

Strong operational profitability and growth across all segments

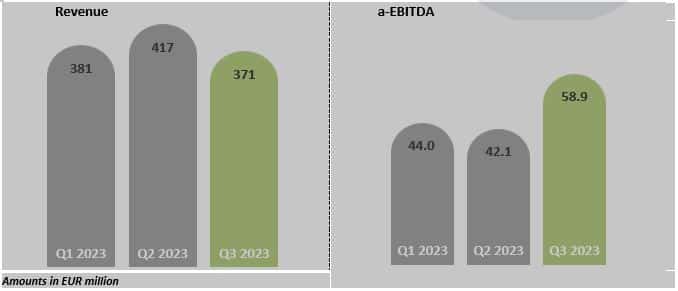

Revenue grew by 12% for the nine-month period to EUR 1,169 million, with Q3 2023 sales slightly down (-4%) compared to 2022 Q3. The improved product mix, however, along with full production schedules in all Group’s plants led to significantly higher margins.

The cables segment completed the production of the submarine cables for Lavrio – Serifos / Serifos – Milos interconnection (phase 4 of the Cyclades’ interconnection in Greece, with a total cable length of 170km) and continued several projects already at execution stage, such as the Sofia OWF inter-array cables in the UK and the high voltage submarine cables for the Croatian Transmission System Operator (HOPS) in the Adriatic Sea. At the same time, the strong demand for cables products, particularly low and medium voltage cables, continued in all our main markets in Central & Western Europe, the Balkans and the Middle East and combined with improved profit margins in these categories to advance the segment’s profitability.

The steel pipes segment exhibited strong performance during Q3 2023 at levels similar to those achieved in the prior six months of the year, built on a strong momentum gained by recent awards and its strong backlog. Corinth Pipeworks started production of pipelines awarded by Chevron, Shell and Equinor (IRPA project) and delivered the 163km steel pipes for the West Macedonia pipeline to DESFA during Q3.

Adjusted EBITDA reached EUR 58.9 million in Q3 2023 (+40% q-o-q, +37% y-o-y) due to full production schedules and improved profit margins. The substantial difference over the previous quarter is attributed to the cables segment with steel pipes keeping their satisfactory performance. 9-month a-EBITDA amounted to EUR 145 million, EUR 50 million (+53%) higher than last year’s comparable period.

Net finance costs are still high, reaching ca. EUR 55 million for the first nine months of the year, more than double those during the same period last year. As outlined in 2023H1 results, this escalation is attributed to seriously higher Euribor rates charged during the entire year, compared to last year’s negative levels for reference floaters. Ongoing investments in cables and larger working capital needs did not allow net debt levels to fall from H1 levels, weighing further down on finance charges.

Despite the above, operational profitability pushed upwards Profit before income tax to EUR 60.1 million for the period ended on 30 September 2023, 13% higher than the EUR 53.1 million recorded in 9M 2022. Profit after tax for the same period stood at EUR 47.2 million (EUR 44.1 million in 9M 2022) representing 4% of revenue, and earnings per share amounted to 0.25 EUR.

New awards keep increasing backlog to new highs

The successful tendering activity continued without disruptions for both segments with total order backlog exceeding EUR 3 billion as of September 30, 2023, the highest level ever achieved by the Group (+20% higher than June 30th). Commercial teams of both segments secured some important orders from July to September 2023, such as:

- the turnkey project awarded by TenneT to a consortium formed by Jan de Nul and Hellenic Cables for three high voltage alternating current (HVAC) offshore grid connection cables connecting wind farms to the DolWin Kappa convertor station in Germany;

- the award of 118km pipeline by Chevron Mediterranean Ltd. for the 3rd gathering line of the Leviathan gas field, in the Southeastern Mediterranean;

- the EPCI contract for the grid interconnection of the Western Offshore Sub Station of Gennaker Offshore Wind Farm in Baltic Sea, Germany by 50Hertz, which includes two export cable systems (80km of 220kV submarine and 210km of 220kV underground cables) with a value of approx. EUR 450 million;

- the supply of inter-array cables for the Eoliennes en Mer Dieppe Le Tréport OWF in France;

- the supply of export cables for Baltica 2 Offshore Wind Farm in Poland;

- three offshore pipeline projects for Aker BP in the North Sea, and

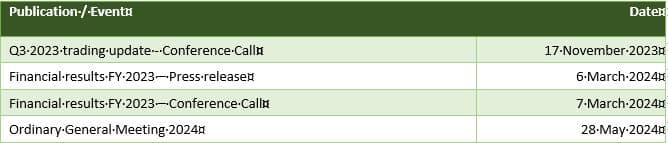

- an offshore and onshore natural gas pipeline for the Floating Storage and Regasification Unit (FSRU)in Italy.OutlookThe cables segment momentum continues in both business units, as demand for cables products remains strong and the cables projects portfolio is growing. Electrification and energy security, the major megatrends for at least the next decade, are directly driving the need for all types of cables and expected to further fuel the order book of the segment. With the expansion plan for the production capacity of the submarine cable factory in Corinth on track and most of that extra capacity already booked, Hellenic Cables is addressing the onshore business growth by (i) creating value in the Thiva plant through additional lines and equipment and (ii) planning a Center of Excellence for low voltage cables in the industrial area of Eleonas (near its factory in Thiva), acquired during 2022.The steel pipes segment is securing its strengthened position and builds its profitability growth on it, based on the increased visibility provided by a strong backlog that guarantees high-capacity utilization for at least the next year. Looking ahead, Corinth Pipeworks expects the gas fuel demand to keep on growing in the short-term, allied to the other two “green energy pillars” (hydrogen and Carbon Capture & Storage), as will the demand for large diameter steel pipes. Order backlog is expected to follow suit, with onshore gas and hydrogen networks gradually coming into front stage and feeding the positive outlook.Given the strong order backlog for both segments and the growing demand for energy infrastructure products worldwide, Cenergy Holdings updates its FY 2023 guidance previously published and expects an adjusted EBITDA in the range of EUR 190 – 200 million for the FY 2023. The financial outlook is subject to several assumptions including (a) smooth execution of energy projects in both segments and (b) limited financial impact from an uncertain global geopolitical and macroeconomic environment, high inflationary pressures and/or supply-chain challenges and/or potential disruptions.Financial Calendar

DISCLAIMER: Any forward-looking statements that may be included in this press release are statements regarding or based on current expectations, plans or understandings of our management relating to, inter alia, Cenergy Holdings’ future results of operations, financial position, liquidity, prospects, growth, strategies or developments in the markets in which its subsidiaries operate. Such forward-looking statements shall be treated as a reflection of information, data and understandings as of the date of the publication of this press release, so you are encouraged not to place undue reliance on them, given that by their nature, forward-looking statements are subject to risks, uncertainties and assumptions that could materially alter the actual results or future events from those expressed or implied thereby. The outcome and financial effects of the understandings, intentions, and events described herein could be adversely affected by these risks, uncertainties and assumptions. Forward-looking statements contained in this press release related to trends or current activities shall not to be taken as a report of the future status of such trends or activities. We undertake no obligation to update or revise any forward-looking statements, either as a result of new information or developments, future events or otherwise. The information contained in this press release is subject to change without notice. No re-report or warranty, express or implied, regarding the fairness, accuracy, reasonableness or completeness of the information contained herein and no reliance shall be placed on it. This press release has been prepared in English and translated into French and Greek. In case of discrepancies between different language versions, the English one shall prevail.

About Cenergy Holdings

Cenergy Holdings is a Belgian holding company listed on both Euronext Brussels and Athens Stock Exchange, investing in leading industrial companies, focusing on the growing global demand of energy transfer, renewables and data transmission. The Cenergy Holdings portfolio consists of Corinth Pipeworks and Hellenic Cables, companies positioned at the forefront of their respective high growth sectors. Hellenic Cables is one of the largest cable producers in Europe, manufacturing power and telecom cables as well as submarine cables. Corinth Pipeworks is a world leader in steel pipe manufacturing for the energy sector and major producer of steel hollow sections for the construction sector. For more information, please visit our website at www.cenergyholdings.com.

Contacts

For further information, please contact:

Sofia Zairi

Chief Investor Relations Officer

Tel: +30 210 6787111, +30 210 6787773

Email: ir@cenergyholdings.com